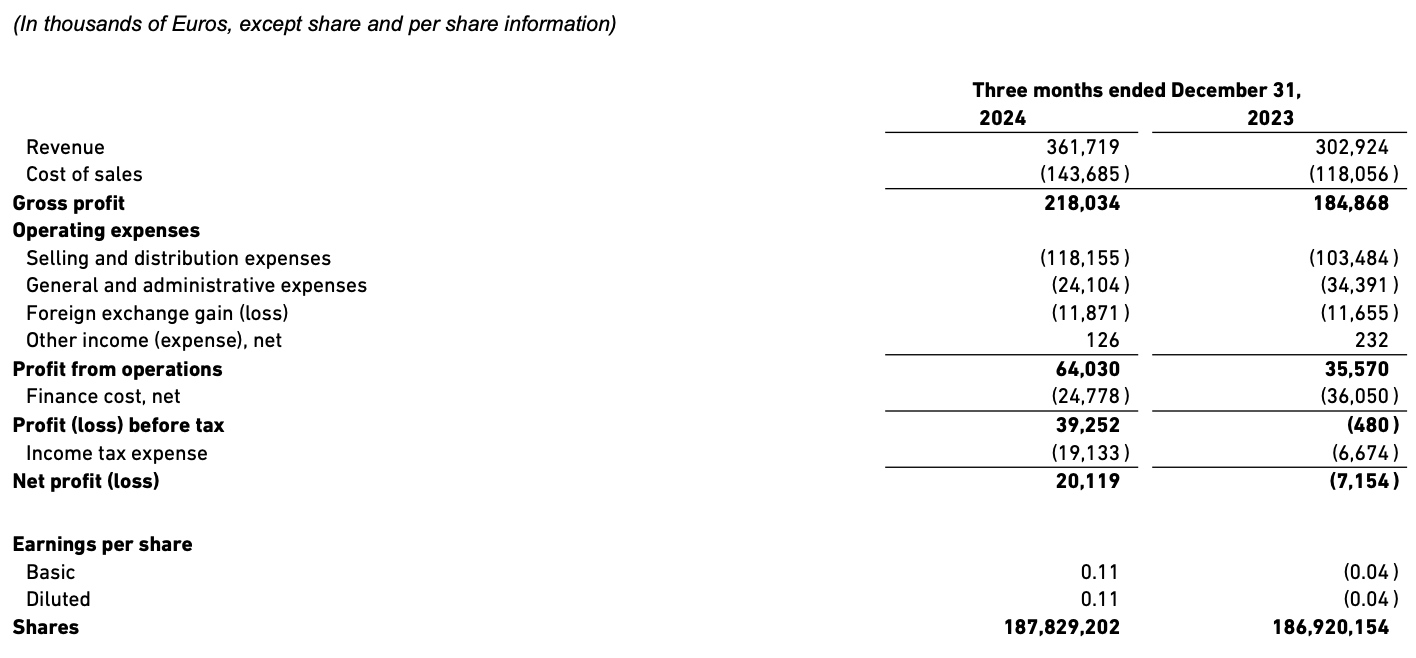

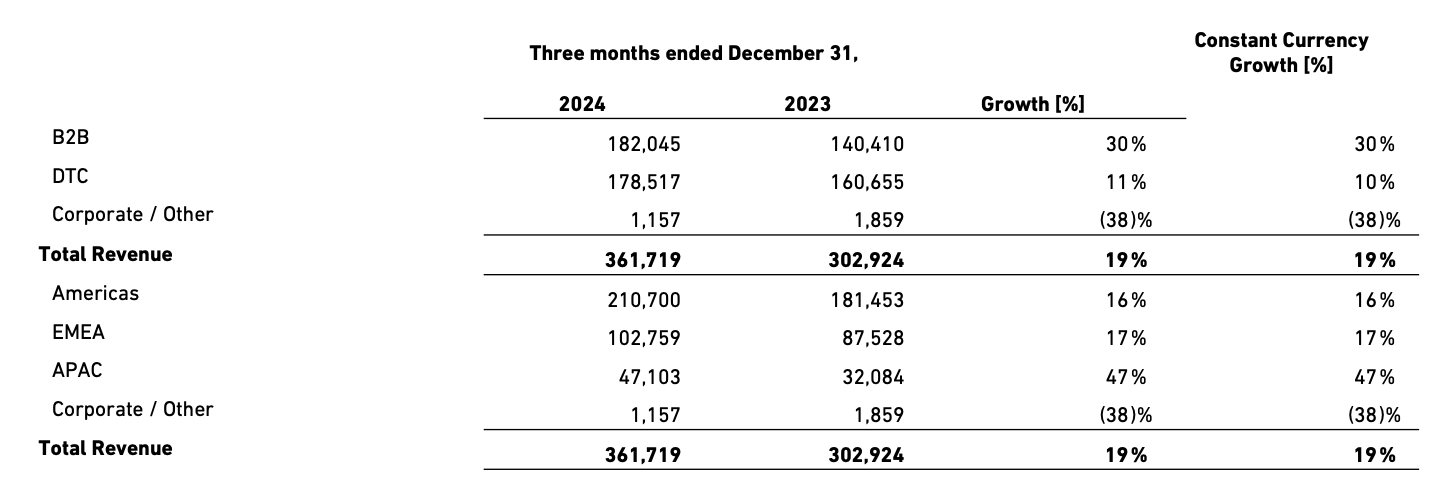

At midday Central European Time on February 20, German heritage footwear brand Birkenstock (NYSE: BIRK) announced key financial results for the first quarter of fiscal year 2025, which ended on December 31, 2024. Benefiting from strong consumer demand during the holiday season, revenue rose 19% year-over-year to €362 million, surpassing analysts’ expectations of €356 million. Notably, thanks to double-digit growth in shipment volumes and mid-single-digit growth in average selling price (ASP), the growth rate of closed-toe shoes was more than twice the group’s average, increasing their business share by 600 basis points.

Birkenstock CEO and board member Oliver Reichert stated: “Our results for the first quarter of 2025 reflect the continued strength of our brand throughout the important holiday season. BIRKENSTOCK proved to be a high-demand gifting item and a must-have for our wholesale partners. Our clogs, other closed-toe shoes, and boots performed very well, with a share of business up 600 bps year-over-year. We once again saw very strong growth across all of our segments, with APAC coming in exceptionally strong as we accelerated the pace of store openings and deliveries to some B2B partners in the quarter. With the strong start to the year, we are confident in our ability to deliver on our guidance for 2025.”

Currently, Birkenstock is ramping up production in Germany and Portugal while actively expanding into new markets such as China and India. Oliver Reichert aims to sustain the brand’s decade-long growth momentum through these initiatives.

On the same day as the earnings release, Germany’s highest civil court ruled that Birkenstock sandals are considered design works rather than artistic creations and are therefore not protected by copyright. Birkenstock had filed a lawsuit seeking to prevent competitors, including Germany’s Tchibo and discount supermarket chain Aldi, from selling similar sandal designs. However, the Federal Court rejected this claim.

Karl Birkenstock, a shoemaker and member of the Birkenstock family, was born in 1936 and is still alive today. However, as some sandal designs he created in the 1970s are no longer protected by design copyrights, Birkenstock’s lawyers had argued that these designs should be classified as artistic works.

Under German law, the distinction between design and art lies in the product’s purpose. Design primarily serves a functional role, whereas applied art must exhibit a certain level of personal artistic creativity.

“The claim is unfounded because these sandals are not protected as applied art under copyright law,” presiding judge Thomas Koch stated.

Birkenstock’s legal representative, Konstantin Wegner, argued that the sandals have an “iconic design” and stated after the ruling that the company would continue pursuing legal action. “We will supplement our arguments in pending cases,” Wegner said, without providing further details.

Last month, the company announced the appointment of Ivica Krolo as Chief Financial Officer (CFO) of Birkenstock Group, effective February 1, 2025. He replaces Erik Massmann, who resigned on January 31. Massmann has pledged to support the transition to ensure a seamless handover.

Since its IPO on the New York Stock Exchange in October 2023, Birkenstock’s stock has gained approximately 19%, though it has underperformed the S&P 500 Index. Following the earnings announcement, the stock experienced significant fluctuations, closing at $54.02 per share on February 20, down 1.23% from the previous trading day. Over the past 12 months, the stock has risen 9.71%, with a current market capitalization of approximately $9.73 billion.

Birkenstock Q1 FY2025 Financial Highlights (as of December 31, 2024):

By Channel:

- B2B: Driven by strong holiday demand and solid sales performance, revenue grew 30% year-over-year at both constant and reported exchange rates. More than 90% of the B2B growth came from existing stores, as core retail partners continued to expand the breadth and depth of their Birkenstock product offerings, including an increasingly diverse range of closed-toe shoes.

- DTC: Revenue increased 11% year-over-year (10% at constant exchange rates), building on a high base of 30% growth (at constant exchange rates) in Q1 FY2024.

Additionally, the company opened four new self-operated stores in Q1 FY2025, bringing the total number of self-operated retail locations to 71.

By Region:

During the reporting period, all regions demonstrated strong performance, achieving double-digit revenue growth:

- Americas: B2B growth was particularly strong, as major wholesale partners expanded Birkenstock’s shelf space to meet robust holiday demand. Closed-toe shoes, especially the Clog collection, performed exceptionally well, accounting for nearly two-thirds of the region’s revenue this quarter.

- Europe, Middle East, and Africa (EMEA): Birkenstock continued to achieve industry-leading growth and expanded its market share across the region. Both B2B and DTC channels performed strongly in all countries. The market penetration of closed-toe shoes increased by 400 basis points year-over-year, now representing over 50% of the business.

- Asia-Pacific (APAC): The company continued to invest heavily in this key growth market, expanding its physical retail footprint and enhancing brand visibility by opening multiple self-operated and partner-brand stores.

Starting from Q1 FY2025 (as of December 31, 2024), the company will make the following changes to its regional market segmentation:

The Middle East and Africa, which were previously part of “APMA” before FY2025, will be merged with the European operations to create a new Europe, Middle East, and Africa (EMEA) reporting and operational segment.

India, which was also previously part of “APMA” before FY2025, will be merged with other Asia-Pacific countries to form a new Asia-Pacific (APAC) reporting and operational segment.

There will be no changes to the Americas region.

BIRKENSTOCK is confirming its previous guidance for fiscal year 2025:

- Revenue growth of 15-17% in constant currency

- Adjusted EBITDA margin of 30.8-31.3%

- Gross margin improvement, moving closer to its long-term target of 60%

| Source: Official financial report, Bloomberg, Reuters, Luxe.CO historical articles

| Image Credit: Birkenstock official website

| Editor: LeZhi