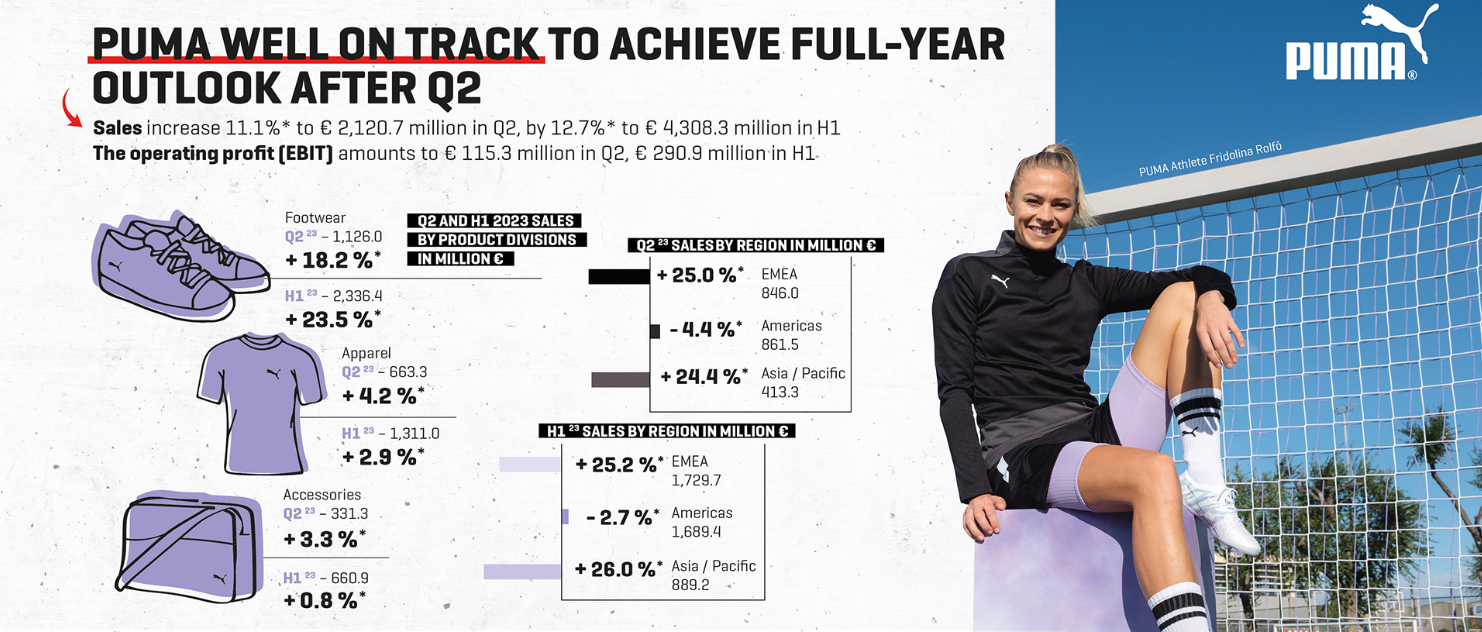

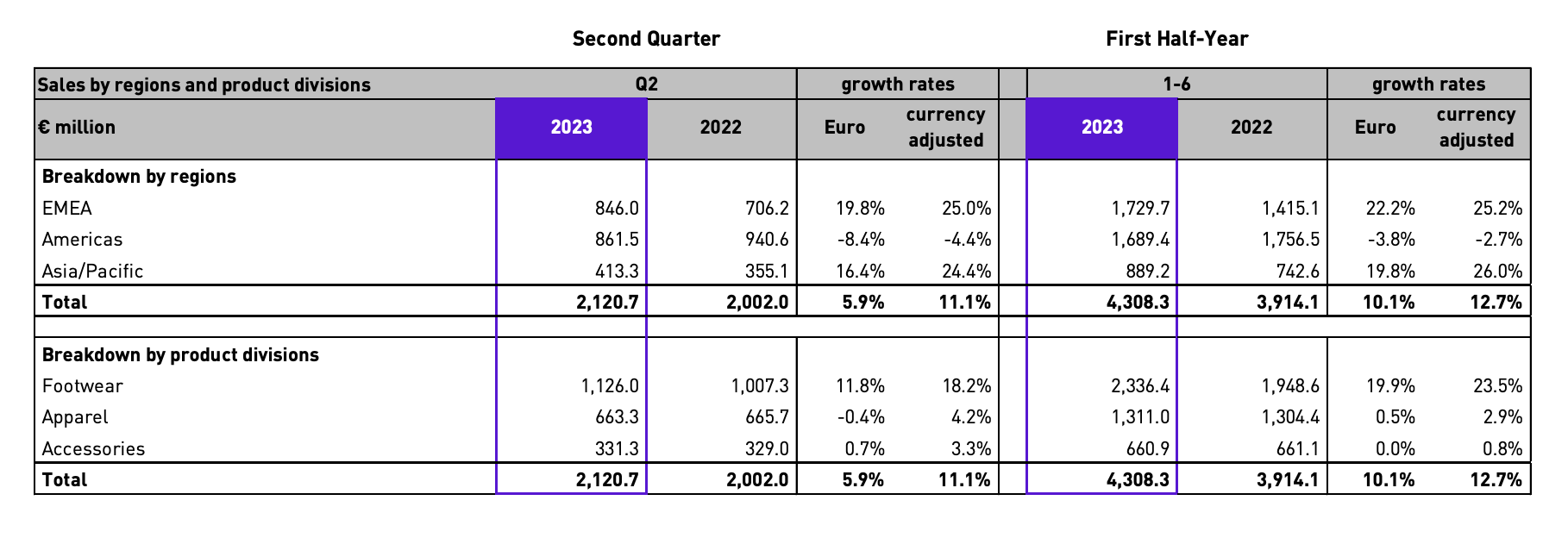

On July 26th, German sportswear brand PUMA released the key financial data for the second quarter and first half of the fiscal year 2023: Benefiting from strong growth in Europe, Middle East, Africa, and the Asia-Pacific region (including Greater China), second-quarter sales increased by 11.1% year-on-year to 2.121 billion euros, while first-half fiscal year sales grew by 12.7% year-on-year to 4.308 billion euros. Within the Asia-Pacific region, buoyed by the recovery in Greater China, growth reached 24.4%. EBIT (Earnings Before Interest and Taxes) and net profit declined by 21.2% and 34.7% respectively.

Arne Freundt, CEO of PUMA, stated, “On the back of our Q2 results, we are perfectly on track to achieve our full-year outlook in the transition year 2023. PUMA continued to grow by double-digits, demonstrating continued strong brand momentum, despite the volatile environment. As the best partner for Wholesale, we worked together with our retailers through elevated inventory levels in the market and successfully normalized our own inventory levels as planned.”

“Our strategic priorities Brand Elevation, winning in the U.S. and China are key for PUMA’s future growth trajectory. We are making good progress on all levels and with the announcement of new leaderships for Global Marketing and Mainland China, we have put the required organizational foundation in place.”

Following the financial report’s release, as of the close of trading on July 26th, PUMA’s stock price rose by 4.6% from the previous day to $6.59 per share, with a current market value of approximately $10.076 billion.

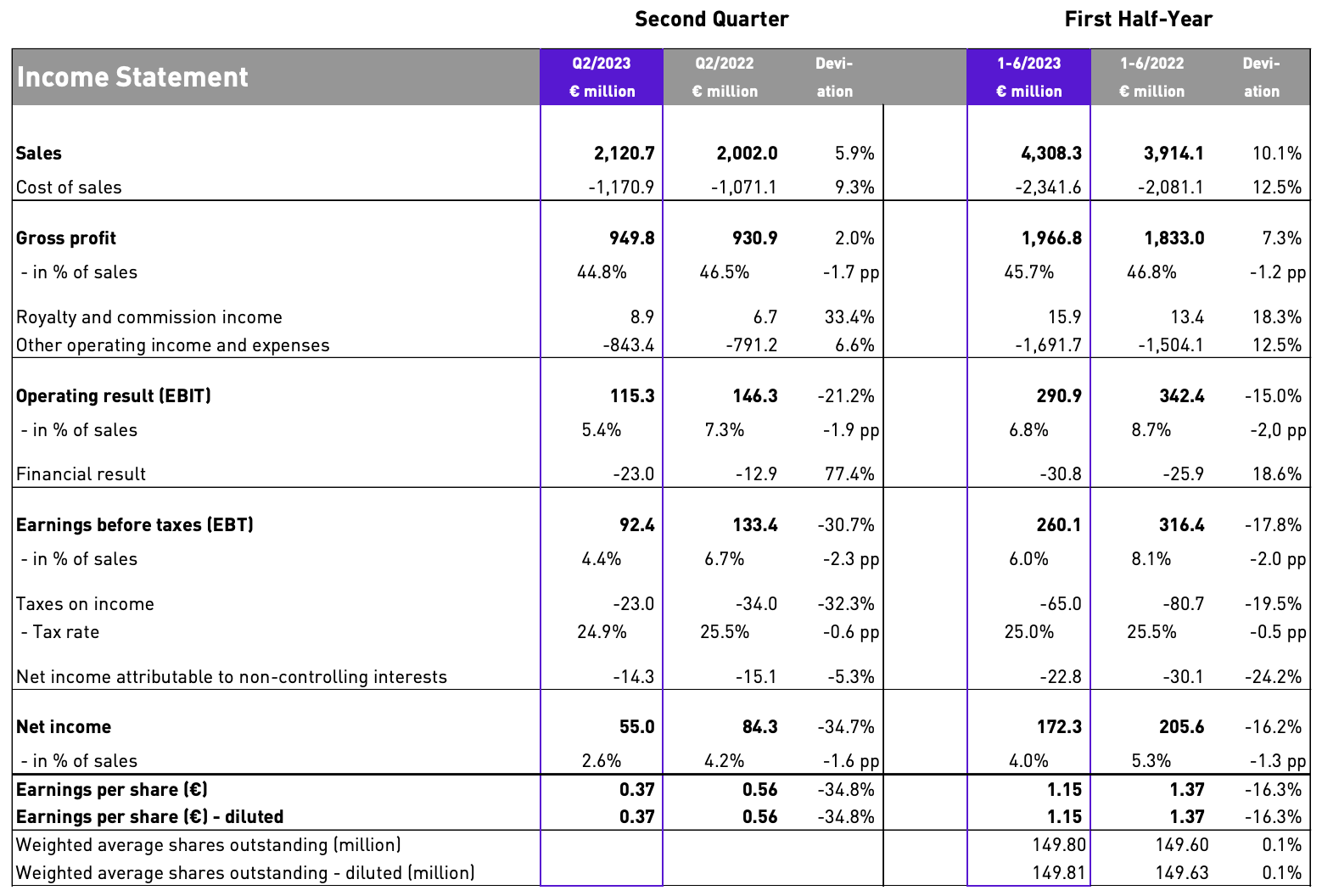

As of June 30th, 2023, the key financial data for PUMA’s fiscal second quarter is as follows:

- The gross profit margin decreased by 170 basis points. This was primarily due to higher procurement and shipping costs, as well as unfavorable currency effects negatively impacting the gross profit margin. However, price adjustments, favorable market mix, and distribution channel efforts partly offset this negative impact.

Specifically by market:

- Benefiting from the sustained recovery trend in the Greater China region after market reopening, the Asia-Pacific region achieved a growth of 24.4% to 413.3 million euros.

- Due to continued weakness in North America, sales in the Americas market were 861.5 million euros (-4.4%), while Latin America maintained strong growth. The decline in North America is attributed to macroeconomic headwinds and PUMA’s relatively dependency on low-priced products.

Specifically by category:

- Footwear sales increased by 18.2%, driven by robust demand for categories such as soccer, basketball, high-performance running, and sport style in the market.

Specifically by channel:

- Wholesale business grew by 6.9%, reaching 1.605 billion euros. This growth was facilitated by collaborating with retailers to manage elevated inventory levels and the results indicate PUMA being retailers’ preferred partner.

- Direct-to-consumer (DTC) business grew by 26.5%, reaching 515.4 million euros. The strong growth in DTC is primarily attributed to the brand’s ongoing momentum and improved product supply.

In light of the strong sales growth in the first half of the year and the continued brand momentum, PUMA stated that its performance outlook aligns with the previously stated outlook for 2023.

During the second quarter, the marketing highlights for PUMA’s key product dynamics were as follows:

- Collaborated with the New York streetwear brand NOAH to launch the first multi-season collaboration series.

- Signed the highly sought-after European football player, Xavi Simons.

- As part of the MELO FASTER TOUR, launched the first European tour with NBA star LaMelo Ball.

Signed a milestone agreement with F1.

|Source: Official Financial Report

|Image Credit: Brand’s Official Website

|Editor: Wang Jiaqi