In recent years, a new wave of retail, led by niche, high-end international beauty and fragrance brands, has been sweeping across the Chinese market. From the bustling commercial districts of Shanghai to the artsy retail landmarks of Hong Kong, a growing number of brands are choosing to open their first-ever standalone stores or launch new retail concepts in Chinese cities, including many independent labels.

This trend reflects Chinese consumers’ rising demand for personalized, high-quality brands and products, confirming that the Chinese market has become a key engine of growth for the global beauty and fragrance industry, as well as a prime testing ground for retail innovation.

Luxe.CO has observed a recent wave of European high-end beauty and fragrance brands establishing a presence at key retail landmarks in China:

— Germany’s BABOR: Enhancing the Professional Skincare Experience via Hong Kong

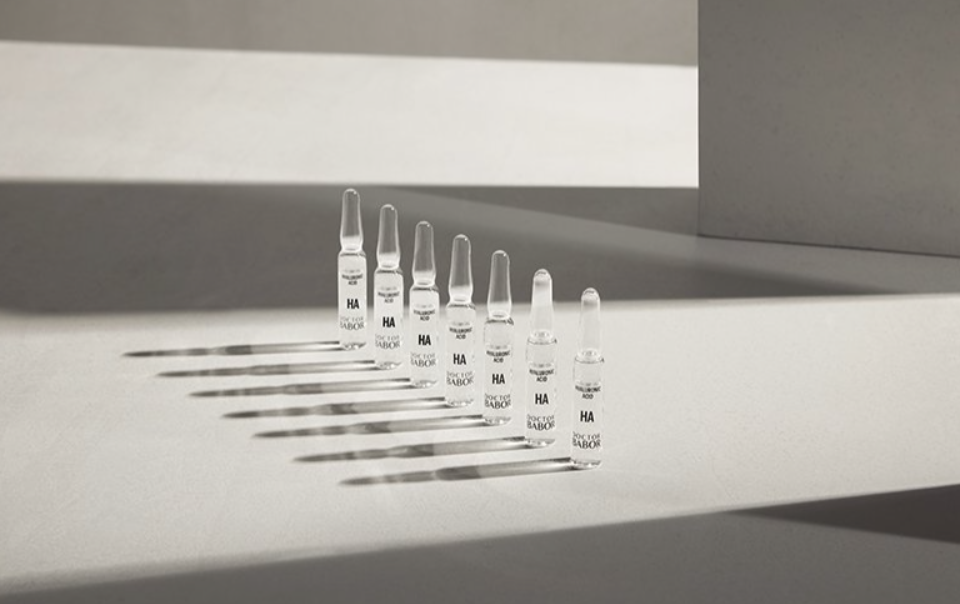

German independent professional skincare brand BABOR has launched a new concept retail store at K11 MUSEA in Hong Kong. Founded in 1956, BABOR is renowned in the global medical beauty and skincare field for its high-tech ampoule serums. It has partnered with over 700 five-star hotels and spas worldwide and has sold more than 1 billion ampoules globally.

By opening in K11 MUSEA, Hong Kong’s art, culture, and retail landmark, the brand aims to elevate its high-end image in Asia while offering consumers an immersive skincare experience that goes beyond the traditional beauty counter.

Inside the store, features such as the Ampoule Bar, showcasing 16 ampoule products; the semi-private Skin Capsule area, equipped with the exclusive Derma Visualizer skin analyzer; and the professional BABOR Expert Cabin spa space all mark a significant step forward in the brand’s new retail strategy.

— France’s Evidens de Beauté: Largest Cultural and Luxury Experience Flagship in Asia Opens in Shanghai

French luxury skincare brand Evidens de Beauté has opened its first brand “castle” store in Asia at Zhangyuan in Shanghai, offering Chinese skincare clients an immersive French luxury spa experience, with treatments priced up to nearly RMB 10,000 (approx. USD 1,370) per session.

This castle-style flagship emphasizes the brand’s heritage and cultural values. Inspired by the 13th-century Château de Montfort in southern France, the store replicates its architectural style with matching furniture, gardens, and 85 full-scale artworks. It merges this aesthetic with Zhangyuan’s century-old Shanghai heritage to create a 300-square-meter lifestyle and art space.

As the brand’s largest cultural and luxury experience center in Asia, and the only store in China offering Evidens de Beauté body spa treatments at the time of opening, the location also uses a selection of exclusive products during its services.

Other beauty and fragrance brands that have opened their first stores in Asia, including China’s Zhangyuan, include Sisley, Amouage’s first Asia-Pacific flagship, and temporary brand exhibitions such as Diptyque’s “Imaginary Paris” pop-up, Givenchy Beauty’s “G Lipstick Haute Couture Banquet,” and SENSAI’s luxury skincare showcase.

— Australia’s Fort & Manlé: A Global Debut for an Independent Perfume House

Australian independent luxury fragrance brand Fort & Manlé has opened its first-ever standalone boutique at Fashion Walk in Causeway Bay, Hong Kong.

Founded by Australian perfumer Rasei Fort, the brand is entirely crafted by its founder, from fragrance to packaging, and is celebrated for its olfactory journeys that blend modern and “Old World” romanticism, drawing inspiration from his global travels. Since its inception, the brand has released 17 fragrances, of which 8 have been discontinued.

As the fastest-growing segment of China’s high-end beauty market, fragrance is drawing increased attention. By launching its global first store in a key shopping district, Fort & Manlé leverages Hong Kong’s international appeal to directly reach Asian fragrance connoisseurs, while also positioning itself to expand into the Chinese Mainland and strengthen its presence among niche perfume enthusiasts.

— France’s Orveda: Focused on “Skin Longevity” and Expanding Presence in China

Orveda, a French high-tech skincare brand under Coty Group, has opened its first global boutique at Jiankangli in Shanghai.

From launching its first House of Orveda in China to now unveiling its first global boutique, the brand continues to deepen its commitment to the Chinese market. Located in Shanghai Centre, a long-standing international community and boutique commercial hub, the site is well-suited to the brand’s target demographic—high-net-worth consumers who prioritize privacy and personalized experiences.

Dedicated to the science of “skin longevity,” Orveda positions its boutique as a “sanctuary where green biotech meets French luxury.” It promises consumers a unique, immersive, and discreet high-end skincare experience centered on cellular-level anti-aging solutions. The focus appears to be on building in-depth services and reputation rather than rapid channel expansion in this early phase.

— France’s Parfums de Marly: Building a Landmark Niche Perfume Destination

French niche perfume brand Parfums de Marly has opened its first themed pop-up store globally, titled “Not Just a Rose Garden,” at Xintiandi North Block in Shanghai.

The artistic installation “Not Just a Rose,” which integrates the brand’s signature motifs of roses, castles, and fountains, has quickly become a social media hotspot in the Xintiandi district. The area has also attracted other niche brands in recent years, such as French fragrance house Trudon, US premium haircare brand Aveda, Italian oral care brand MARVIS, Italian fragrance brand Dr. Vranjes, and historic Italian beauty brand ACCA KAPPA.

This “first global store” boom in the beauty and fragrance space highlights a shared perspective among niche international brands about the value of the Chinese market:

First, consumption upgrading and personalization are gaining momentum. Younger generations and high-income groups in China are increasingly seeking unique, culturally meaningful, and customizable products. No longer satisfied with mainstream brands, they are willing to pay for the stories, efficacy, and rarity of niche offerings—giving independent luxury labels a chance to stand out through differentiation.

Second, the integration of retail innovation and cutting-edge beauty technologies is becoming more pronounced. China’s commercial real estate and retail environments are unmatched in scale and adaptability, making them particularly open to new ideas. This has encouraged many international brands to debut their first-ever or entirely new concept stores here.

… All of these points point to a growing shift toward hybrid retail formats that combine product sales with cultural experiences and artistic expression.

Finally, the deepening regional expansion goes beyond just Beijing, Shanghai, Guangzhou, and Shenzhen. Emerging Tier-1 cities are becoming strategic launchpads for global first stores. For instance, Louis Vuitton’s first global standalone fragrance and beauty boutique and MAC’s first global art flagship both opened at Nanjing Deji Plaza. These moves signal confidence in regional consumer potential and a clear commitment to further penetrating the Chinese market.

In conclusion, China has evolved from being a market follower to a global leader and incubator for high-end beauty retail. It has become the primary battleground for niche luxury brands seeking scale and eager to trial bold, innovative ideas.

| Image Source: Official websites of respective brands

| Editor: LeZhi