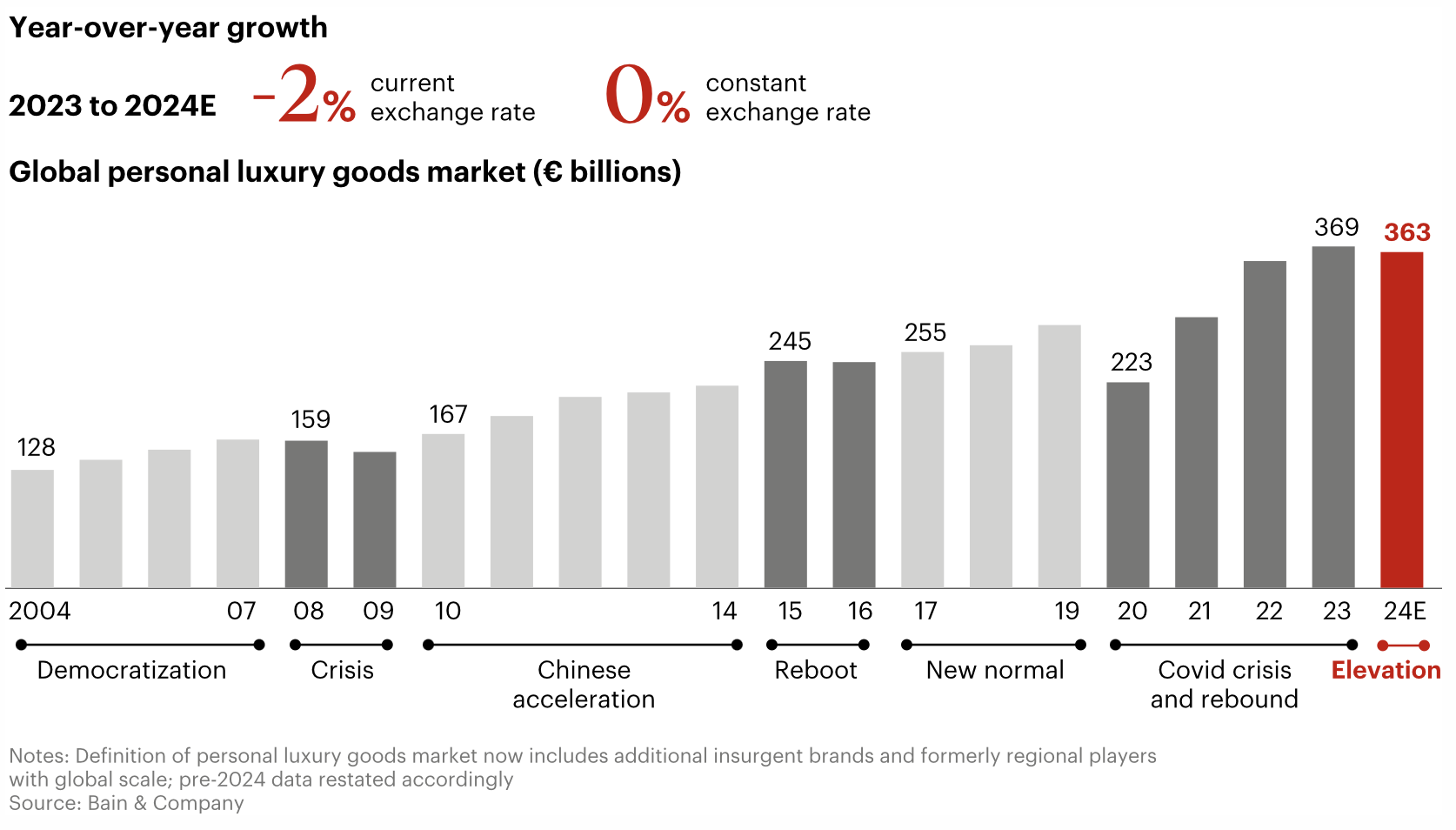

The latest luxury market report, jointly released by Bain & Company and Altagamma (the Italian luxury goods manufacturers’ foundation), projects a 2% decline in the global personal luxury goods market for 2024. Sales, encompassing categories such as fashion, leather goods, watches, jewelry, accessories, fragrances, and beauty, are expected to fall to €363 billion ($392 billion). Only about one-third of luxury brands are forecasted to achieve positive growth this year. The Chinese market is anticipated to contract by 20-22% in 2024, with recovery expected only in the latter half of 2025.

Bain Partner Federica Levato told Reuters, “This marks the first decline in the personal luxury goods industry since the 2008/09 financial crisis, excluding the pandemic.”

The report attributes this forecast to two contrasting trends: the sustained strength of the Japanese market, the stability of the Southern European market, and gradual improvement in the U.S. market, versus the rapid slowdown in the Chinese market and challenges in South Korea. The Chinese market is expected to decline by 20-22%.

If other luxury categories, such as automobiles and hotels, are included, the total global luxury market is forecasted to reach approximately €1.48 trillion ($1.6 trillion), representing a 2% decrease from the record €1.5 trillion ($1.62 trillion) in 2023.

Levato also noted that at constant exchange rates, the global personal luxury goods market—encompassing apparel, leather goods, watches, jewelry, accessories, fragrances, and beauty products—is expected to remain flat during the holiday season. However, China’s performance is projected to remain weak.

Higher product pricing, geopolitical tensions, adjustments in the Chinese market, and global elections have collectively weakened consumer confidence. As a result, many consumers, especially younger ones, are refraining from purchasing luxury goods. “Over the past two years, the number of luxury consumers has decreased by about 50 million, down from the previous total of approximately 400 million,” Levato explained.

Levato further emphasized that market growth prospects depend partly on the strategies brands choose, including pricing decisions. The strong performance of outlet channels, driven by consumers’ focus on value, signals another indication of resistance to price increases.

Compared to tangible goods, consumers are increasingly drawn to experiences such as travel, social activities, wellness, and health. The demand for experiential luxury goods, including yachts, luxury cars, and private jets, is also growing, particularly among high-income consumers.

Globally, beauty and eyewear are the fastest-growing luxury categories, while jewelry remains the most resilient among core segments. In contrast, footwear and watches are facing significant challenges.

The tightening market environment has widened the divide in the luxury sector. The ultra-high-end luxury market is showing positive momentum, while affordable luxury faces significant challenges. Generation Z, in particular, has shown a declining interest in luxury goods, significantly influencing this trend. Meanwhile, higher-spending consumers are deepening their engagement with luxury brands, although they perceive diminishing exclusivity in the sector.

The report projects that in 2024, only about one-third of luxury brands will achieve positive growth, compared to two-thirds in 2023. This creates increasing profitability pressures, setting the stage for 2025 to focus on performance improvement and technology adoption.

Bain forecasts that at constant exchange rates, the personal luxury goods market will grow by 0–4% in 2025. This growth will be primarily driven by strong sales in Europe and the Americas, while the Chinese market is not expected to recover until the second half of 2025. Federica Levato noted, “The U.S. presidential election victory for Donald Trump removed one uncertainty, and potential interest rate cuts and tax reductions may encourage American consumers to increase spending.”

Additionally, by 2025, consumer spending on luxury experiences, such as hotels and dining, is expected to increase compared to personal luxury goods.

Bain believes that despite current challenges, the long-term outlook for the luxury market remains robust due to the expected growth in wealth and the luxury consumer base. However, brands must adopt clear strategies and execute them effectively to achieve this growth. Bain emphasizes three core pillars of the luxury industry: the appeal of craftsmanship, creativity, and unique brand value; meaningful, personalized, and culturally resonant customer engagement; and technology-driven operational excellence.

Bain Senior Partner and Global Head of Fashion and Luxury Claudia D’Arpizio stated, “Despite macroeconomic complexities, the desire for exceptional living experiences has maintained significant stability in luxury consumption. However, the loss of 50 million consumers over the past two years highlights the need for brands to re-evaluate their value propositions. To win back consumers, especially younger ones, brands must emphasize creativity, broaden their engagement, and deliver personalized, humanized interactions for top clients.”

| Sources: Bain Official Website, Reuters, MFfashion

| Image Credit: Official Press Release

| Editor: LeZhi