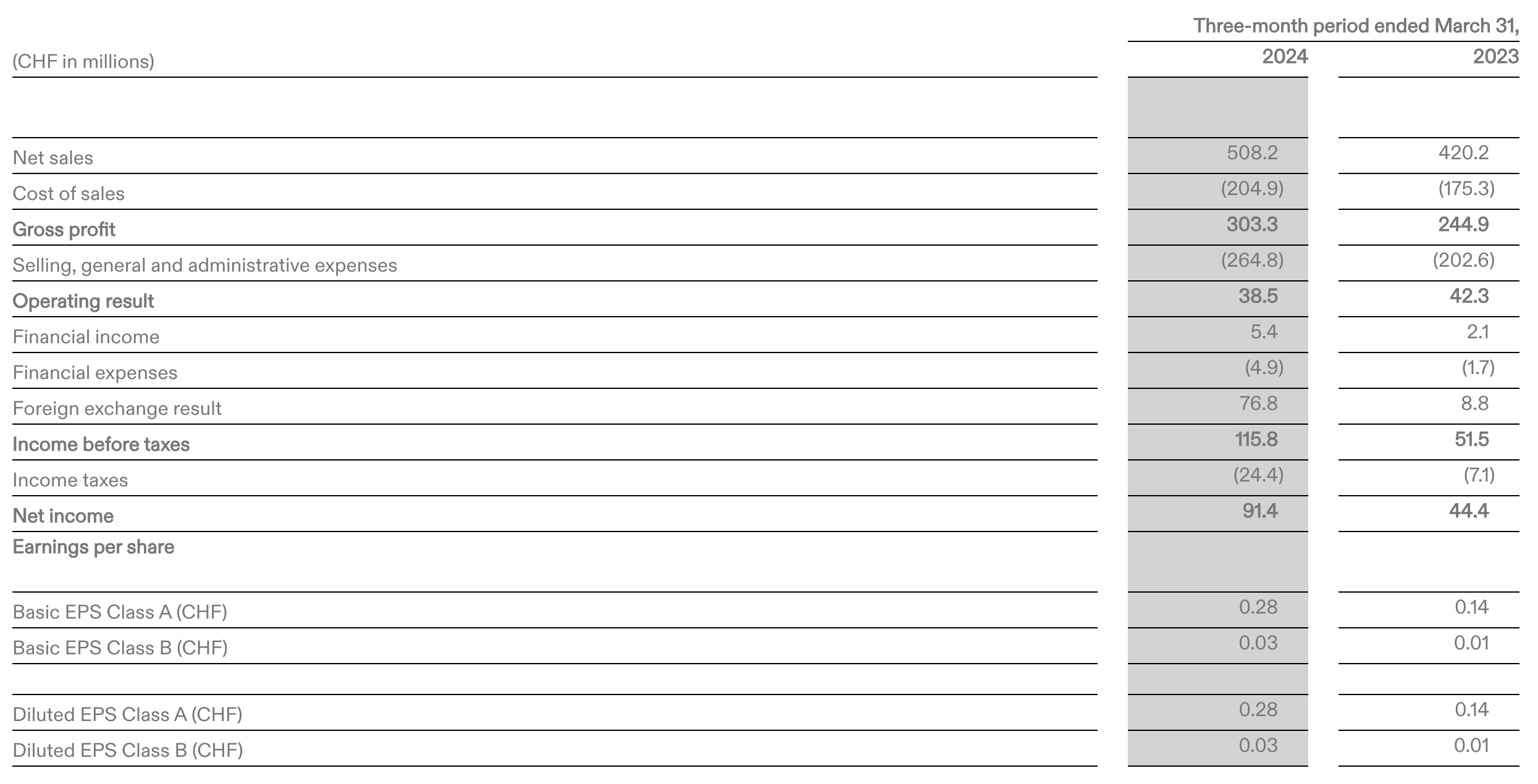

Before the U.S. stock market opened on May 14, Swiss sports shoe manufacturer On Holding AG (On) released its Q1 FY2024 financial report for the period ending March 31, 2024. Strong demand in direct-to-consumer (DTC) channels drove net sales up by 20.9% year-on-year to CHF 508.2 million (up 29.2% at constant exchange rates). This marks the first time the brand’s quarterly net sales have exceeded CHF 500 million, surpassing the previous forecast of CHF 495 million. Net profit surged by 106% year-on-year to CHF 91.4 million, and the gross margin improved to 59.7%, approaching the brand’s target of over 60%.

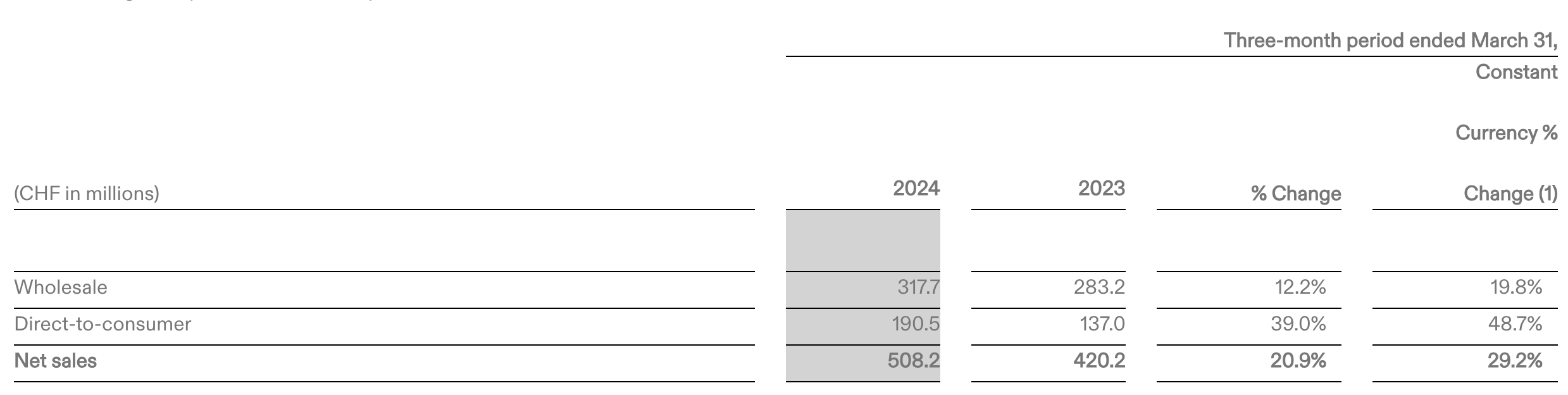

Thanks to increased traffic and transactions on e-commerce platforms and in stores, especially in the Asia-Pacific and EMEA (Europe, Middle East, and Africa) markets, On’s Q1 FY2024 DTC net sales rose by 39% year-on-year, up 48.7% at constant exchange rates, accounting for 37.5% of total sales (up from 32.6% in the same period last year).

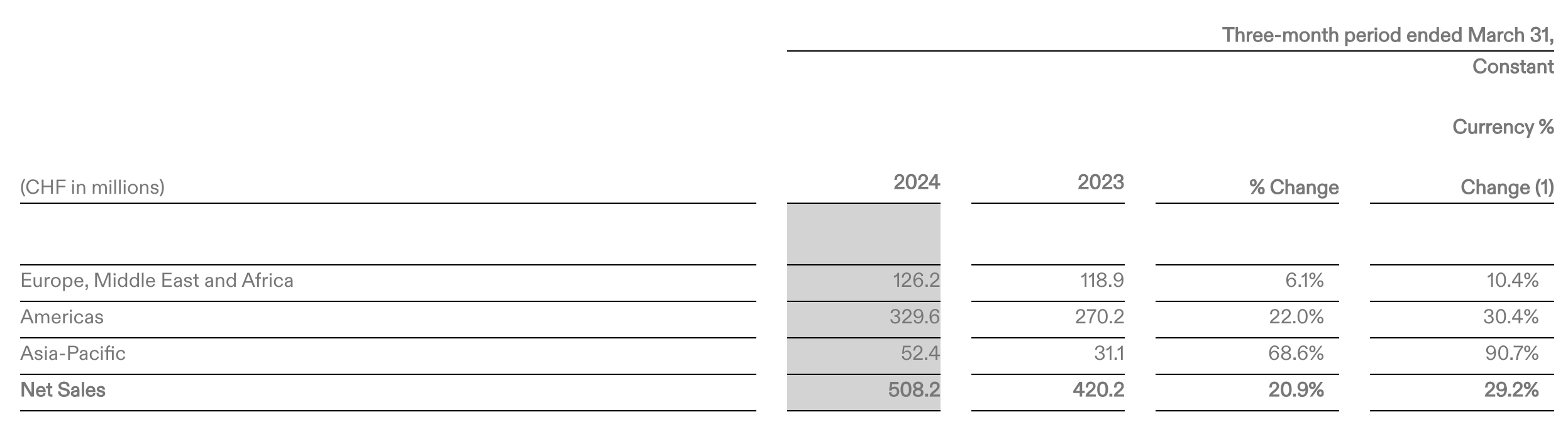

Among all markets, the Asia-Pacific region continued to lead growth, with net sales up by 68.6% year-on-year (up 90.7% at constant exchange rates), accounting for more than 10% of total sales for the first time. Both the direct and wholesale channels in the Chinese and Japanese markets saw strong growth, with the DTC channel performing particularly well.

During the subsequent conference call, On’s Co-CEO and CFO Martin Hoffmann expressed the goal of achieving over 10% of total sales from the Chinese market alone in the next few years. The brand is adapting to the Chinese market environment by continuing to develop digital DTC channels, recently launching a live broadcast studio. Additionally, the brand plans to expand its presence in China, aiming to increase the number of self-operated stores to around 30 by the end of the year. On is also negotiating with a key shopping mall partner in China to open a larger flagship store.

Martin Hoffmann also highlighted the brand’s anticipation for the upcoming Summer Olympics in Paris, where it will open its second store on the Champs-Élysées.

As of the close of the U.S. stock market on May 14, On’s stock price rose by 18.3% from the previous trading day to $36.3 per share, with a year-to-date increase of 34.6%, giving the company a current market value of approximately $10.3 billion.

The robust development momentum has strengthened On’s confidence in achieving its FY2024 targets. The brand reiterated its previous growth forecast, expecting annual net sales to grow by at least 30%, reaching CHF 2.29 billion at current exchange rates. Additionally, the brand anticipates a full-year gross margin of around 60% and an adjusted EBITDA margin of 16% to 16.5%.

Commenting on the Q1 performance, Martin Hoffmann stated, “The first quarter was a very strong start to the year and a further step in the execution of our long-term strategy to be the most premium global sportswear brand. We are thrilled to have exceeded our expectations and surpassed the half-billion net sales mark in a single quarter. This serves as a validation of the strong demand we have experienced across all channels, regions, and product categories. Notably, we see the strength in our DTC channel as a clear marker of the ongoing strong brand momentum. The significantly increased DTC share has also allowed us to reach a very strong gross profit margin in the first quarter, close to the mid-term target we laid out a couple of months ago. Looking ahead, we’re extremely excited for the months to come, filled with groundbreaking innovations, big partnerships, and the opportunity to have a notable impact in Paris this summer.”

On’s Co-Founder and Executive Co-Chairman Caspar Coppetti added, “Hellen Obiri’s win at the marathon in Boston highlights our team’s relentless dedication to delivering cutting-edge and sustainable innovations to athletes and consumers alike. These are the achievements that strengthen On’s performance credibility, and they continue to fuel our increasing market share at key running routes around the globe. We are eagerly looking ahead to the remainder of the year with many more athlete success stories to come, as well as being laser-focused on the premium execution of our strategic priorities.”

Key Financial Data for Q1 FY2024 (as of March 31, 2024):

By Channel

By Market

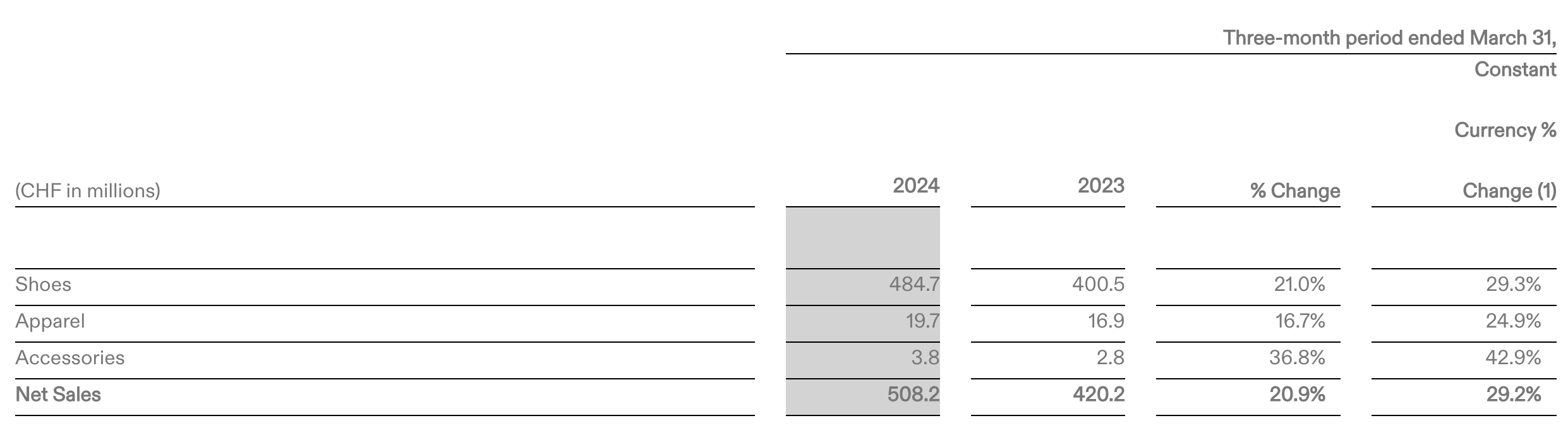

By Product

| Source: Official Financial Report; Conference Call

| Image Cedit: Brand Official Website

| Editor: Wang Jiaqi