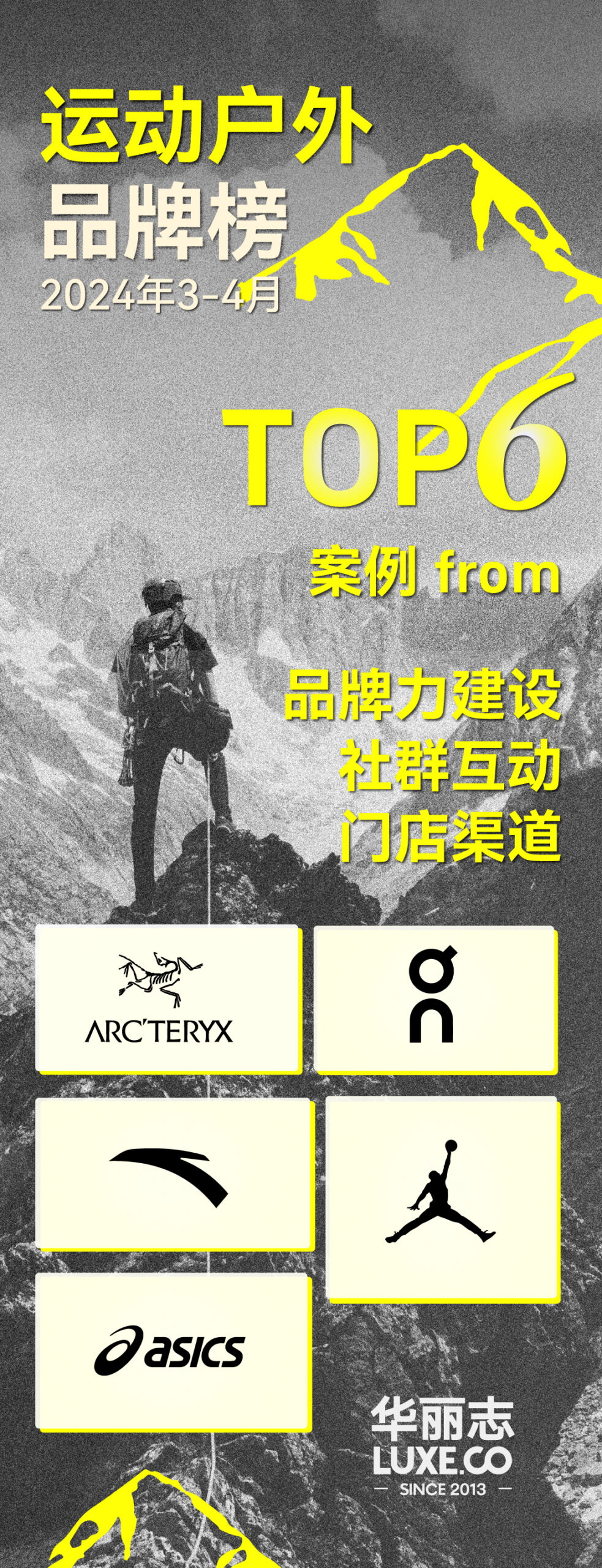

From September to October 2024, Luxe.CO Intelligence analyzed 711 updates from 464 sports and outdoor brands. Based on this research, Luxe.CO Intelligence selected the top 6 brands that industry insiders should watch, providing exclusive insights into each brand. These selections, listed in alphabetical order, highlight two key trends in the highly competitive sports and outdoor sector: community-centered brand culture and store-centered brand identity and image enhancement.

1. ARC’TERYX

ARC’TERYX has further upgraded its in-store retail experience, drawing design inspiration from the concept of the “Cliff House.” This new retail space brings the high-altitude landscapes and experiences typically reserved for professional outdoor athletes into urban areas, re-creating a mountain atmosphere in a retail setting.

Luxe.CO Intelligence Insights:

The essence of ARC’TERYX lies in its connection to the outdoors and mountains, continuously solidifying its expertise and influence in this field. In May, the brand helped relaunch an advanced mountaineering training program in China, dormant for a decade, and initiated a world-class climbing project. In August, ARC’TERYX published the Observation Report on the Development of Chinese Rock Climbing, and in October, it revamped its Yangshuo International Climbing Course.

ARC’TERYX’s stores are vital channels for reinforcing its professional image. The “Cliff House” concept, originally a structure situated on cliffs or steep hillsides, provided essential support to climbers by offering lodging, supplies, rescue services, and educational opportunities. It symbolizes the legacy of outdoor sports.

In its latest store design, mountain elements permeate every detail, from the Coastal Mountain-inspired door handles to sandstone-textured walls, and the segmentation of key sporting scenes. Displays replicate real outdoor settings with mannequins wearing safety harnesses and backpacks equipped with ice picks, embodying the authentic experience of outdoor activities.

The newly designed stores first opened at Beijing Financial Street in late August, followed by locations in Jinan Parc 66 and Wuhan SKP in late September. Through these new store images, ARC’TERYX reasserts its mountain-rooted brand identity while reaching a broader outdoor-oriented audience.

2. Goldwin

Goldwin launched a flagship store in Shanghai’s Jing’an Kerry Centre, its third store in the Chinese Mainland.

Luxe.CO Intelligence Insights:

The vast size and enduring appeal of the Chinese market have drawn numerous sports and outdoor brands worldwide, intensifying competition. Differentiation, however, determines how far a brand can go in this bustling market. Stores serve as crucial channels to showcase a brand’s unique aesthetic and identity, directly engaging consumers.

Goldwin entered the Chinese market in December 2021 with a store in Beijing’s Sanlitun, followed by a Southwest flagship in Chengdu’s Taikoo Li in August 2024. Its third store at Shanghai’s Jing’an Kerry Centre is located alongside brands like Wilson, Peak Performance, and HOKA, illustrating the brand’s strategy of positioning its stores in landmark commercial areas near other sports, outdoor, and fashion brands.

Though Goldwin’s expansion rate may seem conservative, each store remains faithful to the brand’s aesthetic philosophy of “refinement, precision, minimalism, and simplicity.” Decor in the Shanghai store uses three natural materials associated with Japanese aesthetics, creating a warm ambiance that reflects a harmonious blend of humans and nature.

The store has resonated with consumers on a personal level, with some even asking about the scent used in the store on Goldwin’s social media. In an exclusive interview with Luxe.CO, Goldwin CEO Takao Watanabe highlighted the potential of the Chinese market, projecting that it will play a significant role in the company’s growth strategy over the next decade.

Looking forward, Goldwin plans to open four to five stores annually, aiming for a total of 70 stores within 10 years.

3. Lululemon

Lululemon released its 2024 Well-Being Report and, for the fourth consecutive year, launched its annual community initiative, “Together We Grow,” featuring Graphic Rewilding art installations displayed across its stores, community events, and prominent urban landmarks.

Luxe.CO Intelligence Insights:

Today, fitness is not only a health-focused lifestyle for young consumers but also a means to relieve work and life stress, with more young people increasingly focusing on their “emotions” and “feelings.”

Lululemon has been quick to recognize this shift.

Since 2021, Lululemon has published its Well-Being Report each year, encouraging individuals to boost their happiness and discover a state of well-being across physical, mental, and social dimensions.

This year, Lululemon released a dedicated report for the Chinese Mainland, revealing that the region continues to lead globally in well-being scores, though satisfaction lags among men and Gen Z.

As part of the Well-Being Report release, Lululemon extended the “Together We Grow” campaign to stores across China, showcasing wellness tips from Lululemon ambassadors in high-profile stores like Beijing’s Sanlitun and Shanghai’s Jing’an Kerry Centre.

Lululemon’s stores serve as local hubs, with each new location establishing multiple WeChat groups for community management. Within these groups, users are invited to in-store and outdoor activities regularly.

Throughout October, Lululemon hosted over 100 offline community events across nine cities, including Shanghai, Beijing, Chengdu, and Wuhan, helping more people explore a state of well-being. Additionally, Lululemon collaborated with Xiaoyuzhou podcast to launch the “Conversations on Well-Being” series, featuring discussions with four different podcast programs.

Unlike traditional sports brands that focus on athletic performance, Lululemon aims to guide more users to focus on their inner state and overall well-being, encouraging them to find a balanced lifestyle.

This philosophy resonates deeply within the community, boosting Lululemon’s performance in the Chinese market.

According to its fiscal Q2 2024 report, Lululemon’s global net revenue rose 7% year-over-year to $2.4 billion, with the Chinese Mainland showing the largest growth of any market, increasing by 34% year-over-year.

In a post-earnings conference call, CEO Calvin McDonald highlighted the market’s strong growth in Q2, noting that Lululemon continues to attract new customers across stores and e-commerce platforms through innovative product lines, an omnichannel model, and a unique brand position. Through extensive community activities, the brand also actively aligns with the “Healthy China 2030” initiative.

4. On

On opened a flagship store at West Bund Dream Center in Shanghai, the brand’s first dedicated running base in China. The store features various functional areas, including a multimedia zone, self-service lockers, and a pet charging station, along with an innovative running shoe rental service.

Luxe.CO Intelligence Comment:

How does a store designed around user experience differ from a store primarily focused on sales?

On’s West Bund Dream Center store, its first running base in China, centers its design and services on the needs of runners.

Examples of these include fixtures like display racks and seating are mobile to facilitate gatherings and interactions, allowing runners to engage, share, and connect within a flexible, open space. The store exclusively sells running-related footwear and apparel, while also offering a unique shoe rental service. A pet charging station further enables runners to bring their pets along.

If running is at the core of On’s brand culture, then its community is the key to shaping and fostering this culture.

Four years ago, On held its first running community event in China with just six participants; today, the brand hosts hundreds of events nationwide, with tens of thousands participating annually. At a recent event, On’s Head of Offline Commercial Operations in Greater China, Meina Li, shared these community engagement insights.

China is currently emerging as the world’s second-largest running market, with the running boom driving more consumers to invest in running gear and embrace running culture.

For many runners, running is not only a fitness activity but also a social pursuit. Running communities foster a sense of belonging as runners seek camaraderie, creating family-like connections between brands and running enthusiasts.

Positioned near the popular West Bund riverside running path, On Running’s runner hub is designed as a “home” for runners, where they can rest, store belongings, replenish, and participate in various community events hosted by On. Through this approach, On strengthens its core running culture.

According to On’s Q2 2024 financial results, net sales grew 27.8% year-over-year to 567.7 million Swiss francs, setting a new record for quarterly sales. In the Asia-Pacific region, led by the Chinese market, sales surged 73.7% to 59.2 million Swiss francs.

Close ties with the community will enable On to secure its target customer base and further establish a strong brand culture.

5. SALOMON

SALOMON has launched a flagship store in Shanghai’s Xintiandi, offering its full product range in the Chinese Mainland and advancing its goal to become a comprehensive multi-category sports brand. The store opening was celebrated with the “Show of the Wild” fall/winter 2024 fashion show.

Luxe.CO Intelligence Comment:

The popularity of various outdoor sports in China has created growth opportunities for multi-category, multi-scenario professional outdoor brands.

Founded in the French Alps in 1947, SALOMON gained a foothold in China primarily with its trail-running shoes. However, as a professional outdoor brand, SALOMON has an extensive lineup covering trail running, hiking, road running, and skiing, all of which are now available in the new Shanghai Xintiandi flagship store.

Additionally, the store showcases SALOMON’s outdoor lifestyle collections, the experimental SALOMON ADVANCED line, and exclusive collaborations such as with MM6 Maison Margiela. High-performance products from the SALOMON S/LAB series, along with regionally adapted products from the Korean line, are also featured.

Spanning 365 square meters across two floors, the flagship is located at Xintiandi Fashion 2. For a professional outdoor brand, opening a large-format street-facing store in a core commercial district and trendy area like Xintiandi is a significant investment.

Since the beginning of the year, SALOMON has opened stores in second- and third-tier cities like Changzhou, Luoyang, Harbin, Urumqi, Fuzhou, and Kunming, accelerating its expansion across China.

However, for SALOMON, aiming to attract a broader outdoor consumer base through a rich product offering, a flagship store in a prime location serves as an important platform to project a comprehensive brand image, amplifying its influence in the mainstream market.

James Zheng, CEO of Amer Sports, noted in the Q2 2024 earnings call that by year-end, SALOMON is expected to operate 200 stores in China, including both direct and authorized outlets. “We will continue refining our product and sales strategies to maximize SALOMON’s growth potential.”

6. Wilson

Wilson recently opened its Southwest flagship store at Taikoo Li Chengdu. This “Bamboo Pavilion” city concept store combines Wilson’s tennis heritage with local Chengdu culture.

Luxe.CO Intelligence Comment:

According to the 2021 Global Tennis Report by the International Tennis Federation (ITF), China has approximately 20 million tennis participants, ranking second worldwide.

As tennis events become more widespread in China and as more Chinese players rise to prominence, the sport has quickly gained popularity, particularly among high-net-worth and young, educated consumers. Tennis apparel has also captured growing consumer interest.

For over 110 years, Wilson has specialized in sports equipment, particularly tennis, counting legends like Roger Federer among its loyal fans. Since 2021, under current president Gordon Devin, Wilson has ventured into athletic apparel, though the brand remains relatively new to mainstream sportswear consumers.

This year, Wilson has rapidly expanded, opening stores in Chengdu, Jinan, Hangzhou, Shenzhen, Xi’an, Nanjing, Qingdao, and Suzhou, now totaling 27 official stores in China (excluding dedicated tennis and basketball stores).

The Chengdu Taikoo Li flagship spans eight themed areas, including the Wilson Pavilion, Field, Stand, Lounge, Lab, Stock, Garden, and Cafe. Outdoor features, like white mesh structures and thin stainless-steel floor inlays, take design cues from tennis rackets and court nets, embodying Wilson’s aesthetic and athletic DNA.

The Chengdu store offers custom racquet stringing and an extensive apparel lineup, including tennis skirts, jackets, shorts, and athletic shoes.

In an exclusive interview with Luxe.CO, Gordon Devin shared, “This year, we have opened 24 stores in China. By year-end, we have more openings planned. This is just the beginning. We entered retail only two years ago, and we’re introducing our brand in new ways.”

Stores serve as narrative hubs and visual representations of a brand’s identity. Creating distinctive, brand-aligned stores is essential for brands aiming to grow in the Chinese market.

| Image Credit: Brand Official Channels

| Editor: Elisa