After market close on March 27, Chinese high-end beauty group Maogeping Cosmetics Co., Ltd. (HK: 01318) released its financial results for 2024, reporting a 34.6% year-on-year increase in revenue to RMB 3.885 billion (USD 537.7 million).

Profitability:

Gross profit rose by 33.9% from RMB 2.448 billion in 2023 to RMB 3.278 billion (USD 453.3 million), closely tracking revenue growth. The gross profit margin remained stable compared to 2023, at a high 85.0%. Net profit increased by 32.8% year-on-year to RMB 881 million (USD 121.8 million).

This marks Maogeping’s first annual report and financial statement since its official listing on the Hong Kong Stock Exchange in December 2024.

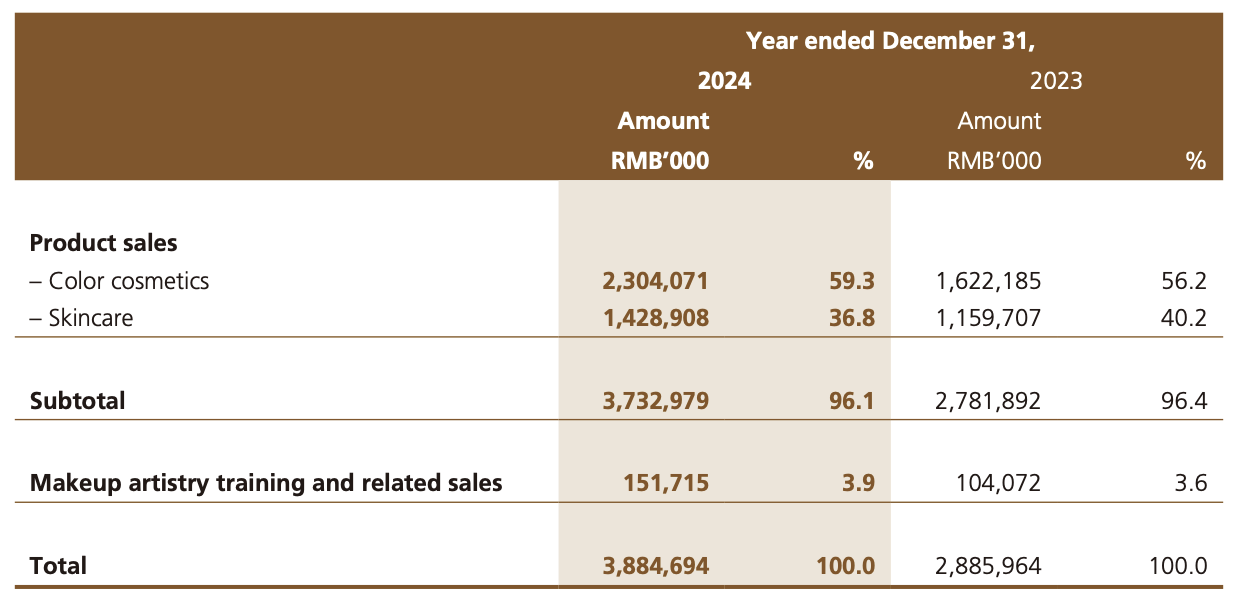

Maogeping’s current main operations are divided into two segments:

- Product Sales:

Revenue grew 34.2% from RMB 2.782 billion in 2023 to RMB 3.733 billion (USD 516.0 million). The group stated, “We continue to enrich and expand our beauty product matrix.” In 2024, over 100 SKUs were upgraded or newly developed. By the end of 2024, the product portfolio included more than 400 SKUs across color cosmetics and skincare categories. - Makeup Artistry Training and Related Sales:

Revenue increased 45.8% from RMB 104 million to RMB 152 million (USD 21.0 million), mainly driven by a rise in enrollment for makeup artistry training courses.

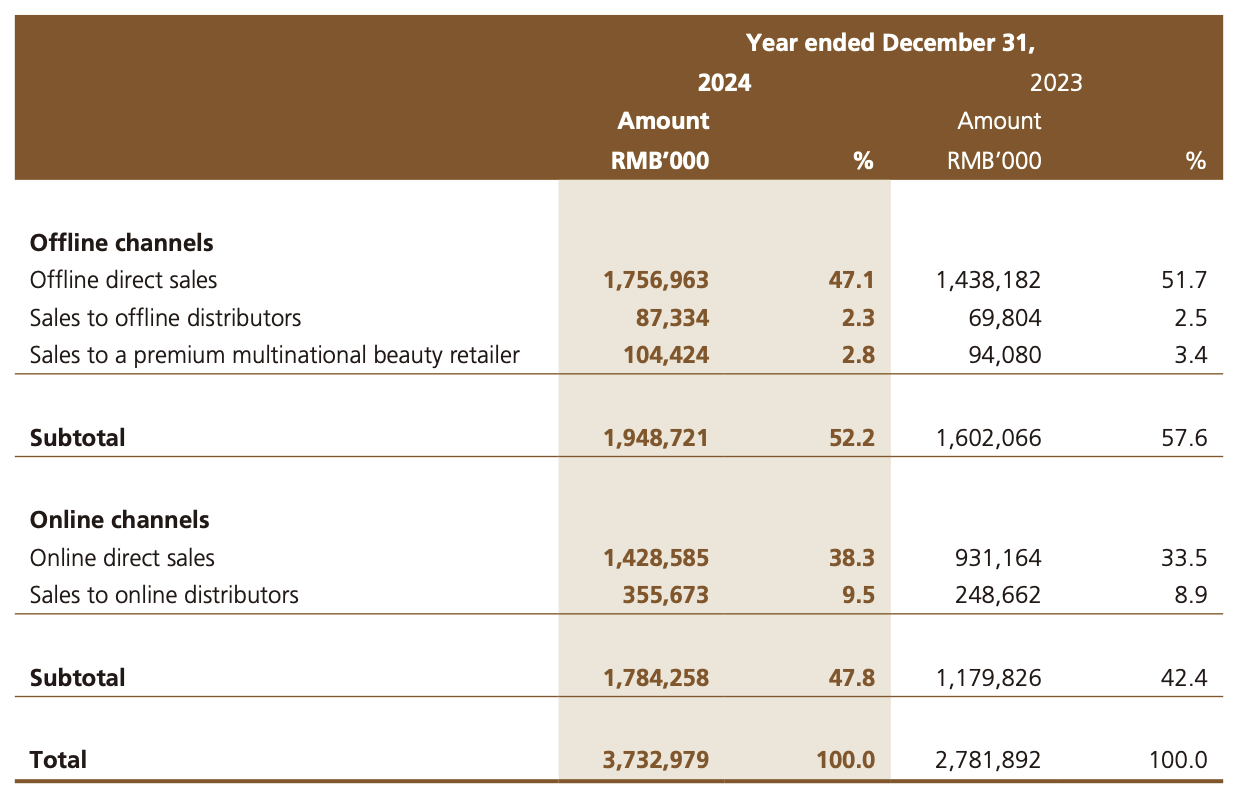

Sales Channels:

- Offline Channels:

Revenue rose 21.6% from RMB 1.602 billion to RMB 1.949 billion (USD 269.6 million), mainly due to an increase in direct offline sales from RMB 1.438 billion to RMB 1.757 billion. This was primarily the result of strengthened sales and marketing efforts in 2024, which boosted average sales per counter. Additionally, the brand entered premium department stores such as Wuhan SKP, Chengdu SKP, and Hangzhou Tower. By the end of 2024, Maogeping had counters in over 120 cities across the Chinese Mainland, including 378 self-operated counters and 31 distributor counters, staffed by more than 2,800 professional beauty consultants. - Online Channels:

Revenue surged 51.2% from RMB 1.18 billion to RMB 1.784 billion (USD 247.2 million), driven by increased sales and marketing efforts on e-commerce platforms. Direct online sales rose from RMB 931 million to RMB 1.429 billion, while sales through online distributors grew from RMB 249 million to RMB 356 million.

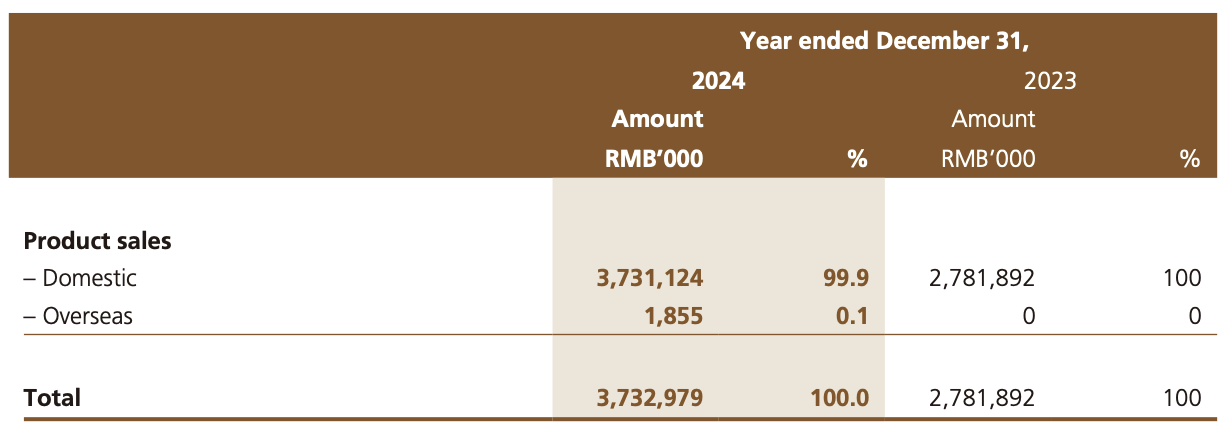

Geographic Breakdown:

In 2024, the group recorded RMB 1.855 million (USD 257,000) in new overseas product sales, primarily due to the addition of new overseas distributors such as Sephora Hong Kong Cosmetics Co., Ltd.

On the trading day following the report (March 28), Maogeping’s share price fell by 9.57% to HKD 103 per share, with a total market capitalization of approximately HKD 50.5 billion. Despite the decline, the stock had gained about 77% since the beginning of the year.

The drop may be linked to the H-share full circulation plan announced alongside the financial results. According to the announcement, the board plans to convert 228 million unlisted shares into H-shares. If approved, the number of outstanding H-shares will increase from 262 million to 490 million, representing a potential 87% increase in free float.

|Source: Official Financial Report

|Image Credit: Official Financial Report

|Editor: LeZhi