On October 23, Italian luxury goods group Salvatore Ferragamo Group (traded on the Milan Euronext under the ticker: SFER) released its financial results for the third quarter and the first nine months ending September 30. Total revenue for the third quarter reached €221 million, representing a year-on-year increase of 1.7% at constant exchange rates and flat growth at current exchange rates, mainly driven by the strong performance of the DTC (direct-to-consumer) channel.

In the third quarter, net revenue in the Asia-Pacific market declined by 10.5% year-on-year at constant exchange rates. However, performance showed improvement compared to the second quarter.

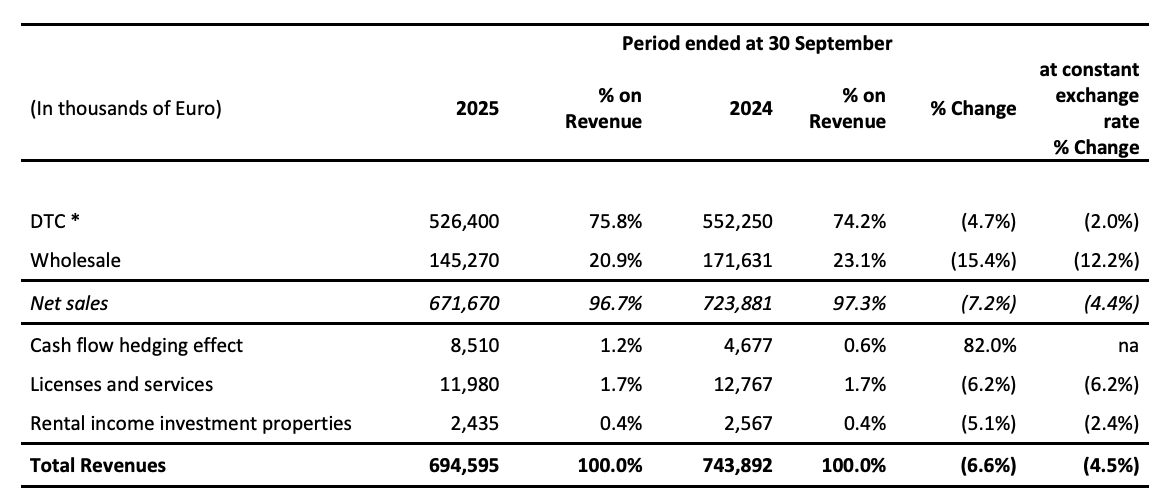

For the first nine months of 2025, Ferragamo Group reported total revenue of €695 million, a 4.5% decline year-on-year at constant exchange rates and a 6.6% decline at current exchange rates.

As of the market close on October 23, Ferragamo’s share price was €6.27 per share, nearly unchanged from the previous trading day, with a current market capitalization of approximately €1.168 billion. Over the past 12 months, the Group’s share price has risen by 5.68%.

Ferragamo stated that since the second quarter of this year, it has conducted and completed a comprehensive business diagnostic assessment to ensure full alignment across design, product, communications, and distribution channels. Over the past three months, the Group has continued to focus on its core business priorities and is gradually implementing the necessary transformations as part of its new strategic initiatives.

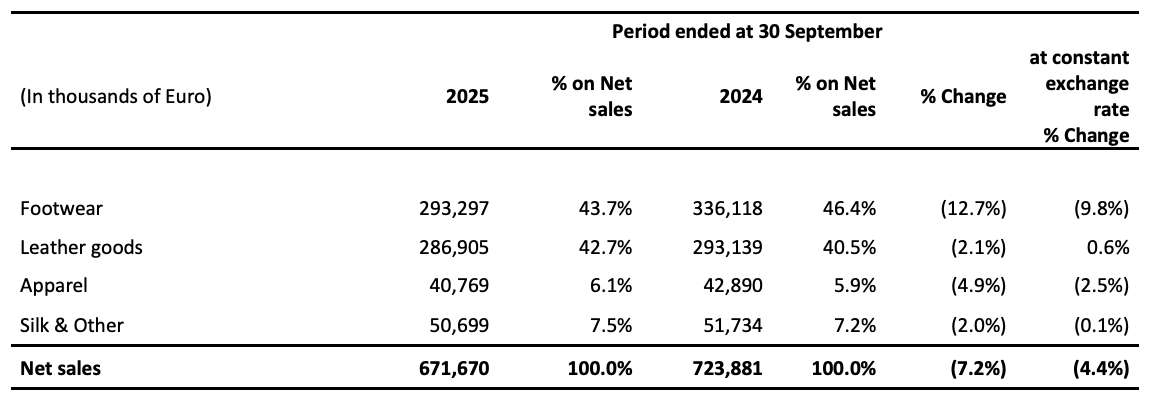

In terms of product offerings, the Group is further strengthening its collections, with a particular emphasis on its two core categories: footwear and leather goods. While balancing heritage with innovation, Ferragamo aims to enhance operational efficiency across its product lines. In the handbags category, the Hug line has steadily become a new pillar of the brand. In women’s footwear, the successful launch of the new Vara collection has further enriched the product matrix.

On the communications front, the Group is adopting new technologies that support precise targeting and improved efficiency to reinforce its core brand values and narrative (as conveyed through pre-fall and fall/winter campaigns), thereby enhancing brand storytelling. With a “digital-first” strategy that covers all consumer touchpoints, Ferragamo is showcasing both its heritage and modern creativity. These campaigns highlight the brand’s renewed focus on craftsmanship and reinterpretation of timeless elegance.

These early-stage initiatives have driven strong performance in the DTC channel this quarter, supported by factors such as increased average transaction value, improved cross-selling effectiveness, the application of innovative technologies to customer segmentation, and effective customer relationship management strategies. Solid results in North America, Europe, and Latin America largely offset the challenges in the Asian luxury market — although Asia’s performance has already improved quarter-on-quarter compared to Q2.

During an analyst call, Ernesto Greco, member of the Executive Board, noted that the small leather goods and accessories category performed well, thanks in part to optimized in-store product presentation across key retail locations. In markets such as the United States, Ferragamo not only retained its existing customer base but also successfully attracted new consumers in the 30–35 age demographic. In September 2025, Ferragamo also received strong recognition from both media and clients for its Spring/Summer 2026 collection presented at Milan Fashion Week.

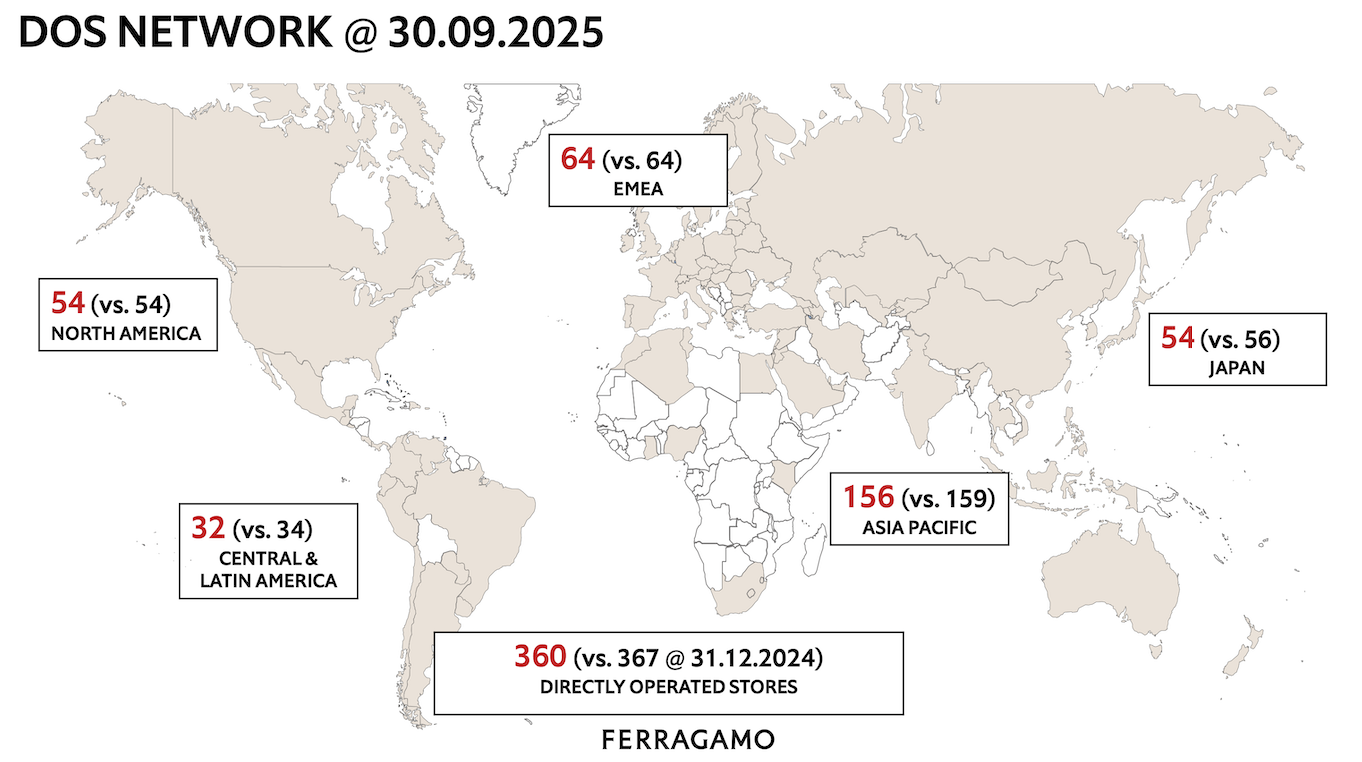

As of September 30, 2025, Ferragamo operated 360 directly owned stores across more than 100 countries worldwide.

Ernesto Greco acknowledged that the fourth quarter remains challenging but expressed optimism about maintaining positive momentum. “So far, October’s DTC performance is slightly above that of Q3, which gives us reason for cautious optimism regarding future trends.”

Despite acknowledging continued uncertainty in the geopolitical and macroeconomic environment, the Group will persist with its strategic initiatives: strengthening market positioning, deepening the connection between its brand DNA and creative capabilities, and ensuring alignment across design, product supply, communications, and distribution channels with customer expectations. Ferragamo believes that with the progressive rollout of new product lines, these efforts will yield more tangible results over the next few quarters.

Going forward, the Group will continue to drive the business with operational agility and financial discipline, adjusting cost structures and business processes as needed — without compromising brand desirability or future growth potential.

By Distribution Channel:

- At constant exchange rates, consolidated net sales through the DTC channel increased by 4.4% year-on-year in the third quarter. Compared to Q2, this quarter saw an acceleration in growth, mainly driven by double-digit gains in the North American and Latin American markets, as well as positive performance in Europe, together offsetting the negative results in Asia.

- E-commerce continued to deliver strong double-digit net sales growth in the third quarter, driven by the robust performance of Ferragamo’s official website, where both order volume and order value increased.

- The wholesale business remained weak in Q3, with net revenue declining 6.7% year-on-year. Despite positive results in the North American market, these were offset by negative performance in other regions, resulting in an overall downward trend.

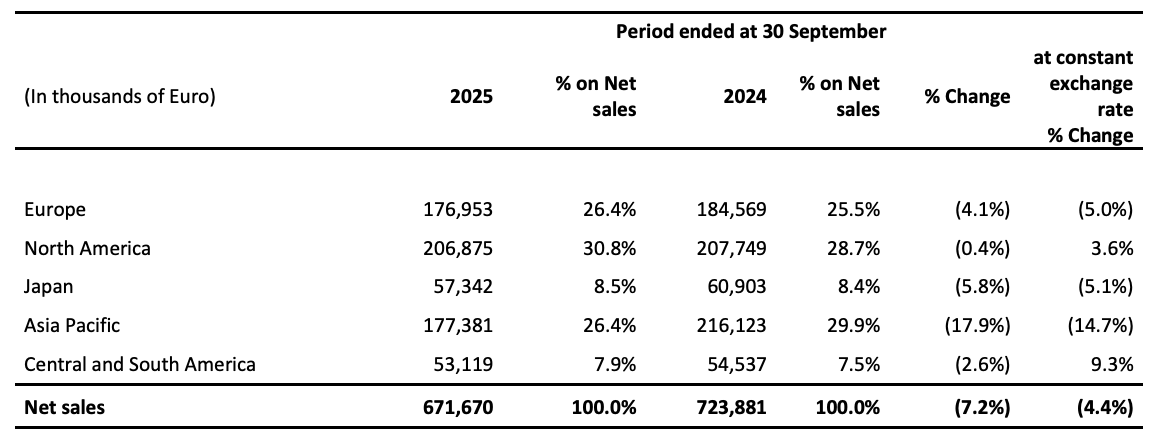

By Geographic Region:

-

EMEA: Net revenue increased by 2.8% year-on-year at constant exchange rates in Q3, mainly supported by higher foot traffic and improved conversion rates in the DTC channel.

-

North America: Net revenue rose 15.6% year-on-year at constant exchange rates. The DTC channel achieved double-digit growth, driven by a 16.0% year-on-year increase in core channel revenue, alongside a double-digit rise in average transaction value. The wholesale business also posted double-digit growth, reversing the weakness seen in the first half of 2025.

-

Japan: Net revenue declined 5.4% year on year at constant exchange rates, still impacted by subdued spending by Chinese tourists.

-

Asia-Pacific: Net revenue declined 10.5% year-on-year at constant exchange rates in Q3, but performance showed quarter-on-quarter improvement from Q2. The DTC channel was the key driver, with the rate of decline narrowing to low single digits.

-

Latin America: Net revenue increased 4.7% year-on-year at constant exchange rates, despite a high comparison base. The DTC channel maintained double-digit growth at constant exchange rates, while the wholesale business continued to decline.

By Product Category:

|Source: Official Financial Report

|Image Credit: Official Financial Report

|Editor: LeZhi