On August 7, before the market opened in New York, Ralph Lauren Corp (NYSE: RL), an American fashion and luxury group, announced its financial results for the first quarter of fiscal year 2025, ending on June 29. The company reported a 1% year-over-year increase in revenue to $1.512 billion, or a 3% increase on a constant currency basis, exceeding expectations, primarily due to strong performance in Europe and Asia. Global direct-to-consumer same-store sales increased by 5% year-over-year, driven by positive retail sales growth across all regions.

Sales in the Asian market grew by 4% year-over-year, or 9% on a constant currency basis, slightly surpassing the company’s expectations. Notably, sales in the Chinese market grew by high single digits year-over-year, or by low double digits on a constant currency basis.

In response, Mr. Ralph Lauren, Executive Chairman and Chief Creative Officer of the group, stated, “Our brand has always been about inspiring a better life and celebrating the moments that bring us together. From our intimate runway show at our New York studio this spring to our elegant Salone del Mobile presentation in Milan and this summer’s Olympics, we are inviting people around the world to step into their dreams through authentic, timeless style.”

Patrice Louvet, President and CEO of Ralph Lauren, commented, “We delivered a solid start to the year, with first quarter performance exceeding our expectations on the top- and bottom-line led by our direct-to-consumer and international businesses. The powerful combination of our brand strength and diverse growth drivers – together with our culture of agility and operating discipline – gives us confidence that our long-term strategy will continue to deliver even through these dynamic times.”

As of the close of trading on August 7, Ralph Lauren’s stock price had fallen 3.37% from the previous day to $159.39 per share, with the latest market value of $9.87 billion. Over the past 12 months, the stock price has risen by 22.47%.

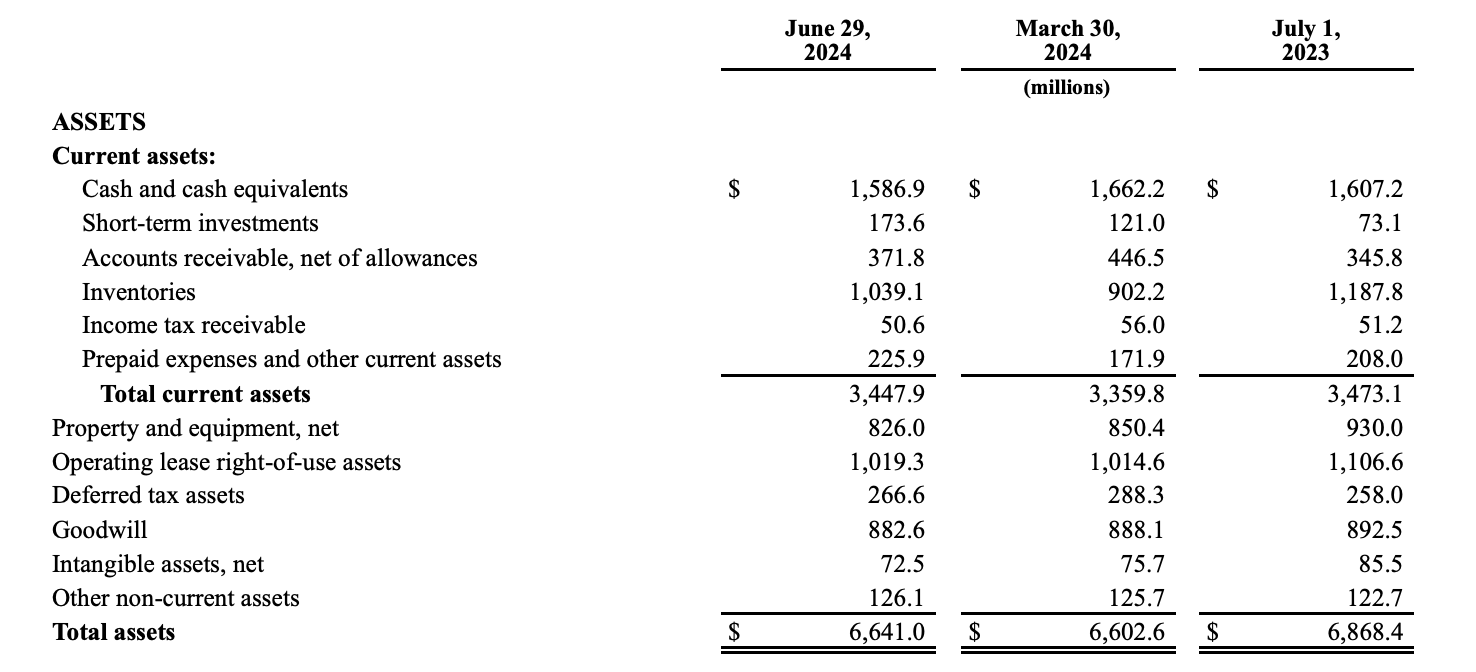

Key Financial Data for Ralph Lauren in Q1 FY 2025:

- Foreign exchange rates negatively impacted net revenue growth by approximately 170 basis points.

- Operating expenses increased by 2% year-over-year to $857 million, primarily due to increased marketing investments related to key event plans.

- Gross profit was $1.1 billion, with a gross margin of 70.5%, up 170 basis points from the previous year. The expansion in gross margin was driven by favorable shifts in product, channel, and geographic mix, lower cotton costs, and AUR growth across all regions.

- Operating income was $209 million, with an operating margin of 13.8%. On an adjusted basis, operating income was $216 million, with an operating margin of 14.3%, up 90 basis points from the previous year.

By Market:

- North America: First-quarter revenue declined 4% year-over-year to $608 million. In retail, same-store sales in North America increased by 1%, with brick-and-mortar store sales growing by 3%, offsetting a 4% decline in e-commerce. The timing difference of Easter this year versus last year had a negative impact of approximately 120 basis points on comparable sales for the first quarter. Wholesale revenue in North America declined 13%, in line with Ralph Lauren’s expectations, mainly due to shifts in shipment timing and reduced off-price channel sales of excess inventory (planned).

- Europe: First-quarter revenue increased 6% year-over-year to $479 million, or 7% on a constant currency basis. In retail, comparable same-store sales grew by 8%, exceeding Ralph Lauren’s expectations, with brick-and-mortar store sales growing by 7% and e-commerce growing by 14%. Wholesale revenue in Europe increased by 5% year-over-year, with stronger reorder trends more than offsetting the negative impact of shipment timing.

- Asia: First-quarter revenue grew 4% year-over-year to $391 million, or 9% on a constant currency basis, slightly exceeding Ralph Lauren’s expectations. Comparable same-store sales grew by 9%, with brick-and-mortar store sales growing by 7% and e-commerce growing by 21%.

During the first quarter of FY 2025, Ralph Lauren accelerated its priorities for the reporting period:

– Elevate and Inspire the Lifestyle Brand

Continued strong momentum in new customer acquisition and loyalty, adding 1.3 million new direct-to-consumer users, with an increase in net promoter scores. Social media followers exceeded 60 million, up 10% from last year. Ralph Lauren also committed to investing in key brand moments to drive genuine connections with consumers worldwide. Examples include the Women’s Collection fashion show in New York in April; the Only Polo summer event; the annual Milan International Furniture Fair and the Milan presentation of the Men’s Purple Label collection; the successful 618 Shopping Festival in the Chinese Mainland; and becoming the official outfitter for Team USA for the 2024 Paris Olympics.

– Drive Core and Expand Further

Ralph Lauren stated that its core business continues to maintain good momentum, achieving low single-digit growth. Meanwhile, high-potential product categories (women’s apparel, outerwear, and handbags) also recorded strong sales growth, growing by mid-single digits on a constant currency basis, surpassing the company’s overall growth rate. Product highlights for the quarter included the Wimbledon Tennis Capsule Collection inspired by tennis spectatorship and the Team USA collection for the 2024 Paris Summer Olympics, for which Ralph Lauren is the official outfitter.

– Winning Key City Markets with Consumer Ecosystems

Ralph Lauren continued to expand its presence in major city ecosystems, opening eight new self-operated and partnership stores in the first quarter. Recently, Ralph Lauren also launched a newly renovated concept store, World of Ralph Lauren, on Michigan Avenue in Chicago, which includes the iconic RL Restaurant and the first Ralph’s Coffee in the Midwest of the United States.

Ralph Lauren further emphasized that its business is supported by five key drivers: its people and culture, best-in-class digital technologies and analytics, operational excellence, a strong balance sheet, and leadership in citizenship and sustainability.

Outlook for FY 2025 and Q2:

For FY 2025, Ralph Lauren expects revenue to grow by approximately low single digits (on a constant currency basis), with an expected increase of around 2% to 3%. Based on current exchange rates, foreign exchange is expected to negatively impact revenue growth by approximately 150 basis points for FY 2025.

Driven by gross margin expansion and operating expense leverage, operating margin for FY 2025 is expected to increase by approximately 100 to 120 basis points on a constant currency basis. Gross margin is expected to increase by approximately 50 to 100 basis points on a constant currency basis. Foreign exchange is currently expected to negatively impact gross margin and operating margin by approximately 40 basis points.

For Q2, Ralph Lauren expects revenue to grow by approximately 3% to 4% year-over-year, or low to mid-single digits, on a constant currency basis. Foreign exchange is expected to negatively impact revenue growth by approximately 160 basis points in Q2.

On a constant currency basis, Q2 operating margin is expected to increase by approximately 80 to 120 basis points, with gross margin growing by approximately 110 to 130 basis points, enough to offset planned increases in operating expenses to support key marketing activities in the quarter. Excluding marketing expenses, operating expenses as a percentage of sales are expected to decrease slightly from last year. Foreign exchange is expected to negatively impact gross margin and operating margin by approximately 40 and 50 basis points, respectively, in Q2.

|Source: Ralph Lauren Official Website and Financial Report

|Image Credit: Ralph Lauren Official Website

|Editor: Wang Jiaqi