According to the latest data released by the Federation of the Swiss Watch Industry, Swiss watch exports in June fell 5.6% year-on-year to CHF 2.2 billion (approx. USD 2.51 billion), primarily due to a significant decline in the U.S., Japan, and Hong Kong markets.

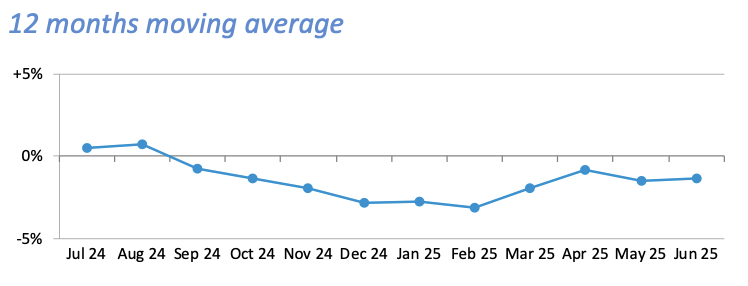

The overall performance for the first half of the year remained relatively stable, with a slight decrease of 0.1% year-on-year to CHF 13 billion (approx. USD 14.82 billion). However, since the market trend has yet to reverse, the downward momentum may become increasingly pronounced.

Swiss Watch Exports by Major Markets in June 2025:

-

Chinese Mainland: Exports rose 6.4% YoY to CHF 173 million (approx. USD 197.3 million), marking the first growth this year

-

Hong Kong: Exports fell 10.6% YoY to CHF 148 million (approx. USD 168.8 million)

-

United States: Exports dropped 17.6% YoY to CHF 310 million (approx. USD 353.4 million)

-

Japan: Exports decreased 11% YoY to CHF 156 million (approx. USD 177.5 million)

-

Singapore: Exports increased 2.6% YoY to CHF 145 million (approx. USD 165.3 million)

-

United Kingdom: Exports slipped 0.1% YoY to CHF 156 million (approx. USD 177.5 million)

-

Germany: Exports rose 5.1% YoY to CHF 126 million (approx. USD 143.7 million)

-

Italy: Exports declined 1.4% YoY to CHF 110 million (approx. USD 125.4 million)

-

South Korea: Exports fell 6.3% YoY to CHF 59.7 million (approx. USD 68 million)

-

France: Exports dropped 6.4% YoY to CHF 123 million (approx. USD 140.2 million)

-

United Arab Emirates: Exports rose 2.9% YoY to CHF 100 million (approx. USD 114 million)

In June, total exports to the six key markets: the United States, the Chinese Mainland, the United Kingdom, Japan, Hong Kong, and Singapore, fell 7.6% YoY to CHF 1.087 billion (approx. USD 1.24 billion), accounting for 50.5% of global exports.

Swiss watch exports to the top 30 global markets dropped 4.9% YoY to CHF 2.019 billion (approx. USD 2.3 billion) in June, representing 93.9% of total exports.

Beyond the top eleven markets, several countries saw double-digit growth, including:

-

Spain (+19%)

-

Netherlands (+12.1%)

-

Canada (+10.4%)

-

India (+22.8%)

-

Greece (+18.5%)

-

Bahrain (+16.6%)

Meanwhile, several regions experienced double-digit declines:

-

Taiwan (China) (-18.2%)

-

Kuwait (-27.8%)

-

Ireland (-24.3%)

-

Portugal (-18.2%)

-

Czech Republic (-66.3%)

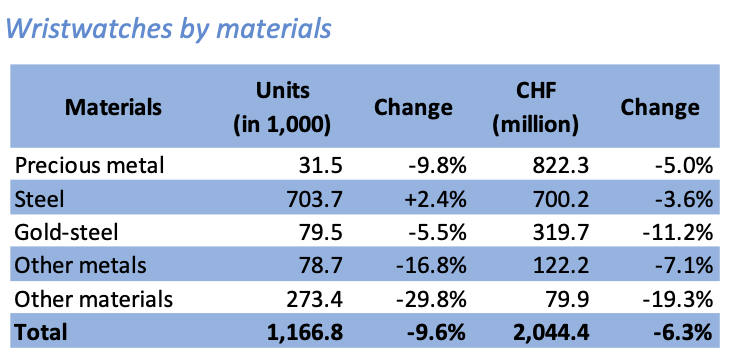

Export Performance by Watch Material (June 2025):

-

Precious metal watches: Export volume down 9.8% YoY; export value down 5%

-

Steel watches: Export volume up 2.4% YoY; export value down 3.6%

-

Steel and gold watches: Export volume down 5.5% YoY; export value down 11.2%

-

Other metal watches: Export volume down 16.8% YoY; export value down 7.1%

-

Watches made from other materials: Export volume down 29.8% YoY; export value down 19.3%

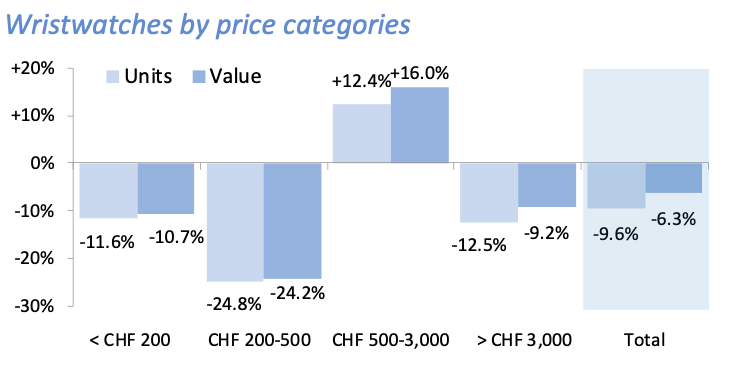

Export Performance by Price Range (June 2025):

-

Watches priced below CHF 200: Export volume down 11.6% YoY; export value down 10.7%

-

Watches priced CHF 200–500: Export volume down 24.8% YoY; export value down 24.2%

-

Watches priced CHF 500–3,000: Export volume up 12.4% YoY; export value up 16%

-

Watches priced above CHF 3,000: Export volume down 12.5% YoY; export value down 9.2%

Swiss Watch Export Report – June 2025

(Charts Source: Official website of the Federation of the Swiss Watch Industry)

-

By Watch Material

-

By Price Segment (Currency: CHF)

-

12-Month Moving Average Trends

(at time of writing, 1 Swiss franc ≈ USD 1.25)

|Source: Official website of the Federation of the Swiss Watch Industry

|Image Credit: Official website of the Federation of the Swiss Watch Industry

|Editor: LeZhi