Luxe.CO Intelligence Releases Exclusive New Report: An Overview of Chinese Gold Jewelry Brands

Gold has undoubtedly been one of the hottest keywords in 2024. Since the beginning of the year, international gold prices have been on an upward trend, exhibiting high volatility and continuously attracting attention from consumers and investors alike.

The revival of traditional Chinese goldsmithing techniques, the accumulation and innovation of local brands in product development, and the rise of younger consumers, particularly a new generation of high-end clientele born in the 1990s and 2000s, have all brought new development opportunities to the gold jewelry industry. Local high-end brands now face a prime opportunity for a comprehensive upgrade.

China’s gold jewelry market has rapidly transitioned from a traditional model of homogeneous competition, channel expansion, and market saturation to a new model centered on building high-premium brands, offering differentiated products, and enhancing high-end retail experiences. Leading brands have reached new heights in craftsmanship, cultural richness, and aesthetics, opening up fresh space for market expansion and capital growth.

-

Lao Pu Gold, which went public just over a year ago, has surpassed RMB 100 billion [approx. USD 13.75 billion] in market value and recently opened its first overseas store at Marina Bay Sands in Singapore.

-

The parent company of Lao Miao Gold, Shanghai Yuyuan Jewelry & Fashion Group, secured RMB 1.77 billion [approx. USD 243 million] in funding from 38 external investors.

-

Lanzhou-based brand Linchao Jewelry received investment from RICHU Capital.

-

Lao Feng Xiang partnered with Taobao and Tmall to host a large-scale livestream showcase during the “Super Jewelry Launch Event.”

Luxe.CO Intelligence, the fashion industry research arm of Luxe.CO, has long focused on global jewelry brands and industry developments. In 2023, the institute released its inaugural Gold Jewelry Brand Report, which analyzed brand-building efforts and identified five key development stages for gold jewelry brands. (See previous report link.)

Today, from long-established market leaders to rising stars and emerging forces, all are intensifying efforts to elevate their brand strategies.

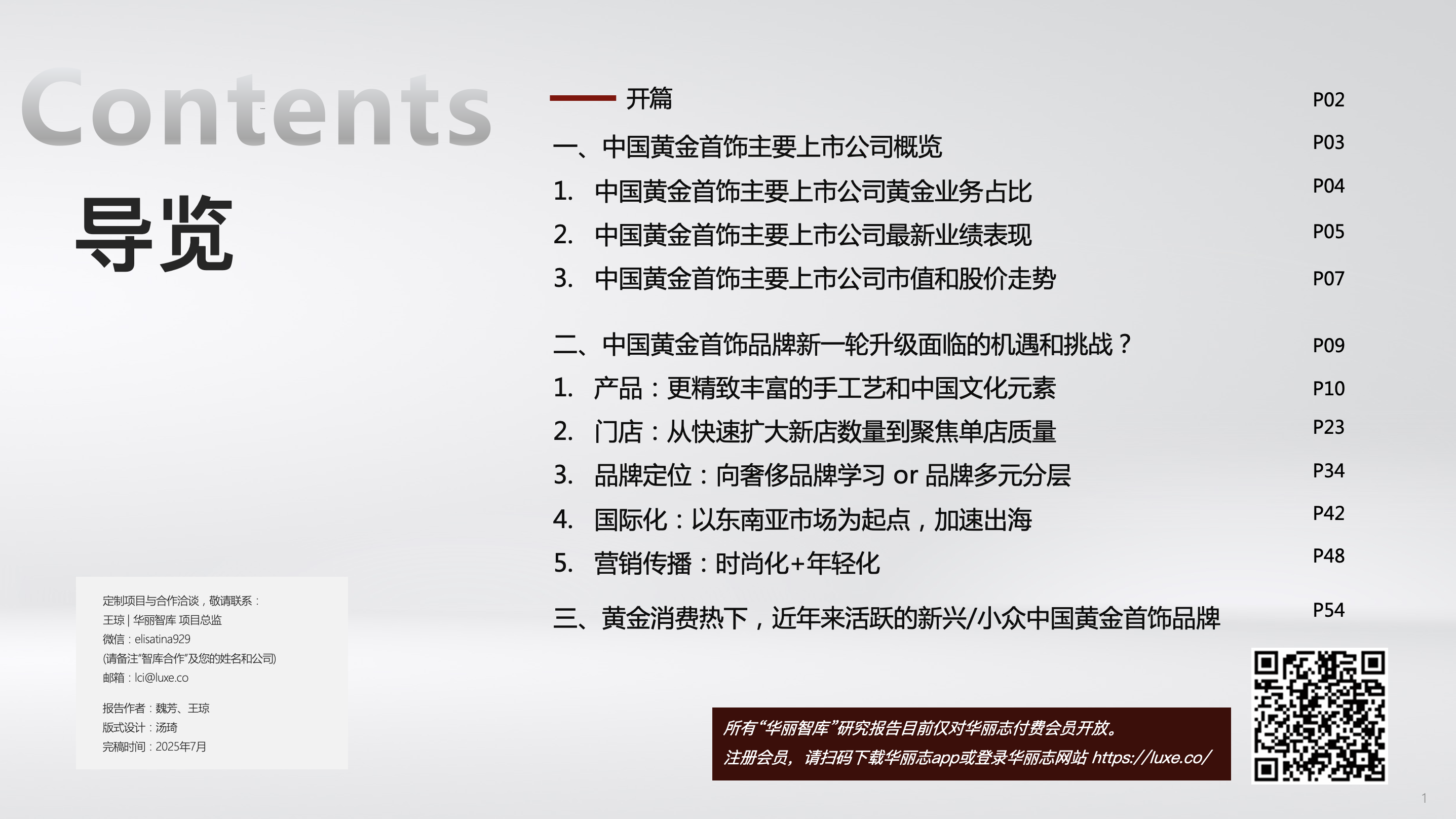

The newly released Overview of Chinese Gold Jewelry Brands features 30 China-based jewelry brands that focus primarily on gold products. It systematically reviews 236 business developments that occurred between July 2023 and June 2025, distilling them into five key dimensions for upgrading Chinese gold jewelry brands.

Part One of the report conducts a horizontal comparative analysis of 14 publicly listed Chinese gold jewelry companies (limited to those with 24K gold products accounting for over 50% of their business). It examines their most recent fiscal-year performance and stock price changes, providing a panoramic view of the current competitive landscape in the domestic gold jewelry market.

Luxe.CO Intelligence also reviewed the financial and market capitalization data from two years ago for these 14 companies and found that their total gold-related revenue grew by 11%, while total market capitalization soared by 93% over the period, clearly indicating the expansion of the overall gold jewelry market.

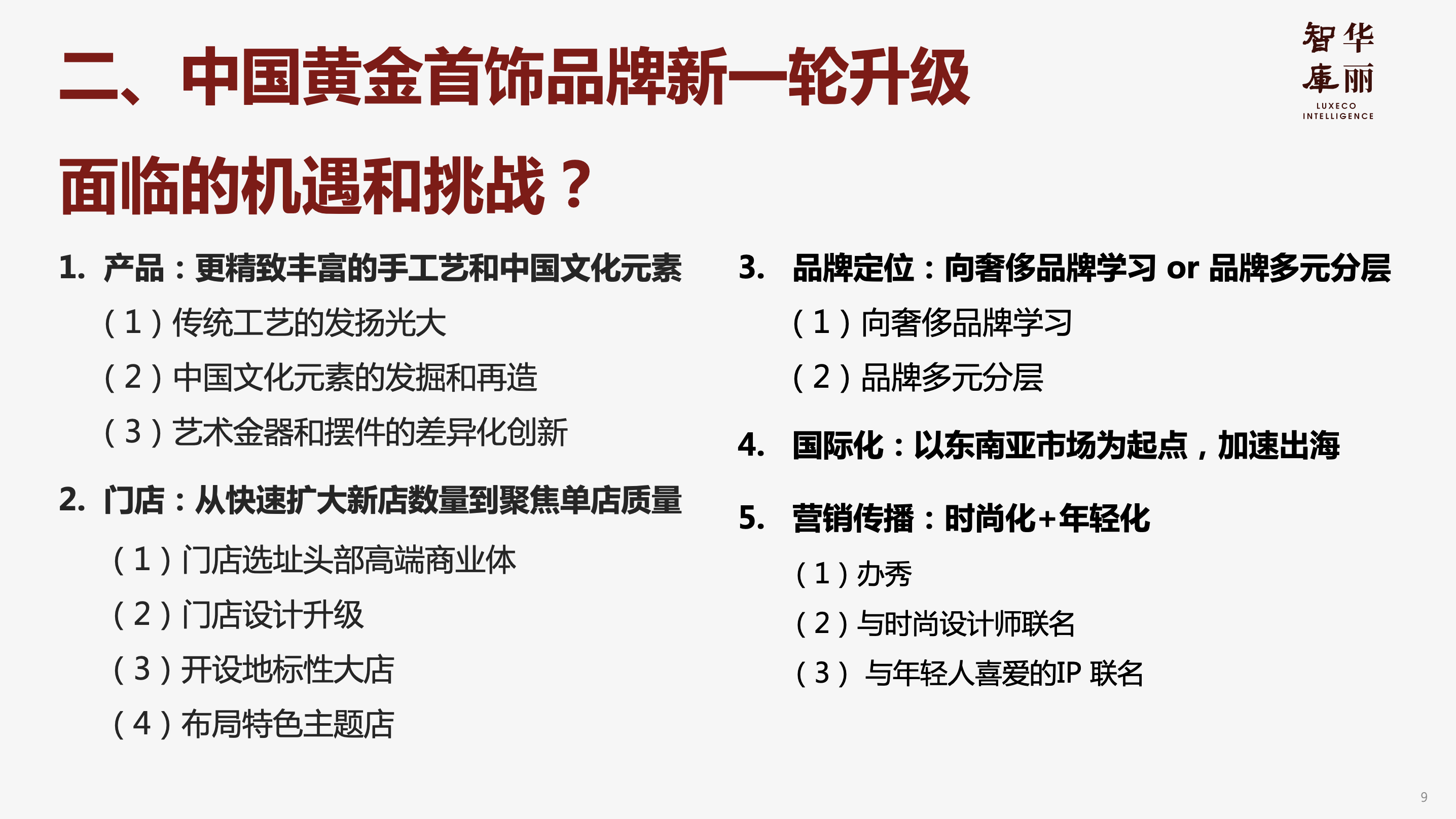

Part Two, which is also the core of the report, analyzes 54 representative, hands-on case studies (from both listed and private companies). It summarizes the opportunities and challenges of this new wave of brand upgrading across five key dimensions: product, retail stores, brand positioning, internationalization, and marketing communications. This section aims to offer valuable insights and inspiration to industry stakeholders for identifying future trends and strengthening brand strategy.

A Luxe.CO Intelligence survey revealed that about 85% of respondents believe gold jewelry has become more fashionable, indicating a surge of interest from style-conscious consumers. This shift is closely linked to brands’ investments in craftsmanship and design, which have helped them carve out more distinct market positions. For example:

-

Chow Sang Sang has developed a major product line based on the traditional filigree and inlay technique.

-

Chow Tai Fook’s new “Chuanxi” collection draws on Chinese character aesthetics and classic symbols like the lock motif, creating modern and stylish pieces imbued with cultural meaning.

However, less than 30% of respondents rated gold jewelry as “very fashionable,” suggesting that “investment and value retention” remains the dominant motivation for domestic gold jewelry consumption. This contrasts significantly with the consumption patterns of other jewelry segments, especially international luxury jewelry brands.

In terms of retail channels, Luxe.CO Intelligence analyzed the net changes in store numbers among leading gold jewelry companies through the end of 2024. It found that aside from a few expansion-minded newcomers or contrarian brands, most major players with previously extensive footprints have started to downsize their franchise and self-operated store networks.

This signals a departure from the traditional model of driving growth through broad, homogeneous store rollout. The new goal is to improve individual store productivity through refined operations.

Key breakthroughs in store quality enhancement are being made in areas such as location and design. For instance:

-

As of June 2025, nearly half (19 out of 42) of Lao Pu Gold’s stores in China (including Hong Kong and Macau) are located in high-end shopping centers such as SKP and MixC.

-

Starting September 2024, Chow Tai Fook is rolling out new concept stores featuring its iconic red color scheme, with plans to refurbish nearly all 7,000 locations by 2029.

More Dimensions and Case Analyses on the Upgrading of Chinese Gold Jewelry Brands

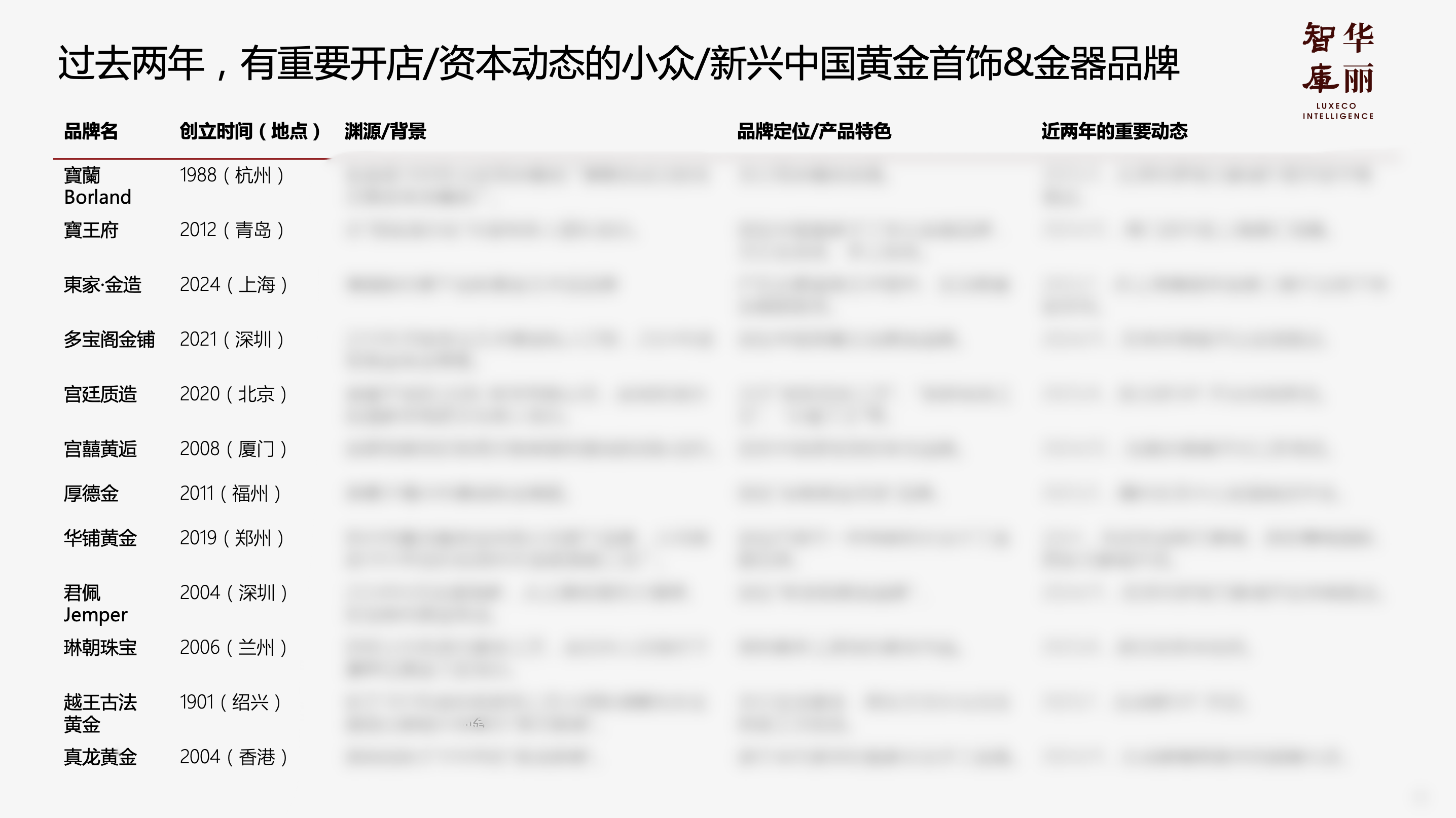

The final section of the report focuses on a growing number of emerging gold jewelry and goldware brands from across the country.

By reviewing the presence of gold jewelry brands in major commercial complexes and tracking their latest developments, Luxe.CO Intelligence discovered:

-

Following Lao Pu Gold’s success in popularizing traditional gold craftsmanship, a wave of new brands focused on ancient goldsmithing techniques has emerged in the past two years.

-

Some long-standing, low-profile niche gold brands are now accelerating their retail expansion into premium venues like SKP and MixC.

-

As market competition intensifies, a number of niche brands are breaking away from conventional gold jewelry categories to pursue differentiated sub-segments.

Looking ahead, the key to sustainable growth—beyond simply riding the gold price cycle—lies in whether brands can truly resonate with consumers through their aesthetic philosophies and brand values.

Luxe.CO Intelligence will continue to monitor and explore whether more niche and emerging brands can leverage this surge in gold consumption to raise brand awareness and achieve higher growth.

The full Overview of Chinese Gold Jewelry Brands report comprises 59 pages.

Event Preview:

On Friday, August 22, Luxe.CO will host the China Gold Jewelry Consumption Opportunities industry seminar in Beijing, where it will present in-depth insights from the new Overview of Chinese Gold Jewelry Brands report.

About Luxe.CO Intelligence

Luxe.CO Intelligence is a one-of-a-kind research and consulting platform for the global fashion industry. Rooted in China and offering a global perspective, it delivers forward-looking consumer insights, industry research, and strategic advisory services.

Leveraging its robust industry network, data intelligence, and knowledge system, Luxe.CO Intelligence focuses on luxury, fashion, beauty, and lifestyle industries. Through structured business information, in-depth sector studies, efficient primary research, rich case studies, and strategic foresight, it provides industry leaders with the best decision-making references.

Explore all reports published by Luxe.CO Intelligence: https://luxe.co/page/hlzk

For collaboration inquiries: lci@luxe.co