In 2021, Luxe.CO launched the exclusive “ Luxury Brands in China Power Ranking,” the only industry list focused on the Chinese luxury market, garnering significant attention and recognition from industry professionals both domestically and internationally.

Over the past four years, with the robust industry database and continuously improving research capabilities of Luxe.CO Intelligence, along with the global and Chinese perspectives of Luxe.CO and its close interactions with the luxury industry, our list has undergone continuous iterations.

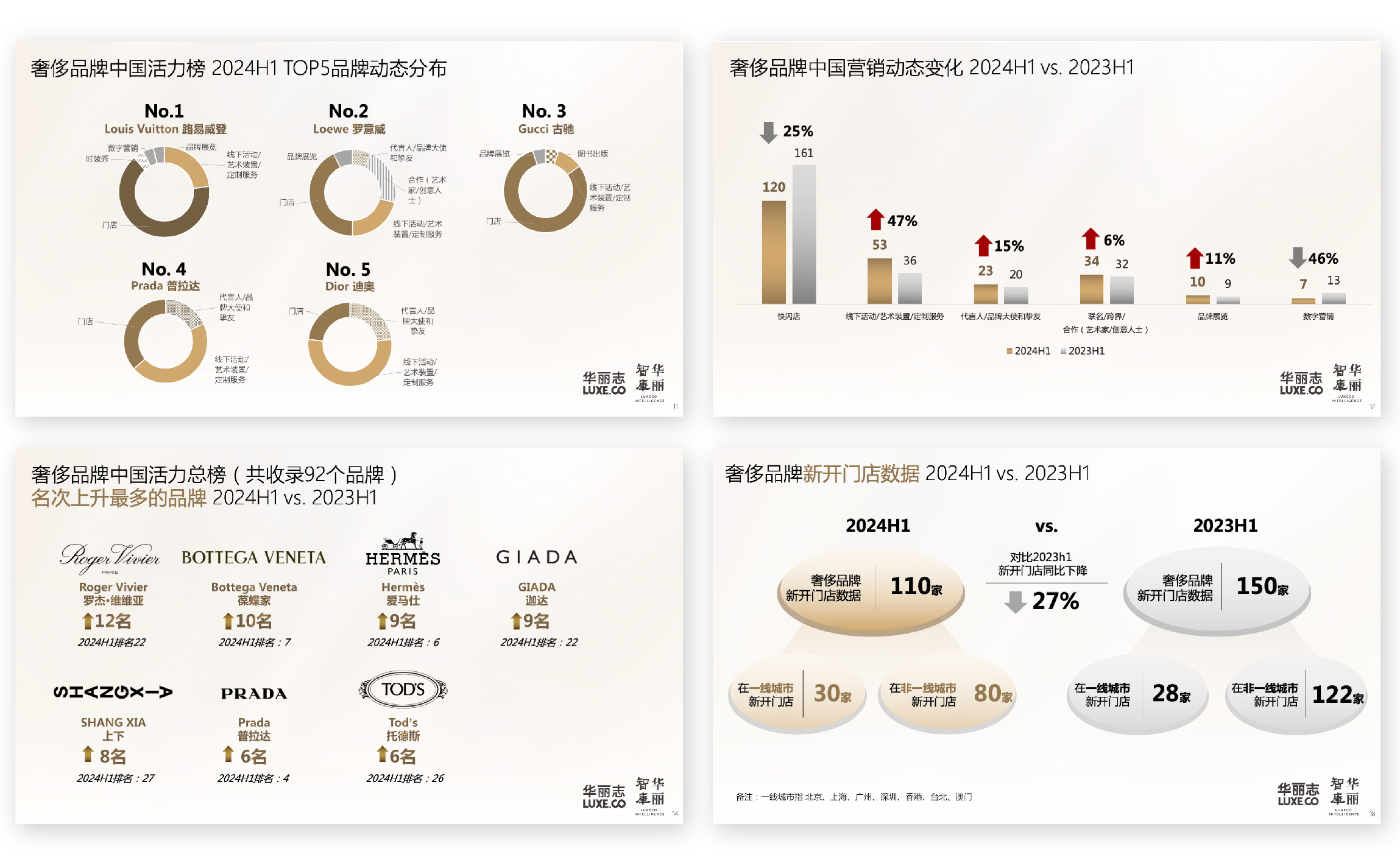

The “China Luxury Brands Power Ranking” comprehensively collects and organizes the latest commercial activities of major luxury brands in the Chinese market over the past year (or half-year), objectively evaluating the importance and impact of each activity with a unified weighted score. This aims to fully present the investment efforts and activity levels of luxury brands in the Chinese market.

(Note: The current list covers the period from January 1, 2024, to June 30, 2024, recording 422 brand activities from 92 luxury brands in the Chinese Mainland, excluding activities related to beauty, fragrance, eyewear, and other peripheral businesses.)

Alongside the list, Luxe.CO has also released the full report “China Luxury Brands Power Ranking 2024 H1 and Industry Insights” (free Chinese version).

We believe that this “China Luxury Brands Power Ranking,” supported by solid data and frontline insights, is crucial not only for luxury brand companies but also offers valuable references for the broader fashion value chain—including commercial real estate, high-end retailers, PR and advertising companies, and other Chinese and overseas brand companies—revealing industry trends and best practices.

Scan this code to download the full report(in Chinese) for free

Today, we are releasing for the first time:

Luxe.CO “Luxury Brands in China Power Ranking 2024 H1” TOP 10 List

The global luxury industry is currently in a very complex and delicate phase.

LVMH Group CFO Jean-Jacques Guiony straightforwardly said, “The link between the macro and micro aspects of our business is exceptionally complex.”

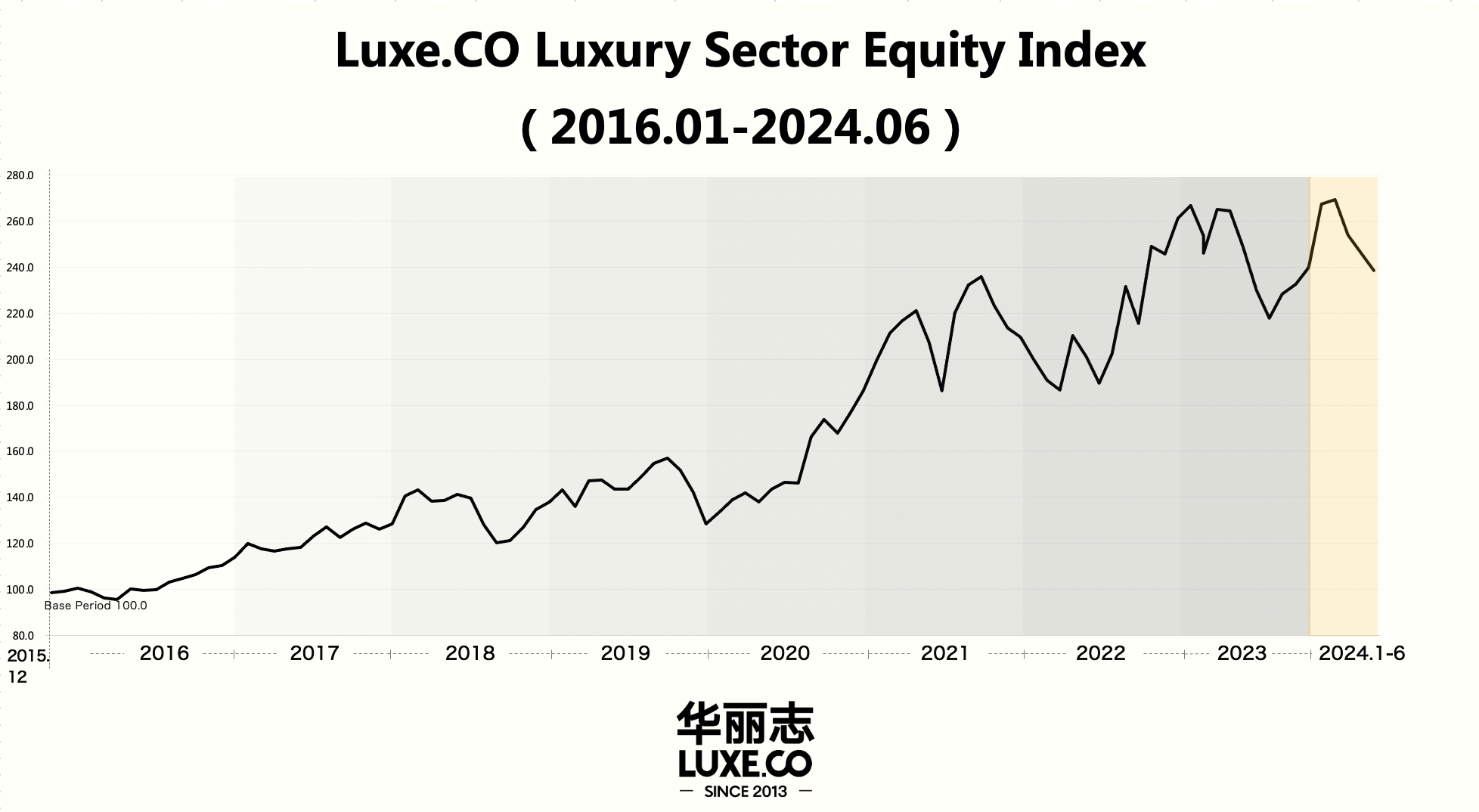

In the first half of 2024, after consecutive rises in the first quarter, the “Luxe.CO Luxury Industry Stock Index” faced a decline for three consecutive months, returning to the level it was at the end of 2023.

Both LVMH Group and Kering Group CFOs mentioned during analyst meetings following the release of their Q1 results this year that “we do not have a crystal ball.”

However, optimism remains the main tone for luxury brands regarding the Chinese market.

Johann Rupert, Chairman of the Board of Swiss luxury giant Richemont, confidently stated, “I do not believe that China’s rise will stop, especially from a medium to long-term perspective.“

In this major report release, you will not only see the latest Top 20 rankings of the China Luxury Brands Power Scores but also gain insights into key store activities and marketing trends of luxury brands. These data and changes reflect the latest understanding and response of major brands to the Chinese market, for instance:

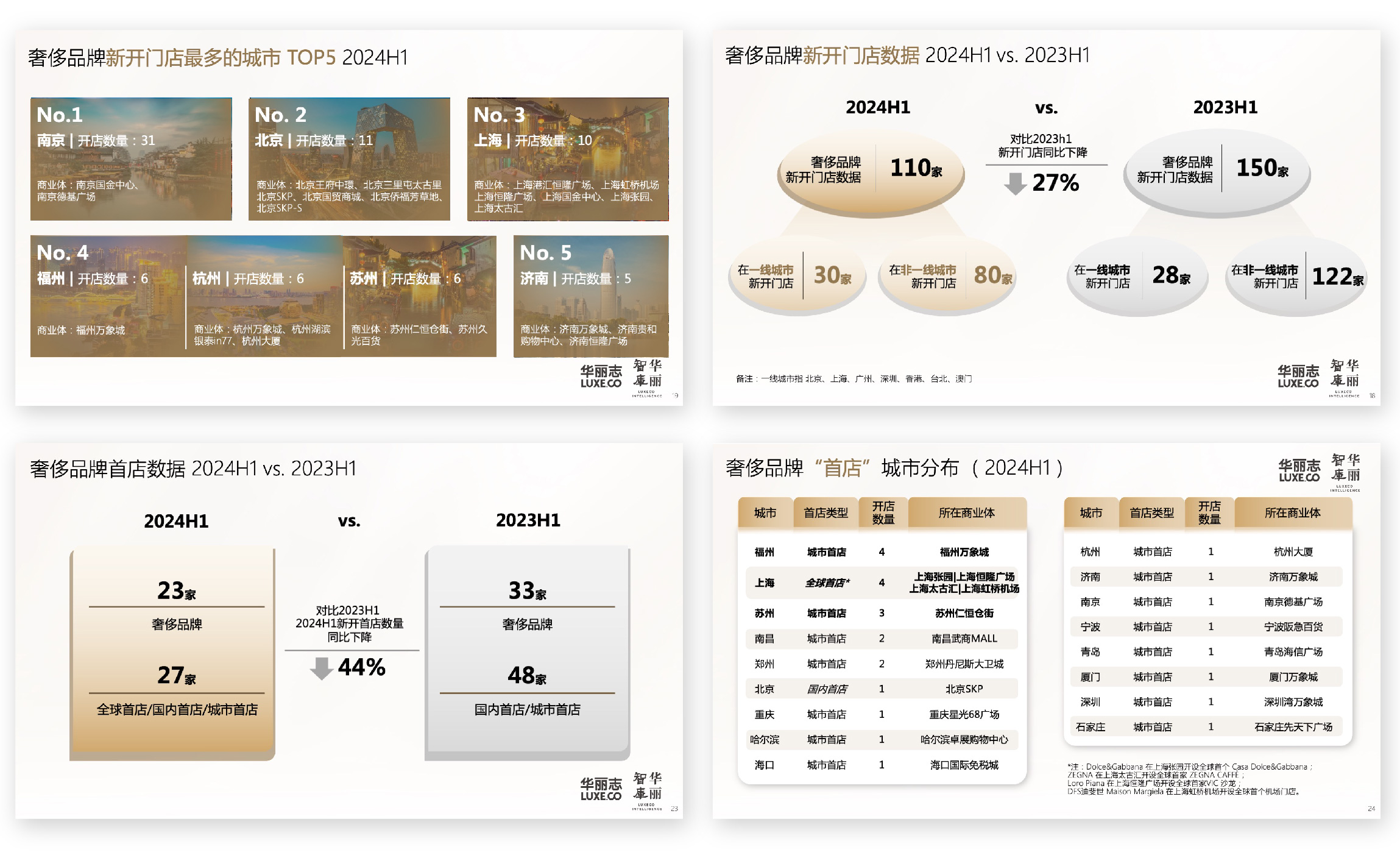

- Compared to the first half of 2023, the number of new stores opened by luxury brands in the first half of this year has decreased by about one-third, but the number of renovations and upgrades to existing stores has doubled.

- Brands are no longer just chasing noise in sponsorships, large events, content marketing themes, or ambassador choices; they are focusing more on conveying a sense of timeless history and humanity.

- Store renovations and upgrades are not limited to the mainland market; Hong Kong and Taipei are also experiencing a wave of brand store upgrades.

(Note: Regarding commercial retail, Luxe.CO will launch the “2024 China Commercial Innovation Awards” at the end of 2024. The award details will be announced later. We welcome various commercial real estate projects to stay tuned, contact us, and submit relevant cases and data.)

Guiony has frequently mentioned China in analyst meetings: “Globally, the biggest change in fashion and leather goods is with Chinese customers, with a year-on-year increase of 10% in the number of Chinese customers”; however, he also admitted, “Chinese customers are now the most unpredictable.”

As the Chinese market environment and local consumers become more complex, mature, and even more “charm-removing,” compared to the bold growth of the past with relatively single marketing content styles, luxury brands need to rethink how to appropriately and with a long-term perspective, showcase their brand value and core spirit.

With the diversification of the social symbol attributes of luxury brands, it is worthwhile for brands to invest more effort than ever in continuously organizing and refining content production and dissemination related to their brand genes, historical archives, vision, and spirit.

Moreover, how luxury brands resonate with local Chinese consumers tests the global headquarters’ understanding of Chinese culture and raises higher requirements for the taste and planning capabilities, selection and screening abilities, user insights, and ecosystem-building abilities of luxury brands’ Chinese teams.

As a senior executive of a fine jewelry and watch brand shared with Luxe.CO, “We are not actually competing with a specific luxury brand; instead, we should look further and continuously cultivate ‘desirability’ within the broader Chinese local customer base.”

Next, we will release the following three reports, so stay tuned!

- “China Luxury Brands Power Ranking 2024 H1 and Industry Insights” (free English version)

- “Luxury Jewelry & Watch Brands China Power Ranking” report (free Chinese/English version)

- “China Luxury Brands Power Ranking” Industry Insights_Full Version (Luxe.CO subscription members only)

You can log in to Luxe.CO and become a subscriber to read all exclusive content for paying members and download all research reports released by Luxe.CO Intelligence. (Click to learn how to become a Luxe.CO subscriber: [Luxe.CO Subscriber](https://luxe.co/subscriber))

About Luxe.CO Intelligence

Luxe.CO Intelligence is a unique research and consulting services platform in the global fashion industry. Based in China, it provides forward-looking consumer insights, industry research, and strategic consulting services with a broad global perspective and in-depth industry insight.

Drawing upon its continuously expanding industry network, data intelligence, and knowledge base, Luxe.CO Intelligence focuses on the luxury, fashion, beauty, and lifestyle industries. It offers industry leaders the best decision-making references through structured business information, systematic industry research, efficient primary research, rich practical cases, and forward-thinking strategic thinking.

For inquiries and collaboration, you can reach them at lci@luxe.co.