Before the market opened on March 26, China Resources Land Limited (HK:01109), the real estate arm of China Resources Group, released its full-year results for 2024. The company disclosed performance highlights of its shopping centers, primarily under the MixC brand, and revealed its latest expansion plans during the earnings conference.

For the full year of 2024, China Resources Land’s revenue increased by 11.0% year-on-year to RMB 278.8 billion [approx. USD 38.5 billion], while net profit attributable to shareholders declined by 18.5% to RMB 25.6 billion [approx. USD 3.5 billion].

On the trading day following the results announcement (March 26), the company’s stock price rose by 1.57% to HKD 25.85 per share, giving it a total market capitalization of HKD 184.3 billion.

China Resources Land currently operates two core business segments: development and sales, and operations. The operations segment includes rental property management, asset-light management (i.e., CR MixC Lifestyle), and ecosystem-related services.

Among these, the rental property business centered around shopping malls generated revenue of RMB 23.3 billion [approx. USD 3.2 billion] in 2024, up 4.8% year-on-year, contributing 8.4%of the group’s total revenue. The segment’s core net profit (excluding fair value gains from investment property appraisals) reached RMB 8.56 billion [approx. USD 1.2 billion], an increase of 9.1%, accounting for 33.7% ogroup’sroup’s total net profit.

Within the operations segment, the property categories include shopping malls, office buildings, and hotels. Shopping malls alone generated rental income of RMB 19.3 billion [approx. USD 2.7 billion], up 8.4% year-on-year. The gross profit margin and operating profit margin climbed to recent highs of 76.0% and 61.0%, respectively. Overall occupancy rates improved by 0.6 percentage points from the end of 2023 to 97.1%.

At the earnings conference, China Resources Land shared further key figures on its shopping mall operations:

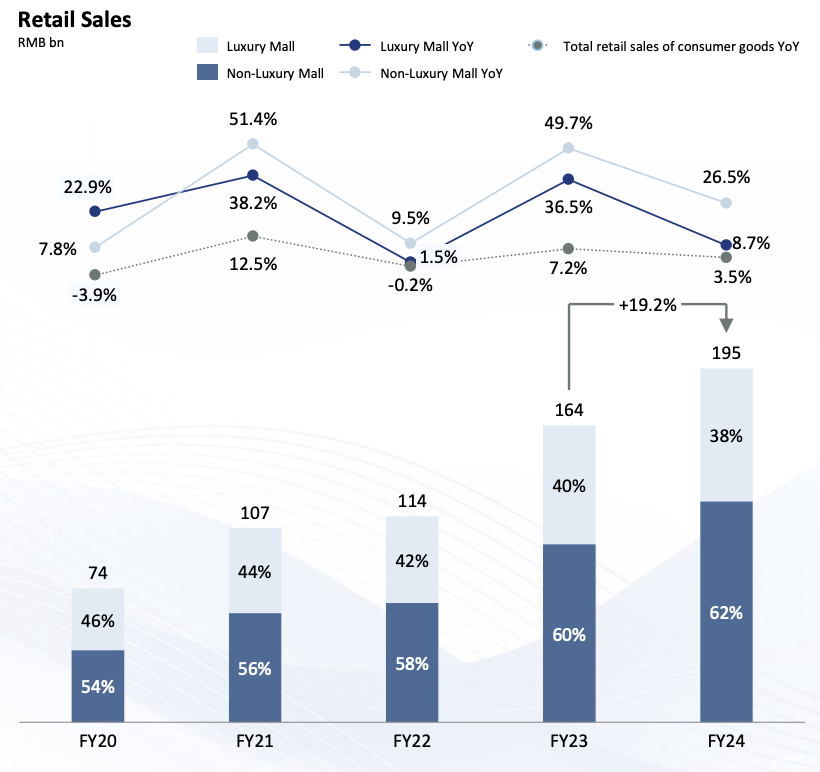

Total retail sales from the group’s shopping malls rose 19.2% year-on-year to RMB 195.3 billion [approx. USD 27.0 billion], with same-store sales up 4.6%, accounting for 0.4% of China’s total retail sales of consumer goods. Retail sales of high-end luxury grew 8.7% year-on-year, representing 62% of the total, while non-luxury retail sales jumped 26.5%, accounting for 38%.

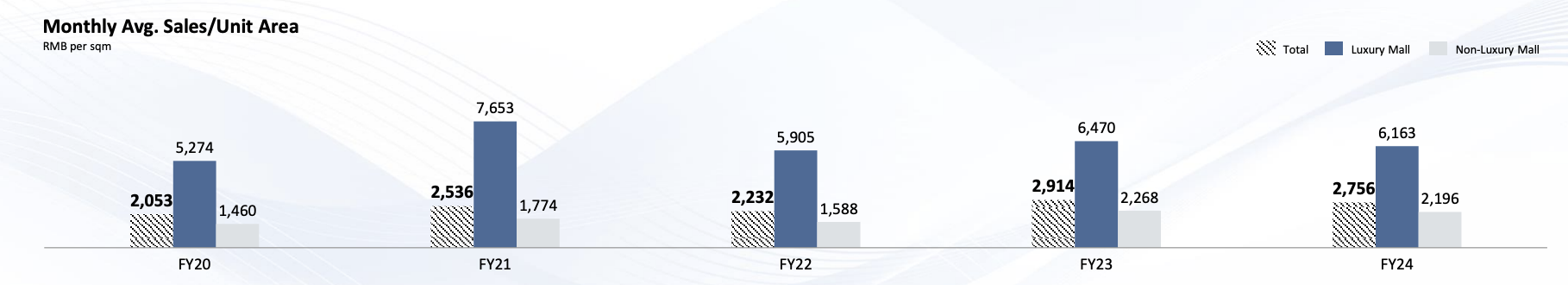

71 of the operating malls ranked among the top three in retail sales in their respective cities. Average monthly sales efficiency across all malls reached RMB 2,756 per square meter [approx. USD 380], with high-end luxury reaching RMB 6,163 [approx. USD 850], and non-luxury at RMB 2,196 [approx. USD 300].

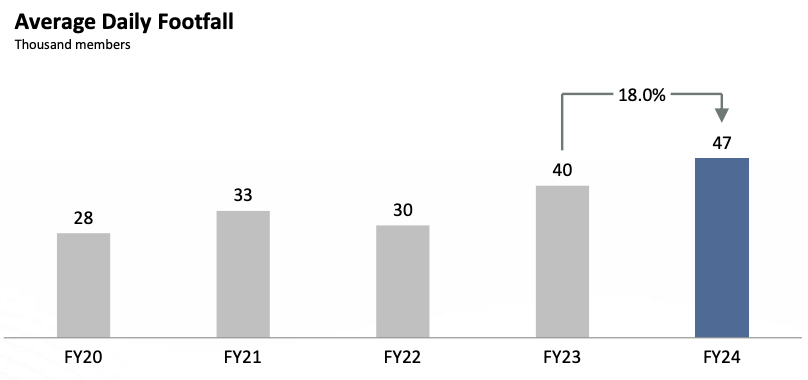

Average daily foot traffic per mall rose 18.0% year-on-year, while the number of loyalty members increased by 32.0% to 61.07 million.

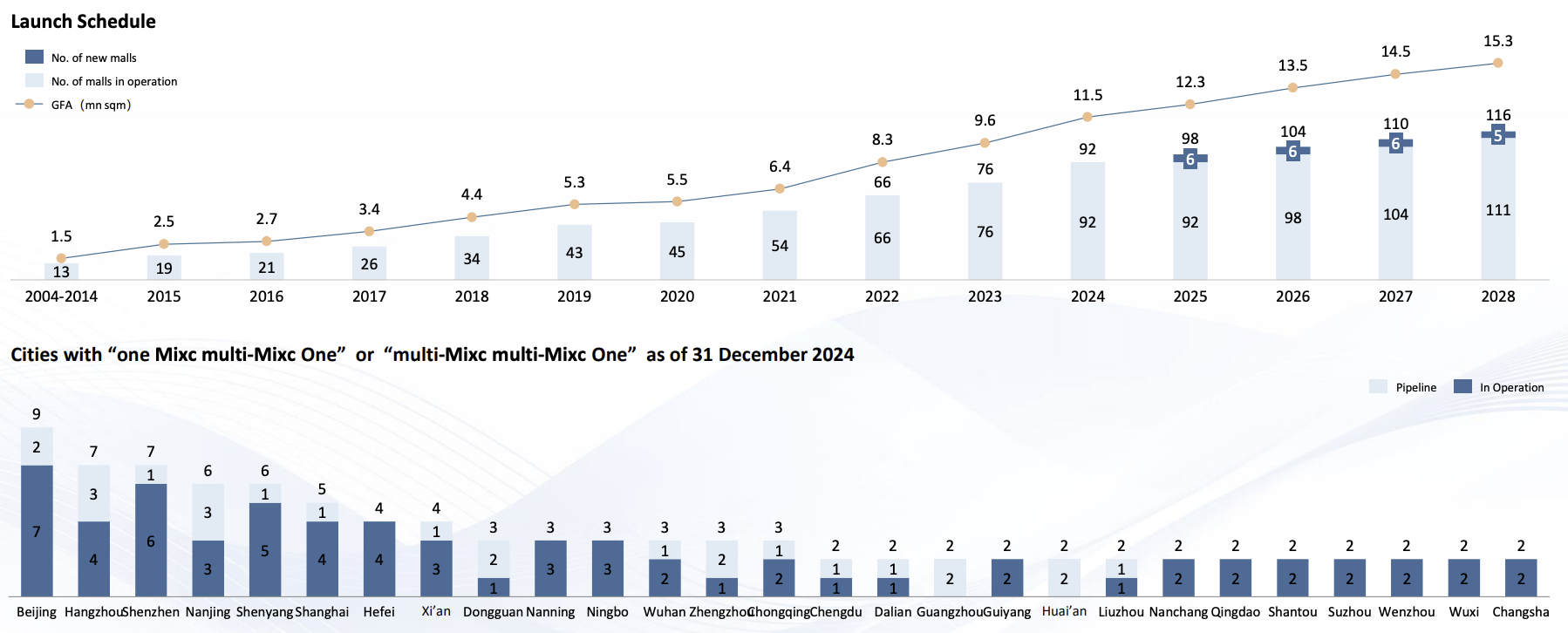

In 2024, the company opened 16 new shopping malls, bringing the total number of operating malls to 92. Highlights include:

- The successful opening of Xi’an MixC, marking the launch of the 4.0 iteration of the MixC concept, which generated industry buzz with its “Tree of Life” centerpiece;

- Yiwu Tiandi and Shaoxing Tiandi projects, which pioneered “culture-business-tourism” product innovation;

- Shenzhen BREWTOWN, which successfully implemented an “Industry + Thematic IP” innovation model.

The newly opened malls achieved an average occupancy rate of 95.9%, contributing 4.3% and 4.2% to total retail sales and rental income, respectively.

As of December 31, the group had established a presence of two or more shopping centers in 27 cities. Going forward, the company will continue to focus on Tier-1, Tier-2, and provincial capital cities, pursuing its “multi-mall per city” and “multi-city multi-mall” strategies. By the end of 2028, the number of operating shopping malls is expected to reach 116.

|Source: Official Financial Report

|Image Credit: Official Financial Report

|Editor: LeZhi