On August 15th, Luxe. CO Intelligence the fashion industry research institute under Luxe.CO, held an online industry forum titled “Observations on China’s High-End Skincare Brands.”

Luxe.CO Intelligence exclusively released the “2023 China High-End Skincare Consumer Survey White Paper” (referred to as “Questionnaire” below) and the “Global Luxury Skincare Brands in the Chinese Market Report” (referred to as “Report” below).

Elisa Wang, SVP of Luxe.CO and Director of Luxe.CO Intelligence, as well as Wang Junyang, a researcher at Luxe.CO Intelligence, provided in-depth interpretations of the two research results.

The forum also invited two senior industry guests from the high-end skincare market for discussions:

- Harvey Tsao, Asia Pacific Brand General Manager of Chantecaille

- Jessie Zhang, China General Manager of Biologique Recherche

Questionnaire: Eight Characteristics of Chinese High-End Skincare Consumers

Caroline Andreotti, an executive at the Coty Group, previously revealed in an exclusive interview with Luxe.CO a set of data: in 2022, Coty Group’s investment in consumer research had increased by more than six times, with a particular emphasis on “consumer research in the Chinese market.”

Based on the survey questionnaire, Luxe.CO Intelligence collected and summarized the consumption preferences of Chinese high-end skincare consumers.

The data showed that over 70% of the respondents claimed to have purchased high-end skincare products priced above 1000 yuan; among them, 31.5% indicated that their highest purchase price even exceeded 3000 yuan.

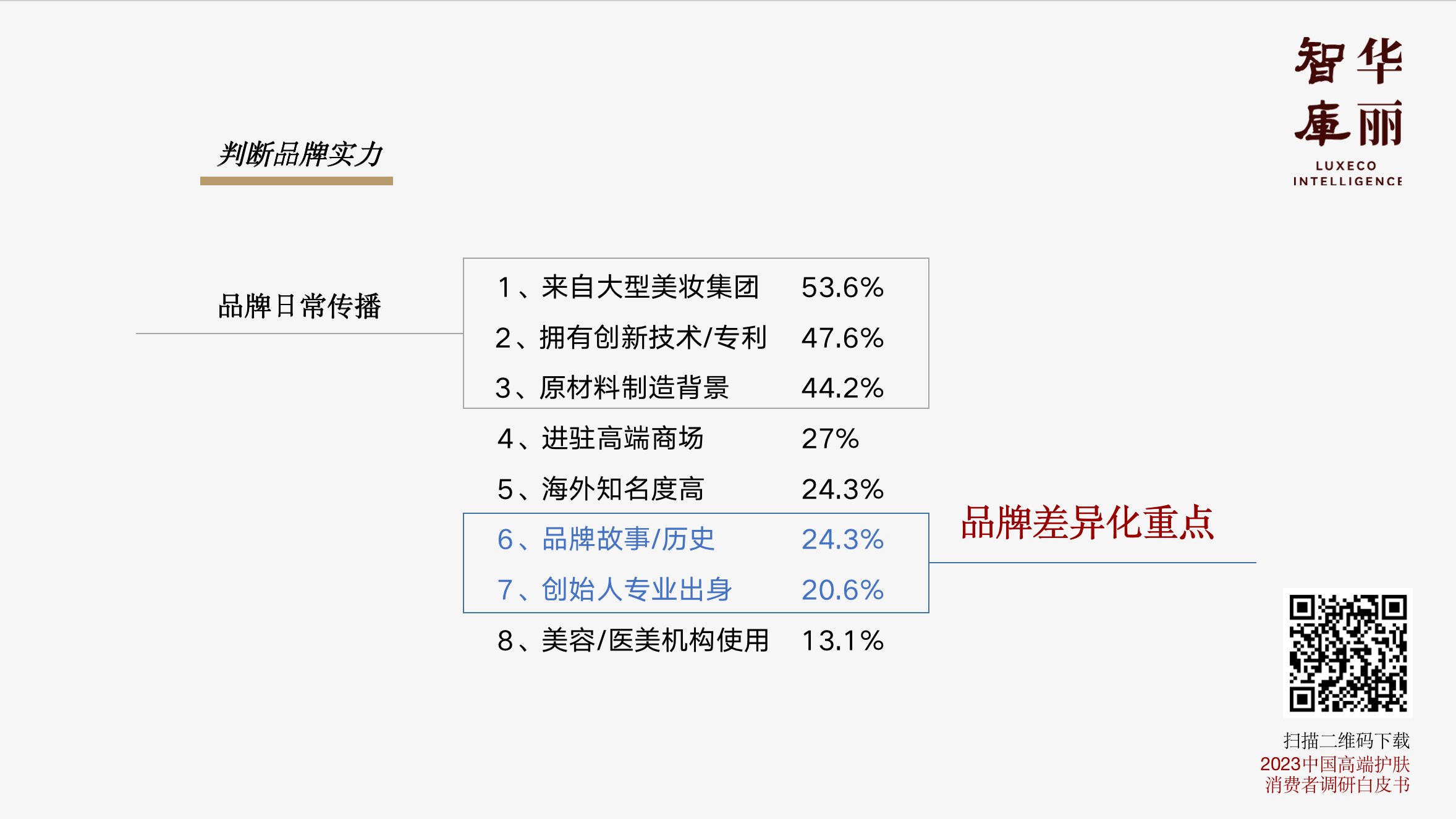

From the perspective of brand strength, “being part of a large beauty conglomerate,” “possessing innovative technology/patents,” and “having a background in raw material manufacturing” have become the basic elements of daily brand communication and are common information for consumers.

In today’s era of information overload, what users expect to see is information that is relatively scarce and not widely known, which is the key to truly achieving differentiated communication for brands. This requires brands to delve deep into their archives to find more “brand stories” and “founder background information” that resonate with consumers and shape the brand’s unique personality.

From the perspective of brand origin, the top three countries with favorable impressions are still “skincare powerhouses” France, Japan, and Switzerland.

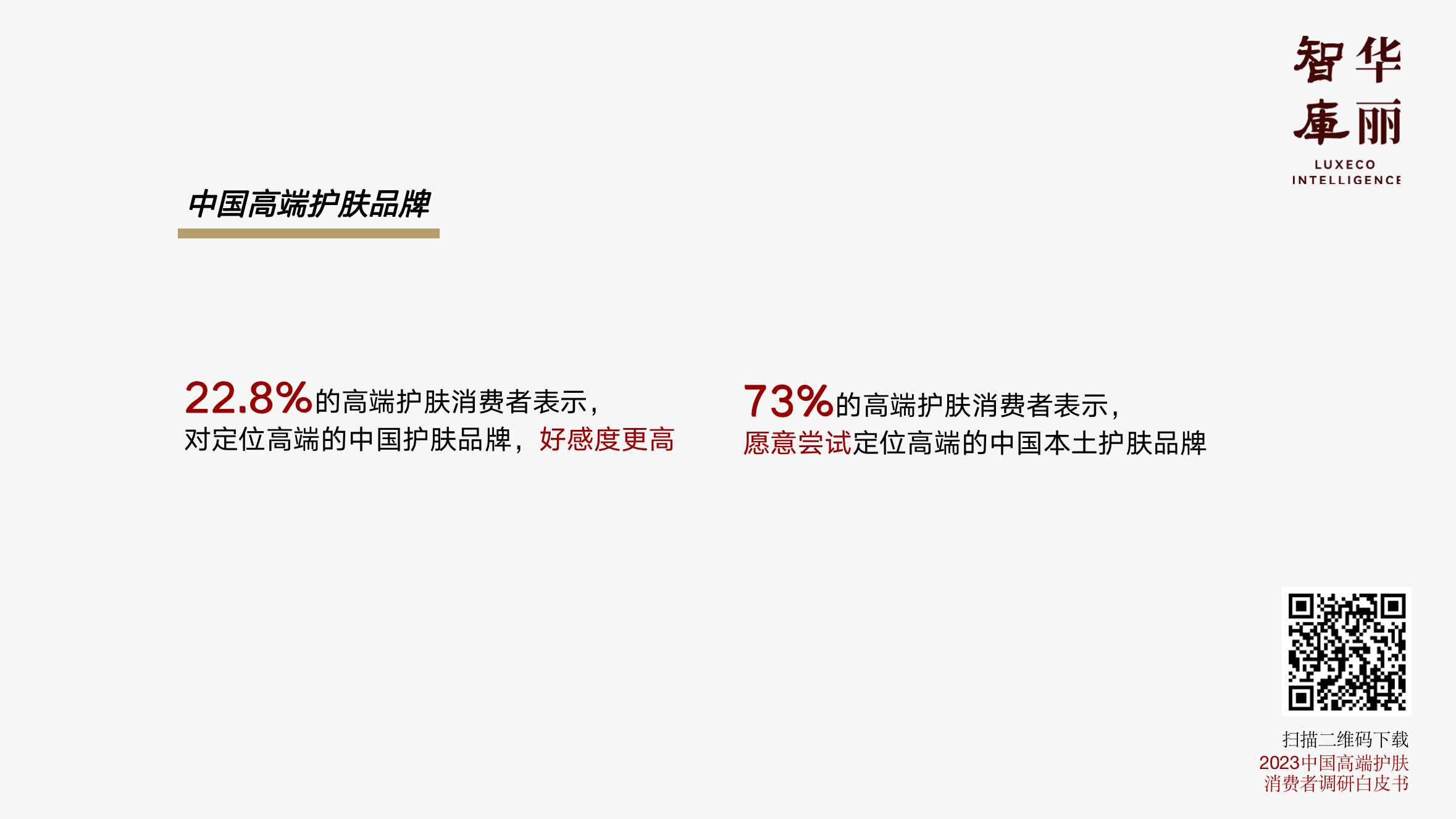

Surprisingly, 73% of the respondents expressed willingness to try high-end Chinese domestic skincare brands. It is certain that China’s domestic beauty and cosmetics companies will eventually experience an upgrade to the high-end.

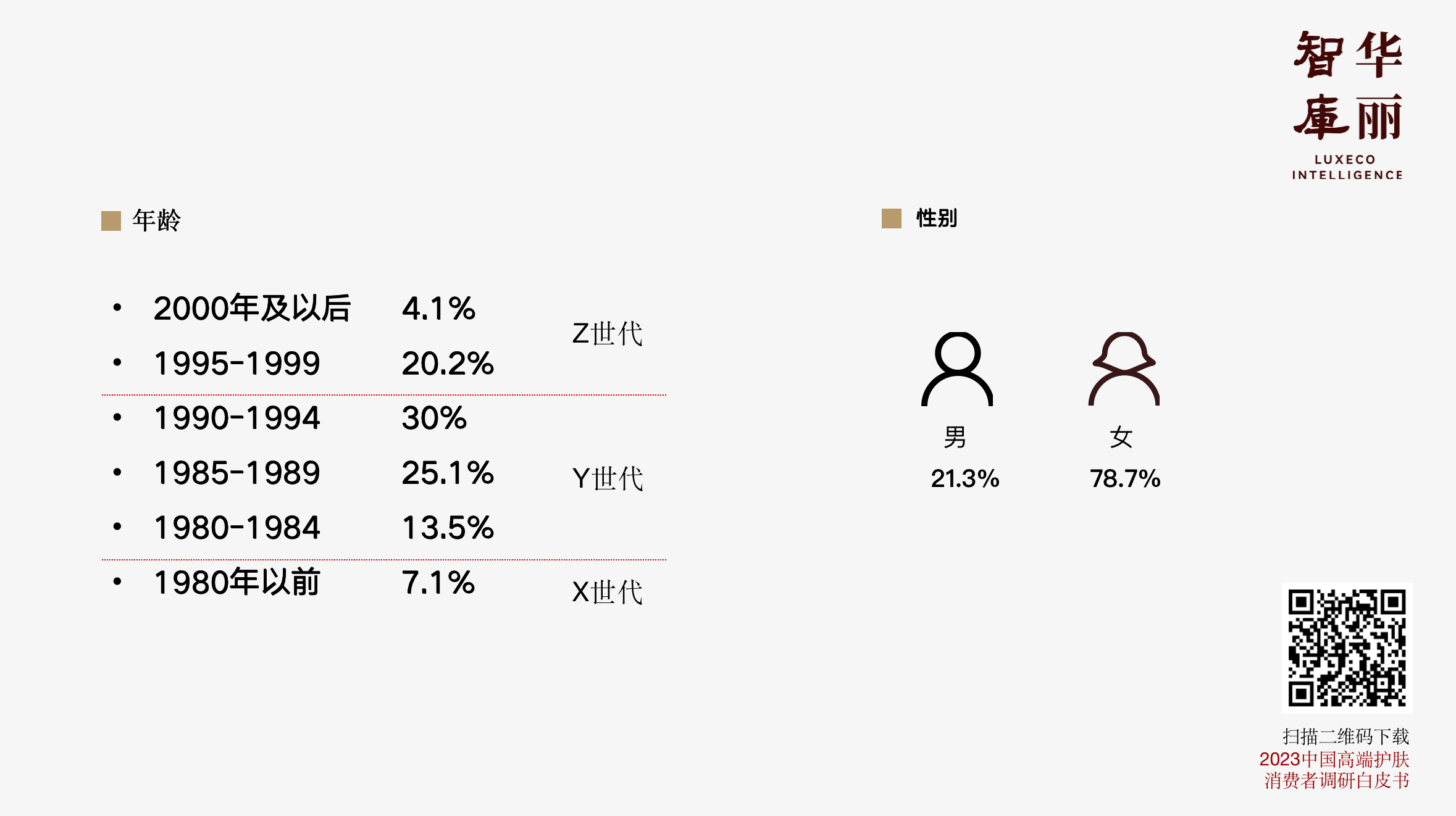

The white paper produced from user research questionnaires presented us with eight major characteristics of this group of target users:

1. Mature consumers with accumulated wealth

2. Significant consumption power and willingness

3. Once determined, they will not easily change their minds

4. Brand reputation and recognition significantly influence purchases

5. Skeptical of excessive endorsements, trust Key Opinion Consumers (KOC)

6. Have some knowledge of the high-end beauty industry and brand research capabilities

7. Lack effective channels to learn about brand stories

8. Increasing awareness of male skincare and planning to invest more budget

Report: Intense Competition for High-End Skincare Brands in the Chinese Market

Since 2022, multiple global multi-brand beauty (skincare) conglomerates have been accelerating their presence in the Chinese market:

- Carita, a French salon skincare brand under the L’Oréal Group

- Aveda, a high-end hair and skincare brand under the Estée Lauder Group

- SENSAI, a Japanese high-end skincare brand under the Kao Group

- Orveda, a super-high-end high-tech skincare brand under the Coty Group

- Tatcha, a high-end natural skincare brand acquired by L’Oréal and introduced to the Chinese market through Sephora

- EFFECTIM, a high-end technology skincare brand launched by Shiseido in the Chinese market

In the realm of independent brands, the German luxury skincare brand Augustinus Bader, valued at 1 billion USD, has recently engaged in joint collaborations with upscale hotels in the Chinese market, hosting pop-up events. The brand’s marketing endeavors have been notably active.

In the context of the above, how important is it for brands to conduct localized consumer research?

Global attention to wellness has been increasing, especially after the pandemic. We have undergone a shift in mindset: from looking good to feeling good, and finally to feeling really good! This includes a strong demand for high-end skincare.

Due to such market opportunities, overseas large-scale multi-brand conglomerates and individual brand companies are focusing on the ultra-premium segment in the already upscale beauty market, leveraging the trend of premiumization.

Elisa Qiong stated, “When it comes to multi-brand conglomerates, people often think of the luxury goods industry, such as LVMH, Kering, and Richemont, which have their own star brands. With the trend towards premiumization in the skincare industry, we have found that beauty conglomerates are also starting to build their own brand pyramids. So, while the brand at the top of the pyramid may not necessarily be the ‘cash cow’ of the conglomerate, it is becoming the ‘star’ within the multi-brand conglomerate.”

The “Global Luxury Skincare Brands in the Chinese Market Report” covers 34 brands with their highest single prices listed.

In the Chinese market, these “star” high-end skincare brands face similar challenges and transformations as luxury brands.

“China’s market is largely reshaping the once very quiet and low-profile high-end skincare industry from various dimensions such as marketing and retail experience.”

Based on this, Luxe.CO Intelligence proposed two suggestions for high-end skincare brands in the Chinese market in the “Global Luxury Skincare Brands in the Chinese Market Report”:

- “Growth Code”: More Trust + More DTC (Direct-to-Consumer) + More Desire

- “Formula for Success”: Professional Efficacy + Omni-channel + Customized/Private Experience = Brand Power for High-End Skincare

Biologique Recherche, China General Manager Jessie Zhang

Biologique Recherche was founded in France in the late 1970s by biologist Yvan Allouche and therapist Josette Allouche. The brand’s name means “biological research,” signifying its emphasis on natural ingredients, with over 80% of its components being natural extracts and no added chemical fragrances, to preserve the integrity of the formulas. The company’s initial goal was to provide professionals in the industry with more precise and effective skincare products and treatments to meet the unmet personalized needs at the time.

In the early 21st century, Dr. Philippe Allouche, a medical researcher, gradually took over the research and development of Biologique Recherche from his parents. The current co-directors, Rupert Schmid and Pierre-Louis Delapalme, took over the company after the passing of Yvan Allouche, while Dr. Philippe Allouche continued as the brand’s Research and Creative Director, driving the brand’s development. Currently, the brand’s business covers top luxury hotel SPAs, medical clinics, and skincare centers in 85 countries/regions around the world, with flagship stores in Paris, Rome, Los Angeles, and Shanghai.

The brand’s first flagship store in China, located in Shanghai’s Jing’an District

In 2012, Biologique Recherche officially entered the Chinese market through a partnership with the Four Seasons Hotel in Hong Kong, gradually becoming known to consumers for its high-potency compound formulas and being nicknamed the “Mystery of Raw Ingredients.”

In 2020, to further expand in the Chinese market, the brand established a wholly-owned subsidiary in Shanghai and officially registered its Chinese name, “宝黎研萃” (Biologique Recherche in Chinese).

As the first member of the Biologique Recherche China team, forum guest Jessie Zhang had worked at Procter & Gamble for over thirteen years and served in two skincare brands. After joining Biologique Recherche, she helped formulate the brand’s China market strategy and built the China team.

Elisa Qiong: We noticed that Biologique Recherche’s first flagship store in China is located in a standalone house in Shanghai’s Jing’an District, rather than in the usual core commercial area. As an independent brand, this is quite unconventional. Why are you so optimistic about the prospects of the Chinese market?

Jessie Zhang: The location of China’s first flagship store continues the DNA of the brand’s global flagship store “Ambassade de la Beauté” at 32 Avenue des Champs-Élysées in Paris. It is situated in the core area adjacent to Jing’an Temple in the Jing’an District, which is quiet and private. As the first flagship store in China, the brand authentically brings the iconic customized skincare experience from Paris to China, presenting a pure and professional Biologique Recherche experience. It creates a comfortable environment akin to coming home, while also helping our professional partners in the China market establish a benchmark for personalized services, forming a circle of high-level customized professional services.

Elisa Qiong: Biologique Recherche is known for personalized skincare. What makes you irreplaceable?

Jessie Zhang: The so-called “quantified customization” involves combining products with high-concentration active ingredients and customized skincare treatments. Additionally, we offer a limited global “Haute Couture” skincare project, similar to the concept of haute couture fashion, starting with the formula to tailor a unique skincare plan for each customer. The process generally involves the guest undergoing a skin test conducted by French experts. The French laboratory then develops a personalized formula and skincare plan based on the test data over a month, eventually providing the customer with exclusive formula products and treatment plans.

Elisa Qiong: What is the focus of the brand’s daily marketing efforts?

Jessie Zhang: Authentic word-of-mouth transmission is the marketing strategy that the brand has consistently adhered to. We refrain from advertising and instead invest all resources into product research and innovation. We believe that “effectiveness is the best advertisement,” which is the brand’s global marketing strategy. The real feedback from consumers constitutes our brand marketing.

Harvey Tsao, Asia Pacific Brand General Manager of Chantecaille

Chantecaille was founded by French artist Sylvie Chantecaille in 1997. The brand formulates luxury vegan makeup,skincare, perfumes, and other products based on the combination of natural herbal ingredients and high-tech meansIt is dedicated to sustainable development and charitable causes. The company is headquartered in New York and its business spans globally. It is well-received in North America and Asia, and entered the Chinese market in 2018 through cross-border e-commerce.

In 2021, Chantecaille was acquired by German personal care giant Beiersdorf, with the brand’s projected sales for the year exceeding 100 million USD.

Harvey Tsao, with over twenty years of experience in the industry, has worked at Chantecaille for 17 years and is one of the earliest employees of the China team.

Elisa Qiong: How do you define a high-end skincare brand?

Harvey Tsao: Exclusive technology + precious ingredients + sustainable origins behind the ingredients.

Elisa Qiong: How does a high-end skincare brand practice sustainability?

Harvey Tsao: The core concept of the Chantecaille brand can be understood as “taking from nature, giving back to nature.” Plant extracts, innovation, and conservation are the brand’s three main principles. Chantecaille was one of the first skincare brands to use plant stem cell technology, maximizing plant repair power while advocating for water-saving concepts in beauty products.

Additionally, the brand releases conservation-themed product series each year. For example, in 2005, it established the “Les Papillons” butterfly-themed makeup collection to protect butterfly habitats, and in 2022, it collaborated with The Elephant Project to release a limited-edition plush elephant toy to support African elephant conservation.

Elisa Qiong: How do you view the accelerated influx of high-end skincare brands into the Chinese market?

Harvey Tsao: I believe this situation has both advantages and disadvantages. Firstly, the influx of many brands indicates that everyone recognizes the potential of the Chinese market, making competition more intense. However, such competition also creates broader market opportunities. If there were only a few players in the market, it would mean that consumers’ awareness of high-end skincare is not yet sufficient.

| Image Credit: Provided by Chantecaille, Biologique Recherche

| Editor: Elisa