On May 15, British luxury group Burberry (London Stock Exchange Code: BRBY.L) released its annual report for the fiscal year ending March 30, 2024. The report revealed a 4% year-on-year decline in total revenue to £2.97 billion (constant currency), falling short of the group’s expectations. Comparable store sales decreased by 1% year-on-year, with the 10% growth in the first half of the fiscal year offset by an 8% decline in the second half.

Same-store sales in the Chinese Mainland grew by 2% year-on-year, but fell by 19% in the fourth quarter. Additionally, the number of customers in the Chinese Mainland decreased by 12% year-on-year in the fourth quarter, with tourist spending accounting for nearly a quarter of their global consumption.

Regarding the performance for the full fiscal year, Burberry CEO Jonathan Akeroyd stated, “Executing our plan against a backdrop of slowing luxury demand has been challenging. While our FY24 financial results underperformed our original expectations, we have made good progress refocusing our brand image, evolving our product and strengthening distribution while delivering operational improvements. We are using what we have learned over the past year to finetune our approach, while adapting to the external environment. We remain confident in our strategy to realise Burberry’s potential as the Modern British Luxury brand and in our ability to successfully navigate this period.”

According to the report, Burberry’s strategic progress for fiscal year 2024 included:

- Refocusing on storytelling around modern British luxury, enhancing brand awareness, and achieving double-digit growth in the number and spending of elite customers.

- Improving the aesthetics and quality of seasonal products, and starting to revitalize larger core collections.

- Transforming the distribution network with 79 new or renovated stores, with more than 50% of the stores being newly built or refurbished.

- Reconfiguring the supply chain according to the new creative vision, improving online replenishment of core products, and strengthening manufacturing capabilities while continuously delivering on the sustainability roadmap.

Looking ahead to fiscal year 2025, Burberry expects challenges in the first half of the year due to external uncertainties but anticipates benefits from these actions starting in the second half. With enhanced control over distribution, wholesale revenue is expected to decline by about 25% in the first half. The company will continue to invest in DTC (direct-to-consumer) while strictly controlling costs to support growth goals. Cost-saving measures have been identified to offset inflation impacts in the second half.

Burberry’s priorities for fiscal year 2025 include:

- Refining brand expression in storytelling and product focus, enhancing engagement with new and existing customers.

- Improving product supply, ensuring balance between seasonal and core collections.

- Enhancing the retail store experience, focusing on conversion rates, improving the online customer experience, and streamlining wholesale channels in the EMEIA (Europe, Middle East, India, and Africa) region to further strengthen distribution control.

- Enhancing operational delivery, driving cost efficiency, and advancing the sustainability agenda.

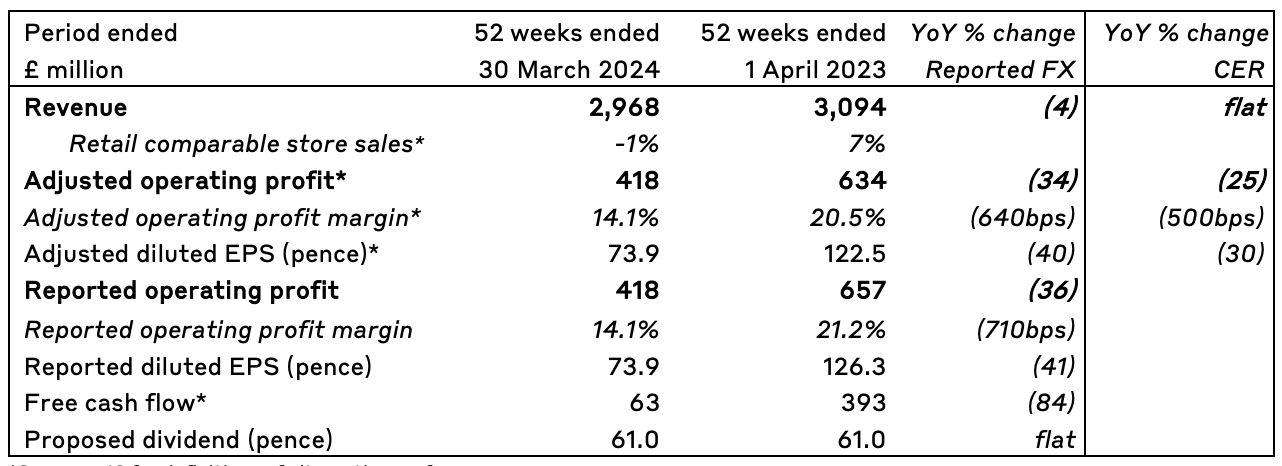

Burberry’s key financial data for fiscal year 2024:

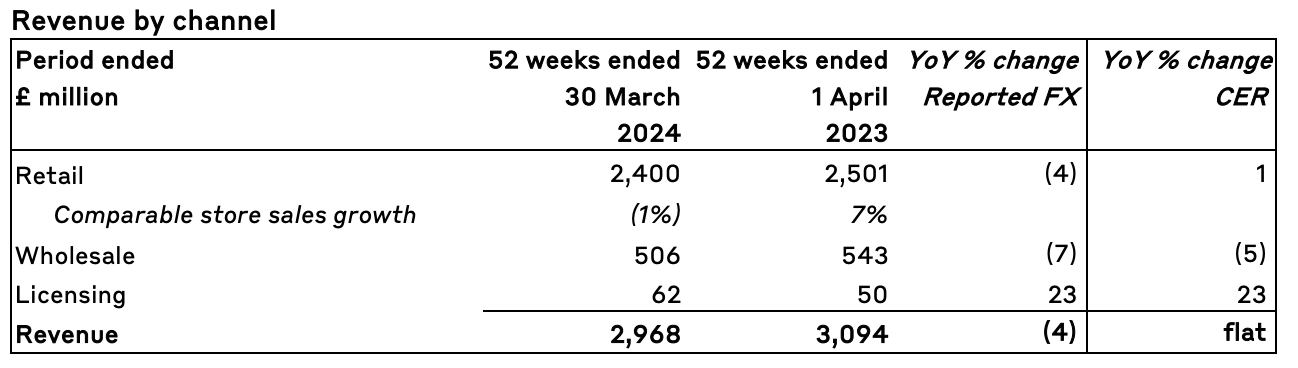

By Channel

- Retail channel performance was impacted by a 2% increase in store area and a 1% decline in comparable store sales.

- Wholesale channel performance declined due to pressure in the Americas market.

By Market

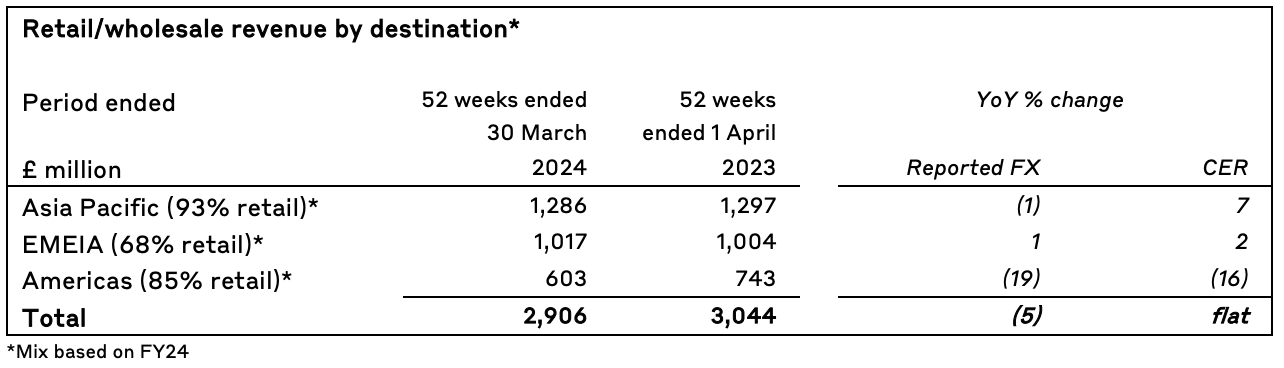

Asia Pacific: Comparable store sales grew by 3% year-on-year, but declined by 17% in the fourth quarter due to economic challenges faced by local customers. Specific figures include:

- The Chinese Mainland: Same-store sales grew by 2% year-on-year, but fell by 19% in the fourth quarter. The number of customers decreased by 12% in the fourth quarter, with tourist spending accounting for nearly a quarter of their global consumption.

- South Korea: Same-store sales declined by 8% year-on-year, with a 17% drop in the fourth quarter. Customer numbers fell by 12% in the fourth quarter, but tourist spending grew by double digits, mainly concentrated in EMEIA and Japan.

- Japan: Same-store sales grew by 25% year-on-year, with an 18% increase in the fourth quarter, driven by strong tourist spending, which more than doubled in the fourth quarter, accounting for half of Japan’s market sales.

- South Asia Pacific: Same-store sales grew by 4% year-on-year, but fell by 24% in the fourth quarter due to a decrease in local customers. Low single-digit growth in tourist spending could not fully offset this impact.

EMEIA: Comparable store sales grew by 4% year-on-year, but fell by 3% in the fourth quarter. The region benefited from strong tourist spending growth, but local customer spending declined by low double digits.

Americas: Both full-year and fourth-quarter same-store sales fell by 12% year-on-year, continuing the trend of relatively broad declines in local customer spending.

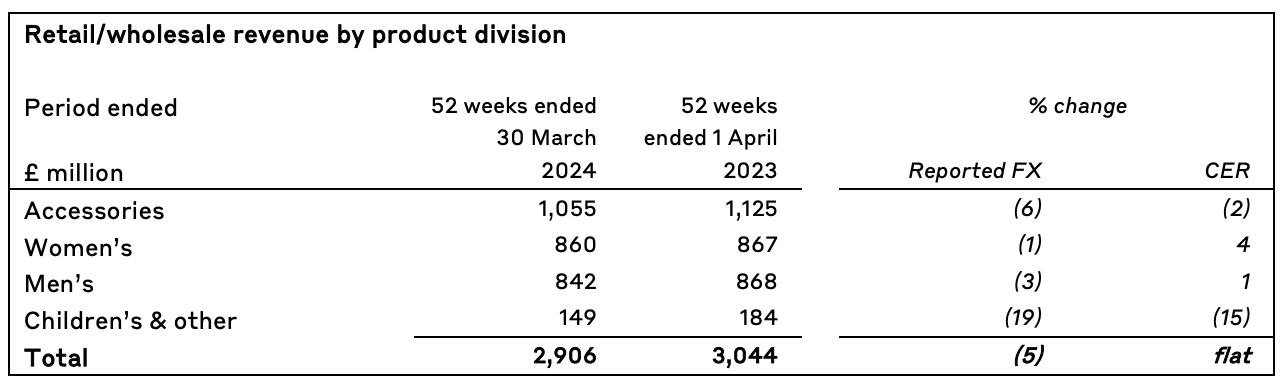

By Product

- Outerwear, led by Heritage trench coats, performed strongly with high single-digit sales growth year-on-year. The scarves category saw double-digit sales growth.

- Sales of men’s and women’s ready-to-wear fell below the group average, with single-digit declines year-on-year.

Hargreaves Lansdown’s Chief Equity Analyst Sophie Lund-Yates commented, “There are many shortcomings in Burberry’s latest data amid the slowdown in luxury demand. The trend in the luxury sector is slowing across the board, so these weak results are not surprising. The question now is how quickly demand will recover, which of course depends on the economy. Compared to other brands, Burberry’s relative lack of brand diversification makes it more susceptible to these cycles. As we enter the new fiscal year, uncertainty remains, and cost-saving measures are necessary to support profits, but this cannot last forever.”

As of the close on May 15, Burberry’s stock price fell by 7.28% to 1102 pence (£11.02), with a cumulative decline of 56.36% over the past 12 months, and a latest market value of £3.952 billion.

| Sources: Burberry official website and financial report, City A.M., Hargreaves Lansdown

| Image Credit: Burberry official website

| Editor: Wang Jiaqi