On November 28, after market close, Chinese down jacket brand Bosideng (HK: 3998) released its results for the first half of FY2025, ending September 30, 2024. During the reporting period, the group’s revenue grew by 17.8% year-on-year to RMB 8.804 billion, and net profit attributable to shareholders increased by 23.0% year-on-year to RMB 1.13 billion. In addition, the gross profit margin slightly declined by 0.1 percentage points to 49.9%, while the operating profit margin improved by 0.2 percentage points to 16.7%.

Since 2018, the group has proposed a new strategic goal and embarked on a new journey of transformation and upgrading. Over the past six years, the group has returned to its entrepreneurial roots, focusing on its core down jacket business and driving transformation through brand building, product innovation, retail upgrades, fast response mechanisms, and digital operations.

In October of this year, Bosideng, in collaboration with Cathay Capital, made a new round of strategic investment in the Canadian high-end down jacket brand Moose Knuckles, making Bosideng an important shareholder of Moose Knuckles.

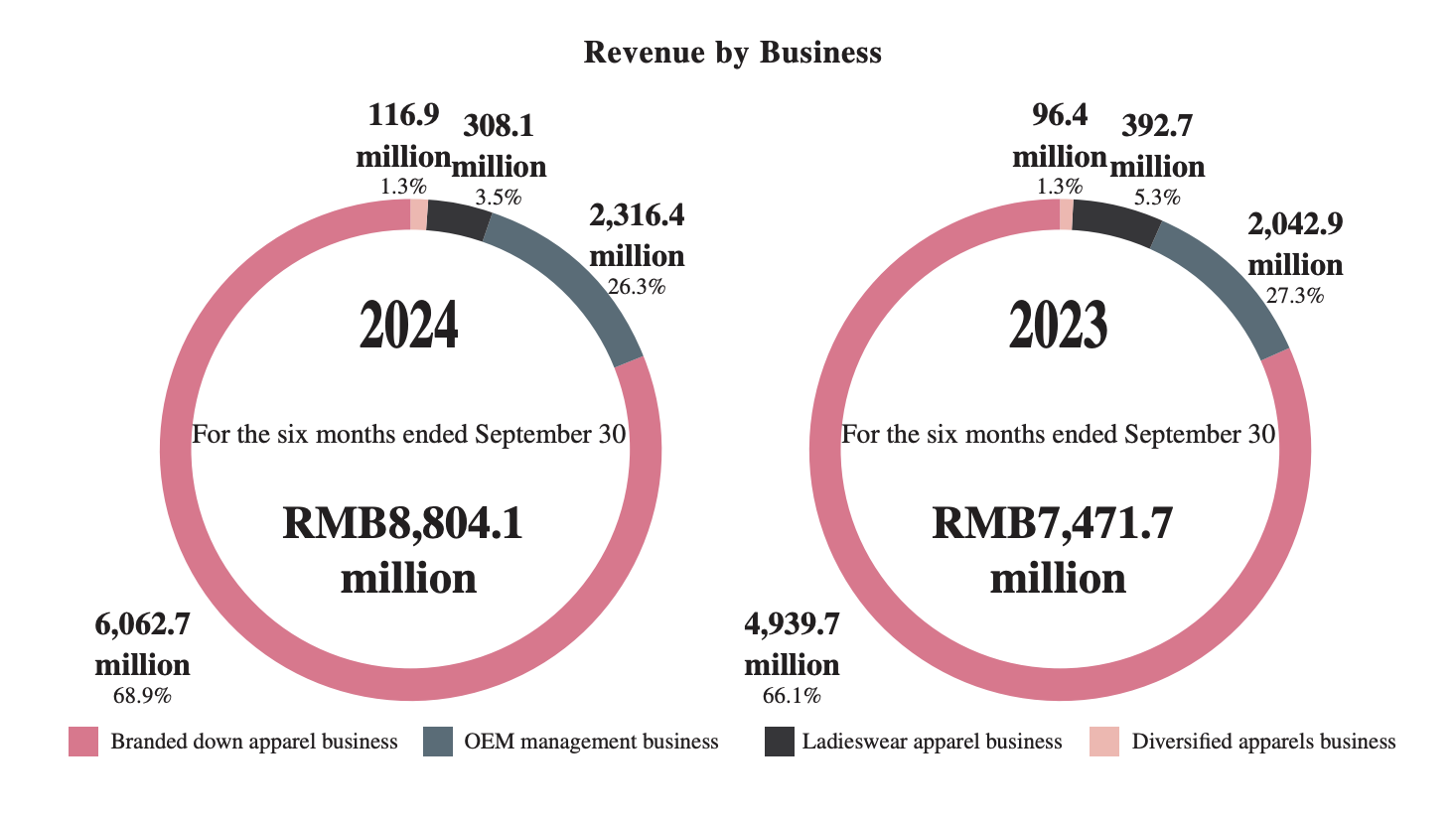

The group’s main business units are branded down apparel, OEM management, women’s apparel, and diversified apparel. During the reporting period, the group’s major business units achieved stable and high-quality growth:

- Branded Down Apparel Business: Revenue increased by 22.7% year-on-year to RMB 6.063 billion, continuing to be the group’s largest revenue source, with its proportion further rising to 68.9% (last year: 66.1%).

- OEM Management Business: Revenue increased by 13.4% year-on-year to RMB 2.317 billion, accounting for 26.3% of the group’s revenue (last year: 27.3%).

- Women’s Apparel Business: Revenue decreased by 21.5% year-on-year to RMB 308 million, accounting for 3.5% of the group’s revenue (last year: 5.3%).

- Diversified Apparel Business: Revenue increased by 21.3% year-on-year to RMB 117 million, accounting for 1.3% of the group’s revenue (last year: 1.3%).

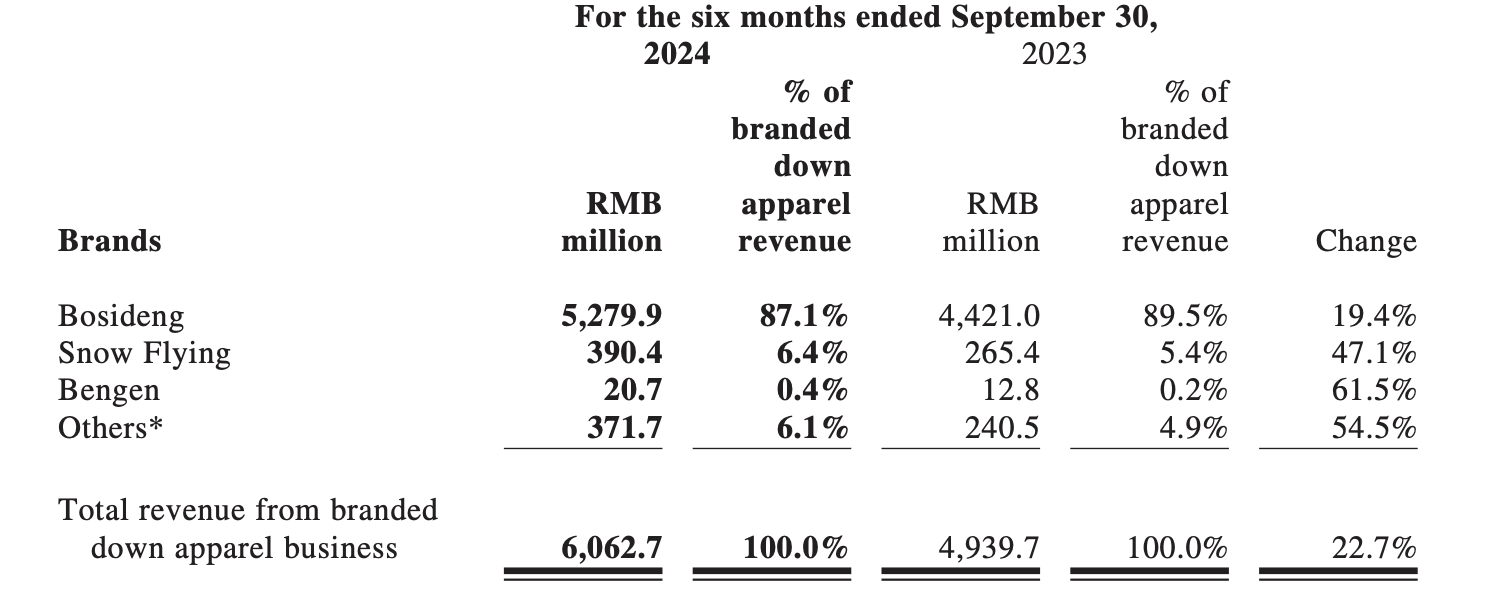

In the most critical branded down apparel business, Bosideng includes its core mid-to-high-end brand Bosideng, as well as more mass-market brands such as Snow Flying and Bengen. For the first time in FY2025, the group proposed the “Four Strengthenings” strategy: strengthening brand leadership, strengthening category operations, strengthening channel management, and strengthening customer experience to comprehensively enhance operational and profitability capabilities.

Details are as follows:

- Bosideng: Revenue increased by 19.4% year-on-year to RMB 5.28 billion, with its proportion of the down apparel segment slightly decreasing to 87.1% (last year: 89.5%).

- Snow Flying: Revenue increased by 47.1% year-on-year to RMB 390 million, with its proportion of the down apparel segment increasing to 6.4% (last year: 5.4%).

- Bengen: Revenue surged 61.5% year-on-year to RMB 21 million, with its proportion of the down apparel segment increasing to 0.4% (last year: 0.2%). Since FY2021, the Bingjie brand has significantly reduced offline distribution channels and shifted its focus to online channel development.

In terms of branded down apparel channels: as of September 30, 2024, the total number of regular retail outlets (excluding seasonal stores) decreased by 29 to 3,188 compared to March 31, 2024. The number of self-operated retail outlets increased by 18 to 1,154, while the number of retail outlets operated by third-party distributors decreased by 47 to 2,034. Self-operated and third-party distributor-operated outlets accounted for 36.2% and 63.8% of the total retail network, respectively.

Among the group’s branded down apparel retail outlets, approximately 26.3% are located in Tier-1 and Tier-2 cities (such as Beijing, Shanghai, Guangzhou, Shenzhen, and provincial capitals), while approximately 73.7% are located in Tier-3 and lower-tier cities.

In December 2021, Bosideng announced a strategic joint venture agreement with the German company Willy Bogner GmbH & Co. KGaA (BOGNER), establishing a joint venture to explore the Chinese market. The joint venture holds exclusive rights to sell and distribute BOGNER and FIRE+ICE apparel in the Chinese Mainland, Hong Kong, Macau, and Taiwan.

As of September 30, 2024, the BOGNER joint venture actively expanded its business in Greater China:

- In terms of brand building, efforts focused on leveraging online content platforms to establish the brand’s luxury ski positioning, highlighting professional ski categories, and targeting luxury fashion consumers. Additionally, the company explored opportunities in year-round luxury sports scenarios, including urban light outdoor and golf settings, to expand consumer engagement through social content.

- For product promotion, the 2024 spring/summer collection was adjusted based on German sports and fashion lines to better align with Chinese market preferences, differentiating scenarios into classic skiing, urban outdoor, and business sports. The 2024 winter collection focused on luxury fashion ski wear, further strengthening the brand’s identity in luxury and professional skiing. The vacation ski series, in particular, gained strong consumer interest upon launch.

- To further develop overseas production capacity and enhance upstream resource integration, the group invested in joint ventures and associated companies, including factories in Vietnam and Indonesia, as well as raw material suppliers in China. These investments operated healthily in the first half of FY2025.

However, the BOGNER joint venture in China has yet to achieve profitability, with Bosideng recording a proportional loss of RMB 5.2 million during the reporting period.

As of the close on November 29, the group’s stock price fell by 3.8% to HKD 4.05 per share, with a total market capitalization of HKD 44.9 billion.

| Source: Official Financial Report

| Image Credit: Official Website

| Editor: LeZhi