As a barometer of the luxury retail market in the Chinese Mainland, this article by Luxeplace.com summarizes the latest performance of eight major commercial real estate developers and their high-end shopping center projects. The companies covered include China Resources, Hang Lung Group, Swire Properties, Wharf Holdings, Beijing Hualian Group, Deji Group, Shui On Construction, and Yanlord. This analysis is based on publicly available financial reports and data collected by third-party institutions, comparing the performance of 2023 with the latest updates in 2024, providing insights into the current trends in China’s luxury market and high-end retail sector.

China Resources (CRC)

China Resources Land, the real estate arm of China Resources Group, has developed the dual product lines of MixC and MixC One over 15 years. MixC targets urban-level shopping centers in first- and second-tier cities, while MixC One focuses on regional centers in first- and second-tier cities and urban centers in third- and fourth-tier cities. The portfolio also includes MixC World, a one-stop lifestyle platform, and the China Resources Tower, resembling a “spring bamboo shoot.”

2023 Performance:

- Group

In 2023, China Resources Land’s total revenue increased by 21.3% year-on-year to RMB 251.14 billion, with net profit attributable to shareholders growing by 11.7% to RMB 31.37 billion. Shopping centers generated rental income of RMB 17.9 billion, up 29.7%.

- Shopping Centers

The 76 operational shopping centers achieved a total retail sales of RMB 163.87 billion in 2023, a year-on-year increase of 44.2%.

Both luxury and non-luxury shopping centers performed well, with retail sales increasing by 36.5% and 49.7% respectively. The proportion of luxury to non-luxury retail remained at 40:60. The total foot traffic exceeded 960 million, with an average daily footfall increasing by 35.4% year-on-year. The number of members rose by 36% to 46.25 million, and the monthly sales per square meter increased by 30.6% to RMB 2,914. Ten new shopping centers and one phased opening were completed, bringing the total number of luxury centers to 12.

- 2024 Latest Performance and Updates

In the first half of 2024, China Resources Land achieved contracted sales of approximately RMB 124.7 billion and a contracted sales area of about 5.211 million square meters, decreasing by 26.7% and 25.7% year-on-year respectively. Recurring revenue reached RMB 22.78 billion, up 14.2%, with rental income from operational properties growing by 16.5% to RMB 14.15 billion.

Seven new shopping centers opened in 2024, including MixC in Wuhan Wuchang, Changzhou, Guiyang, Hefei Baohe, Handan, Beijing Xibeiwang, and Jiaxing Tongxiang. In July, China Resources Land Yiwu MixC World opened, adopting a mixed “block + box” model.

The group plans to open approximately 16 new shopping centers in Beijing, Shenzhen, Nanjing, Xi’an, Changsha, and Zhengzhou in 2024.

Hang Lung Group

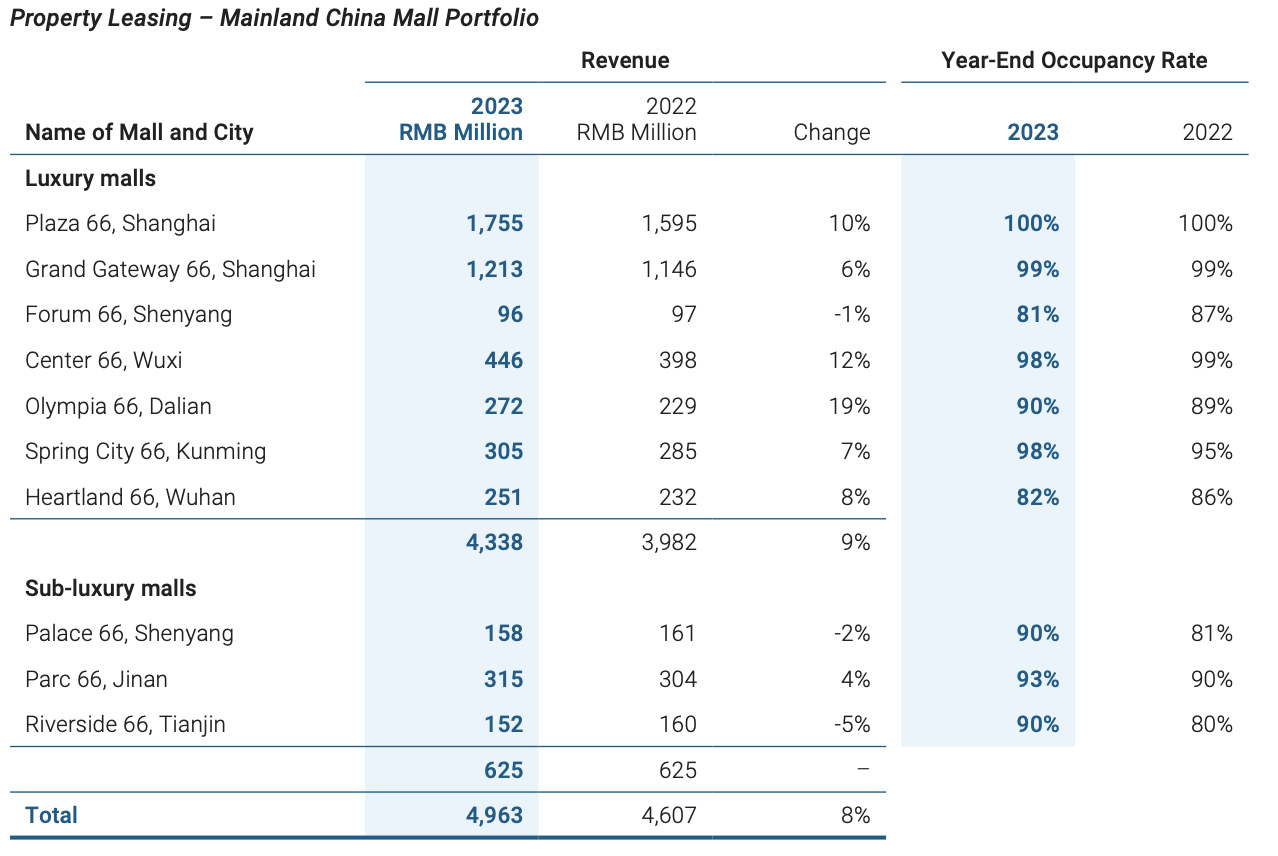

Hang Lung Properties is the real estate arm of Hang Lung Group. In the 1990s, Hang Lung Properties began constructing, owning, and managing several commercial projects in major cities across the Chinese Mainland. Currently, Hang Lung Properties operates 10 shopping mall projects in the Chinese Mainland, including seven high-end malls: Plaza 66 in Shanghai, Grand Gateway 66 in Shanghai, Forum 66 in Shenyang, Center 66 in Wuxi, Olympia 66 in Dalian, Spring City 66 in Kunming, and Heartland 66 in Wuhan. Additionally, there are three mid-to-high-end malls: Palace 66 in Shenyang, Parc 66 in Jinan, and Riverside 66 in Tianjin.

2023 Performance

- Group Performance

In 2023, Hang Lung Properties’ revenue decreased by 0.3% year-on-year to HKD 10.316 billion, with all revenue derived from property leasing (no property sales revenue was realized this year).

For Mainland property leasing, shopping malls remained the primary revenue source, with revenue increasing by 8% year-on-year to CNY 4.963 billion. Specifically, leasing revenue from high-end malls increased by 9% year-on-year, with all high-end malls recording varying degrees of growth except Palace 66 in Shenyang. Leasing revenue from mid-to-high-end malls remained flat compared to 2022.

- Shopping Malls

All shopping centers achieved retail sales growth, with year-on-year retail sales increases as follows: Plaza 66 in Shanghai (24%), Grand Gateway 66 in Shanghai (30%), Forum 66 in Shenyang (44%), Center 66 in Wuxi (19%), Olympia 66 in Dalian (8%), Spring City 66 in Kunming (20%), Heartland 66 in Wuhan (44%), Palace 66 in Shenyang (25%), Parc 66 in Jinan (41%), and Riverside 66 in Tianjin (41%).

Hang Lung Properties reported the following leasing income and occupancy rates for each shopping center:

- 2024 Operational Updates

According to the financial report, Plaza 66 in Shanghai will undergo expansion, adding 13% more retail space in a low-rise standalone building next to the existing second office tower. In the 2023 annual report, Chairman Ronnie Chan mentioned a substantial waiting list of potential tenants for Plaza 66, with clear insights into prospective new tenants and their willingness to pay rent.

The Group also provided an update on Center 66 in Hangzhou, which is expected to be completed in phases starting in 2024.

Simultaneously, Hang Lung Properties and Hang Lung Group announced that Ronnie Chan will step down as Chairman, Executive Director, and Chairman of the Executive Committee. Vice Chairman, Executive Director, and Executive Committee member Adriel Chan, Ronnie Chan’s son, has been nominated and elected as Chairman and Executive Committee Chairman, effective after the 2024 Annual General Meeting.

Additionally, in June, Chanel’s two-story store in Plaza 66, Shanghai, began renovations to expand to the B1 level, creating a four-story flagship store offering various services, including salons.

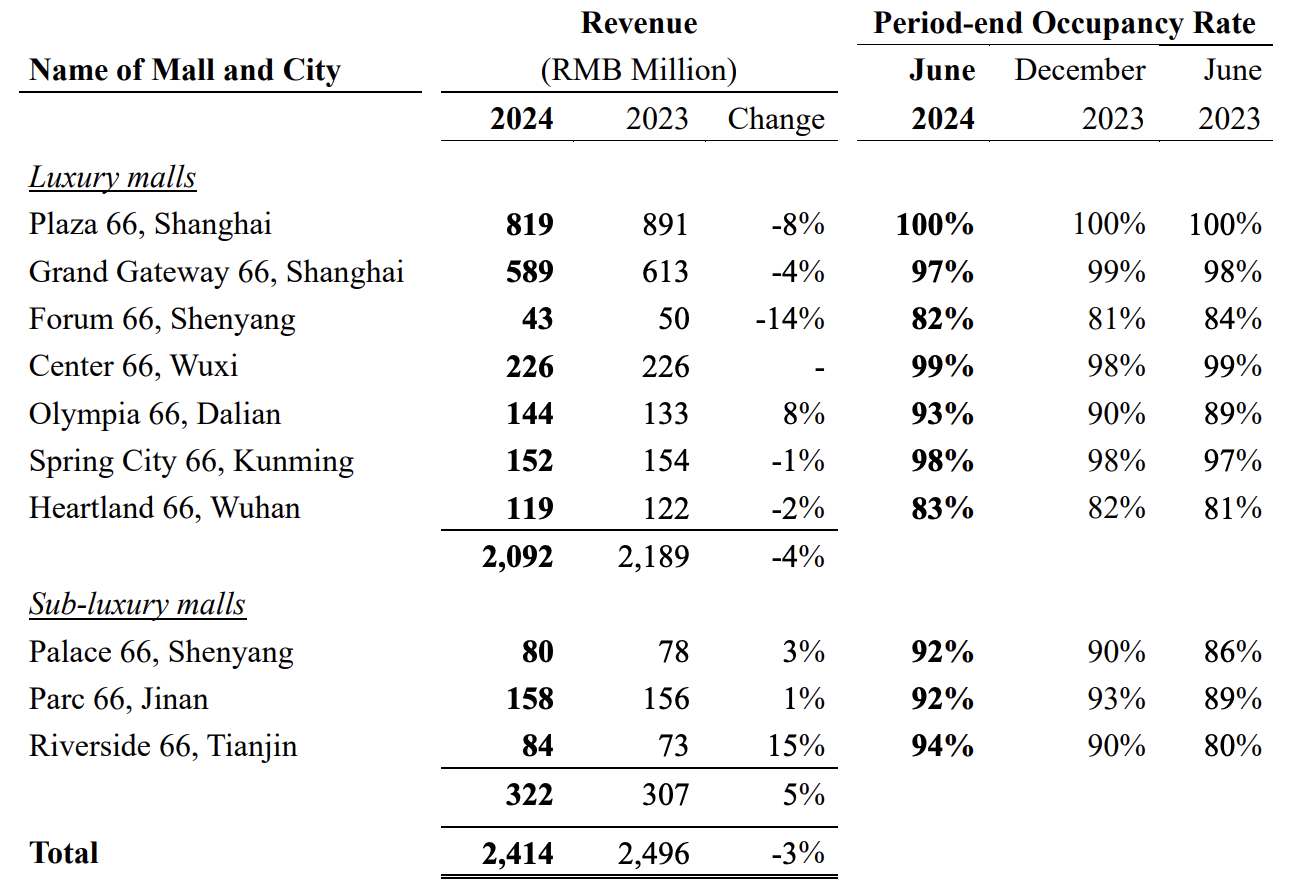

At the end of July, the Group announced its interim results for 2024, with revenue increasing by 17% year-on-year to HKD 6.114 billion. Property sales revenue amounted to HKD 1.228 billion (2023: none). Due to weak luxury consumption in the Chinese Mainland, a slowdown in Hong Kong’s retail and office markets, and the depreciation of the RMB against the HKD, property leasing revenue decreased by 7% year-on-year to HKD 4.886 billion (2023: HKD 5.237 billion). The operational status of the 10 high-end and mid-to-high-end malls in the Chinese Mainland is as follows:

Wharf Group

Wharf Group’s Mainland shopping centers include Changsha IFS, Chengdu IFS, Chongqing IFS, Shanghai Times Square, Wheelock Square in Shanghai, Chongqing Times Square, Dalian Times Square, Changsha Times Outlets, and Chengdu Times Outlets.

2023 Performance

- Group Performance

The Group’s revenue increased by 5% year-on-year to HKD 18.95 billion, operating profit rose by 4% to HKD 6.896 billion, and net profit attributable to shareholders turned positive to HKD 945 million.

Investment property income decreased slightly by 1% year-on-year to HKD 4.843 billion, with operating profit decreasing by 1% to HKD 3.207 billion. Core Mainland investment property income (mainly from Chengdu IFS and Changsha IFS, including office buildings) decreased slightly by 1% to HKD 4.757 billion, and operating profit decreased by 2% to HKD 3.16 billion.

- 2024 Operational Updates

In the first half of the year, Changsha IFS welcomed several major stores, including a newly upgraded Converse flagship store, the first L1-level store in Central China, and a streetwear brand UNDEFEATED store in February.

In June, Chongqing IFS and Chongqing Times Square collaborated with Hong Kong Disneyland Resort to create the “IFS Dream Journey” and “Duffy and Friends Holiday Adventure” themed exhibitions, introducing the popular Disney IPs “Frozen” and “Duffy and Friends” to Chongqing for the first time.

Swire Properties

Swire Properties was established in Hong Kong in 1972 and listed on the main board of the Hong Kong Stock Exchange in 2012. Its business operations mainly include commercial, hotel, retail, and residential properties. Completed Mainland shopping centers include Taikoo Li Sanlitun in Beijing (wholly-owned), INDIGO in Beijing (50% ownership), TaiKoo Hui in Guangzhou (97% ownership), Taikoo Li Chengdu (wholly-owned), HKRI Taikoo Hui in Shanghai (50% ownership), and Qiantan Taikoo Li in Shanghai (50% ownership).

2023 Performance

- Group Performance

The Group’s revenue increased by 6% year-on-year to HKD 14.67 billion, while net profit attributable to shareholders decreased by 67% year-on-year to HKD 2.637 billion.

Investment property remained the main revenue source, with income increasing by 9.6% year-on-year to HKD 13.525 billion. Core retail property income increased by 22% year-on-year to HKD 7.143 billion. The Group’s total retail property rental income in the Chinese Mainland increased by 42% year-on-year to HKD 4.191 billion, excluding rental support and RMB value changes, with a total rental income increase of 45%.

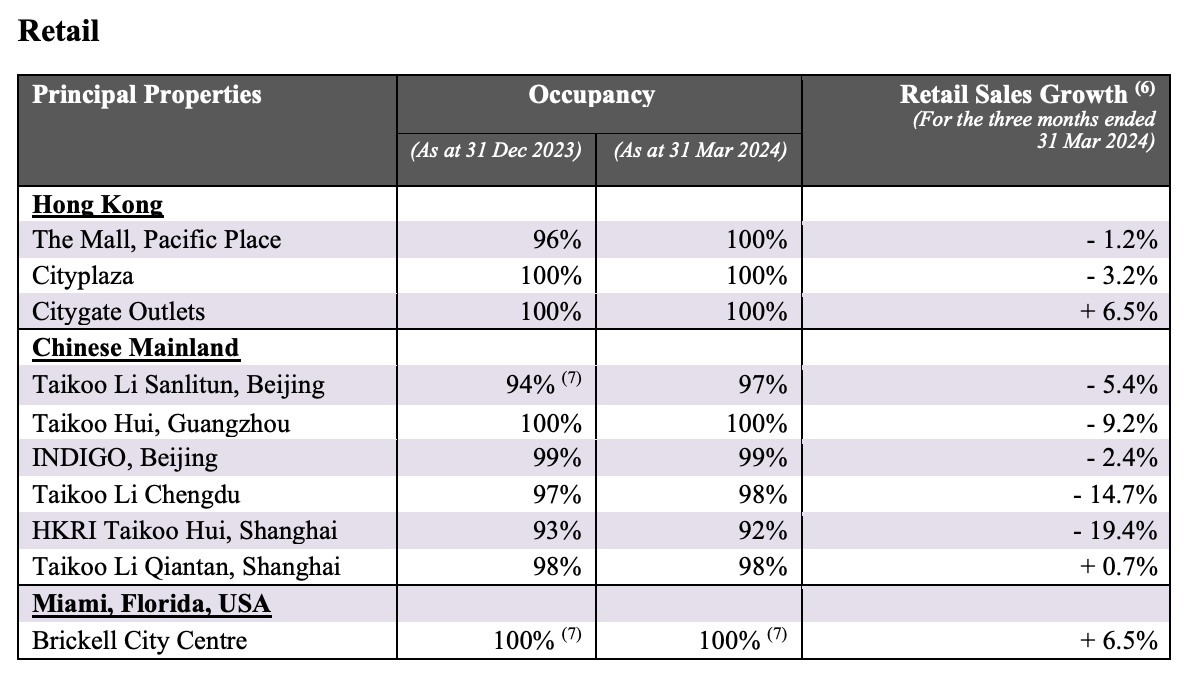

- Shopping Centers

The Group reported that with the lifting of pandemic restrictions, foot traffic significantly improved, and most shopping centers achieved retail sales exceeding pre-pandemic levels. The Group’s retail sales share in the Chinese Mainland (excluding automotive retailers) increased by 46%.

Retail sales growth in 2023 was as follows: Taikoo Li Sanlitun in Beijing (31%), Taikoo Li Chengdu (33%), TaiKoo Hui in Guangzhou (15%), INDIGO in Beijing (27%), HKRI Taikoo Hui in Shanghai (29%), and Qiantan Taikoo Li (79%).

- 2024 Operational Updates

In May, Swire Properties disclosed its operational data for the first quarter of 2024.

In June, Oceanwide Holdings (HK: 03377) announced the sale of its 64.79% stake in INDIGO Phase II and related debts for RMB 4 billion, acquired by China Life and Swire Properties. China Life contributed approximately RMB 3.1 billion, and Swire Properties contributed about RMB 900 million, gaining 49.895% and 14.895% stakes in INDIGO Phase II, respectively. Located in the Jiuxianqiao area of Beijing’s Chaoyang District, INDIGO Phase II will be developed as a flagship commercial complex, including a shopping mall, office buildings, and a hotel, with completion expected between 2025 and 2026. Oceanwide Holdings and Swire Properties jointly own 64.79% and 35% of the project, respectively.

Additionally, in the first half of the year, Swire Properties’ shopping centers welcomed several major stores, including the ANTA SNEAKERVERSE ANTA Collection White Label’s first store, China’s first flagship Jordan store Jordan World of Flight, Lululemon’s largest Asian store in Taikoo Li Sanlitun, and Canada’s premium down jacket brand nobis’ first boutique in China in Taikoo Li Chengdu.

Hualian Group

SKP is a high-end shopping center under the Beijing Hualian Group, which opened in Beijing in 2007. Starting in 2018, SKP expanded to other cities, with the first new location in Xi’an. Construction began on Chengdu SKP and Kunming SKP in the second half of 2020. At the beginning of 2022, SKP announced its plans to establish a presence in Hangzhou, and by the end of 2022, Chengdu SKP commenced trial operations. In July 2024, Wuhan SKP officially opened.

Currently, SKP’s shareholders are Radiance Investment Holdings Pte. Ltd. (Singapore) holding 60%, and Hualian Group holding 40%.

- 2023 Performance

In 2023, Beijing SKP achieved retail sales of RMB 26.5 billion, an increase of 10.8% compared to RMB 23.9 billion in 2022, maintaining its position as the highest-grossing shopping mall in the country. Xi’an SKP reported retail sales of RMB 8 billion, slightly lower than the previous year’s RMB 9.5 billion. The newly opened Chengdu SKP achieved retail sales of RMB 5.5 billion.

- 2024 Operational Updates

In May, the Hermes store in Beijing SKP reopened with a new look, expanding from a single-floor space to two floors, doubling its previous size. The store’s design is inspired by traditional Chinese landscape paintings, paying tribute to traditional culture and the scenic beauty surrounding Beijing. Currently, Beijing has three Hermes stores, and there are 34 stores in the Chinese Mainland.

In July, Wuhan SKP officially opened. The project involved the transformation of the former Wanda Plaza on Han Street and the second phase of Chu River Han Street, with a total business area of approximately 150,000 square meters. It is the fourth SKP in the country and plans to introduce over 1,000 international brands, with more than 200 brands debuting in Wuhan. Over 30 international brands, including Louis Vuitton, Gucci, Prada, Saint Laurent, Loewe, Bottega Veneta, Fendi, Miu Miu, Burberry, Moncler, and Descente, have already opened their latest concept stores.

In July, Hualian Holdings announced that it had signed a “Share Acquisition Framework Agreement” with Beijing SKP to acquire 100% of the equity of Beijing Hualian Beautiful Life Department Store Co., Ltd., which operates the DT51 commercial project. This transaction constitutes a related party transaction, as Beijing SKP is a subsidiary of Hualian Group, the controlling shareholder of Hualian Holdings. DT51, which opened in January 2023, is a fashionable shopping center developed by Beijing Hualian Beautiful Life Department Store Co., Ltd., a joint venture between Beijing SKP and Hualian Holdings, and represents an upgrade in community commerce.

Deji Group

Deji Plaza is a high-end commercial complex developed by Nanjing-based real estate developer Deji Group. Located in the prestigious Xinjiekou business district, known as the “Number One Commercial District in China,” Deji Plaza has been a top performer in high-end commercial real estate nationwide since its opening in 2006.

- 2023 Performance

In 2023, Deji Plaza achieved retail sales of RMB 23.9 billion, a year-on-year increase of 13.9%.

- 2024 Operational Updates

In the first half of the year, Deji Plaza welcomed several first-store brands, including Valentino Beauty’s first global color workshop boutique, Berluti’s first store in Jiangsu, Chow Tai Fook’s “Song” themed experience store in Nanjing, FILA’s sixth-generation image store’s first national store, WEILAN Technology’s first national experience store, and the first national store of Window Moss freshly baked croissant egg tarts.

In May, the Swiss watch brand Breguet launched its “Art of Time” 2024 national tour in Deji Plaza, Nanjing.

Shui On Group

Shui On Land, headquartered in Shanghai, is the real estate arm of Shui On Group in the Chinese Mainland. Completed commercial real estate projects include Shanghai Xintiandi, Taipingqiao, Ruihong Xincheng, Hongqiao Tiandi, Knowledge and Innovation Community (KIC), INNO KIC, Nanjing INNO Future City, Baiziting, Nanjing International Finance Center, Wuhan Tiandi, Wuhan Optics Valley Innovation Tiandi, Lingnan Tiandi in Foshan, and Chongqing Tiandi.

2023 Performance

- Group Performance

The Group’s revenue reached RMB 9.752 billion, with a net profit attributable to shareholders of RMB 810 million. Including properties held by joint ventures and associates, total rental and related revenue in 2023 reached RMB 3.243 billion, a 16% year-on-year increase, with 76% of the revenue coming from Shanghai properties.

- Shopping Centers

The performance growth during the year was mainly driven by rental contributions from the opening of Panlong Tiandi and Xintiandi in Shanghai. As of December 31, 2023, the occupancy rate of the retail property portfolio remained stable, averaging 91%. The sales and foot traffic of the Group’s property portfolio increased to 106% and 110% of the levels during the same period in 2021, respectively. Panlong Tiandi in Shanghai, as Shui On Land’s first “Urban Retreat” project, attracted over one million consumers in its first week of opening, with foot traffic reaching 16 million by the end of 2023.

Additionally, in September 2023, Shui On Land’s other urban renewal project, Xintiandi in Shanghai, was officially unveiled, quickly becoming one of the most sought-after destinations in the city. In December, Shanghai Hongrui Shouyuan Consulting Management Partnership (Limited Partnership), an investment company under China Life Insurance, reached an agreement with the Group to acquire a 65% stake in the Xintiandi project for an initial consideration of RMB 1.206 billion. The Group stated that the transaction aligns with its “asset-light strategy,” expanding its asset management portfolio through strategic partnerships with long-term investors.

- 2024 Operational Updates

In May, Shui On Land announced at a shareholders’ meeting that Stephanie Lo was re-elected as an Executive Director with a 96.8% approval rate. Effective May 28, Stephanie Lo was appointed Deputy Chairman of the Board to assist the Chairman in leading the Board’s decisions on the company’s development direction. Stephanie Lo is the daughter of Vincent Lo, Chairman of Shui On Land, and joined the company in August 2012.

Yanlord Land Group

Since entering the Chinese real estate market in 1993, Yanlord Land Group has successfully developed several large-scale residential and mixed-use commercial projects. Currently, Yanlord owns a core portfolio of completed investment properties and hotels, including Yanlord Landmark in Chengdu, Yanlord Riverside Plaza in Tianjin, Yanlord Marina Center in Zhuhai, Crowne Plaza Sanya Haitang Bay Resort, Yanlord Landmark in Nanjing, and Yanlord Dream Park in Shenzhen.

2023 Performance

- Group Performance

Revenue reached RMB 43.4 billion, a year-on-year increase of 51.1%. Real estate revenue was RMB 38.14 billion, up 54.3% year-on-year. In 2023, Yanlord’s self-owned property and hotel operating income reached RMB 1.75 billion, a year-on-year increase of 32.2%. During the period, Yanlord Dream Park in Shenzhen and Yanlord Haitang Park in Haikou, as new projects, achieved commercial occupancy rates of 95% and 96%, respectively.

On September 28, Yanlord Cangjie in Suzhou officially opened. After 20 years of deep cultivation in Suzhou, Yanlord Land launched the 140,000-square-meter Cangjie project in the core area of the ancient city, at the foot of the millennium-old Xiangmen and near World Heritage Sites such as Pingjiang Road, the Humble Administrator’s Garden, and the Couple’s Retreat Garden, marking a significant commercial venture.

- 2024 Operational Updates

In April, French fashion brand AMI hosted the AMI 2024 Fall/Winter Collection fashion show on the ancient Xiangmen city wall in Suzhou, with Suzhou Yanlord Cangjie and Suzhou Famous City Group as co-organizers. This grand show showcased the main pieces of AMI’s 2024 Fall/Winter men’s and women’s collections. Additionally, the first AMI boutique in Suzhou is located in Yanlord Cangjie. Since its opening in September last year, Yanlord Cangjie, as Yanlord’s latest flagship commercial project, has continued to collaborate with international fashion brands, integrating local cultural elements to create several first stores in Suzhou and Jiangsu. Yanlord Cangjie promotes the integration of local culture with international fashion, aiming to become a globally influential “world showcase.”

Focusing on the “commercial retail” aspect of the fashion luxury sector, Luxeplace.com will launch the “2024 China Business Innovation Awards” at the end of 2024. Details of the award selection will be announced later, and we welcome all major commercial real estate projects to stay tuned, contact us, and submit relevant cases and data.

| Source: Group financial reports

| Image Source: Official group websites, official Weibo

| Editor: LeZhi