On July 30, Procter & Gamble (P&G), the American consumer goods giant, released its financial results for the fourth quarter and fiscal year ending June 30, 2024. The company’s sales reached a record high, but in Greater China, sales declined by 9% organically compared to the previous year.

After the earnings report was released, P&G’s stock price steadily climbed from $161.7 per share at the close on July 30 to $170 per share at the close on August 2, bringing its current market capitalization to $390.55 billion.

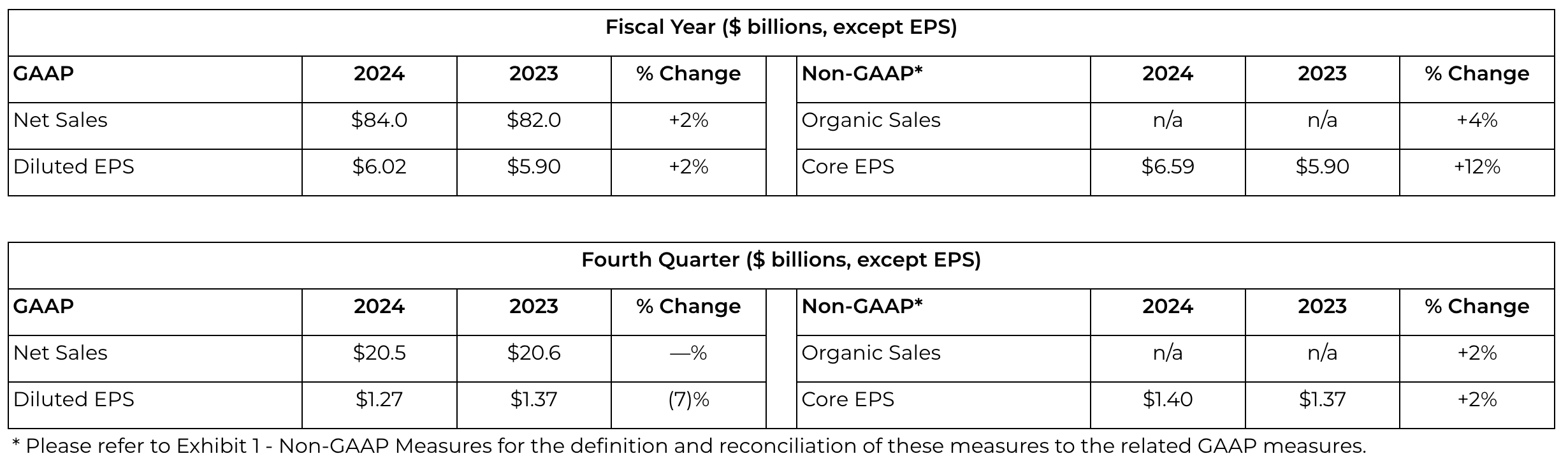

P&G’s net sales for the 2024 fiscal year were $84 billion, a 2% increase year-over-year. Although the growth rate has slowed compared to the previous three years (7.28% in FY2021, 5.35% in FY2022, and 2.27% in FY2023), it marked the highest sales in nearly a decade. Organic sales, excluding the impacts of foreign exchange, acquisitions, and divestitures, grew by 4%, mainly driven by higher pricing. Shipment volumes and product mix remained flat compared to the previous fiscal year.

Key financial data is illustrated in the chart below:

In the 2024 fiscal year, P&G returned more than $14 billion to shareholders through $9.3 billion in dividend payments and $5 billion in stock buybacks. With the dividend increase in April 2024, this marks the 68th consecutive year of dividend increases for P&G and the 134th consecutive year of dividend payments since its founding in 1890.

Jon Moeller, P&G’s Chairman of the Board, President, and CEO, stated, “Fiscal year 2024 was another year of strong results for P&G. The team met or exceeded our going-in plans for organic sales growth, core EPS growth, cash generation and cash returned to shareowners in a challenging economic and geopolitical environment.”

Focusing on the Chinese market, P&G’s Chief Financial Officer, Andre Schulten, highlighted in the analyst conference call following the earnings release: “By market, our top-tier markets grew 4% for the year, with North America up 5% and Europe up 8%. Sales in Greater China declined by 9% organically compared to the previous year, primarily due to market weakness and headwinds faced by the SK-II brand.”

He emphasized, “Regarding China and SK-II, we were severely impacted by a weak 618 sales event, and overall market sentiment in China did not improve in the second half. We had previously emphasized that we expected a slow recovery in China, and this was reflected in our second-half performance.”

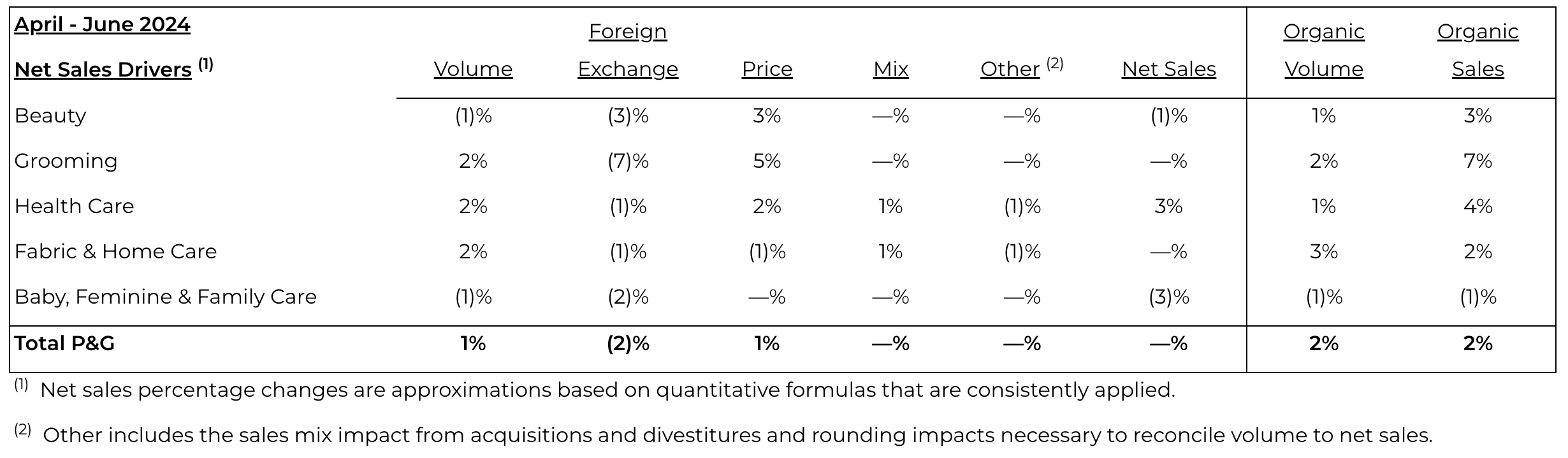

By business segment:

The financial report highlighted the performance of each segment in the fourth quarter:

- Beauty: Organic sales grew by 3% year-over-year

The decline in sales of premium brand SK-II and in Greater China offset the growth driven by higher pricing in the skincare and personal care business, resulting in flat organic sales compared to the prior year. Hair care business sales grew organically by a high single-digit percentage, primarily due to pricing increases and favorable product mix driven by growth in premium products.

- Grooming: Organic sales grew by 7% year-over-year

This is mainly driven by pricing increases and volume growth from innovation in Latin America.

- Health Care: Organic sales grew by 4% year-over-year

Oral care business sales achieved high single-digit organic growth due to a premium product mix and volume growth in North America and Europe. Personal health care business organic sales remained flat, as growth in price and volume was offset by an unfavorable mix due to lower incidence of cold and cough.

- Fabric & Home Care: Organic sales grew by 2% year-over-year

Fabric care sales remained flat as volume growth in North America and Europe was offset by pricing declines due to increased promotional spending. Home care sales achieved high single-digit organic growth due to volume growth from innovation and a favorable product mix.

- Baby, Feminine & Family Care: Organic sales declined by 1% year-over-year

Baby care sales declined organically by a mid-single-digit percentage due to volume declines from market share losses, partially offset by a favorable product mix. Feminine care sales achieved low single-digit growth due to price increases and a favorable product mix. Family care sales remained flat as an unfavorable product mix offset volume growth.

Outlook for Fiscal Year 2025

Looking ahead to the 2025 fiscal year, P&G expects net sales to grow by 2%-4% year-over-year and organic sales to grow by 3%-5%.

Jon Moeller stated, “As we look forward to fiscal 2025, we expect to deliver strong organic sales growth, EPS growth and free cash flow productivity – each in-line with our long-term growth algorithm. We remain committed to our integrated strategy – a focused product portfolio of daily use categories where performance drives brand choice, superiority (of product performance, packaging, brand communication, retail execution and consumer and customer value), productivity, constructive disruption and an agile and accountable organization – all aimed at delivering sustainable, balanced growth and value creation.”

| Sources: Official financial report, Analyst conference call transcript

| Image Credit: Official financial report

| Editor: LeZhi