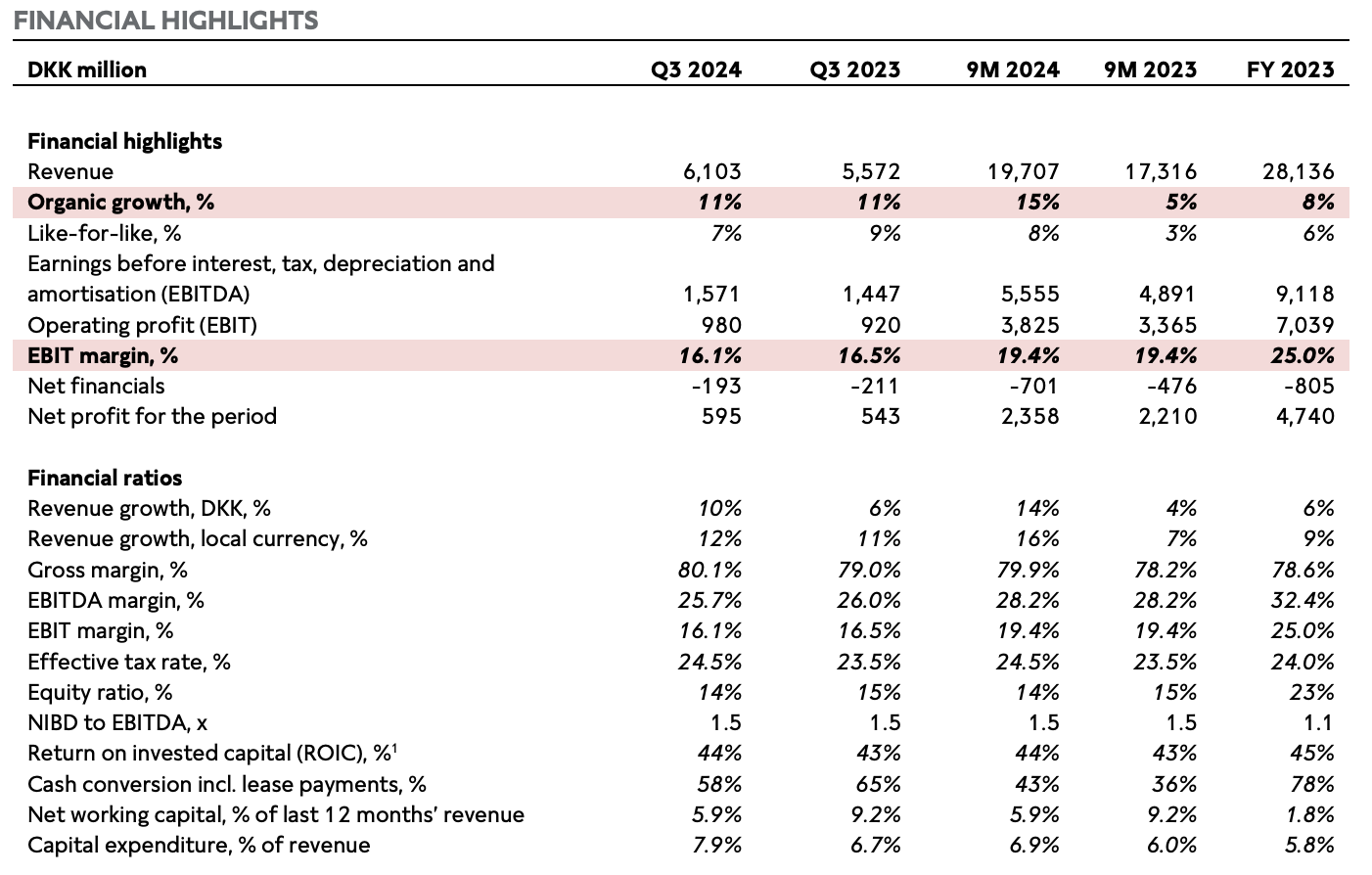

On November 6, the Danish affordable luxury jewelry brand Pandora released its key financial data for the third quarter of 2024. The company’s revenue grew by 10% year-on-year to DKK 6.103 billion (approx. USD 871 million), reflecting an 11% organic growth and a 7% growth on a comparable basis. Thanks to its vertically integrated business model, price increases, and improved cost efficiency, Pandora’s gross profit margin reached 80.1%, up by 110 basis points compared to the third quarter of 2023.

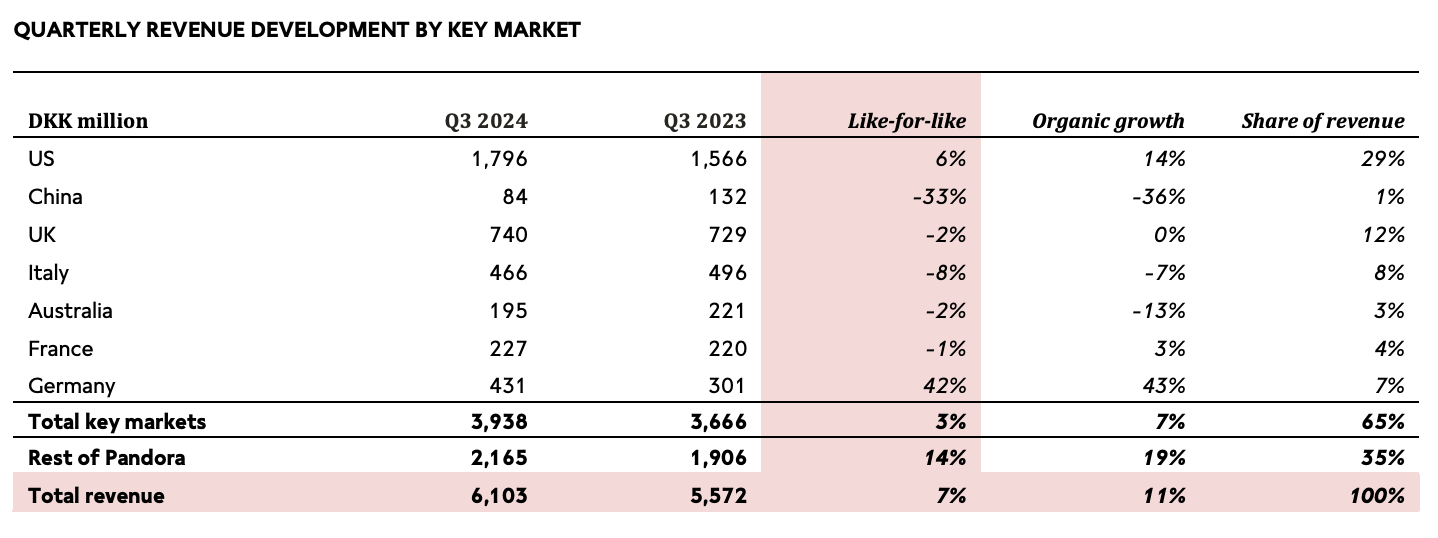

However, the brand continues to face challenges in the Chinese market. On an organic basis, sales in China declined by 33% year-on-year during the quarter, making it Pandora’s most significant declining market. China’s market share in global sales has now fallen to approximately 1%. The decline was partly influenced by Pandora’s decision to reduce promotional activity compared to previous years. Pandora remains committed to navigating the complexities of the Chinese market and gradually building its brand in the region. The company is currently evaluating its next steps in the market.

Alexander Lacik, President and CEO of Pandora, stated, “We are very pleased with our strong results this quarter, particularly in the context of the current macroeconomic backdrop. We are transforming the perception of Pandora into a full jewellery brand and unlocking the next chapter of our growth by attracting more consumers to our brand. Step by step we are capturing the many untapped opportunities, and we will continue to invest in our strategic growth initiatives.”

Following the earnings announcement, Pandora’s share price rose by 1.2% on November 7, closing at DKK 1,054 per share. The company’s market capitalization now stands at approximately DKK 86.721 billion (USD 12.16 billion), reflecting a more than 30% increase over the past 12 months.

Key Highlights of the Phoenix Strategy During the Reporting Period:

- Increased Investment in Strategic Pillars: Pandora continues to expand investments in the four pillars of the Phoenix Strategy—brand, design, market, and personalization. These efforts are yielding encouraging results.

- Core Business Growth: Sales in the “Core” business segment grew by 2% on a comparable basis, while the “Fuel with More” segment grew by 21%, aligning with the overall vision of the Pandora brand.

- Pandora ESSENCE Collection: Following its global mid-year launch in Q2 2024, the PANDORA ESSENCE collection completed its first full quarter of sales. Its organic, fluid, and natural aesthetic has resonated with consumers, generating revenue of DKK 169 million (approx. USD 24.17 million).

- Personalization Services: Customization services continue to drive incremental growth. Engraving services, in particular, gained significant traction, achieving over 100% growth in Q3 2024. Approximately 1,250 engraving machines have been installed worldwide.

- Profit Margin Challenges: Rising commodity prices have posed a 360-basis-point challenge to Pandora’s target EBIT margin of 26%-27% by 2026. However, Pandora has confirmed mitigation measures to offset at least 140 basis points of this impact and is actively pursuing additional measures.

Key Financial Data as of September 30:

By Segment:

By Market:

Pandora anticipates organic sales growth of 11%-12% for 2024, revised from the previous estimate of 9%-12%. The EBIT margin is expected to remain stable at approximately 25%.

Note: As of point of writing, 1 DKK is approximately equivalent to USD 0.14

| Source: Official Financial Report

| Image Credit: Pandora Official Website

| Editor: LeZhi