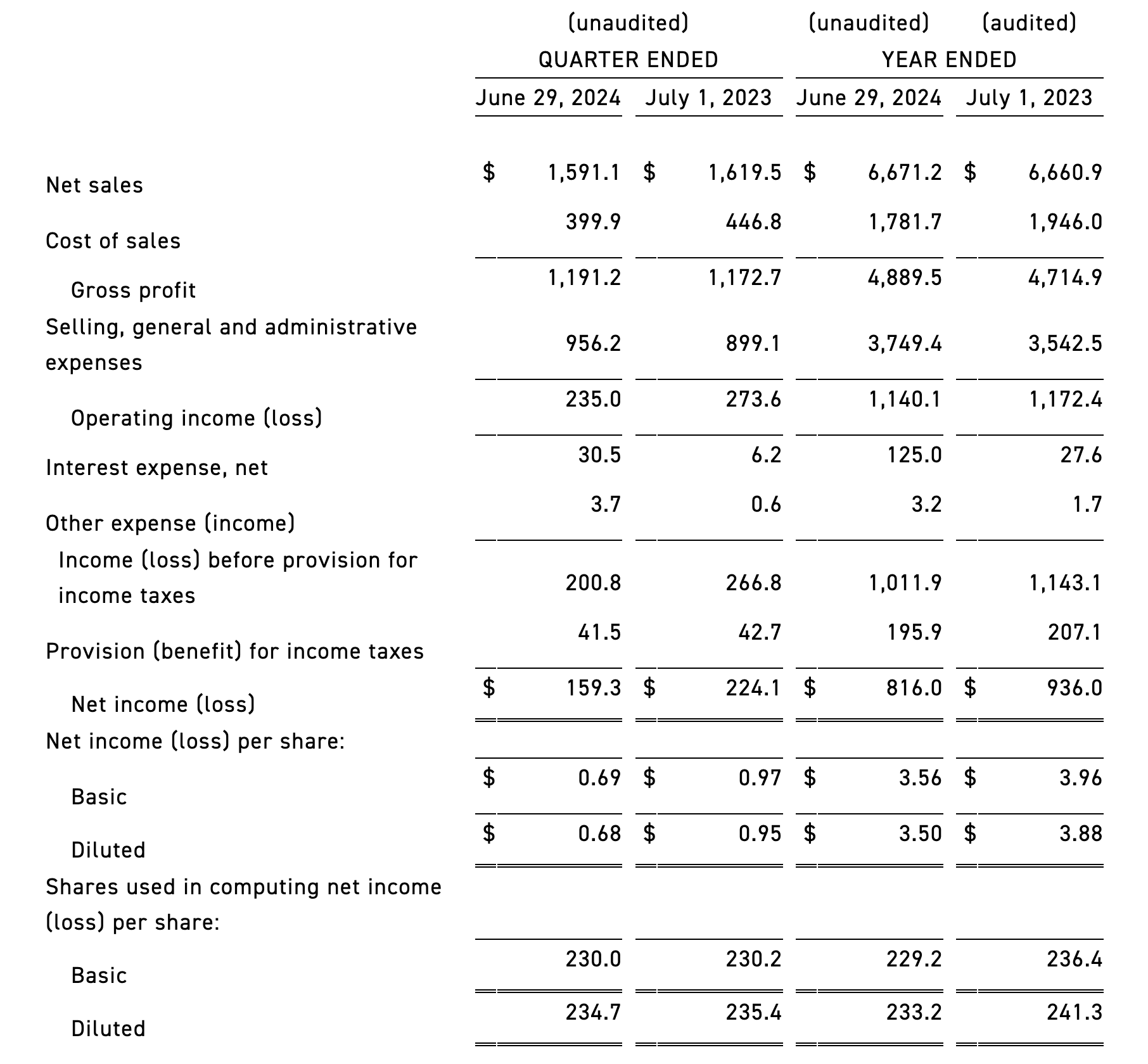

Before the opening bell on August 15th Eastern Time, Tapestry, Inc. (NYSE: TPR), the American affordable luxury brand group that owns Coach, Kate Spade, and Stuart Weitzman, released its full-year financial report for fiscal year 2024, ending June 29, 2024. The company reported a net sales revenue of $6.67 billion, a 1% increase year-over-year on a constant currency basis. Benefiting from lower freight costs, operational improvements, and favorable foreign exchange rates, the gross margin increased from 70.8% to 73.3%. In the fourth quarter, net sales revenue declined by 2% year-over-year to $1.59 billion, but remained flat on a constant currency basis compared to the same period last year.

Joanne Crevoiserat, CEO of Tapestry, Inc., commented: “Our fourth quarter results exceeded expectations, capping a successful year. This is a testament to our passionate global teams whose creativity and exceptional execution continue to fuel our brands and business. Importantly, through an unwavering focus on powering innovation and consumer connections, we meaningfully advanced our strategic agenda in fiscal year 2024, delivering strong financial results against a dynamic backdrop. From this position of strength, we have a bold vision for the future and a steadfast commitment to drive growth and shareholder value for years to come.”

Following the report, Tapestry’s stock price rose by 3.27% to $39.20 per share by the close of trading on August 15th, with a current market value of approximately $9.3 billion.

In fiscal 2024, the group continued to advance its strategic priorities. Despite a complex global economic and consumer environment, the group achieved revenue growth (on a constant currency basis), significant gross margin expansion, double-digit growth in adjusted earnings per share, and strong cash flow.

Key operational highlights for Tapestry during the reporting period include:

- Building Lasting Customer Relationships

- The group enhanced customer engagement, acquiring over 6.5 million new customers in North America alone, with more than half from Gen Z and Millennials.

- Strong Global Growth

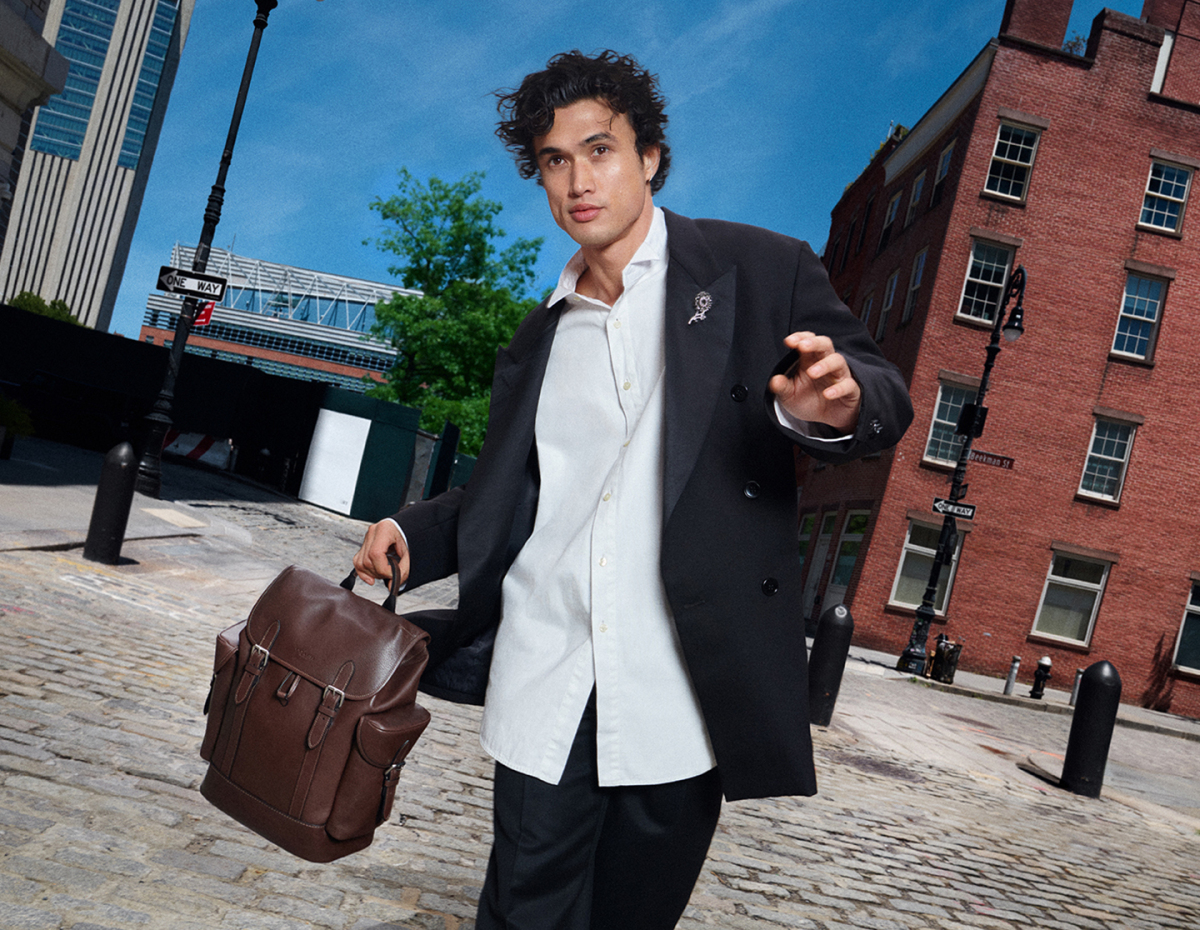

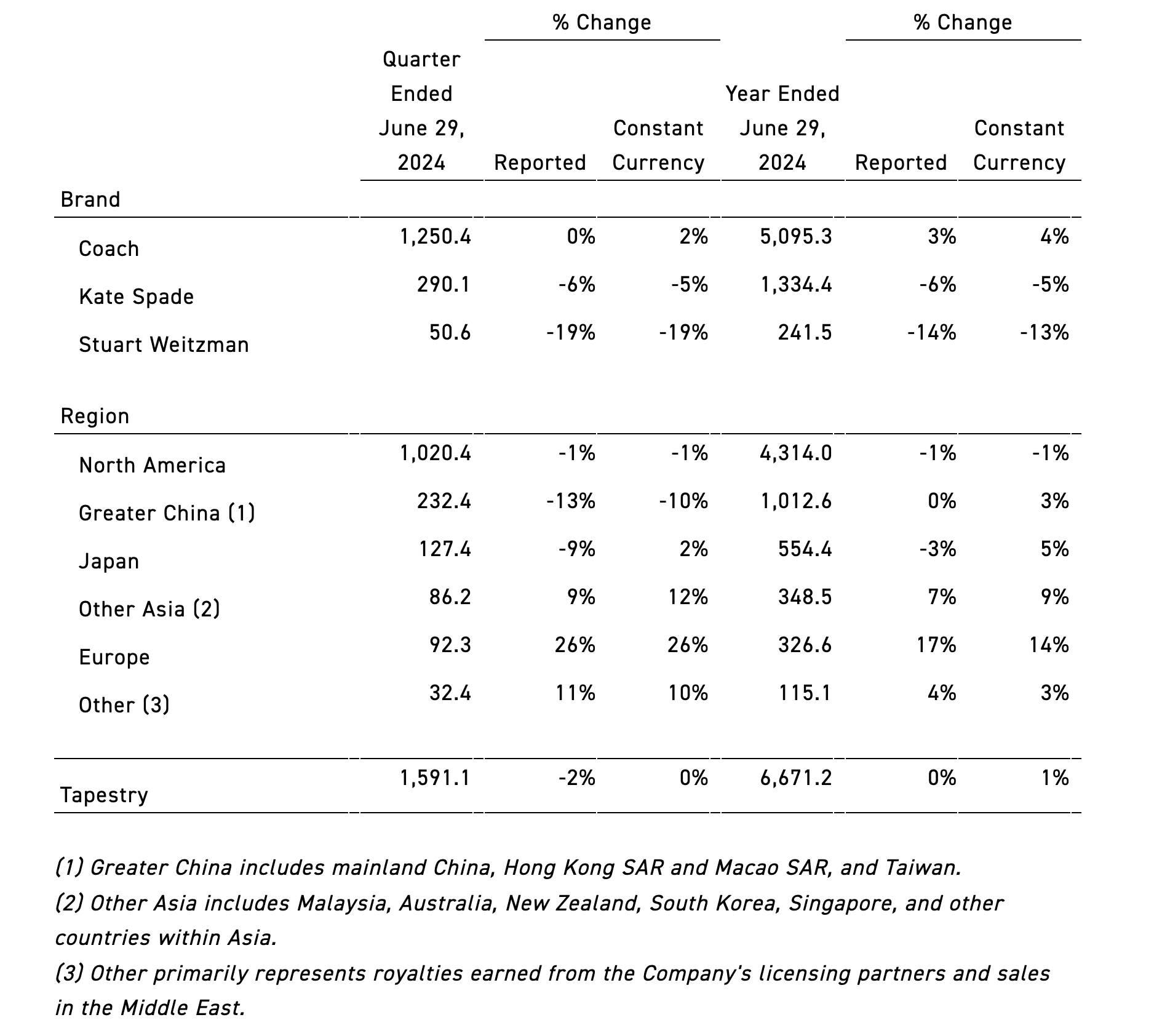

- Fiscal 2024 sales revenue increased by 1% on a constant currency basis, with Coach sales surpassing $5 billion for the first time, setting a new record.

- On a constant currency basis, international market revenue grew by 6%, with Europe (+14%), other parts of Asia (+9%), Japan (+5%), and the Greater China region (+3%) all recording year-over-year growth.

- In North America, sales declined by 1%, but the region saw improved operating margins and profits due to gross margin expansion.

- Double-digit growth in adjusted diluted earnings per share was achieved, exceeding expectations.

- The group generated strong operational and free cash flow of over $1.1 billion in fiscal 2024, supporting its strategic growth agenda.

- Delivering Compelling Omnichannel Experiences

- On a constant currency basis, direct-to-consumer sales revenue remained flat compared to the previous year; wholesale revenue growth was primarily driven by international business, including digital platform expansion.

- Annual global brick-and-mortar sales revenue grew on a constant currency basis, driven by increased productivity per square foot; immersive retail experiences and new concepts were introduced globally, enhancing awareness and engagement among younger customers.

- The group maintained a strong digital presence, with digital channel revenue more than triple pre-pandemic levels, accounting for nearly 30% of fiscal year sales.

- Driving Fashion Innovation and Product Excellence

- The group offered consumers a compelling and distinctive product portfolio, with Coach maintaining strong momentum, driving growth in handbag revenue and average unit retail (AUR).

- As brand builders and operators, the group achieved a strong gross margin expansion of 250 basis points, benefiting from lower freight costs, excellent operational performance, and favorable foreign exchange rates.

- Leveraging Tapestry’s customer engagement platform, the group embedded data-driven insights into the merchandising process, enabling agile inventory management.

As of June 29, 2024, Tapestry Group’s key financial data for the full year are as follows:

- By Brand and region

Based on these results, the group has released its full-year outlook for fiscal year 2025:

- Revenue in the area of $6.7 billion, representing growth compared to the prior year on a reported basis, including approximately 50 basis points of currency pressure. On a constant currency basis, revenue is expected to increase approximately 1% versus prior year;

- Operating margin expansion in the area of 50 basis points compared to prior year;

- Net interest income of approximately $20 million;

- Tax rate of approximately 19%;

- Weighted average diluted share count of approximately 238 million shares;

- Earnings per diluted share of $4.45 to $4.50, representing mid-single digit growth compared to the prior year. This incorporates a negative impact of $0.35 related to the suspension of share repurchase activity due to the proposed acquisition of Capri Holdings Limited, as previously outlined, and an estimated currency headwind of approximately $0.20 versus the Company’s Fiscal 2025 EPS target as provided at its Investor Day in 2022;

- Free cash flow of approximately $1.1 billion, excluding deal-related costs.

| Source: Official Financial Report

| Image Credit: Official Group Website

| Editor: LeZhi