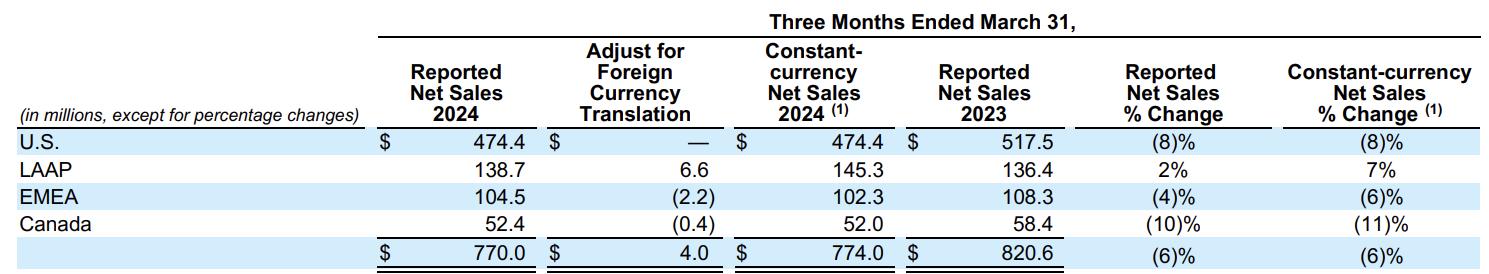

On April 25, local time, the American outdoor apparel group Columbia Sportswear announced its financial results for the first quarter of 2024: net sales fell 6% year-over-year to $770 million. Notably, net sales in the Chinese market grew by 20% year-over-year, making it the best-performing major single market.

In the earnings call following the report, Tim Boyle, Chairman, President, and CEO, along with CFO Jim Swanson, discussed the “reversal” in the Chinese market (Columbia’s net sales in China saw a year-over-year decline in 2022 but began recovering in 2023):

Tim Boyle stated that, from the channel side, Columbia Sportswear’s growth was driven by e-commerce, becoming one of the fastest-growing outdoor brands on the Douyin platform. On the product side, the Transit series, specifically designed for Chinese consumers, performed exceptionally well in the first quarter, surpassing last year’s results and significantly resonating with young Chinese consumers. We expect China to be one of our fastest-growing regions in 2024.

*The Columbia Transit series was launched in early 2023, designed to meet the burgeoning outdoor demand trends in the Chinese market.

However, Tim Boyle also admitted that Columbia has been doing business in China for about 20 years, with direct operations for 5 to 6 years. Despite being a leading brand, the performance in China had not been satisfactory for many years. If you compare our Chinese operations with other companies, you will find that we are relatively small in scale. Now, we have reversed the situation, and compared to other regions, the Chinese market has produced some unexpected results.

Tim Boyle further explained that most improvements in the Chinese market stem from streamlining operations to better meet local market needs. In fact, we did not significantly expand our distribution range.

“While expanding distribution is a good approach, we have focused on improving monthly performance and store efficiency in various ways, including key retail operations and products designed directly for the Chinese market. These products have been improved to better meet local market demands. Lastly, our excellent management team has been crucial in enhancing our business.”

Jim Swanson added that, in fact, we might have closed one or two more stores compared to a year ago. So, all improvements have come from performance enhancements of our existing stores and online partner distributors.

“From a profitability perspective, China is one of our most profitable regions, far exceeding the overall operating profit margin of the group.”

In addition to the flagship brand Columbia, Columbia Sportswear also owns the Canadian outdoor brand Sorel (acquired in 2000), the American outdoor brand Mountain Hardwear (acquired in 2003), and the yoga apparel brand prAna (acquired in 2014).

Columbia Sportswear divides its market into four regions: Canada, the U.S., EMEA (Europe, Middle East, and Africa), and LAAP (Latin America and Asia-Pacific). Driven by the Chinese market, LAAP was the only region to achieve a year-over-year net sales increase in the first quarter. Besides the 20% year-over-year net sales growth in China, the Japanese market remained stable, the Korean market saw a low single-digit decline, and distribution business in the region fell by over 20% year-over-year.

| Source: Columbia Sportswear earnings call

| Image Credit: Columbia Sportswear official website

| Editor: LeZhi