On November 8, 2024, the inaugural Luxe.CO Sports and Outdoor Investment Salon was successfully hosted at the Jing’an Shangri-La Hotel in Shanghai.

With a longstanding focus on the sports and outdoor sector, Luxe.CO has been deeply engaged in this field, covering entrepreneurship, innovation, and investment comprehensively. Luxe.CO systematically conducts extensive and in-depth brand and category research, offering professional readers a thorough understanding of the global sports and outdoor brands’ evolution, innovation trajectories, and shifting trends. The platform also continuously tracks and analyzes global investment and M&A activities in the sports and outdoor space, providing a clear capital roadmap and illustrating entrepreneurs’ and investors’ strategies within various niche sectors.

During this event, Luxe.CO released its inaugural report, Global Sports and Outdoor Investment Trends (2020–2024):

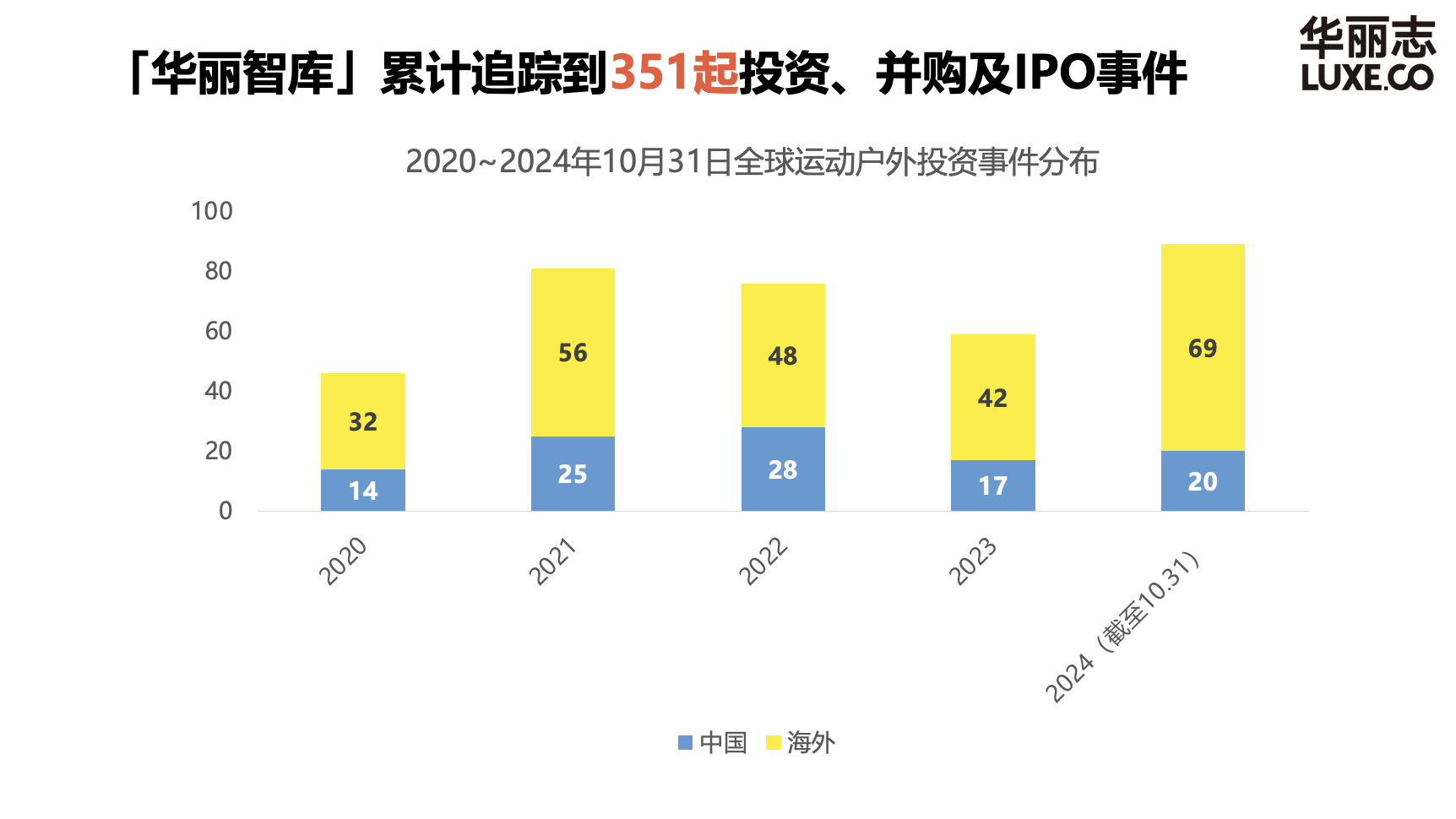

Over the past five years (from 2020 to October 31, 2024), Luxe.CO Intelligence tracked 351 investment, M&A, and IPO events in the global sports and outdoor sector.

(Note: These statistics are based on Luxe.CO Intelligence’s continuous monitoring and do not include undisclosed transactions.)

As interest in health and outdoor activities surged, global investment and M&A activity in this field saw a significant boost in 2021, with 81 transactions recorded. In 2022, the Chinese market experienced a modest peak with 28 investment deals. However, in 2023, global capital markets grew cautious due to a mix of macroeconomic and microeconomic factors. By 2024, investment activity in this sector rebounded significantly, especially in overseas markets, reaching its highest level in five years, with 69 transactions recorded in the first ten months alone.

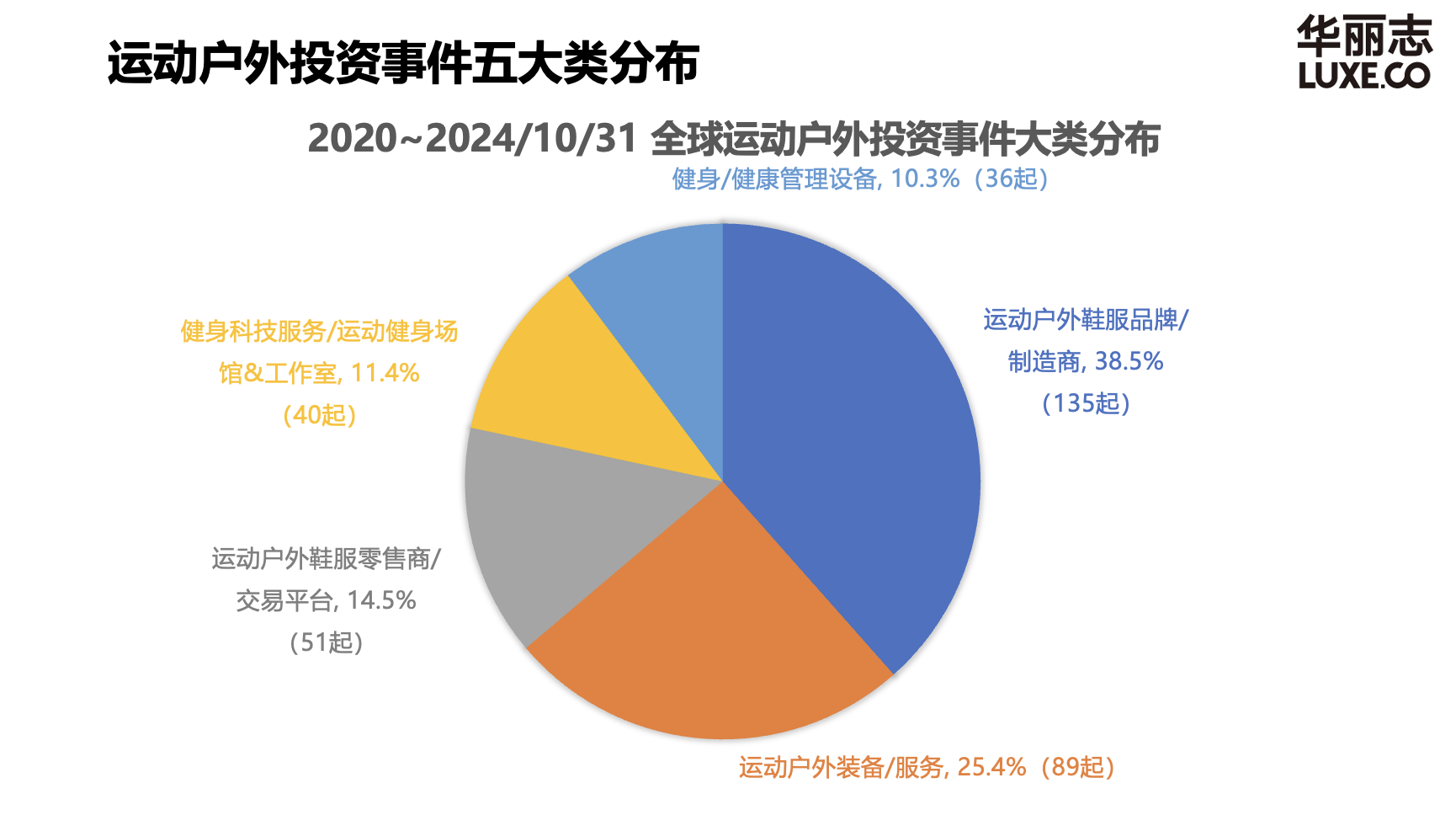

The investment distribution in the sports and outdoor sector over the past five years is as follows: sports and outdoor footwear and apparel brands accounted for 38.5%, followed by sports and outdoor equipment/services (25.4%), sports and outdoor footwear and apparel retailers/platforms (14.5%), fitness technology services/fitness studios & gyms (11.4%), and fitness/health management devices (10.3%).

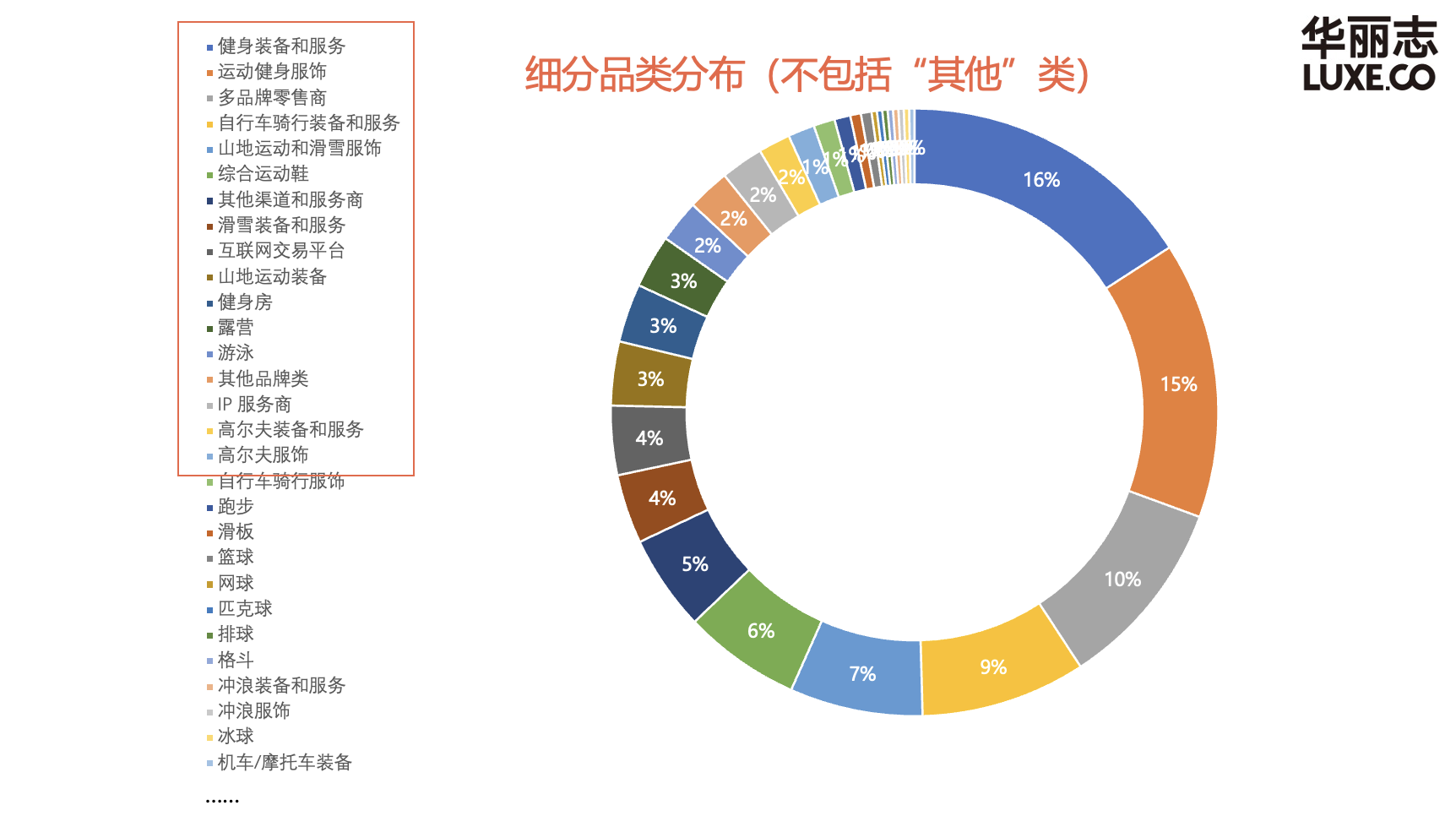

Further segmentation by category and timeline revealed unique insights, which were shared and analyzed in depth during the event.

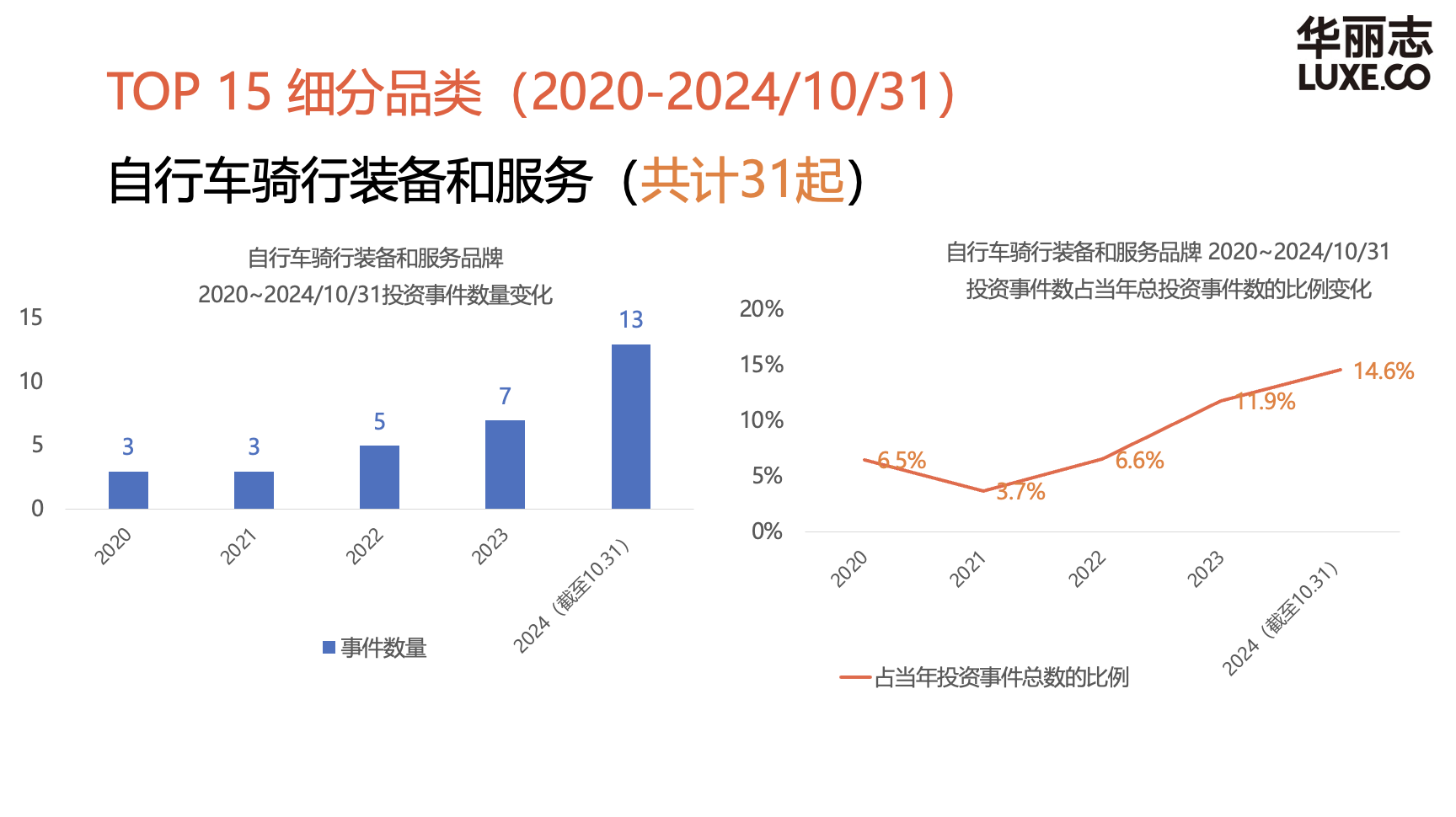

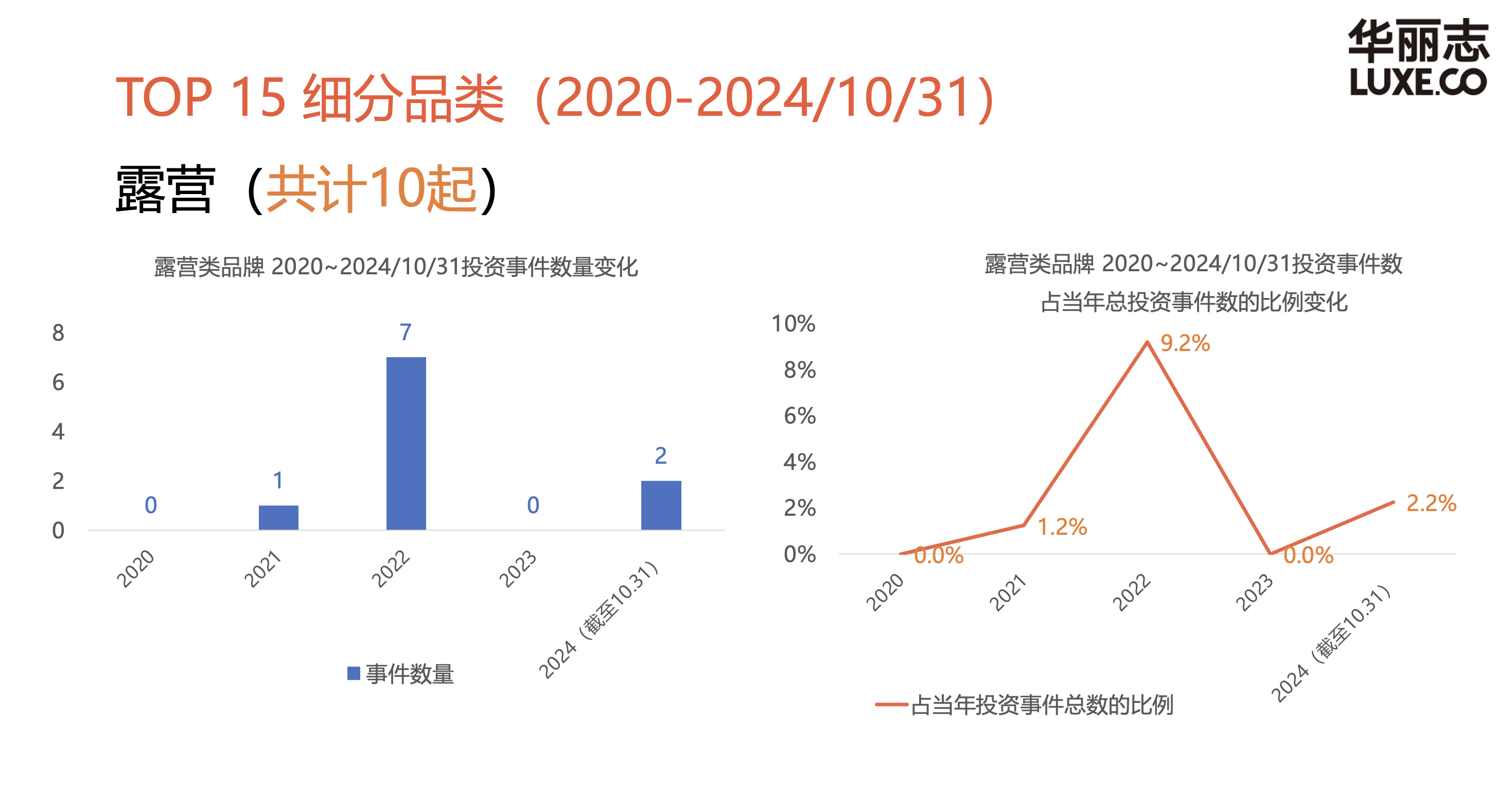

Taking “cycling” and “camping” as examples of emerging niches: Over the past five years, investments in the cycling equipment and services sector have steadily increased, with a significant surge in 2024, reaching 13 deals by the end of October, accounting for 14.5% of total sports and outdoor investment events during this period. In contrast, the camping category experienced a brief peak in 2022 but quickly cooled down afterward.

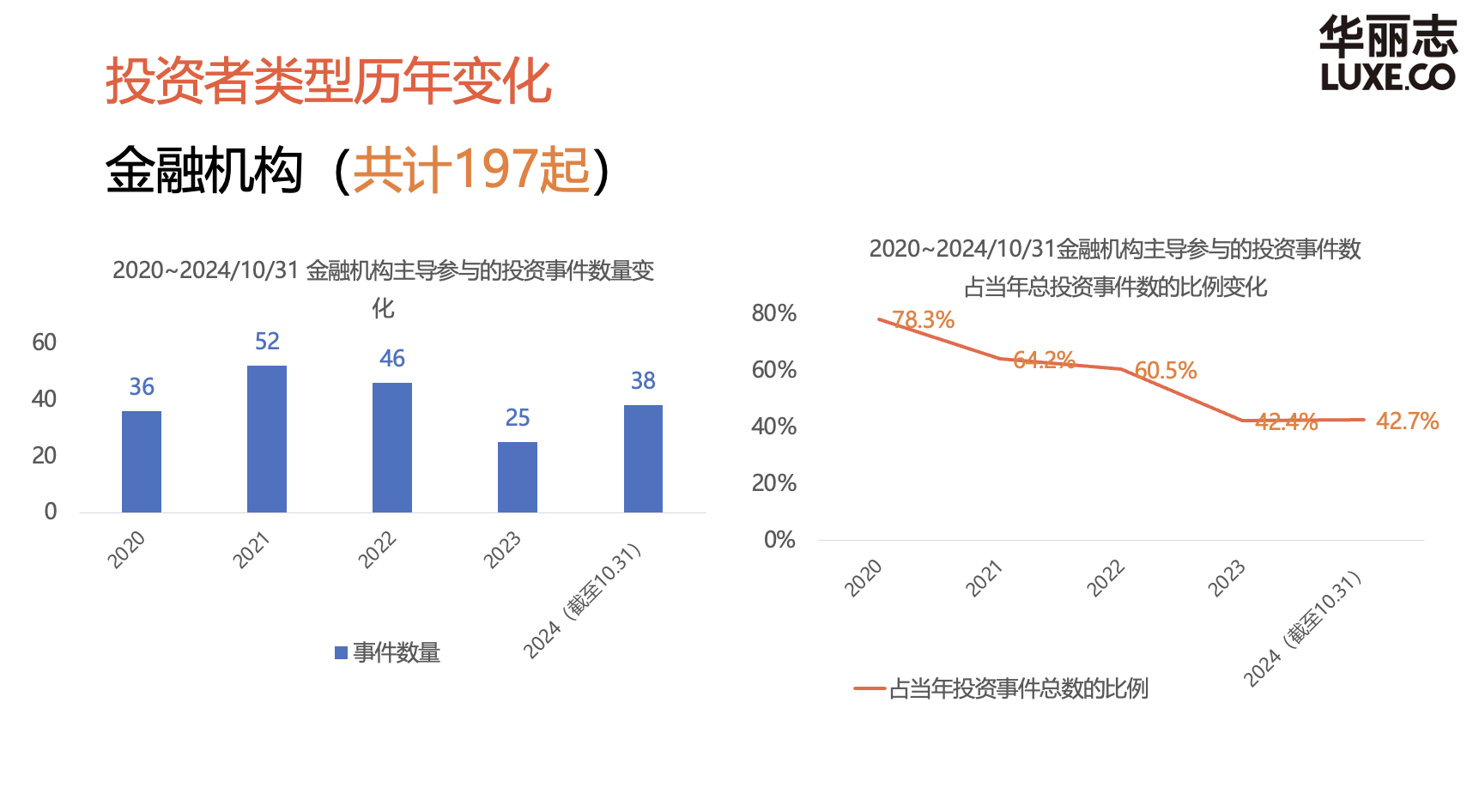

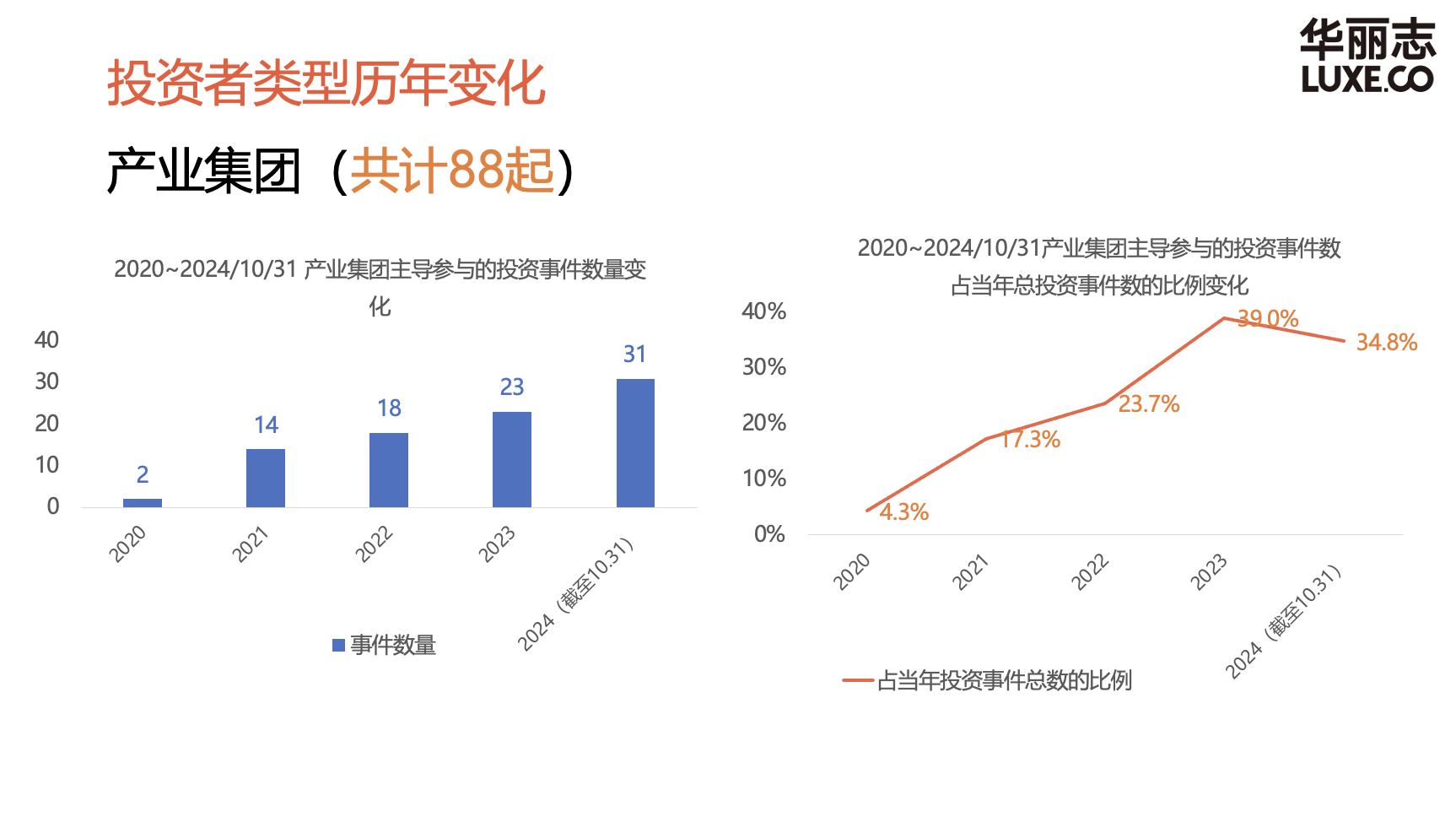

From the perspective of investment institutions, a clear shift in investor types was observed over the past five years. Financial institutions, which dominated in 2020 with 78.3%, declined to 42.7% by 2024. In contrast, industrial groups increased their share from 4.3% in 2020 to 34.8% in 2024.

Based on this data and notable investment cases, Luxe.CO’s Founder and CEO, Alicia Yu, shared five critical reflections:

- Popular concepts such as DTC, sustainability, and disruptive innovation present opportunities for early-stage investors but may also pose risks.

- Emerging brands built from the ground up with VC support might require mature companies to assist in scaling from 10 to 100.

- Should emerging potential brands under industrial groups seek growth capital from financial institutions to share risks?

- Do overseas brands backed by VC/PE investment need participation from industrial groups to localize their operations and gain managerial and commercial resources?

- Can legacy brands in decline achieve revival by separating IP ownership from operations?

Yu also offered six forward-looking judgments for the future:

- Close engagement with the new generation of consumers is essential to distinguish “real needs” from “false trends” and predict “potential opportunities.”

- Deep industry expertise and broad vision are necessary to identify growth trends in emerging subcategories.

- Continuous upgrades to in-store experiences and diversified retail formats are vital for multi-dimensional development.

- Building brand equity requires a balanced approach, aligning short-term gains with long-term benefits.

- With more international brands entering the Chinese market, the competition landscape is becoming increasingly complex, requiring a blend of global perspectives and local expertise.

- Synergies between industry and financial capital can improve investment efficiency, strengthen ecosystems, and enhance value creation capabilities.

At the event, Elisa Wang, Senior Vice President and Director of Luxe.CO Intelligence provided an in-depth analysis of the recently launched Sports and Outdoor Brand Power Rankings. This distinctive ranking reflects Luxe.CO’s comprehensive research and long-term dedication to the sports and outdoor industry. It not only highlights the latest trends in the sector but also offers best-practice references for industry professionals.

Wang also explored the openings of first flagship stores by domestic and international sports and outdoor brands in China between 2021 and 2024, showcasing their vitality in the Chinese market. These brands demonstrated innovative retail strategies and diverse store models to meet the rising demand and evolving preferences of Chinese consumers.

Moreover, Wang compared Luxe.CO’s China Luxury Brand Power Rankings with the Sports and Outdoor Brand Power Rankings, analyzing the similarities, differences, and key takeaways for building brand strength in both sectors.

Zhao Xiaoyue, Vice President and International Cooperation Director of Luxe.CO, shared the team’s insights from their field research across Europe over the past year. By visiting trade shows, retailers, brand headquarters, and engaging in outdoor activities, Luxe.CO gained a comprehensive understanding of the global sports and outdoor industry, identifying innovations and investment opportunities while building a robust global project database.

The salon attracted a warm response from both the financial and industrial communities. Luxe.CO carefully selected 50 professionals from hundreds of applicants, including representatives from well-known domestic and international brands, supply chain enterprises, distributors, startups, strategic investment departments of publicly listed companies, top-tier VC and PE funds, brokerage firms, and premium commercial real estate firms.

During the roundtable discussion, participants freely exchanged views on key topics such as investment opportunities in the sports and outdoor sector, strategies for overseas brands entering the Chinese market, and approaches to brand building and communication.

| Image Credit: Luxe.CO

| Editor: Maier