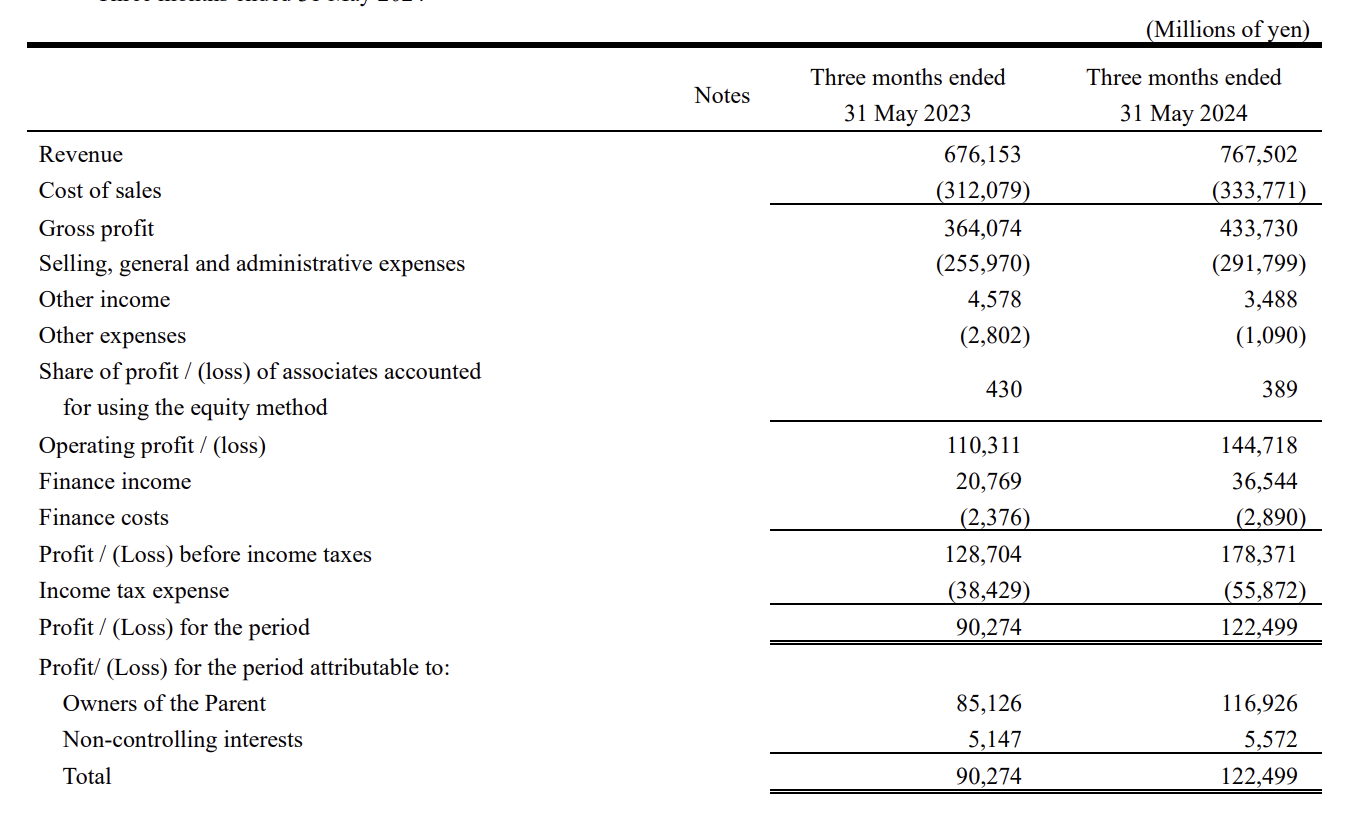

On July 11, Fast Retailing, the parent company of Japanese fast fashion giant UNIQLO, announced its financial results for the third quarter and the first three quarters of the 2024 fiscal year ending May 2024. The company reported significant increases in both consolidated revenue and profits, achieving the best performance in its history:

- For the first three quarters, consolidated revenue reached 2.3665 trillion yen (approximately 108.3 billion RMB), a year-on-year increase of 10.4%. Profit performance was particularly strong, with consolidated operating profit at 401.8 billion yen (approximately 18.4 billion RMB), up 21.5% year-on-year, and net profit attributable to the parent company at 312.8 billion yen (approximately 14.3 billion RMB), a year-on-year increase of 31.2%.

- In the third quarter alone, both revenue and operating profit saw substantial growth. Driven by UNIQLO’s operations in North America, Europe, Southeast Asia, and Japan, the group’s consolidated performance reached a new high. However, UNIQLO in the Chinese Mainland market experienced a decline in revenue and a significant drop in operating profit due to high comparison base from the previous year, low consumer willingness, and unfavorable weather conditions affecting product demand. Despite these challenges, e-commerce performed exceptionally well during the reporting period.

As of the close of trading on July 11, Fast Retailing’s stock price rose by 2.26% from the previous day, with a latest market value of 13.9 trillion yen. Over the past 12 months, Fast Retailing’s stock price has cumulatively increased by 29.66%.

2024 Fiscal Year Third Quarter Performance:

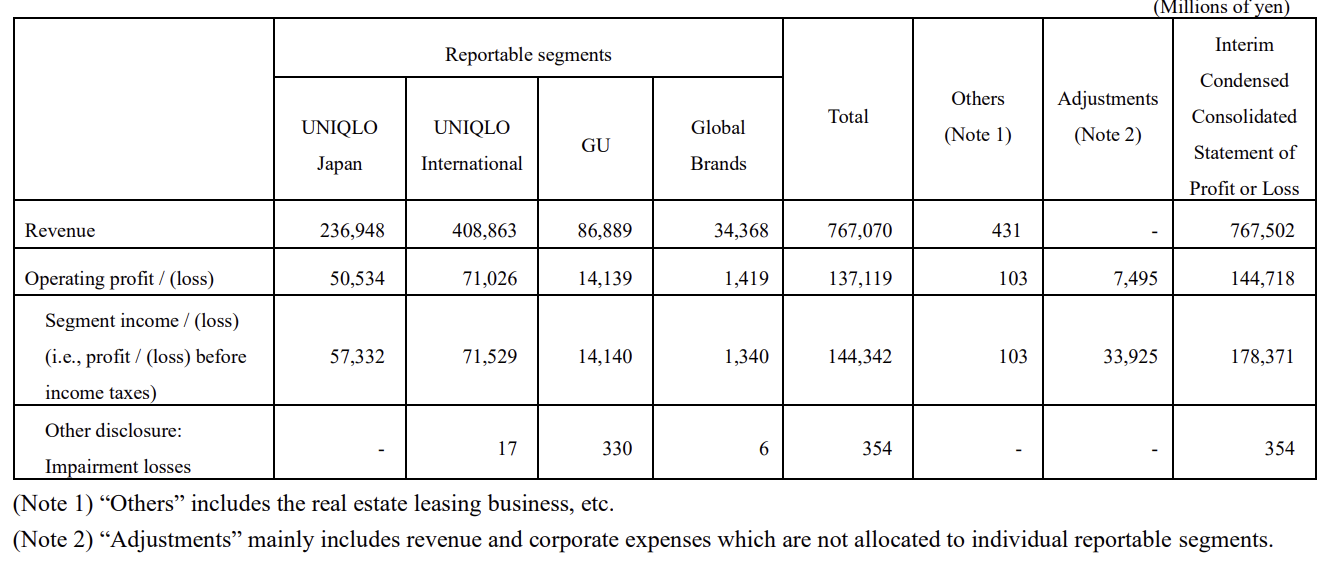

By segment:

Japan UNIQLO Operations: Both revenue and profit saw substantial growth in the third quarter, driven by strong sales of summer products. Quarterly revenue was 236.9 billion yen, a year-on-year increase of 10.4%, and operating profit was 50.5 billion yen, up 56.9% year-on-year. Same-store sales grew by 9.0%, with products like T-shirts and Bratops performing well. Gross profit margin improved by 4.1 percentage points, and the ratio of selling, general, and administrative expenses improved by 2.1 percentage points, contributing to significant profit growth. For the first three quarters, cumulative revenue for this segment was 722 billion yen, up 1.7% year-on-year, and operating profit was 127.8 billion yen, up 28.3% year-on-year.

Overseas UNIQLO Operations: Both revenue and profit saw substantial growth in the third quarter, with strong performance in Europe, the U.S., and Southeast Asia. Quarterly revenue was 408.8 billion yen, a year-on-year increase of 19.4%, and operating profit was 71 billion yen, up 15.6% year-on-year. With the global launch of stores embodying the “LifeWear” concept, brand awareness increased, leading to a virtuous growth cycle. For the first three quarters, cumulative revenue for this segment was 1.2928 trillion yen, up 17.8% year-on-year, and operating profit was 221.9 billion yen, up 20.6% year-on-year.

In particular, revenue and operating profit in the North American and European markets both saw substantial growth. The Southeast Asia, India, and Australia regions also recorded revenue growth and significant profit increases. South Korea experienced growth in both revenue and profit as well.

Greater China: The region recorded a decline in both revenue and operating profit. In the Chinese Mainland market, due to low consumer willingness and unfavorable weather conditions affecting product demand, revenue declined and operating profit dropped significantly. Another factor for the decline was the high comparison base from 2023, the first year after the end of the pandemic, which saw over 50% growth compared to the previous fiscal year (2022), making 2024’s performance benchmarks relatively high.

Despite these challenges, UNIQLO Greater China achieved some outstanding results during the reporting period:

- UNIQLO ranked first in sales on Tmall’s apparel flagship stores during the “Double 11” and “618” events, marking the tenth consecutive year it topped the “Double 11” apparel flagship stores.

- E-commerce channels achieved double-digit growth over the past three months.

- The Central China regional flagship store, Wuhan Chuhe Hanjie Store, opened in May 2024, successfully implementing personalized business strategies. The store attracted over 30,000 customers on its opening day, achieving great success.

GU Operations: The GU segment recorded revenue growth and a significant increase in operating profit in the third quarter. Quarterly revenue was 86.8 billion yen, up 5.4% year-on-year, and operating profit was 14.1 billion yen, up 10.9% year-on-year. The strong sales performance of products reflecting global fashion trends demonstrated GU’s potential for global expansion. For the first three quarters, cumulative revenue for this segment was 246.4 billion yen, up 8.1% year-on-year, and operating profit was 29.4 billion yen, up 14.2% year-on-year.

Global Brands Operations: The segment recorded a decline in both revenue and operating profit in the third quarter. Quarterly revenue was 34.3 billion yen, down 5.1% year-on-year, and operating profit was 1.2 billion yen, down 29.6% year-on-year. The main reasons were impairment losses from the closure of PLST and Comptoir des Cotonniers stores in the previous year. Additionally, Theory’s revenue slightly declined due to the inability to control personnel expenses, leading to a significant drop in profit. Although PLST and Comptoir des Cotonniers recorded revenue declines due to fewer stores, improved cost structures led to better sales, general, and administrative expenses ratios, with PLST achieving operating profit growth and Comptoir des Cotonniers narrowing its losses. For the first three quarters, cumulative revenue for this segment was 103.7 billion yen, down 2.5% year-on-year, with an operating loss of 300 million yen (compared to an operating profit of 1.4 billion yen in the same period last year).

Looking ahead, Fast Retailing has raised its full-year performance forecast, expecting the 2024 fiscal year to achieve the best performance in its history. Consolidated revenue is projected to be 3.07 trillion yen, up 11.0% year-on-year, consolidated operating profit is expected to be 475 billion yen, up 24.6% year-on-year, and net profit attributable to the parent company is projected to be 365 billion yen, up 23.2% year-on-year. In terms of annual dividends, following an interim dividend of 175 yen per share, a year-end dividend of 225 yen is expected, totaling 400 yen, an increase of 110 yen over the previous year.

By segment, Fast Retailing predicts that Overseas UNIQLO Operations will record substantial revenue and profit growth in both the second half and the full fiscal year.

In local currencies, Overseas UNIQLO Operations are expected to have mixed performance across different regions in the second half: Greater China is anticipated to record revenue and operating profit declines in the second half but is expected to see revenue growth and a slight decline in operating profit for the full fiscal year.

To address this, UNIQLO Greater China will focus on:

- Shifting store development strategies

- Further integrating physical and online stores

- Developing product assortments tailored to local characteristics

- Cultivating and developing management talent

Through these key measures, the Overseas UNIQLO Operations aim to enhance the operational capabilities of each store in Greater China, emphasizing “quality” over “quantity” and targeting the opening of 80 new stores annually in the region. Future plans include opening global flagship stores or regional flagship stores in cities with significant growth potential such as Chongqing, Chengdu, Tianjin, Xi’an, Kunming, and Zhengzhou to enhance brand influence. The company aims to accelerate business reforms, stepping into new growth from the new fiscal year.

Additionally, Overseas UNIQLO Operations predict that the South Korean market will record revenue and profit growth in both the second half and the full fiscal year. Southeast Asia, India, Australia, North America, and Europe are also expected to achieve substantial revenue and profit growth in both the second half and the full fiscal year, with improved operating profit margins compared to the previous year.

Japan UNIQLO Operations are expected to record revenue and significant profit growth in both the second half and the full fiscal year. The GU Operations segment is expected to achieve revenue and profit growth in the second half and substantial growth for the full fiscal year. The Global Brands Operations segment is expected to maintain revenue levels similar to the previous year and is projected to turn profitable.

In terms of the total number of stores, Fast Retailing estimates that by the end of August 2024, the number of stores in the Japan UNIQLO Operations segment will reach 798 (including employee franchise stores), the Overseas UNIQLO Operations segment will have 1,708 stores, the GU Operations segment will have 476 stores, and the Global Brands Operations segment will have 622 stores, bringing the total number of stores under the group’s brands to 3,604.

| Sources: Fast Retailing’s official website and financial report

| Image Credit: Fast Retailing’s official website and LinkedIn page

| Editor: Wang Jiaqi