On June 26, after the market closed, Chinese down jacket brand group Bosideng (HK: 3998) released its full-year results for the 2023/24 fiscal year ending March 31, 2024.

During the reporting period, the group’s revenue increased by 38.4% year-on-year to RMB 23.21 billion. The gross profit margin rose slightly by 0.1 percentage points to 59.6%, while operating profit surged by 55.6% to RMB 4.40 billion, and net profit attributable to shareholders rose by 43.7% to RMB 3.07 billion. Both revenue and net profit hit a historical high for the same period for the sixth consecutive year.

Since 2018, the group has embarked on a new strategic goal and commenced a journey of transformation and upgrading. Over the past six years, the group has returned to its entrepreneurial roots, defining the strategic direction of “focusing on the main channel (down jackets) and the main brand (Bosideng).”

As of the close on June 27, the group’s stock price rose by 4.85% to HKD 4.54 per share, with a current market value of approximately HKD 49.8 billion.

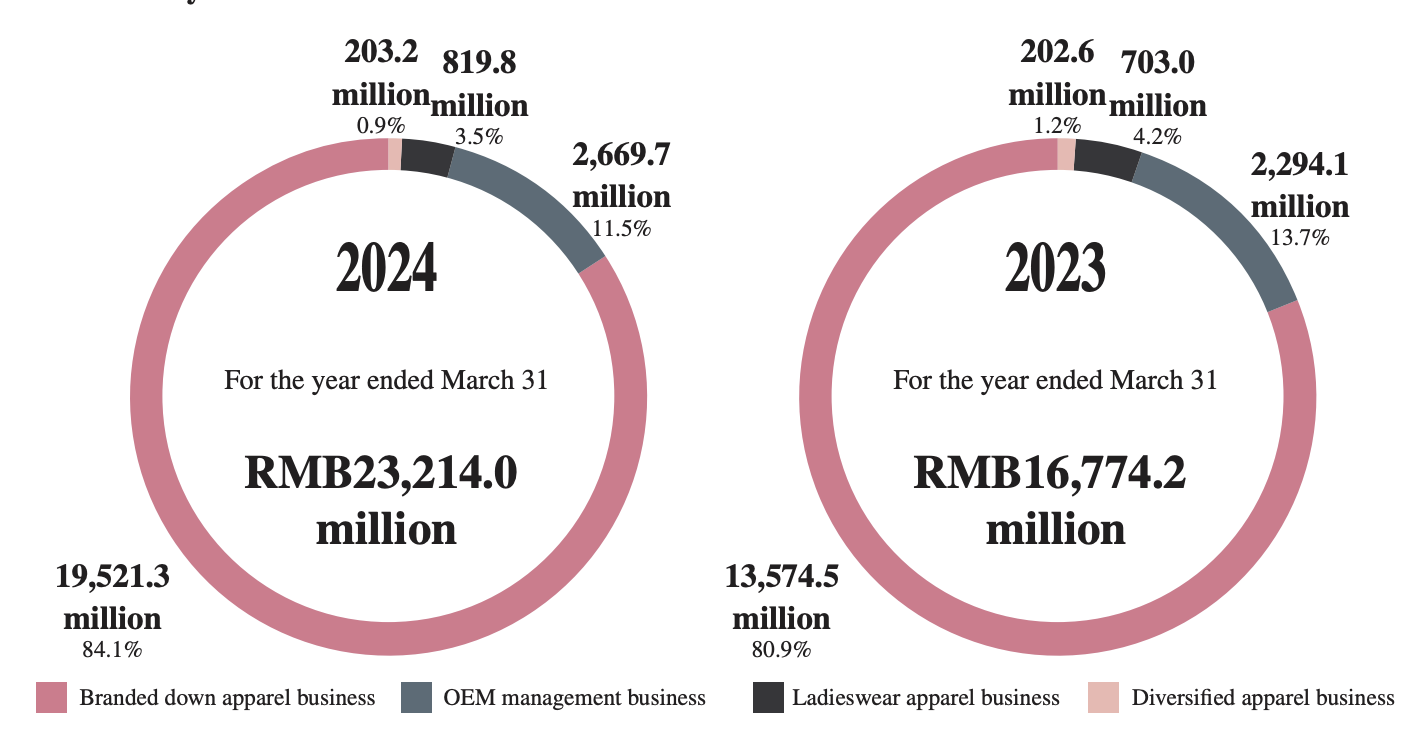

Bosideng Group’s main business segments include branded down jackets, OEM processing management, women’s wear, and diversified apparel. During the reporting period, all segments achieved stable and high-quality growth, with the branded down jacket segment performing the best:

- Branded Down Jacket Business: Revenue increased by 43.8% year-on-year to RMB 19.52 billion, becoming the group’s largest revenue source, with its proportion rising to 84.1% (last year: 80.9%);

- OEM Processing Management Business: Revenue increased by 16.4% year-on-year to RMB 2.67 billion, accounting for 11.5% of total revenue (last year: 13.7%);

- Women’s Wear Business: Revenue increased by 16.6% year-on-year to RMB 820 million, accounting for 3.5% of total revenue (last year: 4.2%);

- Diversified Apparel Business: Revenue increased by 0.3% year-on-year to RMB 203 million, accounting for 0.9% of total revenue (last year: 1.2%).

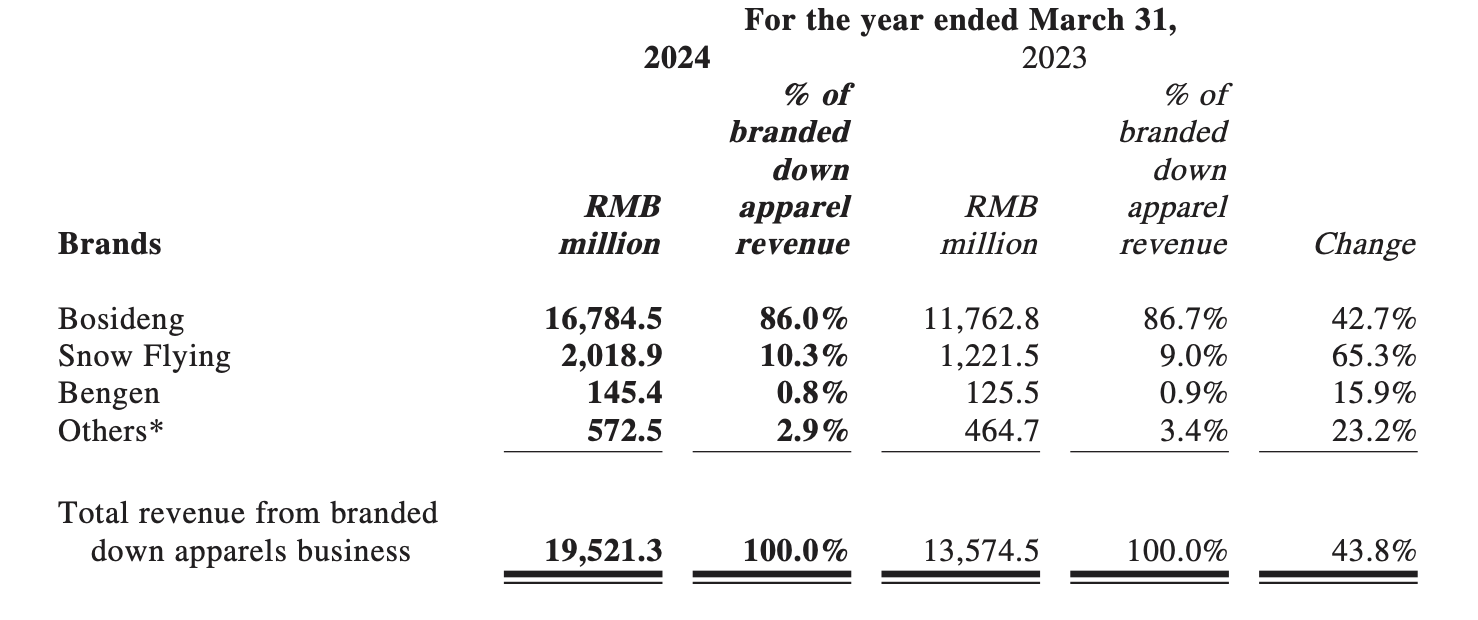

In the most important branded down jacket business, including the core high-end brand Bosideng and the more mass-market oriented Snow Flying and Bingjie:

- Bosideng: Revenue increased by 42.7% year-on-year to RMB 16.78 billion, with its proportion in the down jacket segment slightly declining to 86.0% (last year: 86.7%);

- Snow Flying: Revenue surged by 65.3% year-on-year to RMB 2.02 billion, with its proportion in the down jacket segment rising to 10.3% (last year: 9.0%);

- Bengen: Revenue increased by 15.9% year-on-year to RMB 145 million, with its proportion in the down jacket segment slightly declining to 0.8% (last year: 0.9%). Since the 2020/21 fiscal year, Bingjie has significantly reduced offline agency channels, focusing on online channel development.

Regarding the distribution channels for branded down jackets, the total number of regular retail outlets (excluding peak season stores) decreased by 206 to 3,217 compared to the end of the previous fiscal year, with self-operated retail outlets decreasing by 263 to 1,136, and third-party dealer-operated retail outlets increasing by 57 to 2,081. Self-operated and third-party dealer-operated retail outlets accounted for 35.3% and 64.7% of the entire retail network, respectively. Approximately 28.4% of the group’s branded down jacket retail outlets are located in first- and second-tier cities (i.e., Beijing, Shanghai, Guangzhou, Shenzhen, and provincial capitals), while about 71.6% are located in third-tier and lower cities.

As of March 31, 2024, in addition to regular stores such as flagship stores, high-end stores, mainstream stores, and mass stores, the group had over 1,400 peak season stores.

*Peak season stores refer to stores that operate for 1 week to 3 months during the sales peak season, mainly focusing on provincial capital cities, selling popular seasonal top items, and located primarily in core business districts and sports venues.

In November 2023, Bosideng opened its first nationwide summit-themed concept store at Beijing Wangfujing Intime in88. The store simulates scenes such as ice fields, snow mountains, and snow caves, with a separate “Bosideng Down Technology Center” display area to showcase the technology and innovation of the summit series to consumers.

In December 2021, Bosideng announced the establishment of a joint venture with German company Willy Bogner GmbH & Co. KGaA and reached a strategic joint venture agreement to expand the Chinese market. The joint venture has the exclusive right to sell and distribute BOGNER and FIRE+ICE apparel in the Chinese Mainland, Hong Kong, Macau, and Taiwan.

As of March 31, 2024, the joint venture actively expanded its business in Greater China:

- Brand Building: Significantly increased brand exposure through collaborations with celebrities and key opinion leaders (KOLs);

- Brand Strategy: Focused on core online platforms to create a comprehensive consumer interaction experience;

- Product Promotion: Launched multi-scenario urban, sports series, and Wanderlust capsule series based on the core luxury ski apparel series during the 2023/24 fiscal year;

- Channel Development: BOGNER strengthened its strategic deployment in China, continuously penetrating the high-end target market in China through entering high-end shopping centers in high-tier cities like Beijing and Shanghai, as well as opening flagship stores on Tmall.

However, the BOGNER China joint venture has not yet achieved profitability. In the 2023/24 fiscal year, the joint venture recorded an operating loss, with Bosideng Group’s corresponding share of the loss being RMB 15.6 million.

| Source: Official Financial Report

| Image Credit: Group Official Website

| Editor: LeZhi