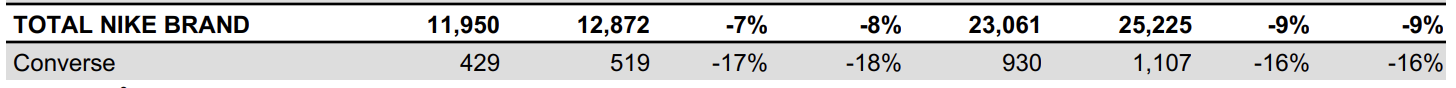

On December 20, the American sportswear giant Nike (NYSE:NKE) announced its financial results for the second quarter of FY2025, which ended on November 30: second-quarter revenue was $12.35 billion, an 8% year-on-year decline on a reported basis and a 9% decline at constant currency. Thanks to new sneakers and running shoes that captured shoppers’ attention, the decline was less severe than analysts’ expectations of a 9.41% drop. Additionally:

- Direct-to-consumer channel revenue was $5 billion, a 13% year-on-year decline on a reported basis and a 14% decline at constant currency;

- Wholesale channel revenue was $6.9 billion, a 3% year-on-year decline on a reported basis and a 4% decline at constant currency;

- Gross margin fell by 100 basis points to 43.6%;

- Diluted earnings per share were $0.78, exceeding analysts’ expectations of $0.63 per share compiled by the London Stock Exchange.

After the earnings report was released, the company’s stock price immediately surged by 11%. Jessica Ramirez, a senior analyst at Jane Hali & Associates, said, “If you closely examine the second-quarter results, the numbers are not good… but they’re better than most feared.” However, after the management’s conference call, the stock price reversed its gains.

As of 3:30 PM on December 20, during after-hours trading the previous day, Nike’s stock price fell 0.54% to $76.68 per share, with the latest market capitalization at $114.8 billion. Over the past 12 months, Nike’s stock has fallen by 34.47%.

Nike’s new President and CEO, Elliott Hill, said, “After an energizing 60 days of being back with my NIKE teammates, our clear priority is to return sport to the center of everything we do. We’re taking immediate action to reposition our business, so we can get back to driving long-term shareholder value. Our team is ready to go, and I’m confident you will see more moments of NIKE being NIKE again.”

In the analyst conference call, Hill stated that his top priority is to rebuild Nike’s retail partnerships and reduce discounts and promotions. “We’ve been overly promotional… markdowns have not only hurt our brand but also disrupted the market and impacted our partners’ profitability.”

Since taking office, Hill has met with many of Nike’s key retail partners. He emphasized that a cornerstone of Nike’s revival plan is reinvesting in local teams in major cities and countries, as they are crucial for fostering the emotional consumer connections needed for Nike to thrive.

To counter competitors who have introduced shoes with better comfort and cushioning performance, Nike has heavily invested in new products such as the Air Max 95 and promoted key product lines like Jordans and Pegasus to attract customers. Last month, Nike announced increased investment in three running shoe lines—Pegasus, Structure, and Vomero—and plans to launch different versions of each shoe at various price points next year. Hill also stated that the initial focus of these investments will include soccer, basketball, training, and sports apparel.

Nike’s Executive Vice President and Chief Financial Officer, Matthew Friend, commented, “NIKE’s second-quarter financial performance largely met our expectations, as we continue to make progress in shifting our portfolio. Under Elliott’s leadership, we are accelerating our pace and reigniting brand momentum through sport.”

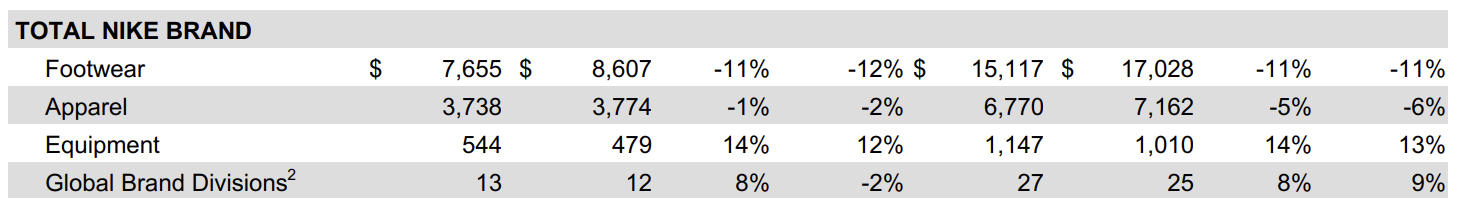

NIKE Brand Sales by Category:

In the Chinese Mainland, this quarter’s revenue was $1.711 billion, a year-on-year decline of 8% (11% decline at constant currency). Footwear accounted for 70.3% of total sales in the market, with revenue reaching $1.203 billion, a year-on-year decline of 12% (14% decline at constant currency). Apparel accounted for 27.6% of total sales, with revenue reaching $472 million, a year-on-year increase of 1% (3% decline at constant currency). Equipment accounted for 2.1% of total sales, with revenue reaching $36 million, a year-on-year increase of 9% (9% growth at constant currency).

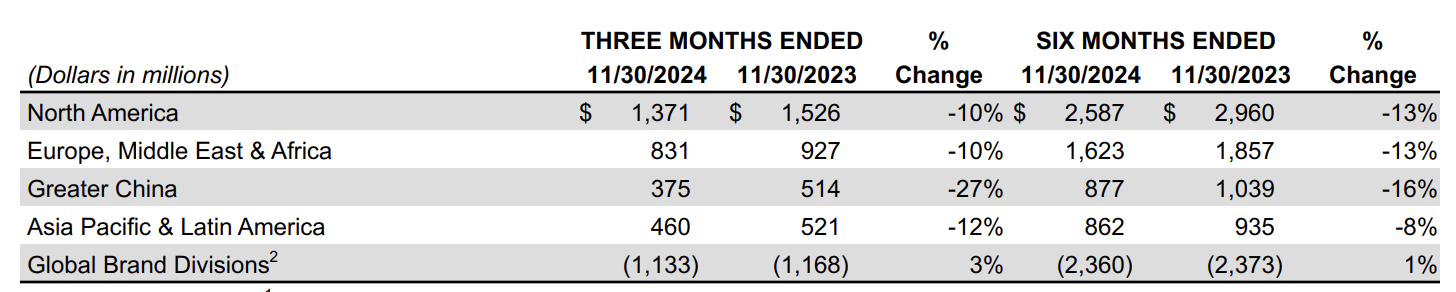

NIKE Brand Sales by Market:

Focusing on the Chinese Mainland, Nike emphasized that the enthusiasm for sports is continuously growing in this market. During this fiscal quarter, Nike continued to accelerate its transformation, returning to the core of the brand by connecting with and inspiring more consumers through sport, while rebuilding its differentiated brand influence and solidifying the fundamentals for future development. In the key running category, Nike announced a refreshed lineup of running shoes and introduced the new brand campaign “Victory Loves Company,” aiming to elevate runner services and experiences. At the same time, Nike continued to develop and expand its diverse event platforms and brand experiences, centering on athletes and serving the local consumer market. From the China tennis season, the “Nike National University Stret Dance Competition”, and the Jordan Dance Arena to the opening match of the “Nike China High School Basketball League” and the declaration for winter outdoor sports, “Wilder Than the Wild,” Nike has continued to collaborate with the younger generation, co-creating a new generation of sports culture and igniting a passion for sports.

Elliott Hill concluded during the conference call: “We are optimistic about the long-term development of the Chinese market and hope to invite more Chinese consumers to embrace sports. Nike is increasing its investment in product innovation in China. We have local product development teams and have established a sports research lab in China to conduct research tailored to Chinese consumers. In addition, we are working with local partners to promote consumer-centered services and experiences.”

Key events in the Chinese market during the quarter included:

- Simplifying its running shoe product lineup to focus on cushioning performance, with the Vomero 18 scheduled for global release early next year.

- Welcoming legendary marathon runner Eliud Kipchoge back to China to inspire local marathoners, while partnering with the Shanghai Marathon for the 13th consecutive year.

- Launching the “Victory Loves Company” campaign to encourage runners to step out of their comfort zones and organizing the “Nike Run 100 Schools” campus relay challenge to support the vision of making China a nation of runners.

- Supporting tennis in China with Zheng Qinwen returning to her home court and Nike elite athletes Jannik Sinner and Carlos Alcaraz making appearances in Shanghai, igniting unprecedented enthusiasm for the sport.

- Concluding the 2024 Nike High School Dance League Finals in Chengdu, with more than 5,500 student dancers participating, and the Jordan Dance Arena Finals in Shanghai, both of which strengthened Nike’s youth culture initiatives.

- Launching the 2024-25 Nike High School Basketball League season, reigniting passion for basketball.

- Upgrading the ACG series with the “Wilder Than the Wild” campaign, generating significant social media engagement.

|Source: Nike official website, financial report, and Reuters

|Image Credit: Nike official website and official WeChat account

|Editor: LeZhi