Latest data from the Federation of the Swiss Watch Industry reveals that exports of Swiss watches fell by 2.2% year-on-year in October 2024, amounting to CHF 2.3 billion. Despite significant declines in exports to the Chinese Mainland and Hong Kong, the overall performance remained aligned with the year-to-date trend.

From January to October 2024, Swiss watch exports globally totaled approximately CHF 21.5 billion, a 2.6% decline compared to the same period in 2023. Notably, exports to the Chinese Mainland dropped by 26.2%, while those to Hong Kong decreased by 19.8%.

October 2024 Export Performance by Market

- Chinese Mainland: Down 38.8% YoY to CHF 167 million

- Hong Kong: Down 14.8% YoY to CHF 162 million

- United States: Up 11.3% YoY to CHF 422 million

- Japan: Up 20.4% YoY to CHF 191 million

- Singapore: Up 0.6% YoY to CHF 141 million

- United Kingdom: Up 2.8% YoY to CHF 165 million

- Germany: Down 5.0% YoY to CHF 109 million

- Italy: Down 1.4% YoY to CHF 93 million

- France: Down 4.5% YoY to CHF 107 million

- United Arab Emirates: Down 13.2% YoY to CHF 97.2 million

Combined exports to six major markets—United States, Japan, the Chinese Mainland, the United Kingdom, Hong Kong, and Singapore—dropped 4.1% year-on-year to CHF 1.25 billion, accounting for 53.3% of total exports.

Exports to the top 30 global markets fell by 2.5% YoY to CHF 2.179 billion in October, representing 93% of total exports.

Markets such as Spain (+16.9%), Australia (+21.5%), Mexico (+28.3%), India (+33.9%), Turkey (+14.9%), Belgium (+10.5%), Malaysia (+36.1%), Greece (+36.7%), and Oman (+26.9%) saw double-digit growth year-on-year.

Notable declines were observed in markets like the Netherlands (-2.5%), Saudi Arabia (-20.2%), Thailand (-27.9%), Qatar (-9.1%), Ireland (-8.4%), Kuwait (-9.5%), Austria (-14.1%), and Bahrain (-27.3%).

Export Performance by Material in October 2024

- Precious Metal Watches: Volume down 4.7%; value down 1.2%

- Steel Watches: Volume down 9.2%; value down 7.6%

- Steel and Gold Watches: Volume down 20.5%; value up 0.6%

- Other Metal Watches: Volume down 30.2%; value down 7.3%

- Other Materials: Volume down 6.8%; value up 19.2%

Export Performance by Price Segment in October 2024

- Below CHF 200: Volume down 8.8%; value down 12.7%

- CHF 200–500: Volume down 12%; value down 9.8%

- CHF 500–3,000: Volume down 22.2%; value down 21%

- Above CHF 3,000: Volume down 3.9%; value up 1.7%

The detailed data underscores a persistent slowdown in key markets, with notable growth in emerging regions. The overall export value continues to be heavily influenced by demand in luxury price segments, which slightly offset declines in other categories.

By Material

By Price Category (In CHF)

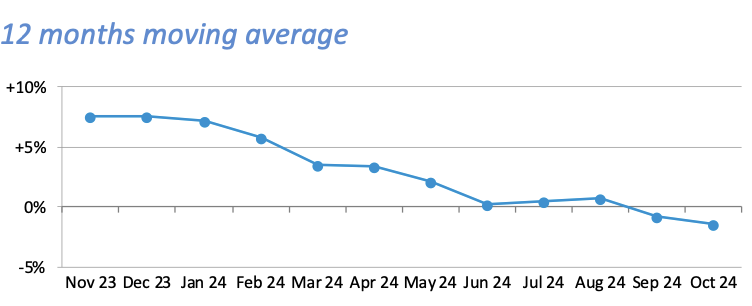

12 Months Moving Average

(Note: At time of writing, CHF 1 ≈ USD 1.1)

| Source: Federation of the Swiss Watch Industry

| Image Credit: Federation of the Swiss Watch Industry report

| Editor: LeZhi