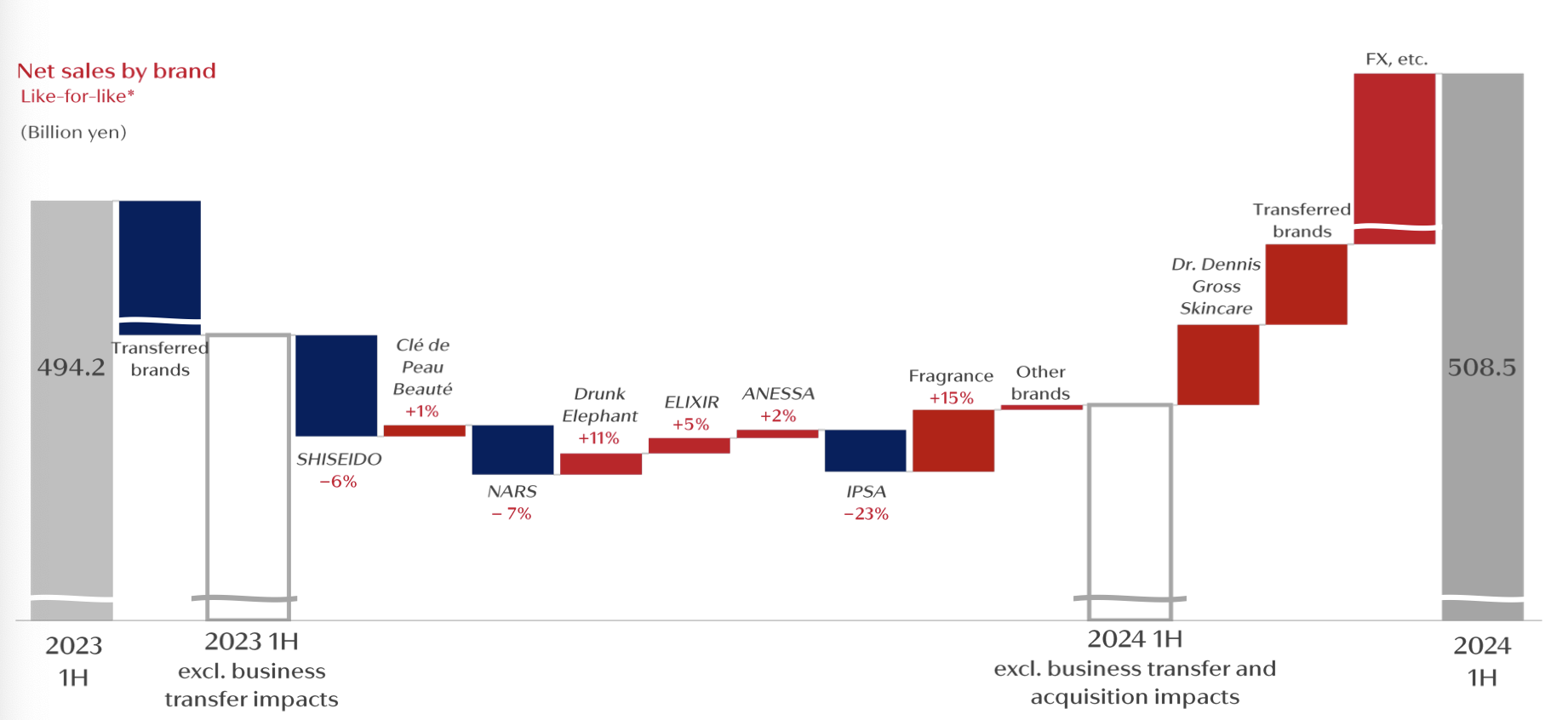

On August 7, Shiseido Company Limited, a leading Japanese beauty giant, released its financial results for the first half of fiscal year 2024, ending on June 30, 2024. The group’s net sales increased by 2.9% year-on-year to JPY 508.54 billion (a year-on-year decline of 4.1% at constant exchange rates), driven by restructuring costs and declining demand in the Chinese Mainland market. The operating loss amounted to JPY 2.728 billion, and net profit attributable to shareholders dropped by 99.9% year-on-year to JPY 15 million.

As a result, on August 8, the company’s stock price fell by JPY 700 to JPY 3,810 per share, hitting the lower limit, with a latest market capitalization of JPY 1.523 trillion.

During the period, the fragrance business and the Drunk Elephant brand led the growth, with increases of 25% and 11%, respectively. Clé de Peau Beauté (+1%), ELIXIR (+5%), and ANESSA (+2%) also saw steady growth. However, IPSA and SHISEIDO brands declined by 23% and 6%, respectively.

Regarding the Chinese Mainland market, the group aims to establish a sustainable and profitable business model, focusing on quality growth in a moderate growth environment. Specific growth strategies include:

– Cost Reduction and Profit Enhancement: Optimizing organizational structure, closing unprofitable stores, and selectively restructuring the brand portfolio.

– Adjusting Channel Strategies for Sustainable Growth:

- Differentiation through offline channels, finding new touchpoints, and opening pop-up stores in third- to fifth-tier cities.

- Strengthening high-growth potential online platforms and expanding official market connections.

- Driving synergies through integrated approaches, such as increasing marketing relevance between the Chinese Mainland market and travel retail, prioritizing brands and products, and capturing the growing demand from inbound tourists to Japan.

– Investing in Key Focus Areas:

- Developing new core products for the SHISEIDO brand and increasing strategic marketing investments.

- Continuously enhancing Clé de Peau Beauté, NARS, and fragrance brands.

- Focusing on high-function, high-efficiency product categories.

- Increasing Drunk Elephant brand awareness, highlighting functionality in promotions, and strengthening joint marketing activities with retailers.

By market, Japan and the EMEA (Europe, Middle East, and Africa) regions achieved double-digit growth, but this was offset by declines in travel retail, the Chinese Mainland, and the U.S. markets.

The Japanese domestic market remained stable, with net sales growing 13.3% year-on-year to JPY 141.52 billion, accounting for 27.8% of total sales. This was primarily due to stable domestic demand and the increase in inbound tourists. During the period, the group implemented the “Mirai Shift NIPPON 2025” business transformation plan in the domestic market, focusing on high-growth, high-profit brands and products, as well as expanding consumer touchpoints, driving continuous growth. Core brand clusters led by SHISEIDO, Clé de Peau Beauté, and ELIXIR achieved strong growth, driven by a steady increase in the number of loyal customers.

Net sales in the Chinese Mainland market grew 0.8% year-on-year to JPY 131.67 billion, accounting for 25.9% of total sales. Comparable sales declined by 6.6%, and at constant exchange rates, sales decreased by 7.6% year-on-year. In the Chinese Mainland market, the group is transitioning from a growth model driven by large-scale promotions to a more sustainable model focused on “value-based brand and product communication aligned with consumer needs.” During the period, comparable sales of Clé de Peau Beauté and NARS achieved steady growth and led the market during the 618 shopping festival, but the SHISEIDO brand was still affected by the discharge of nuclear wastewater.

In the Asia-Pacific market, net sales grew 12.3% year-on-year to JPY 34.45 billion, accounting for 6.8% of total sales. Comparable sales grew by 5.9%, and at constant exchange rates, sales increased by 3.3% year-on-year, mainly driven by the growth in the Thai market and the strong performance of the ANESSA, Drunk Elephant, and SHISEIDO brands in this market.

The Americas market grew 8.4% year-on-year to JPY 57.26 billion, accounting for 11.3% of total sales. Comparable sales declined by 5.4%, and at constant exchange rates, sales decreased by 3.9% year-on-year. While the SHISEIDO and narciso rodriguez brands showed growth, this was offset by reduced shipments due to temporary production declines of NARS and Drunk Elephant.

In the EMEA (Europe, Middle East, and Africa) market, net sales grew 19.5% year-on-year to JPY 62.81 billion, accounting for 12.4% of total sales. Comparable sales grew by 11.8%, and at constant exchange rates, sales increased by 5.9% year-on-year. SHISEIDO achieved steady growth, and fragrance brands led by narciso rodriguez, as well as Drunk Elephant, experienced strong growth.

The travel retail market declined by 13.7% year-on-year to JPY 66.85 billion, accounting for 13.1% of total sales. Comparable sales fell by 22.7%, and at constant exchange rates, sales decreased by 22.6% year-on-year. The growth in the number of inbound tourists to Japan drove a strong recovery in the Japanese market, but in Hainan Island, China, and South Korea, changes in Chinese tourists’ purchasing behavior led to a decline in sales due to decreased shipments.

Other markets saw a 43.8% year-on-year decline in net sales to JPY 13.98 billion, accounting for 2.7% of total sales. Comparable sales grew by 23.8%, but at constant exchange rates, they declined by 44.9% year-on-year.

Shiseido’s forecast for the fiscal year ending December 31, 2024, is:

- Net sales decline by 2.8% year-on-year to JPY 1 trillion

- Profit before tax decreases by 4.7% year-on-year to JPY 32.5 billion

- Net profit attributable to shareholders drops by 1.1% year-on-year to JPY 22 billion

*Note: At time of writing, 100 Japanese Yen = 0.68 USD

| Source: Official press release

| Image Credit: Brand official website

| Editor: LeZhi