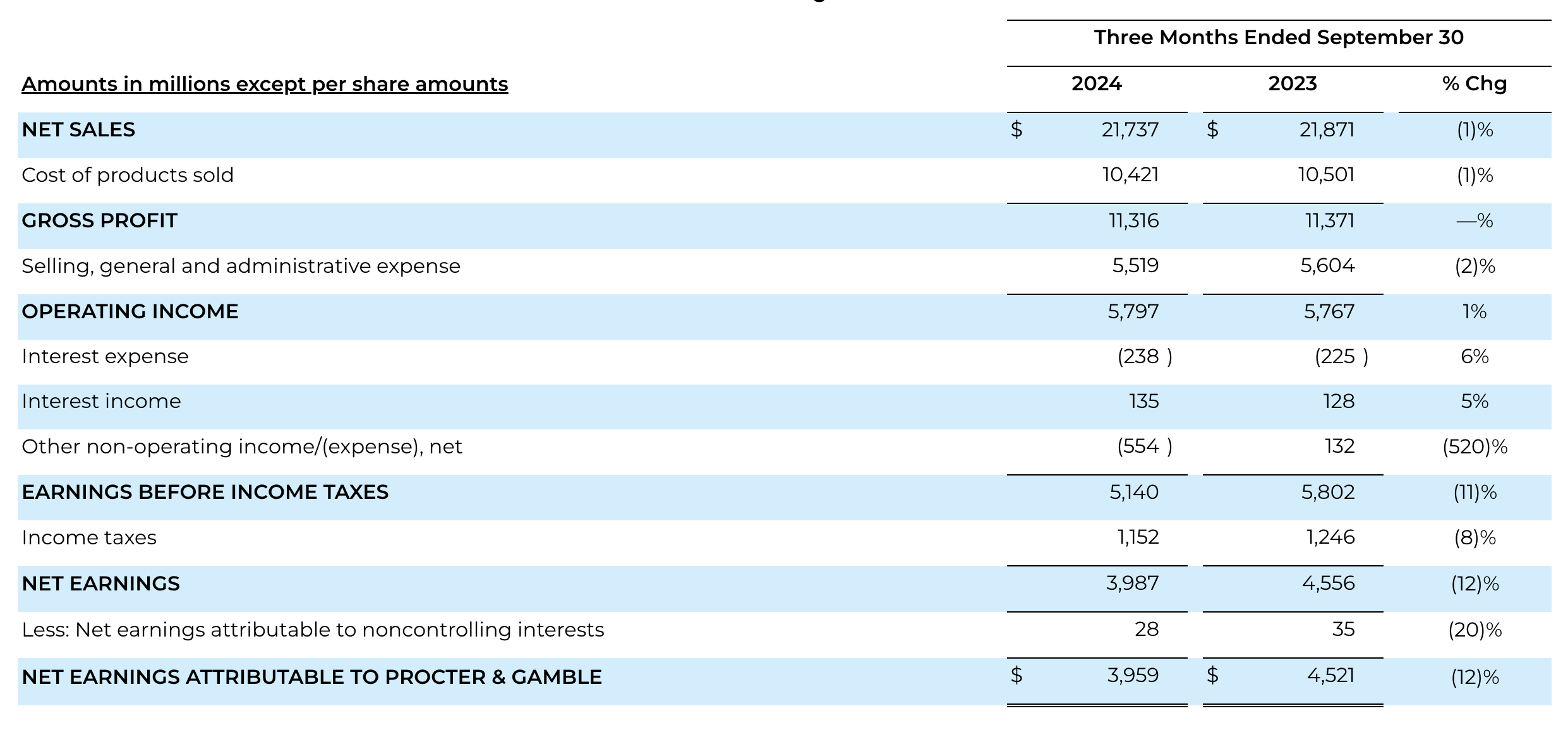

On October 18, before the market opened, American consumer goods giant Procter & Gamble (P&G) announced its key performance data for the first quarter of fiscal year 2025, which ended on September 30. Net sales fell 1% year-on-year to $21.7 billion, missing analysts’ expectations of $21.9 billion. Excluding the impacts of foreign exchange, acquisitions, and divestitures, organic net sales grew by 2%, driven by a 1% increase in pricing and a 1% rise in organic volume.

Jon Moeller, Chairman of the Board, President, and CEO, stated: “Our organic sales growth, earnings and cash results in the first quarter keep us on track to deliver within our guidance ranges on all key financial metrics for the fiscal year,” said Jon Moeller, Chairman of the Board, President and Chief Executive Officer. “We remain committed to our integrated growth strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organization. We have confidence this remains the right strategy to deliver balanced growth and value creation.”

Following the earnings report, P&G’s stock price remained flat as of the October 18 close, with the company’s market capitalization standing at approximately $403.4 billion.

In the first quarter, sales in the Chinese Mainland market declined organically by 15% year-on-year. Chief Financial Officer Andre Schulten noted during a conference call that market conditions further weakened this quarter, and SK-II continued to face challenges. “As we expected, the Chinese market remains weak from a consumer perspective… and will likely continue to be so for the next few quarters,” Schulten said. (According to P&G’s fiscal 2024 report, the Greater China market accounts for about 7% of global net sales.)

Schulten also mentioned that the company plans to launch a series of new and improved products in the second half of the year to sustain growth and support its core businesses. He revealed that P&G is seeking to “revitalize” parts of its Olay beauty business, adding that the brand’s dissolvable cleanser, Melts, is performing well.

As of September 30, P&G’s key financial data for the first quarter of fiscal year 2025 is as follows:

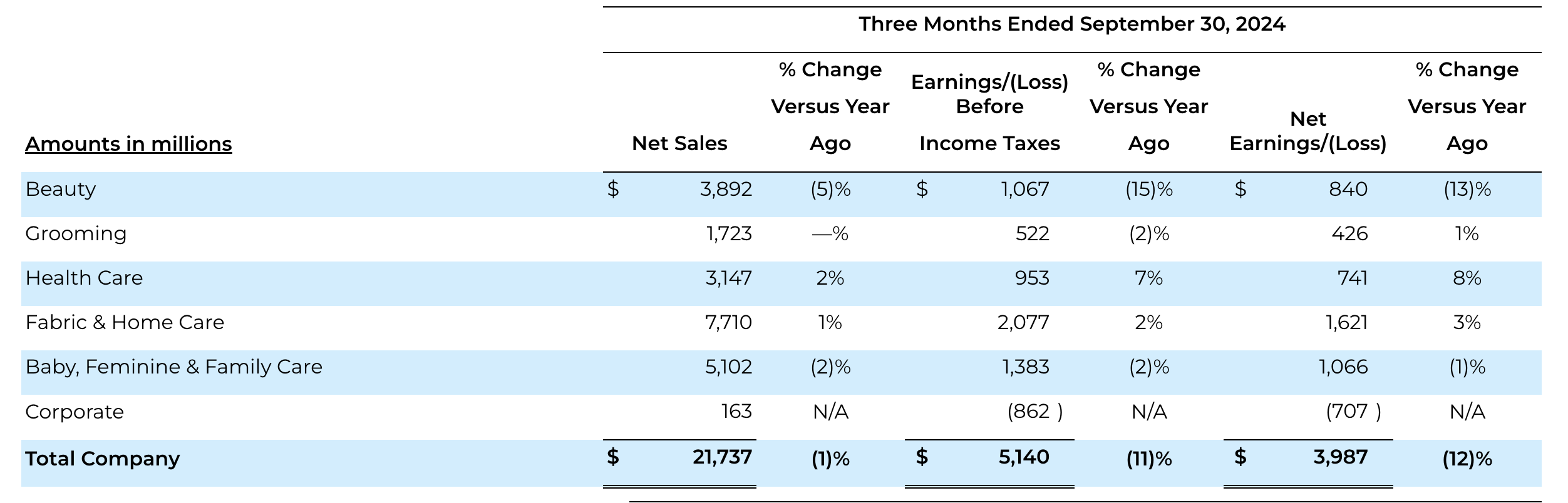

By segment:

- Beauty: Organic sales declined by 2% year-on-year. Hair care saw low single-digit organic growth due to volume increases in North America, Europe, and Latin America, and a favorable premium product mix, offset by declining sales in the Chinese Mainland. Personal care organic sales grew by high single digits, driven by innovation-led volume growth and a favorable product mix. Skin care organic sales fell by more than 20%, primarily due to volume declines and an unfavorable product mix caused by SK-II sales declines.

- Grooming: Organic sales increased by 3% year-on-year, driven by innovation-led volume growth but partially offset by an unfavorable geographic mix.

- Health Care: Organic sales rose by 4% year-on-year. Oral care saw low single-digit organic growth thanks to a premium product mix, though partially offset by volume declines, mainly in the Chinese Mainland. Personal health care organic sales grew by single digits, driven by respiratory product growth and price increases.

- Fabric and Home Care: Organic sales grew by 3% year-on-year. Fabric care saw low single-digit organic growth, supported by a favorable geographic mix in North America and Europe. Home care organic sales grew by single digits, driven by volume growth and a favorable product mix.

- Baby, Feminine, and Family Care: Organic sales were flat year-on-year. Baby care organic sales declined by mid-single digits due to volume decreases, partially offset by a favorable product mix. Feminine care organic sales grew by low single digits, driven by a favorable product mix and price increases, though partially offset by volume declines in international markets. Family care organic sales grew by mid-single digits, driven by strong volume growth.

Based on these results, the company has maintained its previous guidance for fiscal year 2025.

|Source: Official Financial Report, Reuters

|Image Credit: Company Website

|Editor: LeZhi