On August 2nd, German fashion luxury group Hugo Boss announced its key financial data for the second quarter of the fiscal year 2023. Continuing its strategic approach from previous quarters, the company rigorously executed “CLAIM 5,” once again driving performance to new heights. Calculated at constant exchange rates, the sales revenue increased by 20% year-on-year, reaching 1.026 billion euros (+17% based on actual exchange rates). Compared to 2019 before the pandemic, sales surged by an impressive 52%, and growth accelerated further compared to the first quarter. Benefiting from the strong revenue momentum, the second-quarter EBIT (Earnings Before Interest and Taxes) achieved a 21% increase, reaching 121 million euros. Building upon these robust performances, Hugo Boss raised its performance expectations for the fiscal year 2023 once again, following the guidance update in May.

Hugo Boss CEO Daniel Grieder stated, “After our highly dynamic start to the year, we continued our strong performance also in the second quarter. Momentum once again exceeded our own high expectations, despite the overall challenging and uncertain market environment. Following our strategy update in June, both brands, BOSS, and HUGO successfully maintained their growth trajectory. We will make 2023 a new record year for HUGO BOSS, thus providing a robust foundation for achieving our updated 2025 financial ambition.”

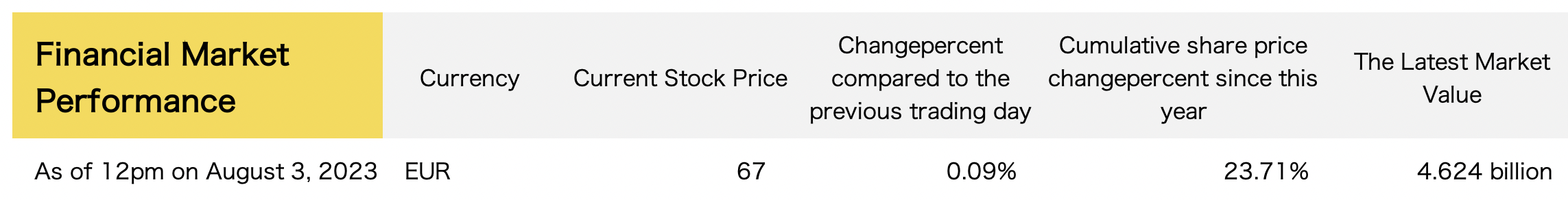

After the financial report was released, as of 12:00 noon local time in Germany, Hugo Boss Group’s stock price experienced a slight decline to 71.28 euros per share compared to the previous trading day. However, the group’s stock price has accumulated a remarkable 31% increase so far this year, with the current market value being approximately 4.9 billion euros.

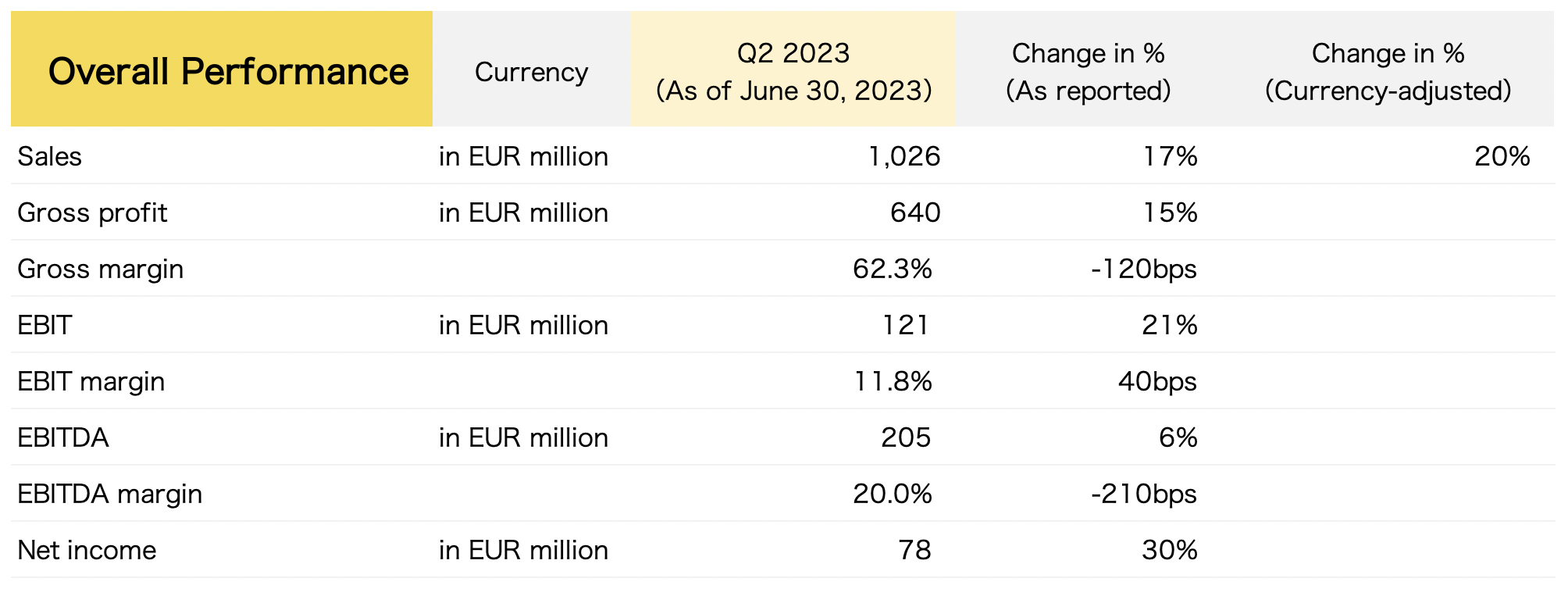

As of June 30th, the key financial data for Hugo Boss in the second quarter is as follows:

- Thanks to the strong growth in sales revenue, Hugo Boss’ second-quarter EBIT increased significantly by 21% to 121 million euros, thereby pushing the group’s EBIT margin up by 40 basis points to 11.8%.

- The increase in revenue offset the decline in gross margin (which decreased by 120 basis points to 62.3%) and further investments in the business as part of “CLAIM 5.”

| By Brand:

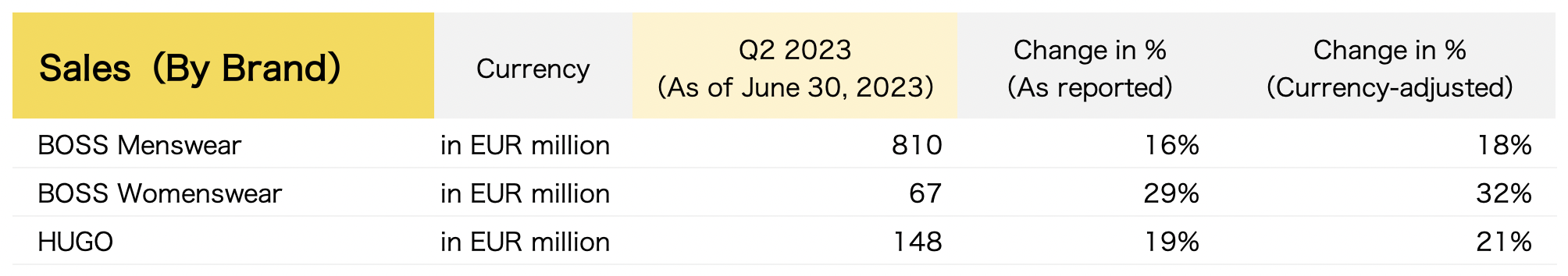

Driven by the promotion of the 2023 Spring/Summer advertising campaigns, both BOSS and HUGO brands maintained their strong sales momentum in the second quarter. Consequently, the two brands expanded their global market share, especially among young consumers. The continued success of the latest BOSS and HUGO collections drove robust sales across all distribution channels.

As a result, BOSS Menswear, BOSS Womenswear, and HUGO achieved double-digit sales growth in the second quarter. Adjusted for exchange rates, revenue from BOSS Menswear increased by 18% year-on-year, while revenue from BOSS Womenswear even grew by 32%. HUGO’s sales revenue, adjusted for exchange rates, increased by 21%.

| By Channel:

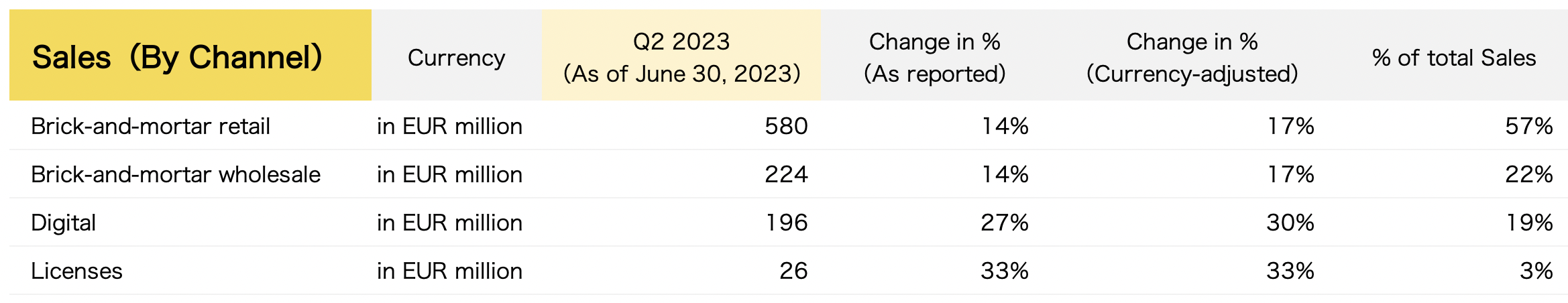

In terms of channels, the development of digital business accelerated in the second quarter. All channels contributed to the strong revenue performance in the second quarter:

- Physical retail sales achieved strong double-digit growth, with revenue increasing by 17% year-on-year. This growth was mainly attributed to further improvements in store efficiency during the second quarter.

- Adjusted for exchange rates, revenue from physical wholesale also increased by 17%, reflecting the ongoing strong reception of the latest BOSS and HUGO collections by global wholesale partners.

- Online business development accelerated further, with revenue increasing by 30% compared to the same period last year after adjusting for exchange rates. This performance reflects double-digit growth across all online channels, including the group’s flagship website and online revenue generated through partnerships.

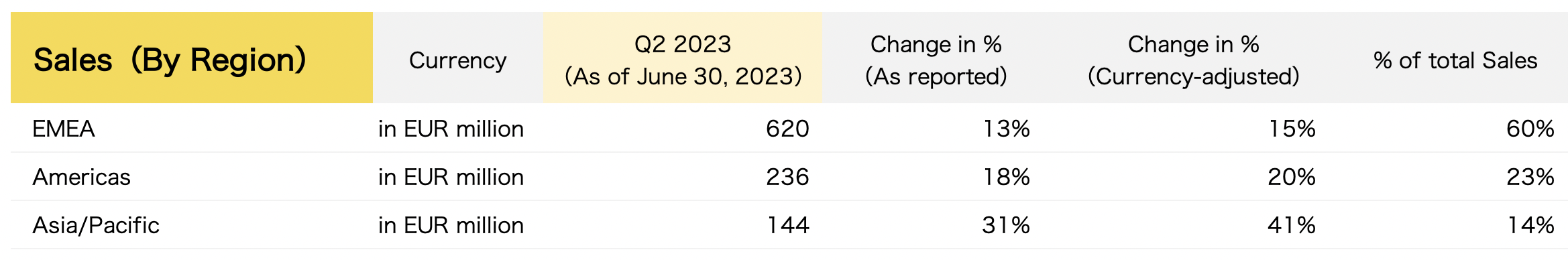

| By Region:

In the second quarter, the group’s business in EMEA (Europe, Middle East, and Africa) and the Americas continued to benefit from strong local consumer demand and a rebound in tourism, while the Asia-Pacific region achieved outstanding growth in the second quarter:

- Revenue in the EMEA region increased by 15% after adjusting for exchange rates. This performance was mainly driven by double-digit growth in major European markets such as Germany (+19%) and France (+15%), as well as a similarly robust growth momentum in the Middle East market.

- The Americas region successfully continued its double-digit growth trajectory, with revenue increasing by 20% after adjusting for exchange rates, reflecting double-digit growth in all markets in the region. After adjusting for exchange rates, the U.S. market, an important market in the region, grew significantly by 16%, with all consumer touchpoints contributing to the growth.

- In the Asia-Pacific region, revenue increased by 41% compared to the same period last year after adjusting for exchange rates. This performance was driven by double-digit growth in Southeast Asia and the Pacific region, as well as further recovery in the Chinese market after it reopened at the end of 2022. Adjusted for exchange rates, revenue in the Chinese market grew by an impressive 56% year-on-year.

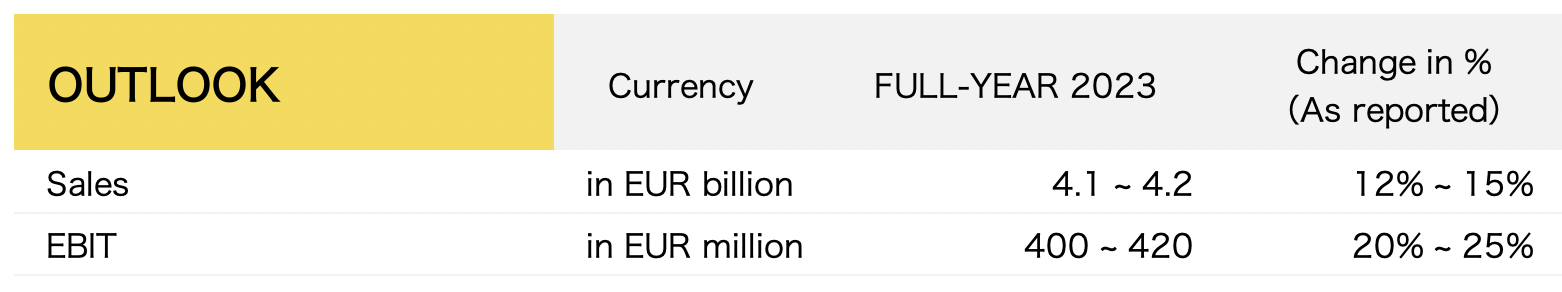

Based on the strong financial performance in the second quarter, Hugo Boss once again raised its performance expectations for the current fiscal year. The company now expects the group’s sales revenue to increase by 12% to 15% to reach a historic high of 4.1 billion euros to 4.2 billion euros (previously expected to grow by approximately 10% to reach about 4 billion euros).

Therefore, 2023 will be another significant milestone for Hugo Boss to achieve its updated 2025 financial targets. By 2025, Hugo Boss is confident in generating 5 billion euros in revenue and at least 600 million euros in EBIT, with an EBIT margin of at least 12%.

| Source: Official financial report

| Image Credit: Group’s official website

| Editor: Wang Jiaqi