On the morning of November 7, American fashion and luxury group Ralph Lauren Corp (hereinafter referred to as “Ralph Lauren”) (NYSE: RL) released its results for the second quarter of fiscal year 2025, ending September 28. Boosted primarily by strong performance in Europe and Asia, the quarter’s revenue increased by 6% on both a reported and constant currency basis, exceeding expectations. Global comparable sales for directly operated stores rose by 10% year-over-year, driven by robust retail performance across all regions.

As of the close of trading on November 7, Ralph Lauren Corp’s stock price rose 6.57% from the previous day to $221.7 per share, giving the company a market capitalization of $13.77 billion. Over the past 12 months, Ralph Lauren’s stock has surged 96.44%.

Ralph Lauren, Executive Chairman and Chief Creative Officer of the group, commented, “A spirit of optimism and the easy elegance of timeless style — these are elements that have come to define our brand. This summer was a celebration of all that we cherish, and as we turn our focus to holiday, we will continue inspiring people around the world to come together and step into their dreams.”

Group President and CEO Patrice Louvet added, “Our teams are executing well on our long-term strategy, injecting energy and excitement behind our storied brand through what continues to be a choppy global operating environment. Our strong business performance across every geography this quarter underscores the resilience of our diversified growth drivers and our elevated consumer base, giving us confidence to take up our financial outlook for the full fiscal year ahead of the all-important holiday season.”

Key Highlights from Q2 under the “Next Great Chapter: Accelerate” Strategy:

Enhancing and Inspiring as a Lifestyle Brand

- The group attracted 1.5 million new consumers through its direct-to-consumer channels, increasing brand awareness and net promoter scores. Social media followers exceeded 62 million, achieving low double-digit growth.

- Key moments of consumer engagement included partnerships as the official outfitter of Team USA for the 2024 Paris Olympics, sponsorship of Wimbledon and the US Open, and the Spring 2025 Ralph Lauren fashion show inspired by the natural beauty and serene elegance of Hamptons coastal living.

Driving Core Business Growth and Expanding into New Markets

- Core business segments grew by low double digits, with high-potential categories such as women’s apparel, outerwear, and handbags seeing mid-double-digit growth, outperforming overall company growth on a constant currency basis.

- Product highlights for the quarter included:

- The US Open Special Collection, featuring modern sportswear inspired by the event’s vibrancy and the classic Polo style.

- The “Denim Daydream” collection, part of the “Artist-in-Residence” project in collaboration with Naiomi Glasses.

- The Pink Pony collection, reflecting Ralph Lauren’s ongoing commitment to cancer care and research.

- Average unit retail prices (AUR) for the group’s directly operated network grew 10%, building on a 9% increase last year, reflecting the continued shift to full-price sales and a solid multi-tier elevation strategy.

Winning in Key Cities through Consumer Ecosystems

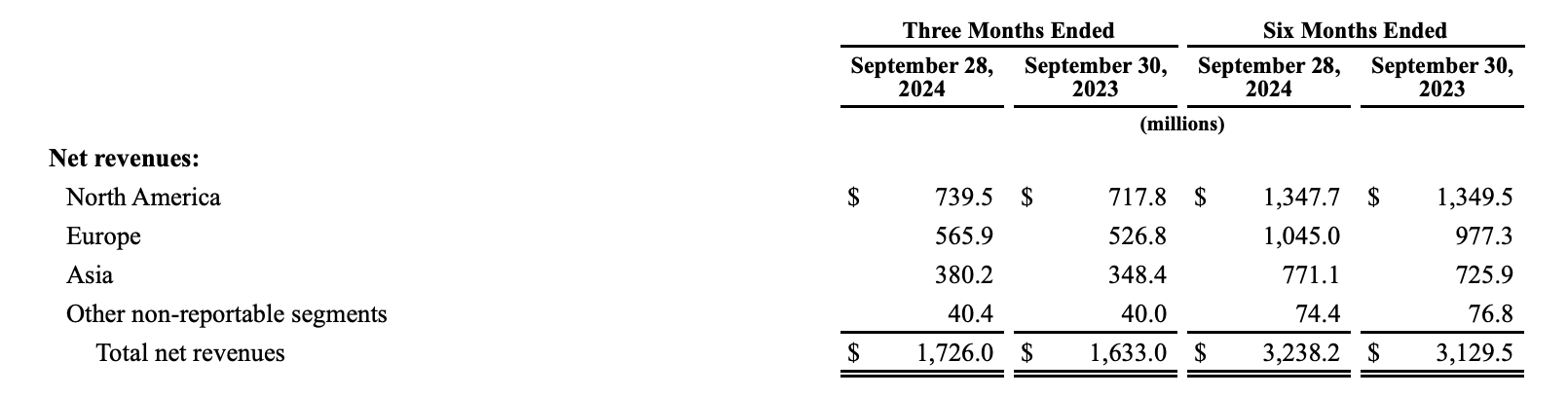

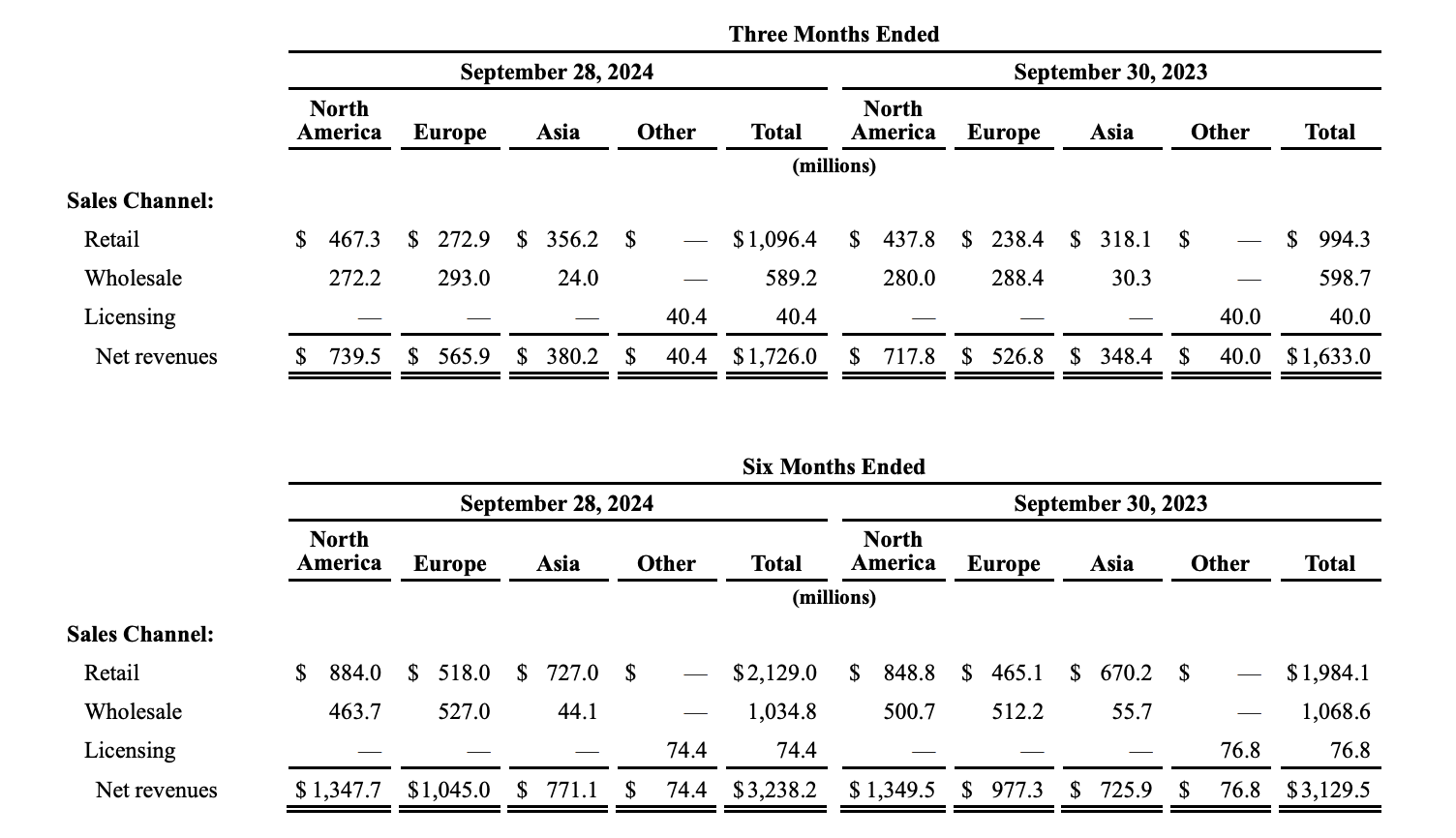

Growth during the quarter was primarily driven by Asia, with revenue rising 9% on a reported basis and 10% on a constant currency basis, surpassing expectations. Growth in the Chinese Mainland reached low double digits on both reported and constant currency bases. In Europe, sales grew by 7% (reported) and 6% (constant currency), driven by sustained brand momentum across the region. North America returned to growth with a 3% increase, supported by stronger direct-to-consumer performance, which offset planned moderation in the wholesale business.

In the second fiscal quarter, the group continued to expand and develop its ecosystem in key cities, opening 25 new directly operated and partner stores. Notable openings during the period included locations in Tulsa, Oklahoma; Giverny, France; and Shenzhen, China.

The group stated that its business development relies on a robust foundation defined by five key drivers: talent and culture, best-in-class digital technology and data analytics, operational excellence, a strong balance sheet, and leadership in corporate responsibility and sustainability.

—By Market—

In North America, second-quarter revenue increased by 3% year over year to $739 million. Comparable store sales in the region rose by 6%, with brick-and-mortar store sales growing by 9%, offsetting a 2% decline in e-commerce performance. Wholesale revenue in North America fell by 3%, in line with the group’s expectations.

In Europe, second-quarter revenue increased by 7% on a reported basis to $566 million and by 6% on a constant currency basis. Comparable store sales in the region rose by 15%, significantly exceeding expectations, with brick-and-mortar store sales and e-commerce growing by 15% and 14%, respectively. Wholesale revenue grew by 2% on a reported basis and slightly on a constant currency basis, as strong replenishment trends balanced out timing differences in merchandise receipts that shifted to the second half of the year.

In Asia, second-quarter revenue rose by 9% on a reported basis to $380 million and by 10% on a constant currency basis, exceeding expectations. Comparable store sales in the region increased by 11%, with brick-and-mortar sales up by 10% and e-commerce sales surging by 19%.

—By Channel—

Looking ahead to the full fiscal year 2025 and the third quarter, the group provided the following projections:

For fiscal year 2025, the group anticipates revenue growth of approximately 3% to 4% on a constant currency basis. Based on current exchange rates, foreign exchange is expected to have a negative impact of around 40 to 60 basis points on revenue for fiscal year 2025. Operating margin is projected to expand by approximately 110 to 130 basis points on a constant currency basis, driven primarily by gross margin expansion and operating expense leverage. Gross margin is expected to improve by about 80 to 120 basis points on a constant currency basis. Foreign exchange is anticipated to have a negative impact of approximately 20 basis points on both gross margin and operating margin.

For the third quarter, the group forecasts revenue growth of approximately 3% to 4% on a constant currency basis, with foreign exchange expected to contribute a positive impact of around 10 to 50 basis points to revenue growth. Operating margin is projected to expand by about 100 to 140 basis points at constant currency, primarily due to gross margin expansion. Foreign exchange is expected to have a neutral impact on both gross margin and operating margin for the third quarter.

Additionally, the group anticipates the full-year tax rate for fiscal year 2025 to be in the range of 22% to 23%, higher than last year’s 19%, which benefited from specific tax incentives. The third-quarter tax rate is expected to be around 22%. Capital expenditures for fiscal year 2025 are projected to range between $250 million and $300 million.

| Source: Ralph Lauren Group official website and financial reports

| Image Credit: Ralph Lauren Group official website

| Editor: LeZhi