At midday on March 26, Beijing-based trend toy company Pop Mart (HKEX: 9992) released its 2024 annual results: revenue soared 106.9% year-on-year to RMB 13.038 billion [USD 1.81 billion], and net profit attributable to shareholders rose 188.8% year-on-year to RMB 3.125 billion [USD 433.8 million].

Revenue from the Chinese Mainland grew 52.3% year-on-year to RMB 7.972 billion [USD 1.11 billion], while business from Hong Kong, Macao, Taiwan, and overseas markets maintained rapid growth, surging 375.2% year-on-year to RMB 5.066 billion [USD 703.3 million], contributing 38.9% of the group’s total revenue—up from 16.9% in 2023.

At the earnings release, Pop Mart’s Chairman and CEO Wang Ning stated, “Although our base is getting larger, we are confident that the Group’s revenue will grow over 50% year-on-year in 2025, surpassing RMB 20 billion for the full year. Overseas revenue is expected to more than double, reaching over RMB 10 billion. Crossing the RMB 10 billion threshold in sales for the first time in 2024 marks a major milestone, and we will continue striving towards the RMB 100 billion goal to become a global Pop Mart.”

Driven by these results, Pop Mart’s share price rose 10.87% on March 26 to HKD 140.7 per share, and continued climbing 9.24% on March 27 to HKD 153.7 per share. Its latest market capitalization reached HKD 206.4 billion, crossing the HKD 200 billion mark for the first time.

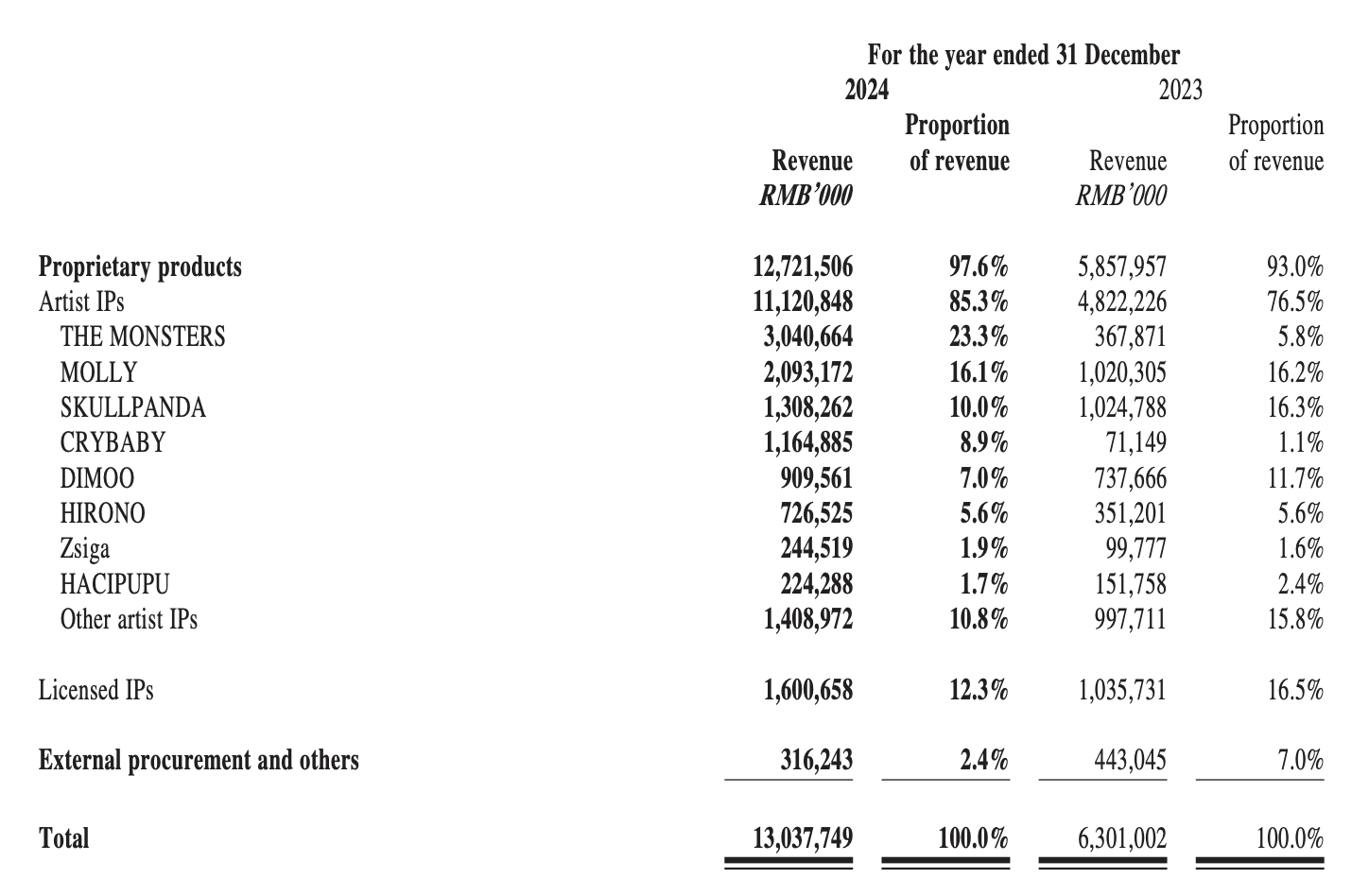

By IP:

Pop Mart adopted differentiated operational strategies based on the uniqueness of each IP, maintaining market buzz and driving strong sales growth. Thirteen IPs each achieved revenue over RMB 100 million:

-

THE MONSTERS: Plush products proved highly popular with consumers, with revenue skyrocketing 726.6% year-on-year to RMB 3.041 billion [USD 421.9 million], increasing its contribution to total revenue from 5.8% to 23.3%.

-

MOLLY: As Pop Mart’s most iconic and classic IP, MOLLY generated RMB 2.093 billion [USD 290.6 million] in revenue, up 105.2% year-on-year, contributing 16.1% of total revenue.

-

SKULLPANDA: The classic “Warmth” series reached cumulative sales of over 791,000 sets, becoming the best-selling single series. The “Comic Image Collection” series, launched in 2024, sold 265,000 sets. SKULLPANDA’s revenue grew 27.7% year-on-year to RMB 1.308 billion [USD 181.3 million].

-

CRYBABY: One of the fastest-growing emerging IPs, with revenue up 1537.2% year-on-year to RMB 1.165 billion [USD 161.6 million], increasing its contribution from 1.1% to 8.9%.

Additionally, Pop Mart’s in-house IP creation studio PDC (Pop Design Center) achieved excellent performance with IPs such as HIRONO, Zsiga, Nyota, and inosoul. Notably, HIRONO’s revenue increased 106.9% year-on-year to RMB 727 million [USD 100.9 million].

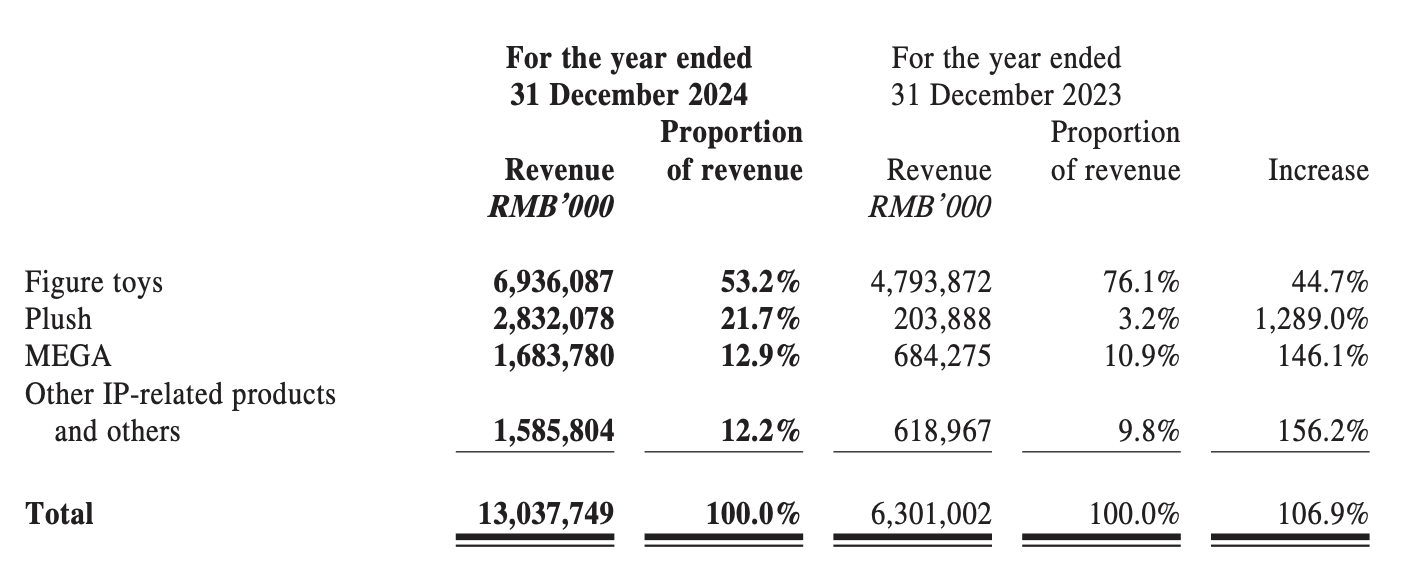

By Category:

Pop Mart’s products are mainly divided into four categories: figure toys, plush, MEGA, and derivatives & others.

-

Figure toys: Revenue rose 44.7% year-on-year to RMB 6.936 billion [USD 962.7 million], remaining the company’s largest category.

-

Plush: Revenue surged 1289.0% year-on-year to RMB 2.832 billion [USD 392.7 million], with its contribution to total revenue rising significantly from 3.2% to 21.7%.

-

MEGA: 2024 marked the fourth year of the MEGA COLLECTION. As brand operations matured, revenue rose 146.1% to RMB 1.684 billion [USD 233.7 million], accounting for 12.9% of total revenue.

-

Derivatives & Others: In 2024, Pop Mart launched its first building block product. This category saw revenue grow 156.2% year-on-year to RMB 1.586 billion [USD 220.2 million], accounting for 12.2% of total revenue.

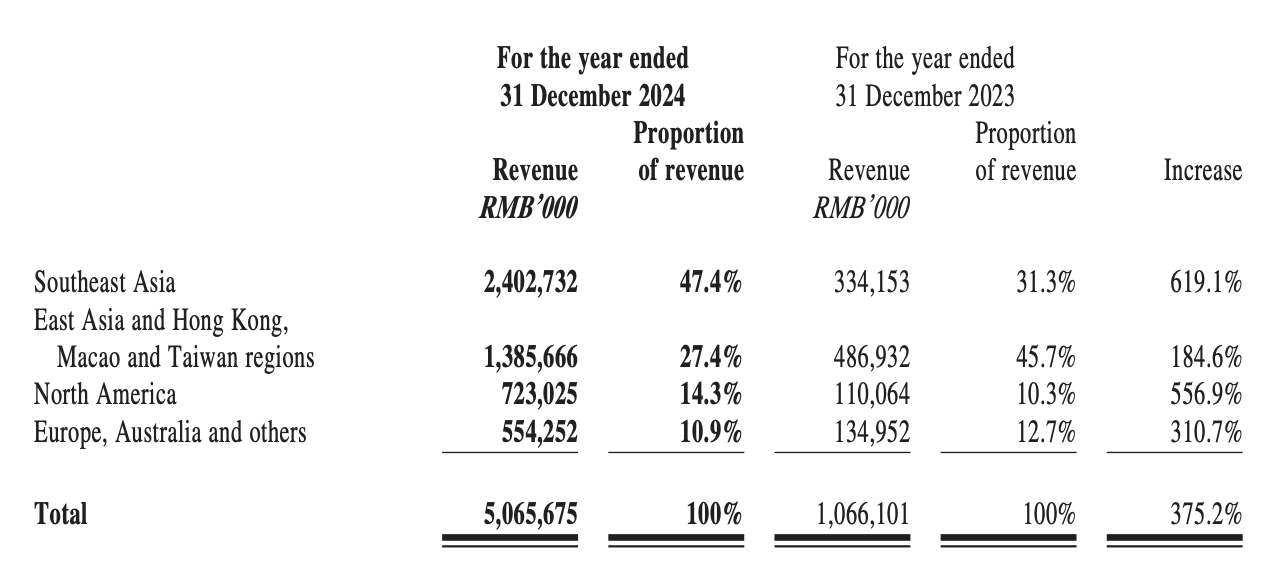

By Region:

-

Chinese Mainland: Revenue grew 52.3% year-on-year to RMB 7.972 billion [USD 1.11 billion].

-

Hong Kong, Macao, Taiwan, and Overseas: Further segmented into Southeast Asia; East Asia and Hong Kong, Macao, Taiwan; North America; and Europe, Oceania & Others. In 2024, Southeast Asia became the largest overseas market, with revenue surging 619.1% year-on-year to RMB 2.403 billion [USD 333.3 million].

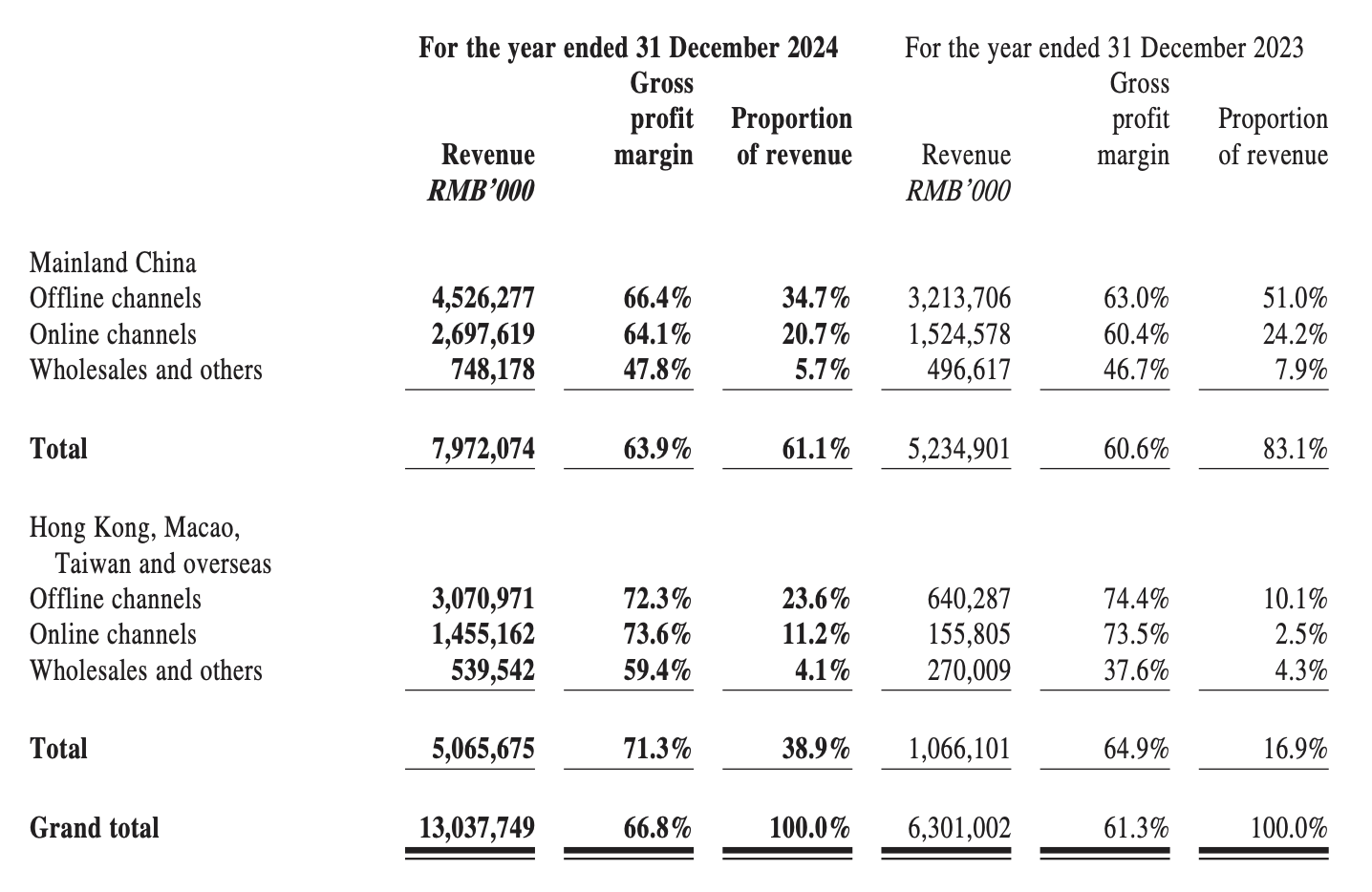

By Channel:

In the Chinese Mainland:

-

Offline Channels: Revenue increased 40.8% year-on-year to RMB 4.526 billion [USD 627.5 million]. Of this, retail stores grew 43.9%, and Robo Shops increased 26.4%.

-

Online Channels: Revenue jumped 76.9% year-on-year to RMB 2.698 billion [USD 374.0 million]. Pop Mart’s blind box vending machines, Tmall flagship store, Douyin platform, and other online channels grew by 52.7%, 95.0%, 112.2%, and 86.8% respectively.

In Hong Kong, Macao, Taiwan, and Overseas:

-

Offline Channels: Revenue surged 379.6% year-on-year to RMB 3.071 billion [USD 426.2 million]. Retail stores increased by 404.0%, and Robo Shops grew 131.9%.

-

Online Channels: Revenue skyrocketed 834.0% year-on-year to RMB 1.455 billion [USD 202.0 million]. Pop Mart’s official website, Shopee, TikTok, and other online channels grew by 1246.2%, 656.0%, 5779.8%, and 389.3% respectively.

| Source: Pop Mart Financial Report

| Image Credit: Pop Mart Financial Report, Pop Mart Official Website

| Editor: LeZhi