After the close on April 16th, the French luxury conglomerate LVMH (Moët Hennessy Louis Vuitton) released its financial results for the first quarter of 2024: sales revenue decreased by 2% year-over-year to 20.7 billion euros, with an organic growth of 3%, meeting analyst expectations.

As the first luxury giant to announce its Q1 results, LVMH’s performance, which met expectations, provided some reassurance to cautious investors, especially following a profit warning from another French luxury giant, Kering (predicting a sales decrease of about 10% for the same period). By the close of April 17th, LVMH’s stock price had risen by 2.84% to 804 euros per share.

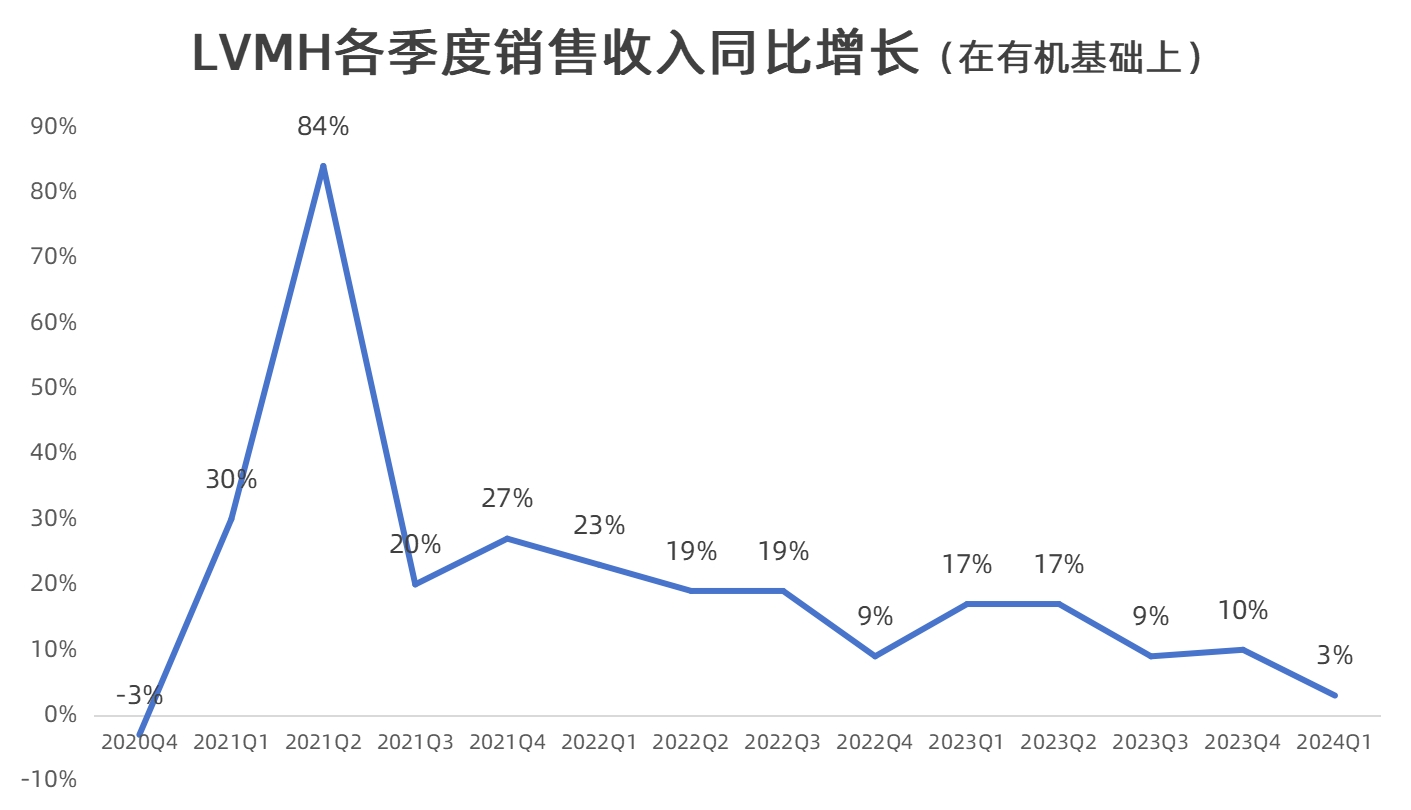

However, compared to its own past performance, this marks the lowest growth rate for LVMH since the first quarter of 2021, post-pandemic.

At the analysts’ meeting following the earnings release, Financial Communications Director Rodolphe Ozun (host) and Chief Financial Officer Jean-Jacques Guiony (main speaker) were present, where “growth” was a focal point of discussion among the analysts.

Jean-Jacques Guiony admitted that the current “normalization” seems abnormal compared to the high growth of recent years. He humorously noted his lack of a crystal ball for predicting the future, highlighting the complex interplay between macro and micro factors in their business. He acknowledged the clear impact of inflation on their consumers.

This article from Luxeplace.com will delve into LVMH Group’s largest market (Asia, mainly China), the fastest-growing department (beauty retail led by Sephora), the biggest brand (Louis Vuitton), and one of the key fashion trends of 2023 (Quiet Luxury), based on the financial report and the meeting. More insights from Jean-Jacques Guiony will be presented in a “Q&A” format.

“Chinese customer numbers increased by 10% year-over-year, but they are becoming increasingly difficult to forecast.”

Jean-Jacques Guiony noted that the proportion of American, European, and Japanese customers in fashion and leather goods remains similar to trends observed since the third quarter of last year, possibly with a slight decrease.

The most significant change, however, has been among Chinese customers. It is encouraging that globally, the number of Chinese customers has increased by 10% year-over-year, although the growth rate for fashion and leather goods customers is slightly below 10%.

“The first one is that Q4, the numbers were pretty high, was boosted by a very easy comparison base in Q4 2022, with the lockdowns taking place in- well, more than the lockdowns, I mean, the pandemic situation taking place inmainland China in Q4 2022. So, this was a high boost to the growth in the Chineseclient base in Q4. And secondly, we are anniversarizing a pretty strong business lastyear in Q1 following at the end of the zero COVID policy.,” explained Jean-Jacques Guiony.

However, he also mentioned the increasing difficulty in forecasting Chinese customer behavior which is now the most unpredictable. He outlined two main reasons:

- Due to the market fluctuations caused by the outbreak and lifting of pandemic restrictions, 2023 is hard to use as a reference. There was a time when only Macau was open to mainland Chinese consumers, followed by the reopening of the Hong Kong and then Japanese markets. The markets need time to stabilize.

- The proportion of tourists among Chinese customers is gradually increasing. However, where Chinese consumers are shopping is slightly different from last year. For instance, in the first quarter, possibly 90% were in Asia last year, but less than 80% this year. Predicting where they will shop in the future—whether in China, elsewhere in Asia, or beyond—is also challenging.

Among global markets, Japan may benefit the most from Chinese tourists. Japan’s Q1 sales revenue increased by 32% year-over-year, raising its contribution to the group from 7% to 9%, mainly due to purchases by Chinese consumers. Japan remains one of the fastest-growing travel destinations for Chinese tourists.

The weakening yen is also a key factor for Chinese shoppers in Japan; compared to Japan and China, the average price in Japan is significantly lower than in China. In Europe, the Japanese market has a premium of about 10%, while it holds a 20%-22% premium over China. “We repeatedly increased prices in Japan tooffset the weakness in the Japanese Yen. Overall, the price impact was about 7% in thefirst quarter of this year.”

Regarding the sectors most frequented by Chinese customers, Jean-Jacques Guiony revealed that growth in the watches and jewelry segment (including customers in China and abroad) is slightly lower than in the fashion and leather goods sector.

“On jewelry… we’ve seen some swings and some volatility with Asian customers and particularly Chinese customer, even within the first quarter. So, the situation there is not that easy to analyze, particularly considering that we have implemented price increases (between 4%-6% depending on product) during the first quarter, which are making the analysis quite complex.”

Focusing on the Chinese domestic market, Jean-Jacques Guiony expressed concerns about the sales network in China, which has been a long-standing issue.

“During the pandemic, we more than doubled the local business in China without really opening a lot of square meters. There was only so much we could do during the pandemic years to enlarge properties that we had. And frankly, we didn’t do much in2021 and 2022. Progressively, some projects are being opened and will help us sort of limit the saturation of some existing stores. When you double, or even more than that, a business, without adding square meters, obviously you reach a very high profitability and productivity, which is a good point. But in terms of client service, at some point, it becomes necessary to enlarge the network to diminish productivity, but to do a better job with the client. This is exactly what we are doing.”

“There’s no need to question the growth potential of Louis Vuitton; it will continue to lead growth.”

An analyst pointed out that they observed Louis Vuitton tends to launch more Canvas series (such as Monogram, Damier, etc.) during economic downturns and more Leather series (such as Taiga, Nomade, Utah, Epi, etc., which are generally positioned higher) during economic upturns. Will Louis Vuitton introduce more “accessible” products to meet the needs of “aspirational customers”?

Jean-Jacques Guiony responded frankly, saying, “With regards to LV, and your analysis of good times leather, and bad times canvas, frankly, it’s not as simple as that. I mean, these two categories of their own dynamics, mostly based on new product introduction. We have had very successful product introductions in leather over the last couple of years. We have had canvas product introduction that was successful last year and this year. So, they have their own dynamics. We don’t have a specific strategy as to the share of canvas versus leather. We try to – the breadths of the brand, as you know, is quite large, and we try to satisfy the various segments of the customer base by offering product at different price segments and in different materials.“

Jean-Jacques Guiony said, “Frankly, I don’t think the situation of aspirational customers in the western part of the world is connected in anyway with the offer. The question is inflation, which is taking its toll, with a particular intensity on this group of customers, and which is the same thing in the US and in Europe. And it’s quite interesting, and it’s quite interesting that we don’t see it in China. The reason why we don’t see it in China is that there is no such thing, at least for the time being as inflation in China. So, I think as long as inflation will be a factor for this group of customers, we will not do miracles, and basically we expect only a gradual improvement with this population in the coming quarters.”

Jean-Jacques Guiony revealed that the future growth drivers in the fashion and leather goods division will still be Louis Vuitton, Dior, Celine, Fendi, among others. Our growth advantage actually lies in the portfolio itself. Of course, we have many brands, and of course, the leading one is Louis Vuitton, which remains the group’s largest brand, and we expect Louis Vuitton to lead the growth again.

“There have always beenquestions as to the ability of Vuitton to grow further. I’ve been 20 years with the group,and I’ve heard that since I joined. And this brand has always been able to reach newfrontiers in the past, and we hope to do exactly the same with a different positioning,but the same extraordinary potential moving forward.”

“Sephora exits the Korean market due to lack of a winning strategy; full-price sales in China prove challenging”

In the first quarter, the selective retailing division saw a year-over-year sales increase of 5% and an organic growth of 11%, making it the best-performing division. Sephora, in particular, achieved significant growth, continuing to expand its market share. Growth remains particularly strong in North America, Europe, and the Middle East. The store network continues to expand, especially in North America.

Jean-Jacques Guiony stated, “So, Sephora in the US, I would mention two things. One is the fact that we suffered more than the others in the pandemic, the reason being that our store format is very much biased toward downtown and shopping malls. Some competitors are more exposed to suburban malls, which were favored by the client base during the pandemic. So, we had a tough time during the pandemic, and exiting the pandemic is playing the other way around. So, we benefit from that. People are back in the center of towns. They’re also back in the shopping malls, and we benefit from that where the bulk of our stores are present.

The second thing I would mention is that we have always, particularly in the US, put the emphasis on merchandising, which has always been the key strengths of Sephora in the US, and we never gave up on that. We are still at the forefront of innovation in terms of brands, in terms of product., and that’s probably the main reason why people are coming to Sephora. Sephora is not just engaging into a transactional relationship with its or her customers. It is also a place where people discover, try and do other things than they would do in a traditional store.“

In March this year, Sephora Korea announced on its official website that it would gradually cease all operations in Korea from May 6, including its app, official website, and physical stores.

Regarding the exit from the Korean market, Jean-Jacques Guiony candidly said, “Korea, is it – well, the reason why we closed Korea was that there was no winning strategy there. I mean, we reviewed that many, many times. It’s a very competitive market, and the merchandising advantage was not entirely obvious in Korea, which is not so easy to penetrate with non-Korean brands. So, there was no winning strategy. So, we decided to exit.

I wouldn’t draw the conclusion quickly that this is significant of the fact that Sephora is not working well in Asia. There are markets, particularly like Singapore, where we are doing well.”

Jean-Jacques Guiony specifically mentioned the Chinese market, saying, “China, we are extremely hopeful that the merchandising effort that we are doing today will pay off at some at some point. Obviously, if we keep on competing at full price with discounted product in China coming from Daegu or parallel trade, this is not going to work. But we have other ideas about this market, and we are extremely hopeful that Sephora will develop a strong presence there, playing the differentiation factor, not the mainstream, but the differentiation factor.”

Recently, Sephora appointed Xia Ding as the General Manager of Sephora Greater China.

“Quiet Luxury prevails, but it’s not suitable for all brands”

“Quiet Luxury” was one of the key fashion trends of 2023, with Loro Piana being regarded as a typical brand of this style.

Jean-Jacques Guiony stated, “I mean, if you look at the numbers of Loro Piana for instance, they are clearly a testimony that quiet luxury is doing well, and really the brand is moving from strength to strength.”

“We will not all of a sudden convert a business that is almost €50 billion into just quiet luxury. I mean, it has to be more diverse than that, but obviously if quiet luxury is there to stay, we’ll deal with that as we already do.”

More from the transcript:

Q: With currencies down 4% in Q1 on thetop line, plus a delayed impact of hedging from last year, what’s the outlook for the impact of currencies this year if the currencies don’t move from the current level?

Jean-Jacques Guiony: We expect globally that currencies will have overall during theyear, a slight negative impact on sales if everything stays the same minus for in Q1. It’ll be some time before we cross the level for the yen and the renminbi that we are -where we are today. So, particularly the yen and the renminbi will create further pressure on currencies, but diminishing as the year goes by.

So, the normal pattern of something like minus X in sales, and usually something like 2x in impact on operating profit, which is usually what we get.

Q: Were there great disparities in terms of the brand performance between Bulgari and Tiffany during the quarter? And more specifically at Tiffany, could you share with us more details on the brand performance across the different regions or on nationality?

Jean-Jacques Guiony: The breakdown of Bulgari and Tiffany by geographies is not at all thesame. So, there is almost half of the business for Tiffany being done in the US, with ahigh exposure to the aspirational customer. So, obviously, this has been taking its toll inthe last four, five quarters, as we explained many times. Bulgari is much more exposedto the Asian customers and the Chinese one in particular, which remained positive inthe first quarter of the year.

Q: In terms of e-commerce relating also to Fashion & Leather, can you comment on the penetration? Assuming it’s a drag, how has the drag trended across the quarters? Is it less of a drag now, and how do you view this channel given the shift back to traffic to stores?

Jean-Jacques Guiony: No, e-commerce was not a drag. I mean, e-commerce could have a lower growth rate than it used to have, but it’s a function of availability of product. If products are being sold in stores, we see no necessity to put a lot of them onto the e-commerce and vice versa. So, basically, I would view the fact that e-commerce is growing less than stores asa good sign of the health of the store channel, which is obviously by far the most important for us.

Q: Has it now been confirmed that Hainan will become a tax-free province in 2025? And how big do you think that that opportunity can be for you, given there are already some pretty big incumbent players in that market?

Jean-Jacques Guiony: We have no reason to believe that it’llnot happen. As far as the competition is concerned, well, there is one sizable project already under construction, and our project is the second one. The other project are, I would say, not of the same magnitude of these two project in the south of the island. So, we would expect, given the size, the global size of the market, that these two projects, including the one from DFS, will dominate the market, which will progressively turn, if not into duty paid, or at least in a model that will be not be very different from what happens in Macau or Hong Kong for instance. So, we are very hopeful that our project will make – will be one of the two leading project in Sanya and in Hainan going forward.

Q: Just wondering if you can share more about the seasonality of your brand investment for Tiffany this year?

Jean-Jacques Guiony: There is no particular seasonality there. We are extremely determined to push the brand and its business, particularly in Asia. So, we are making sizable investment into this part of the world, which is obviously very important going forward, and there is no particular seasonality.

We really have a clear feeling that whenever we revamp a store in Asia, this is the place in the world where the yield is the highest. I mean, we usually get pick up in sales that are quite significant and are better than any other region in the world.

| Source: LVMH Group Conference Call

| Image Credit: LVMH Group Official Website

丨Reporter:Wang Jiaqi

| Editor: LeZhi