[Luxeplace Monthly Luxury Stock Report] March 2025

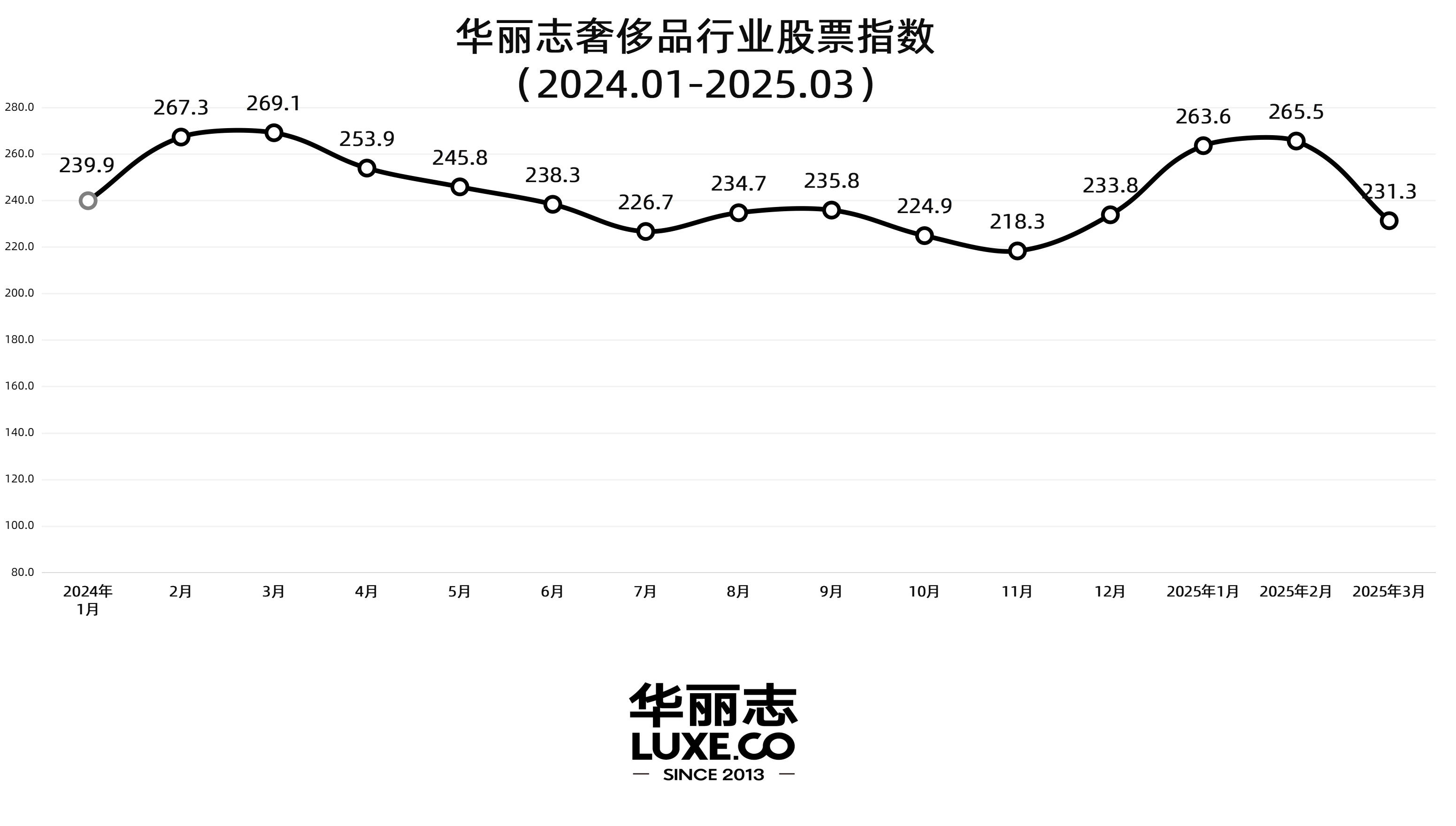

Luxe.CO has published the “Luxe.CO Luxury Industry Stock Index” on a monthly basis since 2016. The chart below illustrates the stock performance trends of the global luxury industry over the past year and in previous years.

This month, increased uncertainty in the macroeconomic environment—particularly the fluctuations in U.S. tariff policy—has negatively impacted the luxury industry.

As a result, after two consecutive months of gains at the beginning of the year, the Luxe.CO Luxury Industry Stock Index fell sharply again, dropping from 265.5 to 231.3—a decline of 12.9%—bringing it back to the level seen at the end of last year.

Over the same period, the Stoxx Europe Luxury 10 Index declined from 4,242.08 to 3,596.36, a decrease of 15.2%.

Major global stock markets also experienced varying degrees of decline this month. France’s CAC 40 Index fell from 8,111.63 to 7,790.71, down 4.0%; Italy’s FTSE MIB Index declined from 38,655.09 to 38,051.99, down 1.6%; the Stoxx Europe 600 Index dropped from 557.19 to 533.92, down 4.2%; and the U.S. S&P 500 Index fell from 5,954.5 to 5,611.85, a decline of 5.6%.

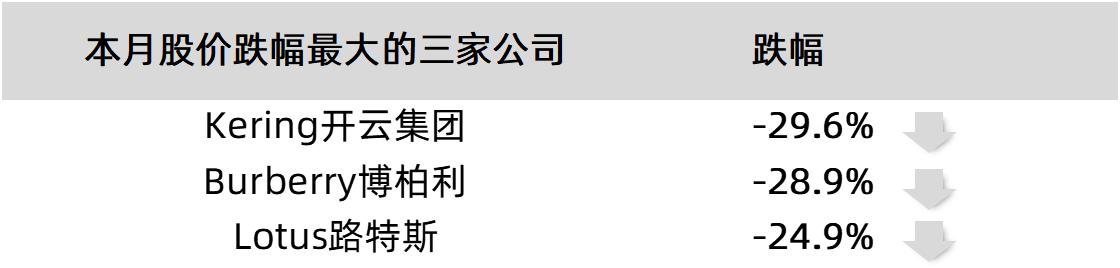

Overall, in March 2025, only 3 of the 27 stocks tracked by the Luxeplace Luxury Industry Stock Index saw gains, with all three posting increases of more than 10%. Laopu Gold once again recorded the highest share price increase among all listed luxury companies (+46.2%), and another Chinese jewelry giant, Chow Tai Fook, also posted a 17.3% gain. Meanwhile, 24 stocks declined, with 22 of them dropping by more than 10%.

This article by Luxe.CO presents a comprehensive review of the key developments among globally listed luxury companies over the past month, including 1) highlights from the latest financial reports, 2) capital market activity, 3) executive changes, and 4) major corporate initiatives.

An appendix is included: “Stock Price Changes and Latest Market Capitalizations of Global Listed Luxury Companies in March 2025.”

— Latest Developments of Listed Luxury Companies —

Key Highlights from the Latest Financial Reports:

Laopu Gold (+46.2%): This month, the group released its full-year 2024 results, reporting a 167.5% year-on-year increase in revenue to RMB 8.506 billion [USD 1.18 billion] (2023: RMB 3.180 billion). Gross profit surged 162.9% year-on-year to RMB 3.501 billion [USD 485 million], with the gross margin stable at 41.2%. Net profit attributable to shareholders rose sharply by 256.2% to RMB 1.480 billion [USD 205 million]. This marks the company’s first annual financial report since its main board listing on the Hong Kong Stock Exchange on June 28 last year.

Swatch (-13.3%): The group released its full-year 2024 financial report this month. Net sales declined by 14.6% year-on-year to CHF 6.735 billion (at constant exchange rates: -12.2%). Operating profit and net profit both dropped by more than 70%, falling to CHF 304 million and CHF 219 million, respectively. In particular, net sales in the Greater China region fell by 30.3% year-on-year to CHF 1.833 billion, making it the group’s most severely impacted market. However, the region still accounted for 27.2% of total sales, remaining Swatch’s largest market.

Safilo (-15.5%): The group reported its full-year 2024 results this month. Due to the expiration of its licensing agreement with Jimmy Choo and continued unfavorable conditions in the North American sunglasses and sports segments, total sales declined 3.1% year-on-year to EUR 993.2 million (down 2.3% at constant exchange rates). Excluding these factors, overall sales trends still showed slight growth. Net profit turned positive, reversing a loss of EUR 24.6 million in the previous year to a profit of EUR 22.3 million.

Brunello Cucinelli (-15.5%): This month, the group released its full-year 2024 results. Revenue rose by 12.2% year-on-year to EUR 1.2784 billion (at constant exchange rates: +12.4%), slightly exceeding expectations, with steady growth achieved across all major markets throughout the year. Operating profit increased by 12.9% to EUR 211.7 million, with an operating margin of 16.6%. EBIT grew 12.9% year-on-year to EUR 211.7 million, and net profit rose 19.5% to EUR 128.5 million.

Prada (-18.2%): The group announced its full-year 2024 results this month, reporting net revenue of EUR 5.4 billion, a year-on-year increase of 17% at constant exchange rates, significantly outperforming the market average. Retail sales rose 18% year-on-year at constant exchange rates to EUR 4.8 billion, driven by same-store sales growth and full-price sales. By brand, the Prada brand continued to post steady growth, with retail sales up 4% year-on-year at constant exchange rates. Miu Miu achieved a record high, with retail sales skyrocketing 93% year-on-year.

Salvatore Ferragamo (-23.5%): The group released its full-year 2024 results this month. Total revenue fell 10.5% year-on-year to EUR 1.035 billion (at constant exchange rates: -8.2%). Both operating profit and net profit slipped into the red, recording losses of EUR 49.001 million and EUR 68.069 million, respectively.

Capital Market Activity:

Brunello Cucinelli (-15.5%): The group announced that it repurchased 73,500 ordinary shares between March 17 and 21, at an average price of EUR 108.4712 per share, for a total amount of nearly EUR 8 million (excluding commissions). Following this buyback, the company now holds 123,500 treasury shares, representing approximately 0.2% of the total shares outstanding.

Prada (-18.2%): This month, Reuters cited sources revealing that the group’s CEO Andrea Guerra had flown to New York City to initiate preparations for a potential acquisition of Italian luxury brand Versace. The report also indicated that Lorenzo Bertelli, the fourth-generation heir of the Prada Group and son of Miuccia Prada and Patrizio Bertelli, joined the trip. Prada has not yet commented on the matter.

Kering (-29.6%): This month, the group announced that it had completed an investment transaction with private equity firm Ardian for a portfolio of three premium real estate assets in Paris, under the terms disclosed on January 15, 2025. The portfolio includes Hôtel de Nocé at 26 Place Vendôme and two properties located at 35-37 Avenue Montaigne and 56 Avenue Montaigne.

Executive Changes:

Chow Tai Fook (+17.3%): This month, the group appointed Karen Yih as Chief Financial Officer of Chow Tai Fook Jewellery Group, replacing Board Member and Executive Director Cheng Bing Hei, who will now focus on strategic oversight, capital management, investor relations, and company secretarial matters. The appointment takes effect on April 1. In her new role, Yih will drive progress in financial management, long-term growth, and transformation strategies, including financial planning and analysis, financial reporting, operations management, risk management, and legal affairs.

Mulberry (-7.7%): This month, the group’s Chief Commercial Officer Ian Earnshaw stepped down. Earnshaw joined the brand in 2013 and had served as Chief Commercial Officer since 2022, having previously held roles such as Commercial Director. He has also worked at brands including Burberry, Banana Republic, Club 21, and Zara.

Capri (-10.2%): This month, the group’s Italian luxury brand Versace announced the appointment of Dario Vitale as Chief Creative Officer, succeeding Donatella Versace, who turns 70 this year. The appointment takes effect on April 1, 2025. Versace noted that Dario Vitale’s appointment marks the introduction of a fresh perspective while maintaining respect for the brand’s heritage and future potential. Vitale previously served as Design and Image Director at Prada Group’s Miu Miu.

Hermès (-11.9%): This month, the group proposed the nomination of three new members to its board of directors: Jean-Laurent Bonnafé, CEO of BNP Paribas SA, for a three-year term; Bernard Emié, former head of France’s Directorate-General for External Security (DGSE), for a two-year term; and Cécile Béliot-Zind, CEO of dairy company Bel Group, for a three-year term.

Moncler (-14.4%): This month, the group’s holding company Double R Srl released a new list of board members, which includes Alexandre Arnault, the second son of LVMH Chairman and Deputy CEO of Moët Hennessy. The group also appointed Marco Viganò as Global Chief Client Officer and President of the EMEA (Europe, Middle East, and Africa) region.

Richemont (-16.6%): This month, the group’s Italian high-end watch brand Panerai announced that CEO Jean-Marc Pontroué would step down, to be succeeded by Emmanuel Perrin, effective April 1. Perrin most recently served as Head of Richemont’s Specialist Watchmakers division. He has been with the group for 33 years and has held senior positions at Cartier and Van Cleef & Arpels.

Pandora (-16.8%): This month, the group announced the appointment of Nicole Clayton as Managing Director of the British Isles, replacing Sonia Lopez Delgado, who stepped down for personal reasons. Clayton previously served as Global Chief Digital Officer at Nestlé-Nespresso.

LVMH (-17.7%): This month, the group appointed Jean-Christophe Babin, CEO of BVLGARI, as CEO of the LVMH Watches Division, effective April 1, succeeding Frédéric Arnault. Earlier this month, LVMH announced a series of senior management changes: Frédéric Arnault was appointed CEO of Loro Piana, replacing Damien Bertrand; Damien Bertrand will transition to Louis Vuitton as Deputy CEO; Pierre-Emmanuel Angeloglou was appointed CEO of Christian Dior Couture.

Prada (-18.2%): This month, the group appointed Markus Hoogeveen as Retail Director for the Central Europe market. Hoogeveen began the role in January this year. He previously held the same position at French luxury brand Celine. Before that, he worked at Balenciaga for nearly three years, and from 2015 to 2017, he held a position at Prada. He has also worked at PVH Group, adidas Group, and H&M in various roles.

Kering (-29.6%): This month, the group appointed Demna as the new Creative Director of its Italian luxury brand Gucci, effective early July. Demna has served as Creative Director of another Kering-owned brand, Balenciaga, since 2015. During his tenure, he “redefined modern luxury, gained global acclaim, and solidified his authority in the fashion industry.”

Demna appointed as the new Creative Director of Italian luxury brand Gucci

Major Corporate Initiatives:

Hermès (-11.9%): This month, the group returned to the Grand Palais in Paris to host the annual Saut Hermès 2025 equestrian show jumping competition. This year, the top 50 ranked riders from around the world gathered in the nave of the Grand Palais to compete in 10 events of the Fédération Française d’Équitation’s highest-level CSI 5* international show jumping competition.

LVMH (-17.7%): This month, the group announced the official establishment of the LVMH-INSEAD Alumni network, created in partnership with INSEAD, the European Institute of Business Administration. The launch ceremony was held on March 19 in the Grand Salon of Moët Hennessy. The LVMH-INSEAD Alumni initiative aims to promote mentorship programs and talent development, while also strengthening ties between INSEAD graduates and the LVMH Group and its portfolio of brands.

Prada (-18.2%): This month, the group announced the opening of “Prada Rong Zhai Café” in Shanghai, a new concept designed by acclaimed director Wong Kar-Wai. It marks Prada Group’s first standalone dining venue in Asia. Starting March 31, 2025, the café and restaurant will officially open to the public, with a three-day grand opening celebration from Friday, March 28 to Sunday, March 30. From noon on March 29, guests can make reservations through the “Prada Rong Zhai Café” WeChat Mini Program.

Appendix: Stock Price Changes and Latest Market Capitalizations of Global Listed Luxury Companies – March 2025

|Editor: LeZhi