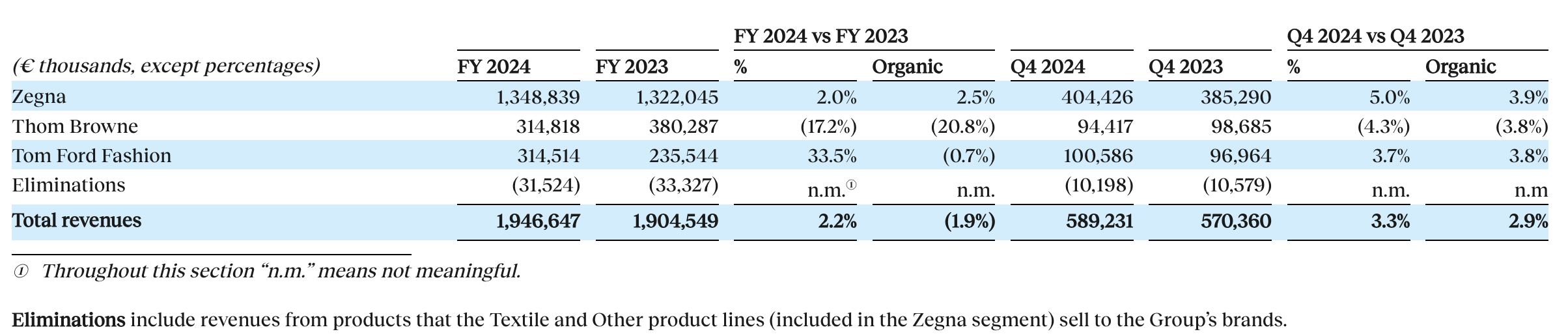

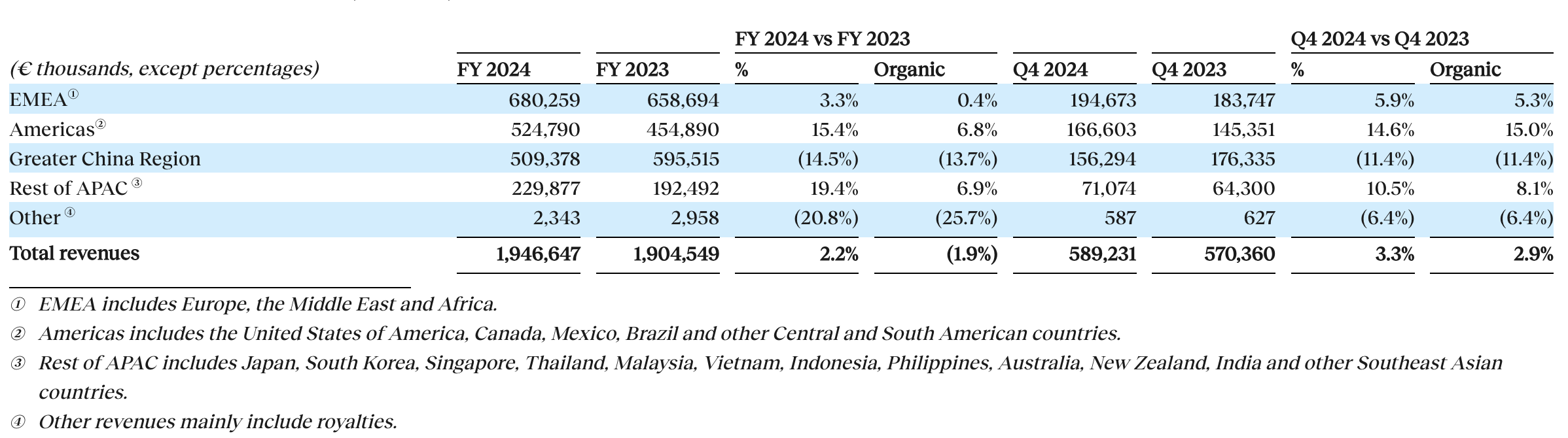

Before the market opened on January 27 (EST), Italian luxury group Ermenegildo Zegna (Zegna) announced its preliminary results for Q4 and the full fiscal year 2024. The group reported an annual sales revenue increase of 2.2% year-on-year to €1.9466 billion (at constant exchange rates: +3.4%), while Q4 sales revenue grew 3.3% to €589.2 million (at constant exchange rates: +3.6%).

In Greater China, full-year sales revenue stood at €509.4 million, marking a 14.5% decline year-on-year (organic decline of 13.7%), accounting for 26% of the group’s total revenue, making it the group’s third-largest market. In Q4, Greater China recorded €156.3 million in revenue, down 11.4% year-on-year (organic decline of 11.4%).

Group Chairman and CEO Ermenegildo “Gildo” Zegna commented, “”In the fourth quarter of 2024, Group revenues increased 3% boosted by the ZEGNA DTC channel which grew by +11% with double-digit growth in the US and in EMEA, sequentially accelerating compared to the previous quarter. Thom Browne and TOM FORD FASHION also reported positive growth in the highly important DTC channel in Q4.“

“Beyond the numbers, I feel confident in our strategic projects pipeline. The recent ZEGNA fashion show was acclaimed as one of the strongest ever for the brand with the presentation of our ultra-luxury Vellus Aureum, made by the finest wool, developed thanks to our know-how and unique Filiera. This has reaffirmed ZEGNA’s position at the forefront of timeless luxury menswear.”

“At Thom Browne, we have strengthened our global merchandising and retail teams with important additions in the US and Europe and are looking forward to seeing the brand’s show in February close the New York Fashion Week. At TOM FORD FASHION, the team is fully focused on delivering strong collections under the new creative leadership of Haider Ackermann.”

Following the earnings release, as of market close on January 27, Zegna Group’s stock rose 5.43% to $9.52 per share, bringing its latest market capitalization to €2.385 billion.

Earlier this month, ZEGNA held its Winter 2025 fashion show during Milan Fashion Week, featuring the Vellus Aureum collection. The brand’s legacy in premium wool dates back to 1963, when founder Ermenegildo Zegna established the Wool Trophy Awards in Australia to honor sheep farmers’ dedication to producing the finest, lightweight wool.

Looking ahead, Ermenegildo “Gildo” Zegna stated, “We expect 2025 to play out differently across various geographies. While we have seen solid performance in the Americas and EMEA in the first weeks of January, we also believe that there will be ongoing volatility with respect to consumer demand in China. We are prepared to navigate these challenges with the guidance of our talented team and a sharp focus on our priorities: continuing to build on brand equity, focusing investments on key strategic projects and doubling down on our existing strengths.”

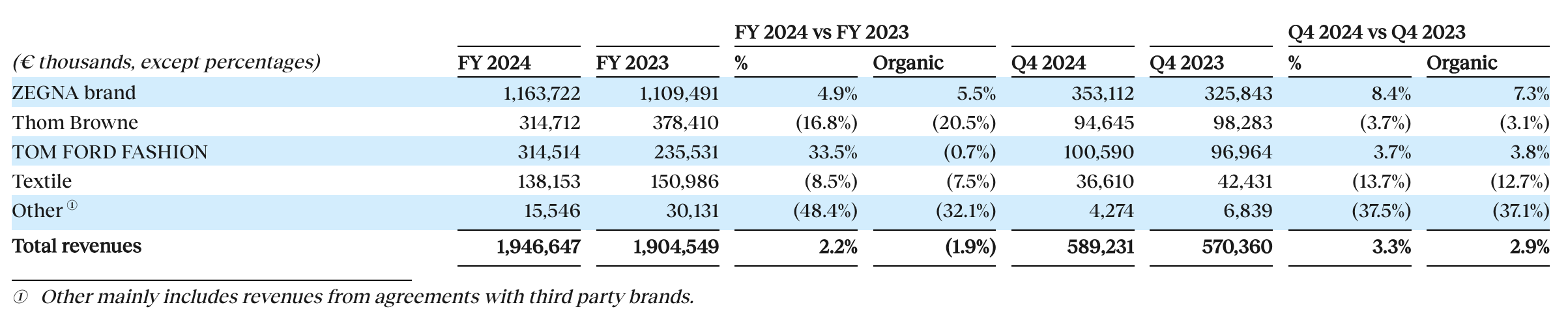

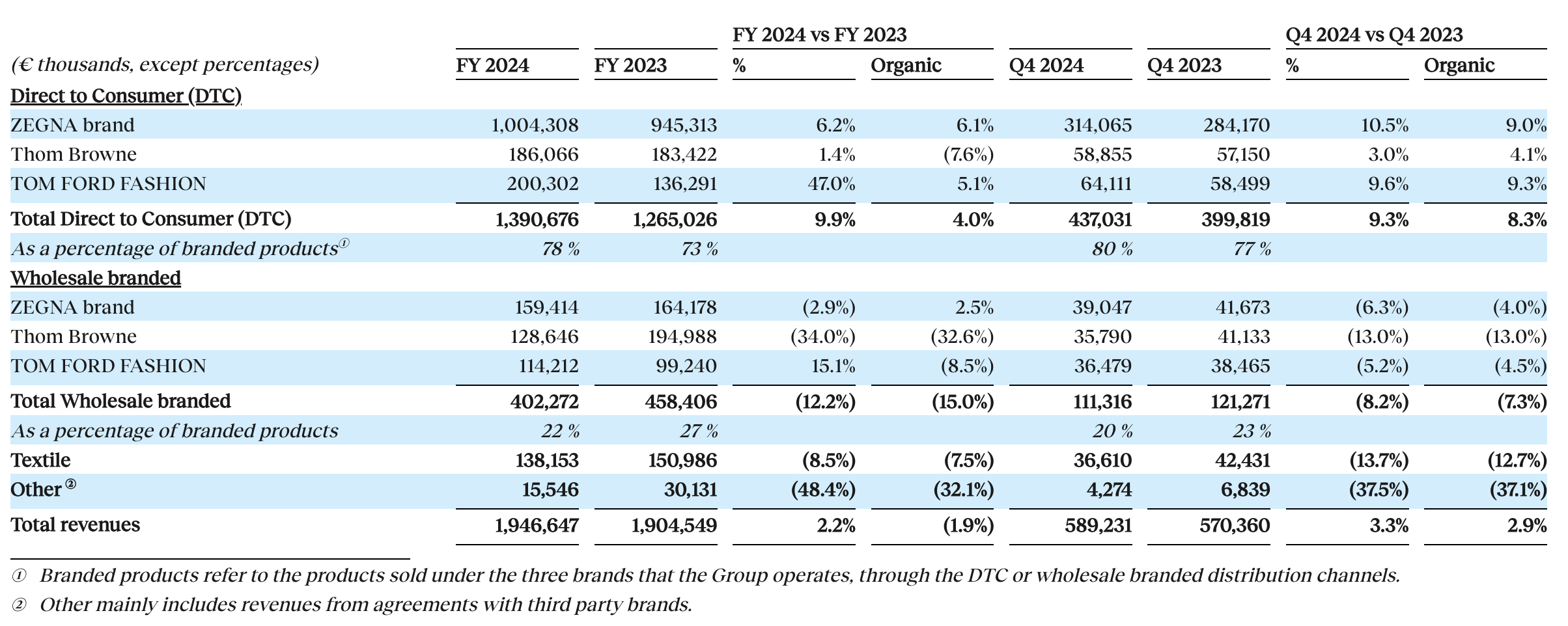

Performance by Segment

- Zegna Brand (including ZEGNA, textiles, and others): Growth in this segment was primarily driven by the strong performance of the ZEGNA brand, which offset the slowdown in the textiles division.

- Thom Browne Brand: Compared to the previous quarter, Q4 revenue improved, supported by a strong direct-to-consumer (DTC) channel and an improved wholesale business, particularly due to the early delivery of the Spring collection. Thom Browne performed well in Japan, South Korea, and the U.S., but this growth was offset by declines in Greater China and EMEA.

- Tom Ford Fashion: Q4 growth was driven by the strong performance of the U.S. DTC channel.

Performance by Business Line

- Zegna Brand Products: Performance was fueled by continued strong organic growth in the U.S. and EMEA, accelerating compared to Q3 2024, mainly due to double-digit growth in direct-to-consumer sales. The Greater China region showed slight improvement on an organic basis compared to Q3 2024, but remained below Q4 2023, reflecting ongoing challenges in the region’s luxury market.

- Other: The decline in this category was mainly due to the termination of Tom Ford product distribution licenses following Zegna’s acquisition of Tom Ford International LLC on April 28, 2023.

Performance by Distribution Channel

DTC (Direct-to-Consumer):

In the fourth quarter, ZEGNA brand’s DTC revenue drove the group’s performance, increasing 10.5% year-on-year (organic growth: +9.0%), supported by strong sales in the Americas and EMEA. As of December 31, 2024, the ZEGNA brand operated 281 directly owned stores (DOS), with a net reduction of four stores in Q4. This included two new store openings in Monaco and Wuhan SKP, while some smaller boutiques and outlet stores were closed.

The Thom Browne brand’s performance in Q4 was boosted by continued double-digit growth in South Korea and Japan, as well as new store openings. As of December 31, 2024, Thom Browne operated 116 directly owned stores (DOS), with a net increase of 10 stores in Q4, including a new flagship in Beijing Taikoo Li and the conversion of several stores in Canada from wholesale to retail.

For TOM FORD FASHION, the brand saw a net increase of two stores in Q4, including a flagship store in Singapore’s Paragon Mall and a new store in Madrid. As of December 31, 2024, TOM FORD FASHION operated 64 directly owned stores (DOS).

Wholesale:

ZEGNA brand’s wholesale revenue declined, reflecting the brand’s continued focus on DTC, with a highly selective approach to wholesale. Additionally, the conversion of certain wholesale locations to retail (such as shop-in-shops) impacted overall performance.

For Thom Browne, the brand’s ongoing efforts to streamline its wholesale business had a negative impact on revenue, though this was partially offset by the early delivery of the 2025 Spring/Summer collection. Based on the brand’s current order backlog and the already delivered 2025 Spring/Summer products, wholesale revenue for Q1 2025 is expected to decline by double digits.

TOM FORD FASHION’s wholesale revenue declined, reflecting the conversion of two major wholesale locations (Harrods Man and Saks Woman) to retail, as part of the brand’s strategic shift towards strengthening its direct-to-consumer presence.

Performance by Region

- EMEA: Performance was driven by strong growth in the ZEGNA brand, partially offset by negative wholesale performance in Thom Browne.

- North America: Performance was supported by double-digit growth in the ZEGNA brand, but partially offset by lower-than-group-average growth in Thom Browne and TOM FORD FASHION, despite both brands showing positive momentum.

- Greater China: The region remained challenging, particularly in the Chinese Mainland.

- Asia-Pacific: Growth was primarily driven by solid performance in South Korea and Japan.

The full-year 2024 financial report is scheduled for release on March 27.

| Source: Official Financial Report

| Image Credit: Group Website

| Editor: LeZhi