As Luxe.CO celebrates its tenth anniversary, the “Luxury Brands in China Power Ranking” has come to the third year.

Backed by our proprietary industry database and proven research capabilities, this unique “Power Ranking” produced by Luxe.CO provides a comprehensive overview of the latest development of almost ALL major luxury brands in China market over the past year.

Based on the continuous tracking and collection of data and cases, it offers an objective and systematic summary and analysis of the various activities carried out by these brands; while the “ranking”, calculated by taking into consideration both the intensity and the importance of the activities, outlines a vivid picture of these brands in terms of strategic focus and level of investments in China luxury market.

The trends and best practices revealed in this report are not only crucial for luxury brands but also hold significant reference value for the broader fashion value chain, including commercial real estate, high-end retailers, public relations and advertising companies, as well as other Chinese and overseas brand companies.

“People tend to forget that China is still a young market,” said the global CEO of a luxury brand during conversation with Luxe.CO. We resonate with this sentiment:

On the one hand, the “youthfulness” of the China market signifies vibrancy, dynamism, opportunities, and possibilities. The rapid growth of the luxury goods industry in China in recent years has fully validated this.

On the other hand, the “youthfulness” of the China market also implies more “uncertainty.” Brand building is still in its early stages, market penetration is relatively shallow, and the “brand power” is yet to be firmly established. The target demographics are always evolving;mindset and behavior patterns of local consumers, especially the young ones, are constantly shifting —— the center of attention, means and routes of consumption and communication …

To keep up with this “young” and “uncertain” market of such a magnitude, luxury brands cannot merely hold on to the status quo but constantly renew their efforts on different aspects as retail expansion/upgrading, content development, communication and customer relations.

Executives at the headquarter of luxury brands should always keep China at the top of their agenda, and proactively adjust their strategy and tactics in line with the ever-evolving landscape. Through continuous learning and innovation, they must work closely with the local team to maintain and enhance the brand’s “visibility,” “vitality,” and “relevance” in the China market.

The effectiveness of these investments should not only be evaluated and judged based on short-term sales data but also on the impacts on the “awareness,” “reputation” and “desirability” of the brands among Chinese consumers over a much longer period of time —— which are critical in acquiring genuine pricing power and ensuring sustainable growth for the brand.

The latest edition of the “Luxury Brands in China Power Ranking,” covers the period from January 1st to December 31st, 2023, with 953 activities from 104 luxury brands recorded (Please note: This report does not include brand activities in beauty, skincare, and fragrance.)

From this report, you will gain a clear understanding of which luxury brands have increased investments in China in the challenging year of 2023 and find out where they specifically directed their efforts. Also, you will know which cities opened the most new luxury brand stores, and what best practices are worth referencing and learning from.

Today, we issue the following two rankings:

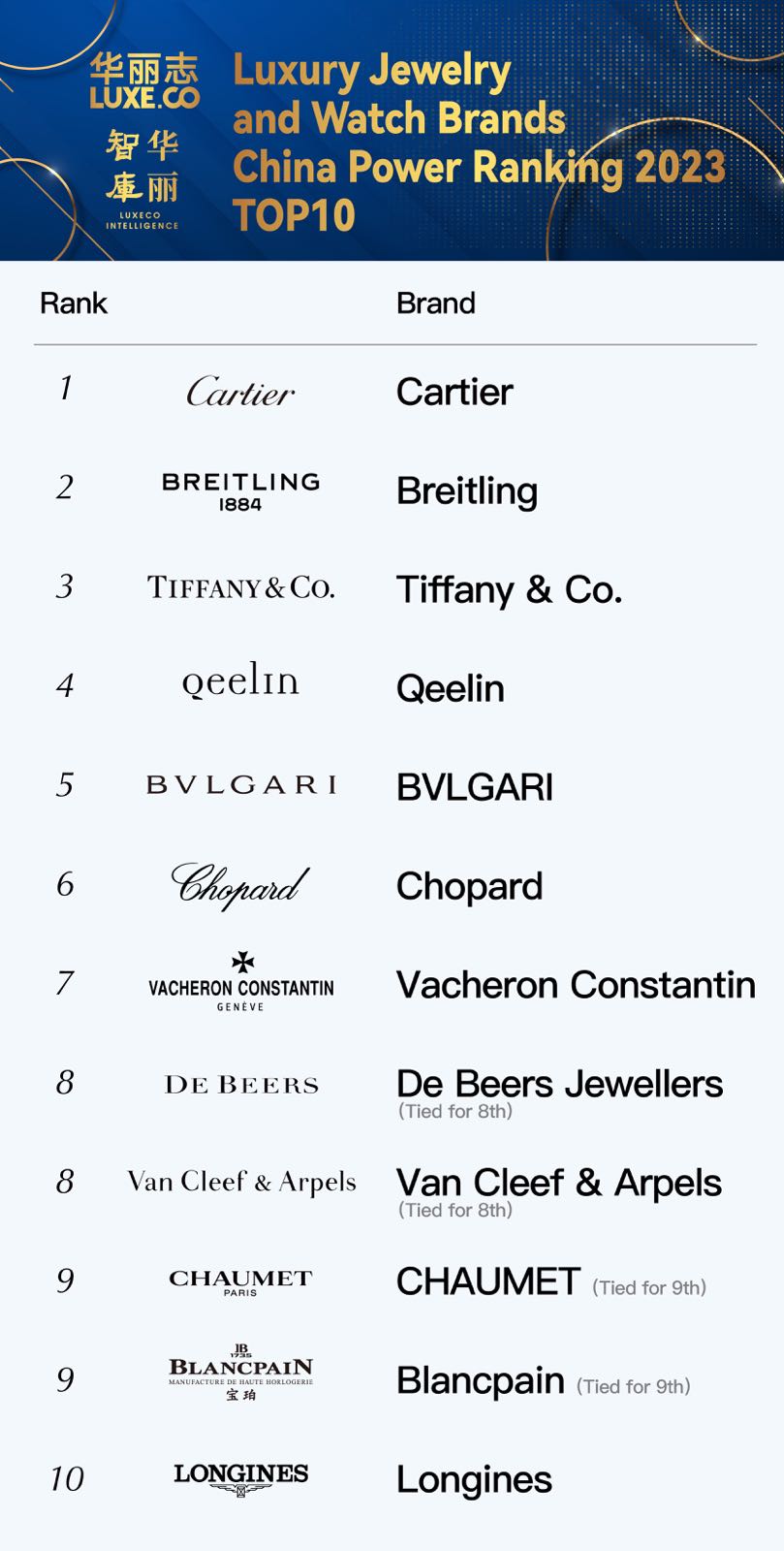

“Luxury Brands in China Power Ranking 2023” TOP 10

“Luxury Jewelry and Watches Brands China Power Ranking 2023” TOP 10

Congratulations to all the brands on the list!!!

Click here to download the full text of “Luxury Brands in China Power Ranking & Top Cases 2023″( in English)for FREE!

In the report, you will read the following contents:

- Which brands made it to the “Luxury Brands in China Power Ranking TOP 20”?

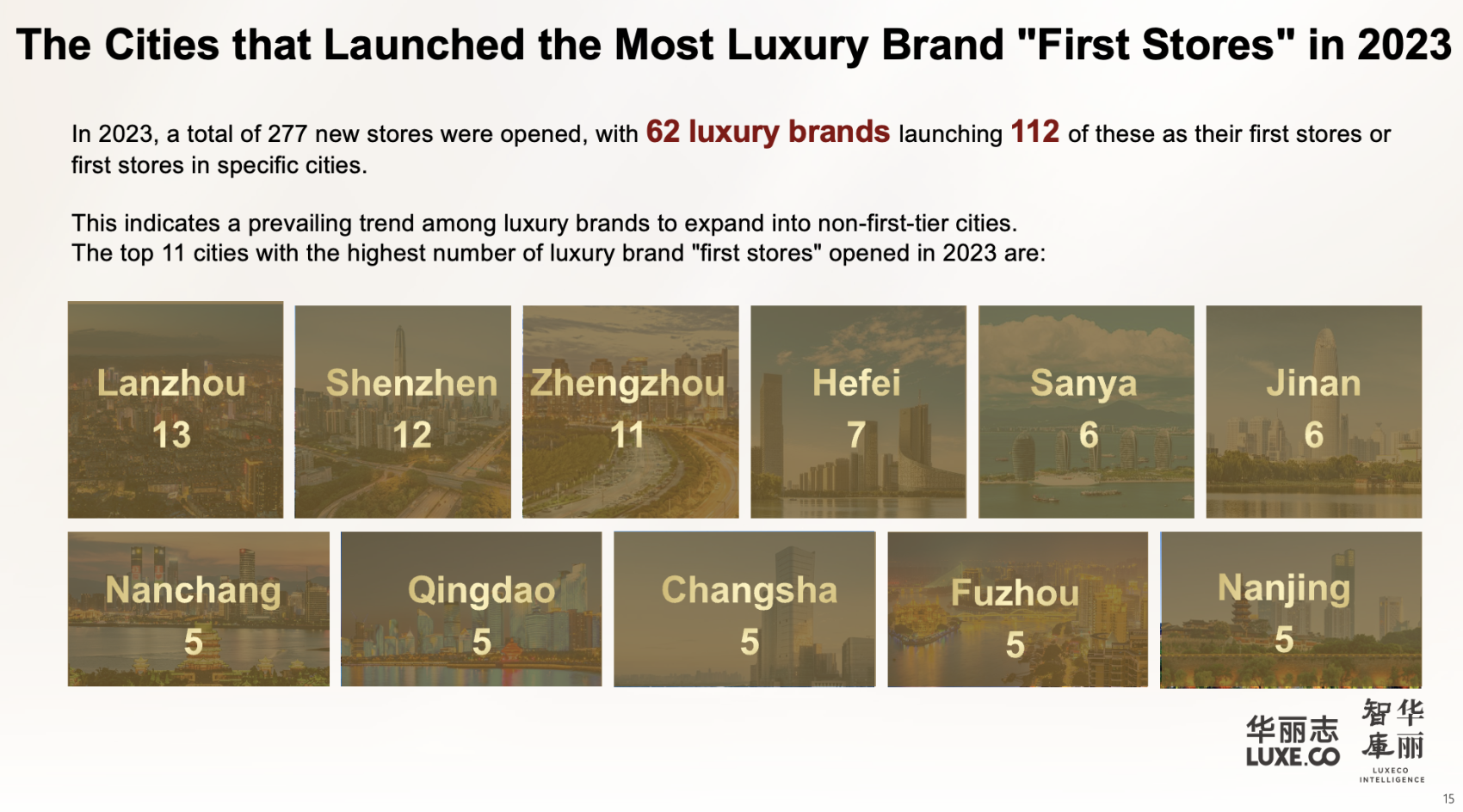

- Which Chinese cities welcomed the most luxury brand “first stores”over the past year?

- Which luxury brands opened the most new stores?

- How did top 10 brands allocate their resources among various activities in China?

- …

Through the exclusive data compiled by Luxe.CO, we found:

- Luxury brands further increased their store opening efforts: Compared to 2022, the number of new physical stores opened in China increased by 45% year-on-year.

- Luxury brands expanded their geographical coverage, focusing on non-first-tier cities: In the past three years, the number of new stores opened in non-first-tier cities has increased year by year. In 2023, 74% of the stores were located in non-first-tier cities, a 68% increase compared to 2022.

- Of the 277 new stores in the past year, 112 stores from 62 brands were first stores or city-first stores in China.

- The cities that the most luxury brand “first stores” located in last year were: Lanzhou (13), Shenzhen (12), Zhengzhou (11), Hefei (7), Sanya (6), Jinan (6), Nanchang (5), Qingdao (5), Fuzhou (5), Changsha (5), Nanjing (5)

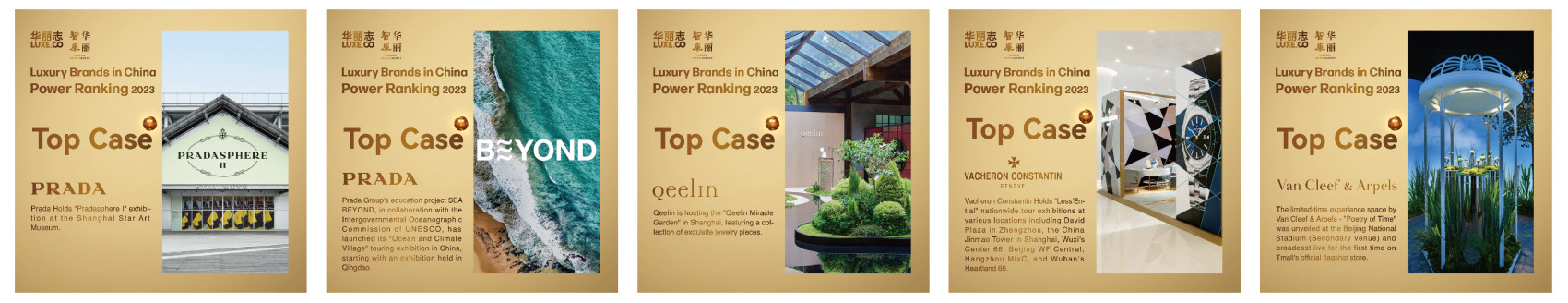

— TOP 15 Brand Cases & Luxe.CO Insights

While compiling the annual Power Ranking, Luxe.CO Intelligence hand-picked 15 top cases from the 953 activities in 2023. These cases represent the best practices of luxury brands’ marketing efforts in China over the past year. For each case, we have highlighted the most important learning points and key trends reflected.

These cases are significant marks left by luxury brands as they deepen their presence in the China market. They are expected to have lasting effects on connecting with local consumers and enhancing brand power. Through the many interesting details, we could see the level of marketing investment of the brands in China and the capability of the brand’s team in terms of planning, execution, and innovation.

We hope the following top cases will provide new clues, inspirations and stimulations to our readers in their own effort to build and upgrade their brands in luxury and many other different sectors.

About Luxe.CO “Luxury Brands in China Power Ranking”

Luxury brands and the luxury industry have been the main focus of research and media coverage for Luxe.CO since its inception in 2013.

In May 2020, Luxe.CO issued the first “Luxury Brand Bi-weekly Reports” ; one and half year later, we produced the first “Luxury Brands in China Power Ranking” for the year of 2021.

The “Luxury Brands in China Power Ranking” report is the industry’s first comprehensive and systematic summary and analysis on the activities carried out by major luxury brands in the China market regarding channel expansion and brand marketing.

The list includes ten categories of brand dynamics: store expansion, fashion shows in China, brand exhibitions, visual communication, collaborations, sponsorship, creative partnerships, brand spokespersons/ambassadors/friends, digital marketing and e-commerce, and other brand activities. (Note: This report does not include luxury brand beauty, skincare, and fragrance updates)

The scoring for the Power Ranking is calculated based on data collected by Luxe.CO on the marketing activities and channel expansion efforts of major luxury brands in the China market in 2023. Different weighting factors are assigned to different subtypes of brand activities based on their importance and magnitude. For example, the weight for a grand exhibition is higher than a regular exhibition, and the weight for a nationwide first store opening is higher than that of a city’s first store opening, with first stores in first-tier cities carrying higher weight than those in second-tier cities, and so on.

Click here to download the full report (in English)for free

Or scan the QR code to download the report

About Luxe.CO Intelligence

Luxe.CO Intelligence has been deeply involved in the fashion and luxury sectors for a long time. Leveraging our continuously expanding industry network, data intelligence, and knowledge system, we are committed to providing professional, innovative, and forward-looking consulting services to brands and companies in China and overseas. Our areas of focus include brand revitalization and upgrade strategies, brand content and communication strategies, niche industry positioning and opportunity analysis, and strategies for entering the Chinese market.

Contact for collaboration: lci@luxe.co