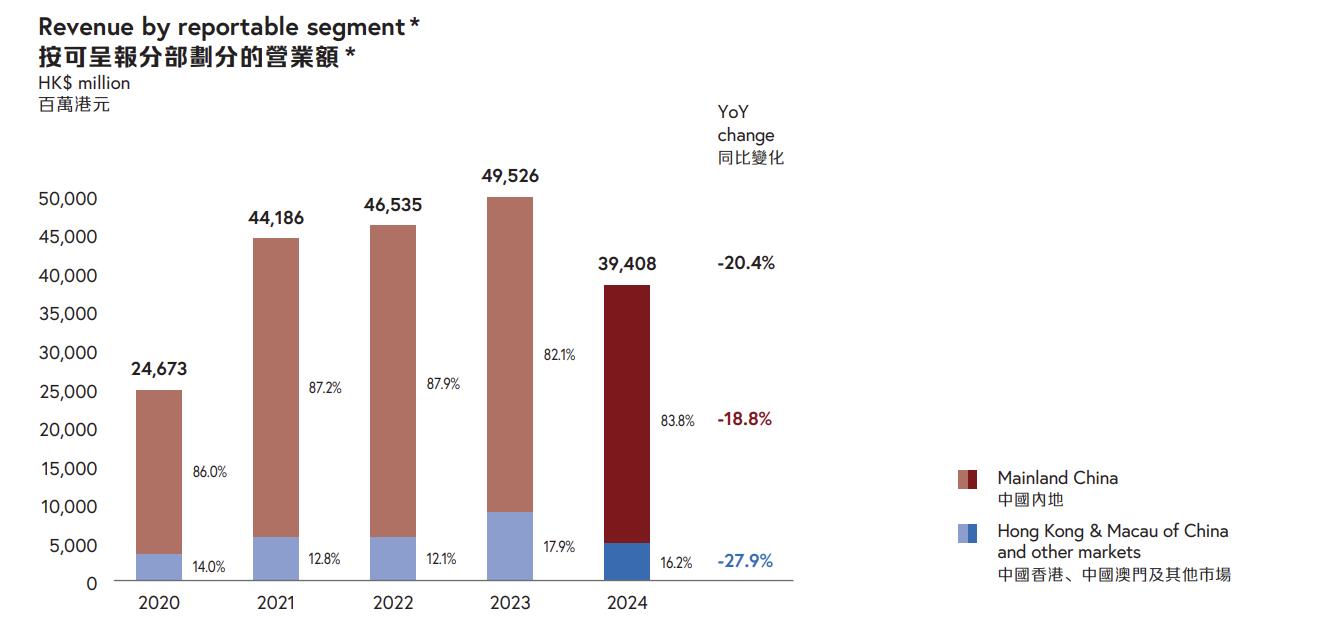

After the close of trading on November 27, Chow Tai Fook Jewellery Group Ltd., a leading jewelry giant based in Hong Kong, announced its interim financial results for the six months ending September 30, 2025. The report reveals that revenue was impacted by weakened consumer demand in key markets, driven by external macroeconomic factors and significant fluctuations in gold prices. Revenue fell by 20.4% year-on-year to HKD 39.408 billion (compared to HKD 49.526 billion in the first half of FY2024). However, stringent cost management enabled operating profit to increase by 4.0% year-on-year to HKD 6.776 billion, and the operating profit margin improved by 400 basis points to 17.2%.

Additionally, the group’s gross profit margin saw significant improvement during the period, rising by 650 basis points to 31.4%, supported by higher retail product margins from rising gold prices and increased contributions from fixed-price gold products.

The group also announced the authorization of a share buyback program, under which it plans to repurchase up to HKD 2 billion worth of shares, funded by internal resources.

Dr. Henry Cheng Kar-shun, Chairman of Chow Tai Fook Jewellery Group, stated:

“Amid a complex and volatile market environment, Chow Tai Fook Jewellery remains steadfast in pursuing sustainable growth and fostering long-term business resilience. We are committed to advancing our brand transformation to enhance competitiveness and seize opportunities in the Chinese Mainland and broader markets.”

Looking ahead, the group anticipates a gradual improvement in business fundamentals in the second half of FY2025, driven by narrowing declines in same-store sales and a slower pace of store closures, barring unforeseen external factors or extraordinary circumstances.

On the trading day following the announcement (November 27), Chow Tai Fook’s stock rose 6.85% to HKD 7.33 per share, bringing the group’s total market capitalization to HKD 73.2 billion.

By Region:

During the reporting period, revenue in the Chinese Mainland declined by 18.8% year-on-year. Revenue in “Hong Kong, Macau, and Other Markets” fell by 27.9% year-on-year, as changes in consumer preferences and shopping patterns among mainland tourists and local citizens took a toll. However, retail value in “Other Markets” (excluding mainland duty-free stores) grew by 8.5%, sustaining positive momentum. Several major markets, including Singapore, Malaysia, Thailand, and Japan, reported growth in retail value, supported by the recovery of travel retail and strong local jewelry demand.

Revenue contribution from the Chinese Mainland slightly increased during the period to 83.8%.

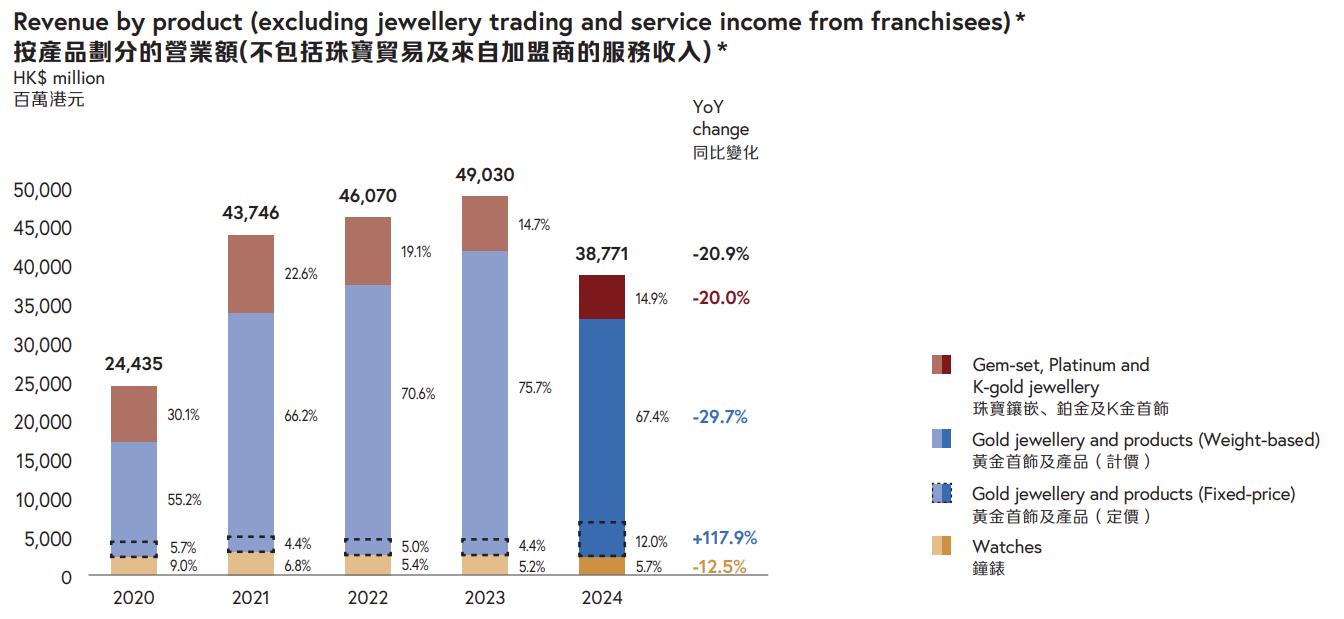

By Product:

Revenue from gold jewelry and products declined by 21.6% year-on-year during the reporting period. This category accounted for 79.4% of total revenue, representing a 70-basis-point drop. Fixed-price gold jewelry sales performed strongly, with retail value contributions doubling year-on-year to 14.2% of the total gold-related category. The “Chow Tai Fook Rouge” collection, launched in April, recorded retail sales exceeding HKD 1.5 billion.

Revenue from jewelry, platinum and K-gold jewelry, and watches—classified as non-essential products—fell by 20.0% and 12.5%, respectively. During the reporting period, the group introduced the “Chow Tai Fook Palace Museum” collection, which combines traditional Chinese culture and craftsmanship, and the “Chow Tai Fook Bond” collection, a new wedding collection inspired by the symbolism of the olive tree, featuring key products such as the signature two-prong solitaire diamond ring.

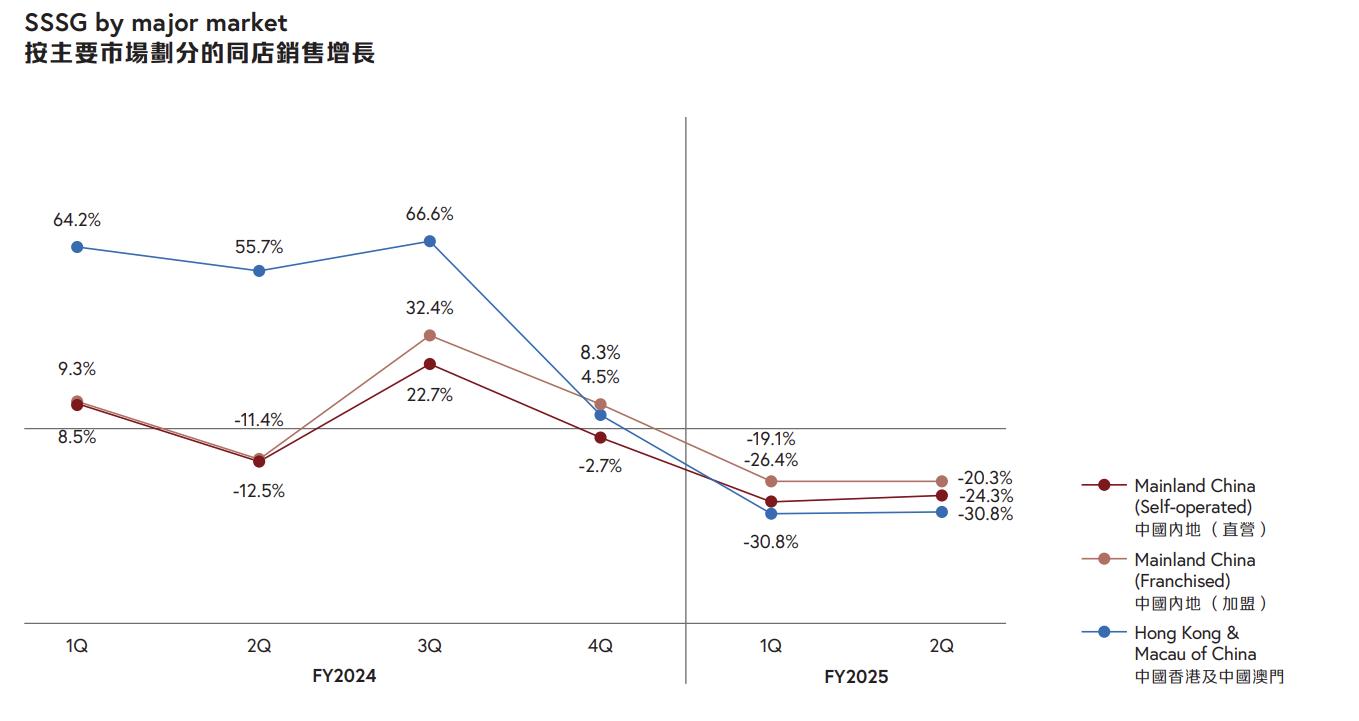

By Same-Store Sales:

Same-store sales at directly operated stores in the Chinese Mainland dropped by 25.4% year-on-year. Franchise retail points, reflecting the high proportion of recently opened stores, recorded a same-store sales decline of 19.6% during the reporting period.

In Hong Kong and Macau, same-store sales fell by 30.8% year-on-year, with Hong Kong declining by 27.6% and Macau by 40.7%.

As of September 30, the group operated nearly 7,000 retail points in the Chinese Mainland, with a net closure of 239 stores during the period. The group announced plans to open a new five-story flagship store in Shanghai in 2025, marking its first flagship location in the Chinese Mainland. The group stated that it would continue to adopt a data-driven approach to selectively open new stores in response to industry trends.

In Hong Kong and Macau, the group reported a net closure of three retail points. In “Other Markets,” three new stores were added during the period, including one mainland duty-free store and two retail outlets in Japan, aimed at capturing new retail opportunities. Chow Tai Fook also launched its first new-concept store on Queen’s Road Central in Hong Kong during the period, which the group described as a significant milestone in its brand transformation journey.

| Source: Official Financial Report

| Image Credit: Official Website

| Editor: LeZhi