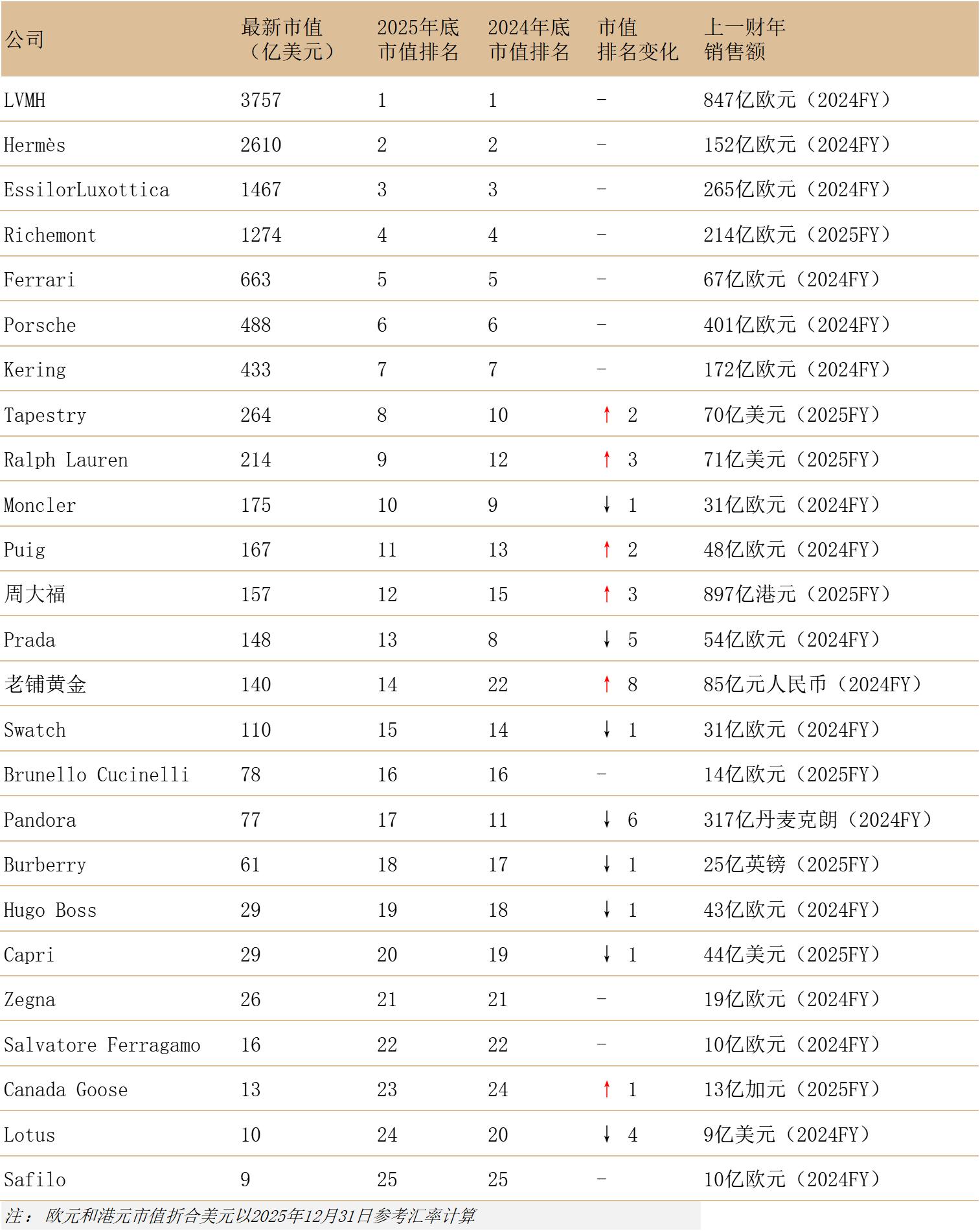

According to statistics compiled by Luxe.CO, as of the end of 2025, the top 25 publicly listed luxury companies worldwide by market capitalisation are as follows. Among them, two Chinese brands, Chow Tai Fook (No. 12) and Laopu Gold (No. 14), ranked within the global top 15. Notably, Laopu Gold recorded the largest increase in market capitalisation among all publicly listed luxury companies over the past year.

From a market-cap perspective, the rankings of the top seven luxury groups remain unchanged from last year. The parent company of brands including Louis Vuitton, Dior, Bulgari, and Tiffany & Co., French luxury conglomerate LVMH Group, retained the No. 1 position (despite being briefly overtaken by French peer Hermès during 2025). Hermès ranked second, followed by global eyewear leader EssilorLuxottica in third place. Swiss luxury group Richemont, a powerhouse in high jewellery and watchmaking, ranked fourth. Two luxury carmakers, Ferrari and Porsche, placed fifth and sixth, respectively. French luxury group Kering, the parent company of brands such as Gucci and Saint Laurent, ranked seventh.

Two U.S. luxury groups, Tapestry, the parent company of Coach (No. 8), and Ralph Lauren Corporation (No. 9), both moved up in the rankings, entering the global top 10.

Rankings from No. 10 to No. 25 saw significant reshuffling. Among them, Chinese high-growth company Laopu Gold, known as “the first listed guofa (traditional Chinese gold craftsmanship) gold brand,” jumped eight places, rising from No. 22 in 2024 to No. 14, the largest increase among all peers.

From January 1 to January 20, 2026, the market-cap rankings of Chow Tai Fook and Laopu Gold continued to climb. Chow Tai Fook rose to No. 11, while Lao Pu Gold advanced to No. 13. In addition, Puig replaced Moncler at No. 10, with Moncler sliding to No. 12.

As of the market close on January 20, the publicly listed luxury companies ranked No. 14 to No. 25 by market capitalisation are: Prada, Swatch, Brunello Cucinelli, Burberry, Pandora, Capri, Hugo Boss, Zegna, Salvatore Ferragamo, Canada Goose, Lotus, and Safilo.

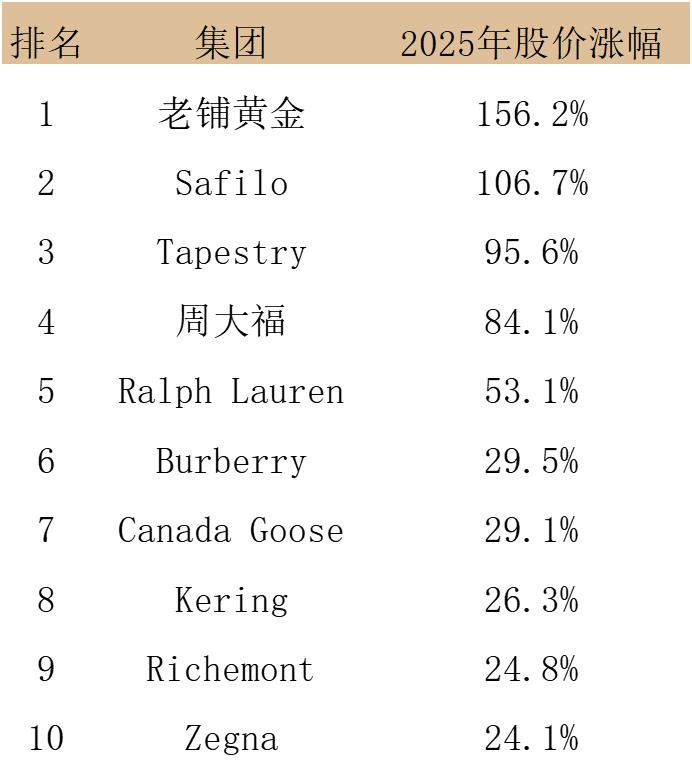

2025 Top 10 Luxury Companies by Share Price Growth

In 2025, among the 27 constituent stocks covered by the Luxe.CO Luxury Industry Index, 16 recorded share price gains. The top 10 all posted increases of over 20%. Ten stocks declined, while one remained flat. The top 10 luxury companies by share price growth in 2025 are as follows:

Luxe.CO analysed the key factors driving share price growth for these ten companies:

— Laopu Gold (“the first listed Chinese heritage gold brand”)

With a full-year increase of 156.2%, Laopu Gold ranked first among the 27 constituents of the Luxe.CO Index, highlighting the rising momentum of “Oriental aesthetics” and the counter-cyclical resilience of the “hard luxury” category.

-

Completion of domestic high-end retail footprint: As of the end of 2025, Laopu Gold’s stores covered China’s top 10 premium shopping malls where luxury brands cluster, including 6 stores in SKP malls and 12 in the MixC system.

-

Rapid revenue and profit growth: In the first half of 2025, revenue surged 251.0% year-on-year to RMB 12.354 billion (USD ~1.71 billion), while net profit rose 285.8% year-on-year. According to Frost & Sullivan, its revenue per store and sales per square meter ranked first among jewellery brands in the Chinese Mainland.

-

Strengthened pricing power: In response to rising gold prices, the brand implemented phased price increases. Financial data show no significant negative impact on sales volumes, with gross margin maintained at 38.1%.

-

Overseas expansion: Its first overseas store opened at Marina Bay Sands in Singapore, with plans to enter Tokyo, Japan.

— Italian eyewear group Safilo

Safilo’s share price rose 106.7%, with particularly strong performance in the second half of the year.

-

Profit margin at a decade high: Adjusted EBITDA margin reached 11.6% in the first half of 2025, the highest level in nearly ten years.

-

Renewal of key brand licenses: Early renewal of supply agreements with Kering Eyewear through 2029, along with renewed eyewear licenses for brands including Under Armour and Dsquared2, stabilised medium-term business expectations.

-

Asia-Pacific growth: Sales in the Asia-Pacific region grew 14.1% year-on-year in the first half, with the company highlighting continued demand from Chinese consumers for high-end eyewear.

-

Supply-chain investment: Acquired a 25% stake in UK eyewear company Inspecs Group, expanding its footprint in optical products.

— U.S. accessible luxury group Tapestry

With a full-year increase of 95.6%, Tapestry led the U.S. luxury sector, reinforcing its position as a leader in accessible luxury.

-

Core brand outperformance: Coach exceeded expectations. In fiscal Q1 2026 (ended September 27, 2025), revenue in Greater China grew 19% year-on-year at constant currency, becoming a key growth driver.

-

Divestment of non-core assets: Terminated the planned acquisition of Capri and sold high-end footwear brand Stuart Weitzman for USD 120 million, refocusing resources on Coach and Kate Spade.

-

New growth strategy: Launched the “Amplify” strategic plan, emphasising emotional consumer connections and fashion innovation.

— Hong Kong–based jewelry giant Chow Tai Fook

The company’s share price rose 84.1%, with profitability reaching a five-year high.

-

Operating margin improvement: Through store optimisation and cost control, operating margin expanded to 17.5% in the first half of fiscal 2026 (ended September 30, 2025), the highest level in nearly five years.

-

Premiumization strategy: Launched the “Timeless Harmony” high jewellery collection to enhance competitiveness and pricing power in the high-end segment.

-

Strong overseas performance: Same-store sales in Singapore and Malaysia rose nearly 30% in the first half of fiscal 2026, while overseas retail value (excluding duty-free stores in the Chinese Mainland) grew 16.9% year-on-year.

-

Recovery in Hong Kong and Macau: Benefiting from improved retail sentiment, same-store sales in Hong Kong, Macau, and other markets increased 4.4% year-on-year.

— U.S. luxury group Ralph Lauren

Shares rose 53.1%, benefiting from its long-standing commitment to classic style and a more accessible luxury positioning.

-

Sustained growth in China: The China market recorded positive sales growth for 21 consecutive quarters. In fiscal Q2 2026 (ended September 27, 2025), revenue grew over 30% year-on-year.

-

Improved revenue mix: High-potential categories such as womenswear, outerwear, and handbags outpaced the company average.

-

Updated long-term strategy: Introduced the “Next Great Chapter: Drive” plan, focusing on winning key city markets and expanding new businesses.

— British heritage luxury brand Burberry

Up 29.5% for the year, with early signs of a successful turnaround.

-

Return to profitability: In the first half of fiscal 2026 (ended September 27), Burberry achieved an adjusted operating profit of GBP 19 million, reversing prior losses.

-

Refocus on core strengths: New CEO Joshua Schulman rolled out the “Burberry Forward” strategy, re-emphasising the brand’s “British luxury” identity.

-

Cost control measures: Expanded cost-saving initiatives targeting GBP 100 million in annual savings by fiscal 2027, involving the reduction of approximately 1,700 roles globally.

-

Index re-entry: In September 2025, Burberry rejoined the FTSE 100 Index, reflecting market recognition of its turnaround progress.

— Canadian premium outerwear brand Canada Goose

Shares rose 29.1%, with a strengthened direct-to-consumer model and a more balanced product mix.

-

Growth in non-winter categories: Strong sales of spring/summer products such as T-shirts and polo shirts reduced reliance on winter items.

-

Continued DTC growth: Direct-to-consumer revenue recorded positive growth for three consecutive quarters, rising 21.8% year-on-year in fiscal Q2 2026 (ended September 28, 2025).

-

Stable performance in Greater China: Revenue in Greater China grew 11.6% year-on-year, serving as a key growth engine in Asia-Pacific.

-

Retail network upgrades: Flagship stores in Paris and Amsterdam were renovated, adding art installations and experiential spaces.

— French luxury group Kering

Following the appointment of new CEO Luca de Meo, Kering’s share price rebounded 26.3% for the year.

-

Management overhaul: For the first time, Kering entrusted executive leadership to a professional manager. Capital markets are optimistic about Luca de Meo bringing efficiency and fresh strategic thinking from his successful automotive background.

-

Divestment of non-core assets: Sold its beauty business to L’Oréal for EUR 4 billion, significantly reducing leverage.

-

Supply-chain efficiency: Luca de Meo set a goal to shorten the design-to-shelf cycle to six months, addressing inventory buildup and improving market responsiveness.

-

Brand strategy adjustment: Gucci unveiled the first collection by its new creative director to positive feedback. Kering plans to further develop YSL and BV, reduce reliance on Gucci, and strengthen its hard luxury positioning through phased acquisitions of Italian high jewelry manufacturers.

— Swiss luxury group Richemont

Shares rose 24.8%, supported by its strong portfolio of high jewellery brands.

-

Robust jewellery performance: The jewellery division (Cartier, Van Cleef & Arpels, Buccellati, etc.) posted 17% year-on-year sales growth at constant currency in fiscal Q2 2026 (ended September 30, 2025).

-

Expansion of jewellery portfolio: Acquired Italian high jewellery brand Vhernier.

-

Strengthening soft luxury: Acquired 85% of knitwear manufacturer Miles and injected capital into British menswear brand Dunhill.

-

Stabilisation in China: Sales in China (the Chinese Mainland, Hong Kong, and Macau) grew 7% year-on-year in fiscal Q2, improving from a decline in Q1.

— Italian luxury group Zegna

Up 24.1% for the year, marking a new era in family governance.

-

Clear succession plan: Announced a new leadership structure, with two fourth-generation family members set to become co-CEOs in 2026.

-

DTC growth: Growth in direct-to-consumer channels offset wholesale declines, with organic revenue up 6% in Q3 2025.

-

Outdoor sports investment: Increased its stake in Canadian trail running shoe brand norda to 32.5%, with further increases planned.

Appendix: “Luxe.CO Luxury Industry Stock Index”

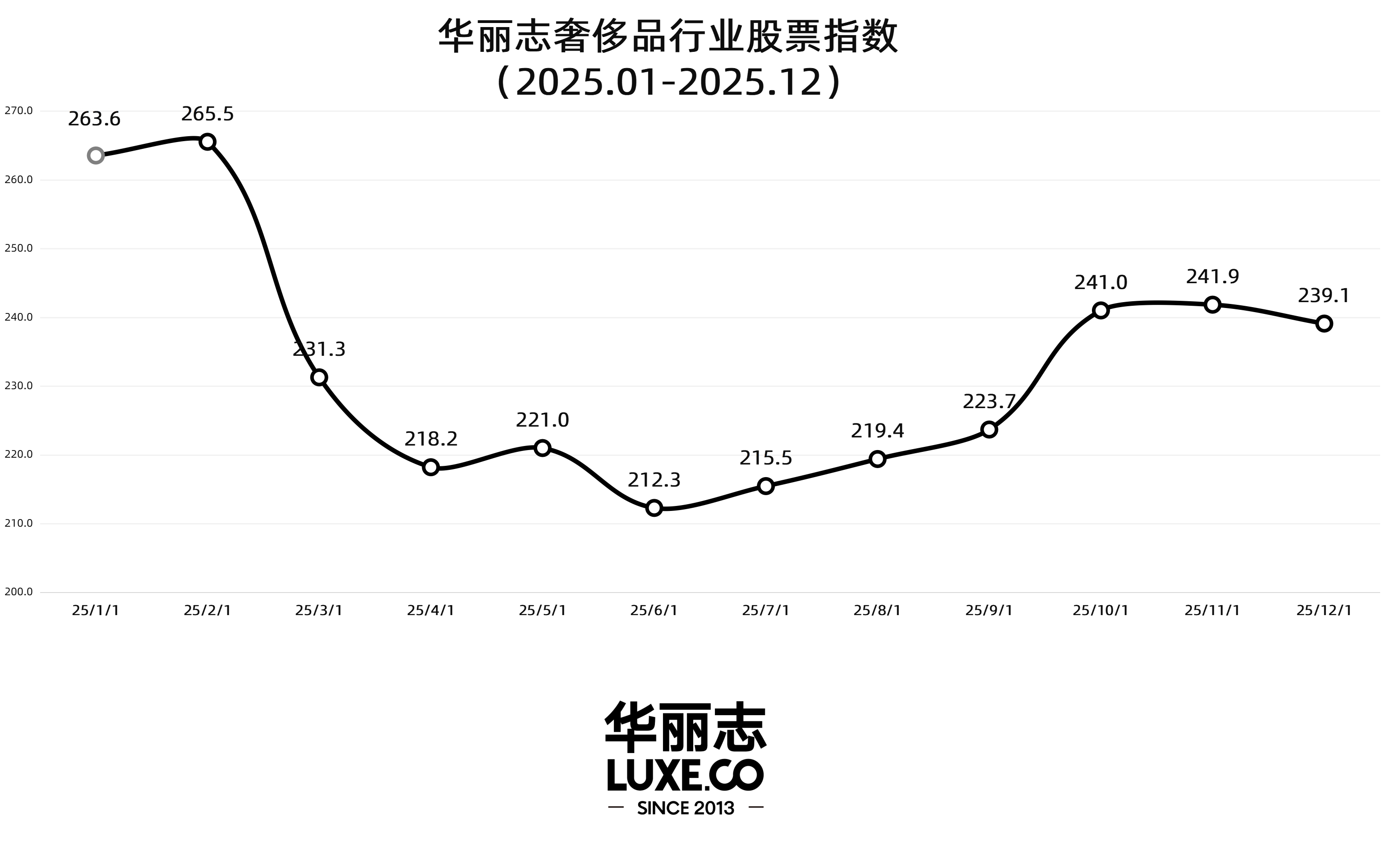

In 2025, the global luxury industry entered an adjustment phase, with the Luxe.CO Luxury Industry Stock Index tracing an “N-shaped” trajectory.

In January, buoyed by strong earnings from industry leaders, the index surged to near-record highs (262.1 points). In the second quarter, however, threats of higher U.S. tariffs and weaker-than-expected performance in the Chinese luxury market triggered a sharp correction, with the index hitting a nearly three-year low (212.3 points) at the end of June. In the second half, as major companies’ performance stabilized, the index rebounded for five consecutive months, ultimately closing at 239.1 points, slightly above its level at the end of 2024 (233.1 points).

| Image Credit: Brand websites

| Editor: