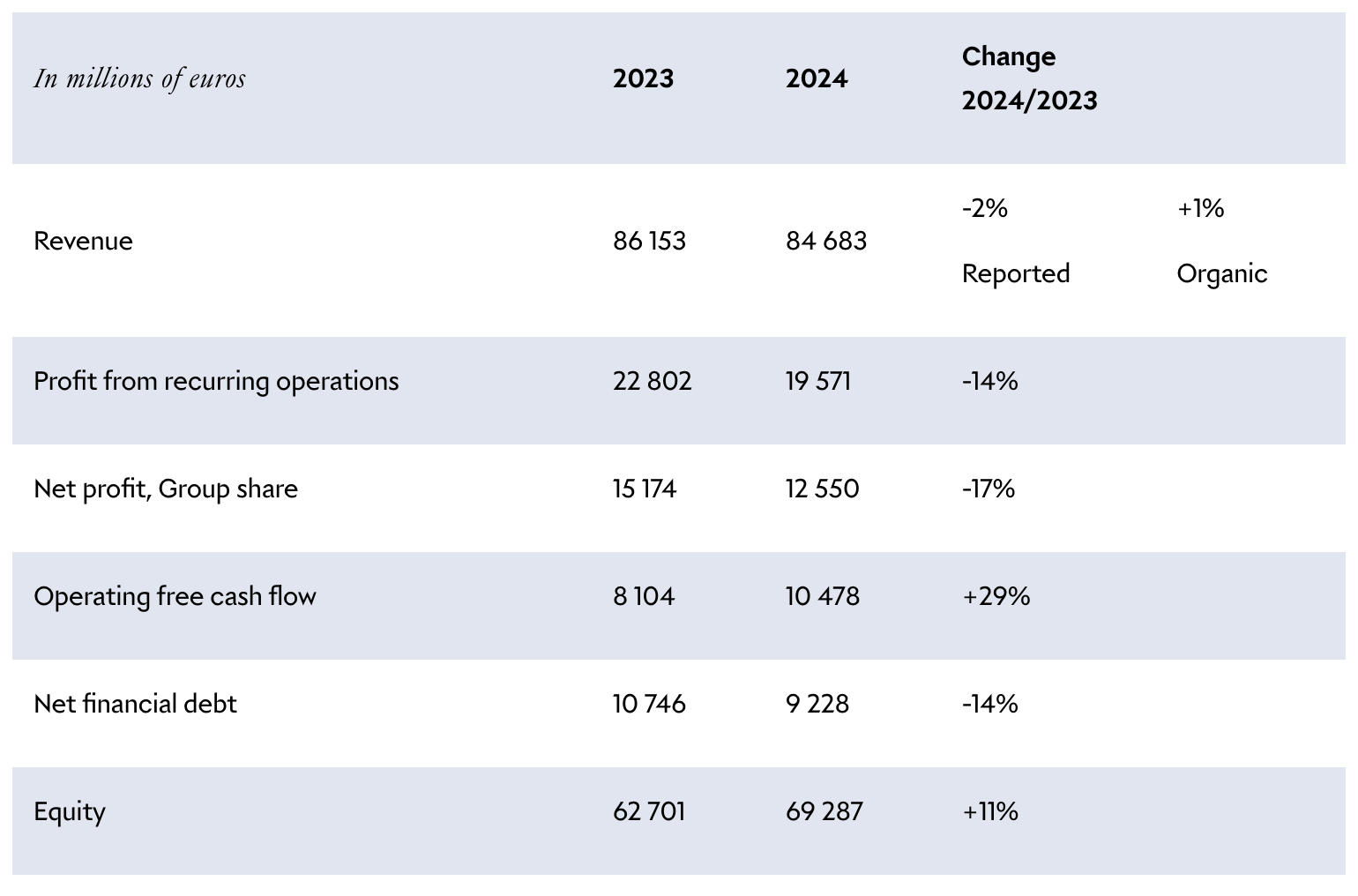

After the market closed on January 28 (local time), French luxury giant LVMH (Moët Hennessy Louis Vuitton) released its full-year 2024 financial results. Despite a challenging economic and geopolitical environment, as well as the impact of an exceptionally strong post-pandemic growth base in recent years, the group achieved 1% organic revenue growth, reaching €84.7 billion (reported basis: -2%), surpassing expectations.

However, for the first time since 2020, LVMH’s recurring operating profit declined, falling 14% on an organic basis to €19.6 billion. This was primarily due to slower growth, rising costs, and pricing pressures, which affected profit margins.

In the fourth quarter, organic revenue grew 1% year-over-year to €23.9 billion, marking an acceleration compared to the third quarter and exceeding analysts’ expectations of a 1.25% decline.

LVMH Chairman and CEO Bernard Arnault commented:

“In 2024, amid an uncertain environment, LVMH showed strong resilience. This capacity to weather the storm in highly turbulent times – already illustrated on many occasions throughout our Group’s history – is yet another testament to the strength and relevance of our strategy. The creativity and very high quality of our products, our steadfast commitment to excellence, the agility of our teams and the good geographic balance of our locations underpin the success of LVMH and its Maisons, backed by the dedication of all our people. This dedication was also behind one of the Group’s finest collective achievements of 2024: LVMH and its Maisons’ partnership with the Paris 2024 Olympic and Paralympic Games, which helped make the world’s foremost sports competition a resounding success and showcased French expertise and craftsmanship on the global stage.

“As part of our ongoing commitment to design, culture and heritage, we were also glad to witness the reopening of Notre-Dame Cathedral in Paris at the end of the year, even more beautiful following its restoration, which took place with support from donors including LVMH. We also recently celebrated the 10th anniversary of the highly successful Fondation Louis Vuitton, which has drawn 11 million visitors since it opened and maintained its mission of making cultural events accessible to the widest possible audience.

“While remaining highly vigilant with regard to cost management and our single-minded focus on the desirability of our designs, we enter 2025 with confidence. Guided by our mission – ‘Passionate about creativity’ – and our core values, the Group will rely on the agility and talent of its teams to set the stage for future success and further extend its leadership in the luxury market.”

LVMH Chief Financial Officer Jean-Jacques Guiony told the Financial Times that the company experienced a “roughly stable“ year, adding that the fourth quarter saw “objectively better” performance in Europe and the U.S.

“We are in a ‘wait-and-see’ mode,” Guiony noted. “because the economy in the US is good, but our performance is linked to inflation, to interest rates and to regaining confidence . . . from aspirational customers who were under pressure earlier in the year. That’s all underway now.”

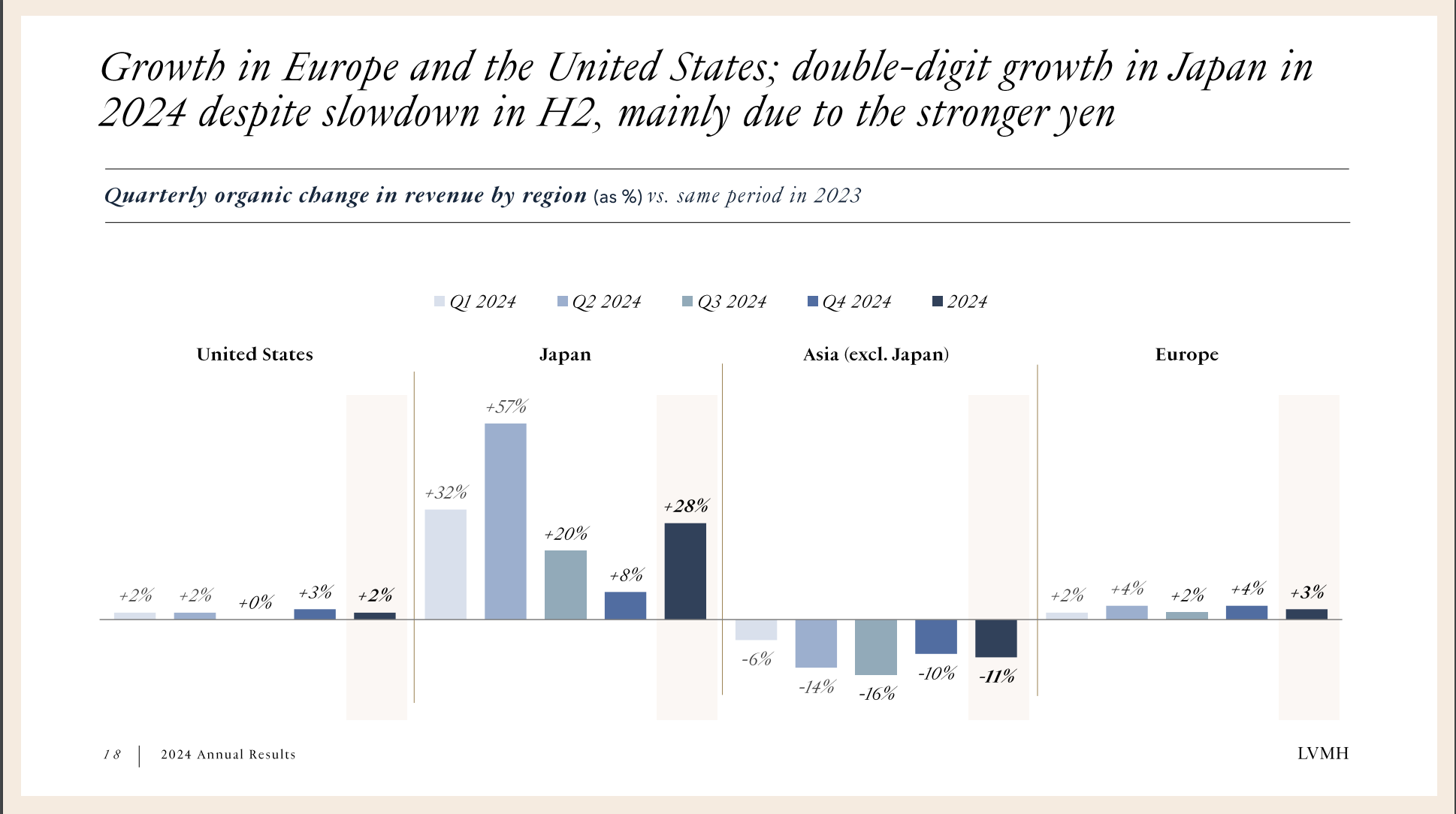

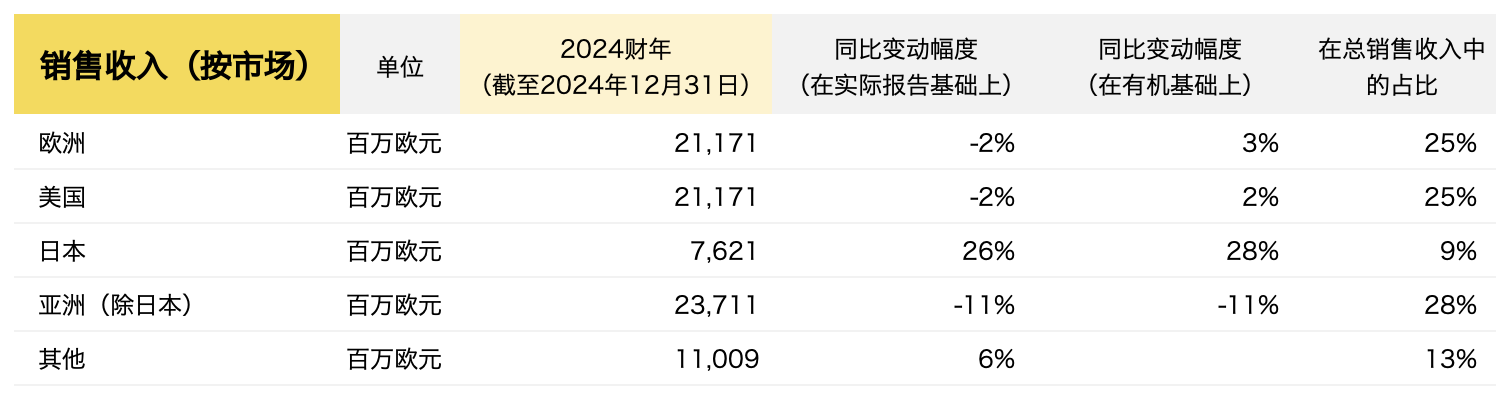

In China, Guiony acknowledged that the market remained sluggish but showed improvement compared to previous quarters. LVMH’s sales in the Asia-Pacific region (excluding Japan), led by the Greater China market, declined 10% year-over-year in the fourth quarter and 11% for the full year. Analysts at HSBC stated that they “remain convinced, for the sector as well as for LVMH, that Chinese consumption has not deteriorated further since Q3 2024” and noted that the U.S. market had picked up “convincingly” following the November presidential election.

LVMH’s Key Achievements in 2024

Resilience Amid Global Turbulence

- Sustained organic revenue growth despite market volatility.

- Revenue growth in Europe and the U.S.; Japan performed exceptionally well due to a weaker currency.

- Significant negative impact from exchange rate fluctuations, particularly on the Fashion & Leather Goods and Wines & Spirits segments.

- Operating free cash flow increased by 29%, exceeding €10 billion.

- The Wines & Spirits segment continued to reflect the demand normalization trend that began in 2023.

- The Fashion & Leather Goods segment maintained strong performance, supported by product appeal, with operating profit margins remaining at an exceptional level.

- The Perfumes & Cosmetics segment demonstrated strong momentum, with Dior’s Sauvage continuing to be the world’s best-selling fragrance.

- All Watches & Jewelry brands launched numerous innovations and continued investments in marketing and retail evolution.

- Sephora delivered outstanding performance, further strengthening its leadership in global beauty retail.

Advancements in the LIFE 360 Environmental Program

- Accelerated implementation of circular design policies: 31% of raw materials used in LVMH brands’ products and packaging were sourced through recycling processes.

- Achieved absolute greenhouse gas emissions reduction targets (Scope 1 and Scope 2) two years ahead of schedule: emissions in 2024 were reduced by 55% compared to 2019 (surpassing the 2026 target of a 50% reduction).

- Water consumption at production sites and workshops decreased by 10% compared to 2023 (on track for the 2030 target of a 30% reduction).

- As part of the group’s biodiversity protection plan, 3.8 million hectares of animal and plant habitats were restored or regenerated by the end of 2024 (with a 2030 target of 5 million hectares).

Significant Economic and Social Impact in France and Worldwide

- As of the end of 2024, LVMH had over 215,000 employees worldwide, including nearly 40,000 in France.

- Recognized as the largest private-sector recruiter in France.

- Through the Institut des Métiers d’Excellence (IME), LVMH has preserved and transmitted expertise in over 280 professions related to design, craftsmanship, and customer experience, training more than 3,300 apprentices since its founding in 2014.

- Supported over 910 non-profit organizations and charitable foundations in 2024, with approximately 65,000 LVMH employees participating in community partnerships that benefited over 1.9 million people.

- Invested €5.5 billion in operations in 2024, primarily for retail network expansion and production facility development, including €1.7 billion in France.

- Operates 119 production sites and artisan workshops in France.

- Paid a total of €6 billion in corporate taxes worldwide in 2024, with approximately half contributed in France.

LVMH Group’s Key Financial Data for Fiscal Year 2024 (as of December 31, 2024):

Performance by Region

Europe and the U.S. achieved organic growth. Japan recorded double-digit revenue growth, driven by a weaker currency. Other parts of Asia reflected strong spending by Chinese consumers in Europe and Japan.

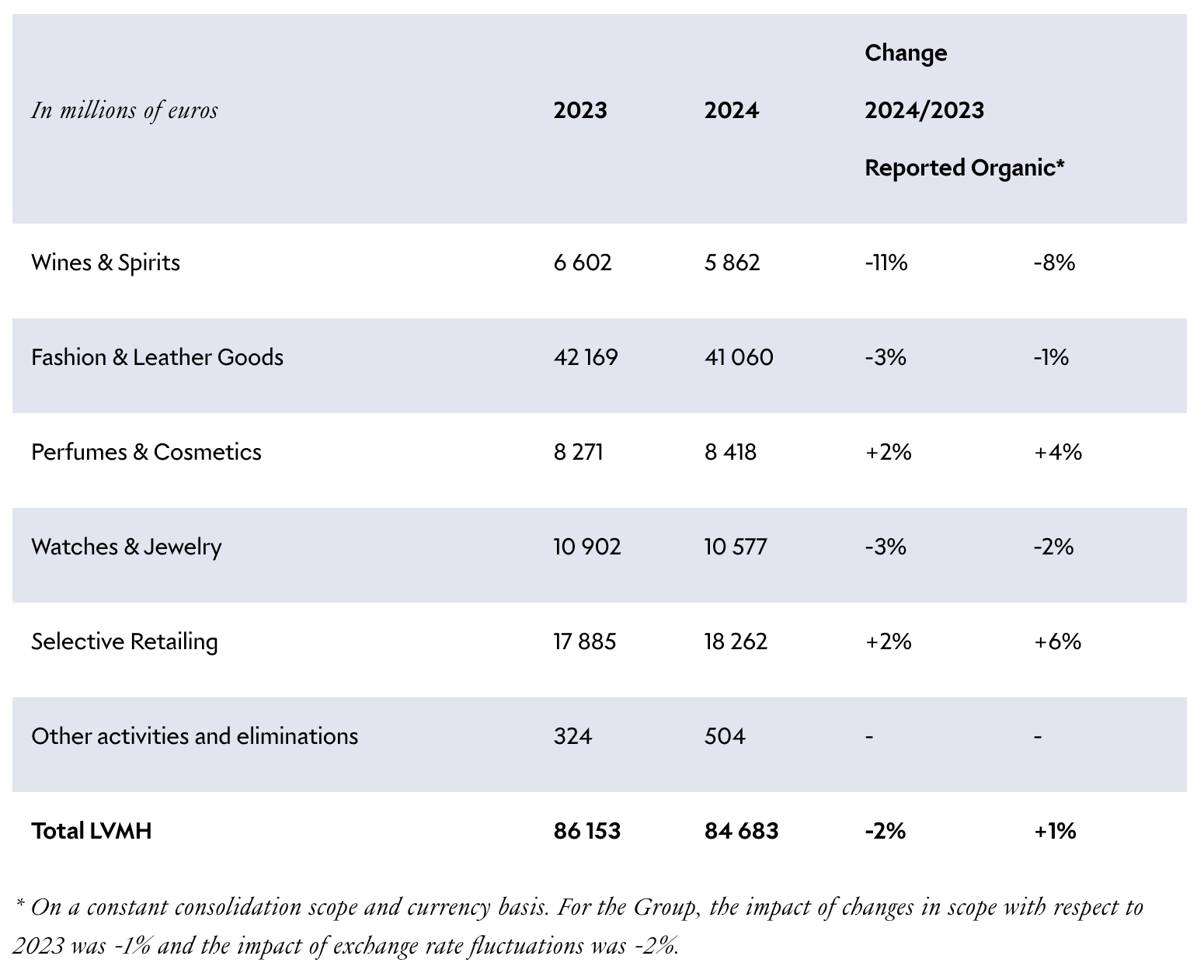

Performance by Business Segment

Wines & Spirits

Following three years of exceptional growth, the post-pandemic demand normalization trend for Champagne and Cognac, which began in 2023, continued in 2024, accompanied by a slowdown in consumption and a more challenging environment in the Chinese market. LVMH’s Champagne brands maintained a market-leading position, holding over 22% of Champagne AOC shipment shares.

Hennessy Cognac revenue was impacted by weak local demand. Meanwhile, Château d’Esclans accelerated its international expansion in the Provence rosé wine sector. The group also launched SirDavis, a new American whiskey brand, in partnership with Beyoncé Knowles-Carter.

Fashion & Leather Goods

Louis Vuitton and Christian Dior both garnered significant attention during the Paris 2024 Olympic and Paralympic Games.

Louis Vuitton reaffirmed its excellence in travel innovation, crafting bespoke trunks at its historic Asnières workshop to house some of the world’s most prestigious sports trophies. This included the trophy for the 37th America’s Cup in Barcelona, as well as the medal and torch cases for the Paris 2024 Olympics and Paralympics. The brand’s new flagship store in New York was a resounding success, offering customers an immersive experience.

Christian Dior maintained its creative momentum, blending tradition with modernity. The L’OR DE DIOR exhibition at Beijing’s Guardian Art Center showcased the brand’s deep cultural ties with China through an artistic lens. The newly launched My Dior jewelry collection, inspired by Dior’s signature Cannage quilting, celebrated and reinterpreted traditional craftsmanship. Dior also marked the holiday season with spectacular window displays worldwide, particularly at its flagship boutique at 30 Montaigne in Paris and the new Dior Gold House in Bangkok.

Loro Piana celebrated its centennial in 2024, highlighting its unparalleled craftsmanship and achieving outstanding performance, culminating in an exclusive holiday takeover of all windows at Harrods in London. Loewe experienced strong growth, driven by increasing brand recognition and bold product designs. Rimowa continued its steady expansion.

LVMH also welcomed two new creative directors: Michael Rider at Celine and Sarah Burton at Givenchy.

Perfumes & Cosmetics

The segment’s growth was fueled by the continued success of core product lines, strong innovation, and a selective distribution strategy.

Christian Dior performed exceptionally well. Sauvage fragrance maintained steady growth, reinforcing its position as the world’s top-selling perfume. Rihanna was introduced as the new face of the iconic J’adore fragrance, and the new Miss Dior perfume achieved remarkable success. The makeup category, particularly the Forever foundation range, also contributed to Dior’s strong performance.

Guerlain’s fragrance business thrived, especially its high-end L’Art & La Matière collection and the newly introduced Florabloom scent from the Aqua Allegoria line. Givenchy saw further growth in its beauty division, driven by the Prisme Libre loose powder and its expanding fragrance portfolio.

Maison Francis Kurkdjian opened a new showcase boutique on Rue François 1er in Paris, while Fenty Beauty expanded into China and launched a new haircare line.

Watches & Jewelry

The segment faced some declines due to ongoing store renovations, increased marketing investments, and exchange rate fluctuations.

Tiffany & Co. launched its global campaign “With Love, Since 1837”, spotlighting its signature collections. The new Tiffany Titan collection, designed by Pharrell Williams, received widespread acclaim. To commemorate the 50th anniversary of Elsa Peretti’s designs, the brand introduced a bracelet ring version of the iconic Bone cuff. The rollout of Tiffany’s new store concept was highly successful, with the New York Fifth Avenue flagship, The Landmark, achieving record revenue in 2024, establishing itself as the world’s premier luxury boutique. Since joining LVMH, Tiffany’s high jewelry sales have quadrupled, and its operating profit has doubled.

BVLGARI celebrated its 140th anniversary with the Eternally Reborn campaign and the launch of the Aeterna high jewelry collection, setting new revenue records. The brand also introduced the Tubogas jewelry line, a modern reinterpretation of its iconic 1950s designs.

Chaumet gained significant attention for designing the medals for the Paris 2024 Olympic and Paralympic Games.

LVMH also announced a 10-year global partnership with Formula 1. Starting in 2025, TAG Heuer will return as the official timekeeper of Formula 1.

Selective Retailing

Sephora achieved double-digit growth in both revenue and profit, further solidifying its position as the world’s leading prestige beauty retailer. The brand continued expanding its global footprint, particularly in the UK and the U.S., where its partnership with Kohl’s saw significant progress.

DFS (Duty Free Shops) has yet to recover to pre-pandemic 2019 levels, with operations still heavily impacted by exchange rate fluctuations.

Le Bon Marché continued its success with record-breaking revenue, supported by its differentiated strategy of continuously evolving product offerings, curated experiences, and exclusive events.

Despite ongoing geopolitical and macroeconomic uncertainties, LVMH remains confident in its brand-driven growth strategy, which emphasizes continuous innovation, strategic investments, and a steadfast commitment to desirability, product excellence, and highly selective distribution.

With its agile teams, entrepreneurial mindset, and diversified geographic footprint, LVMH is setting ambitious goals for 2025, reaffirming its leadership in the global luxury market.

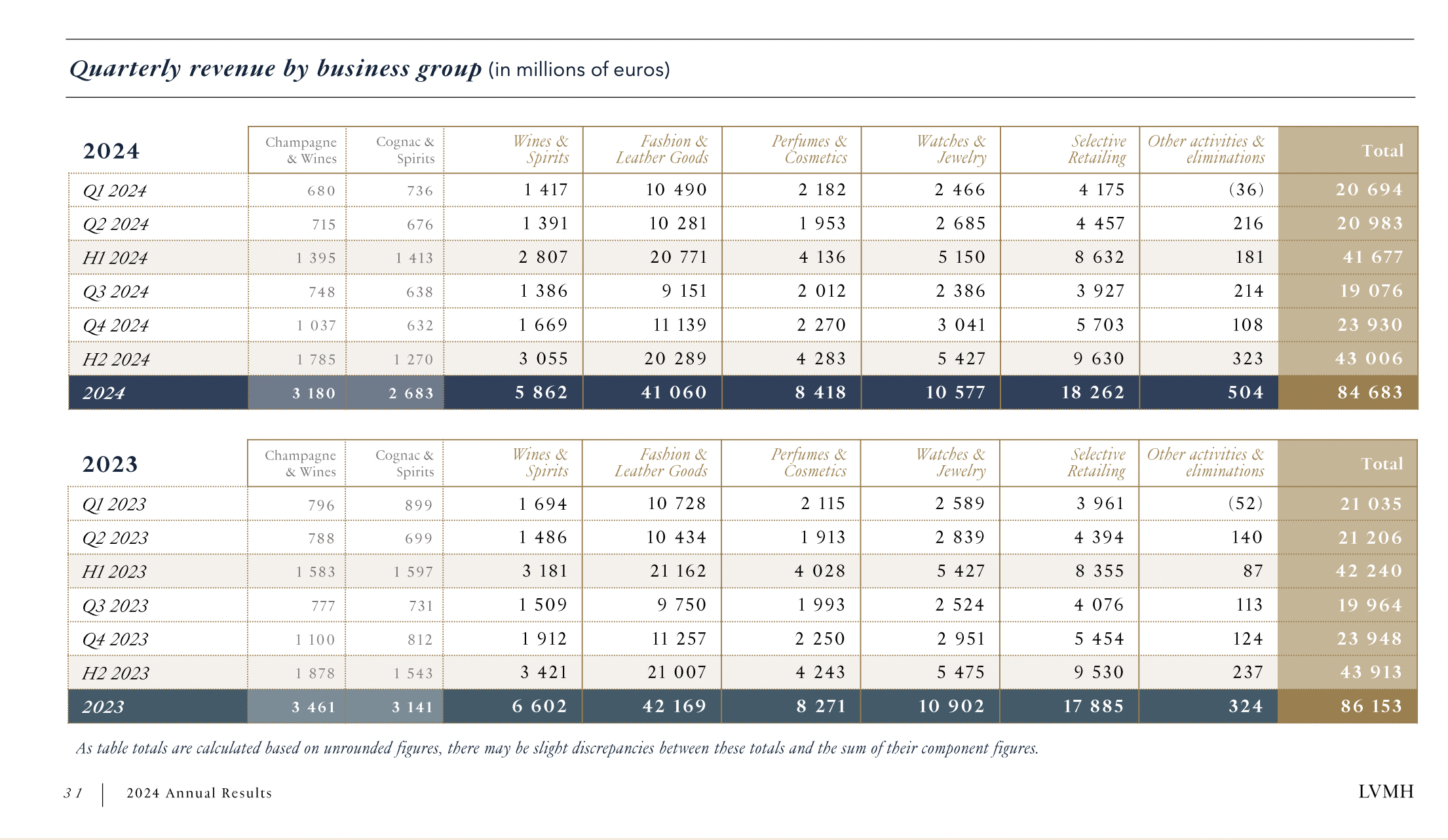

Appendix: LVMH’s 2024 Quarterly Revenue by Business Segment

| Sources: Official Financial Report, Financial Times, Luxe.CO archives

| Image Credit: LVMH Official Website

| Editor: LeZhi