According to the Italian media MFFashion, Italian luxury bedding brand Frette has changed its owner. Private equity investment fund Change Capital Partners has sold its 100% ownership of Frette to Raza Heritage Holdings, a consortium of strategic and private equity investors. Frette, founded in 1860, has a history of 163 years.

Bloomberg reports, that Raza Heritage Holdings is a Chinese consortium led by Ding Shizhong, the Chairman of ANTA Sports. The transaction is valued at approximately 200 million euros.

Insiders mention that Ding Shizhong participated in the transaction through a personal investment tool, and the deal is unrelated to ANTA Group. This Chinese consortium also includes Hong Kong businesswoman Adrienne Ma, whose parents are the founders of the renowned Hong Kong luxury fashion store JOYCE, Walter Ma, and Joyce Ma.

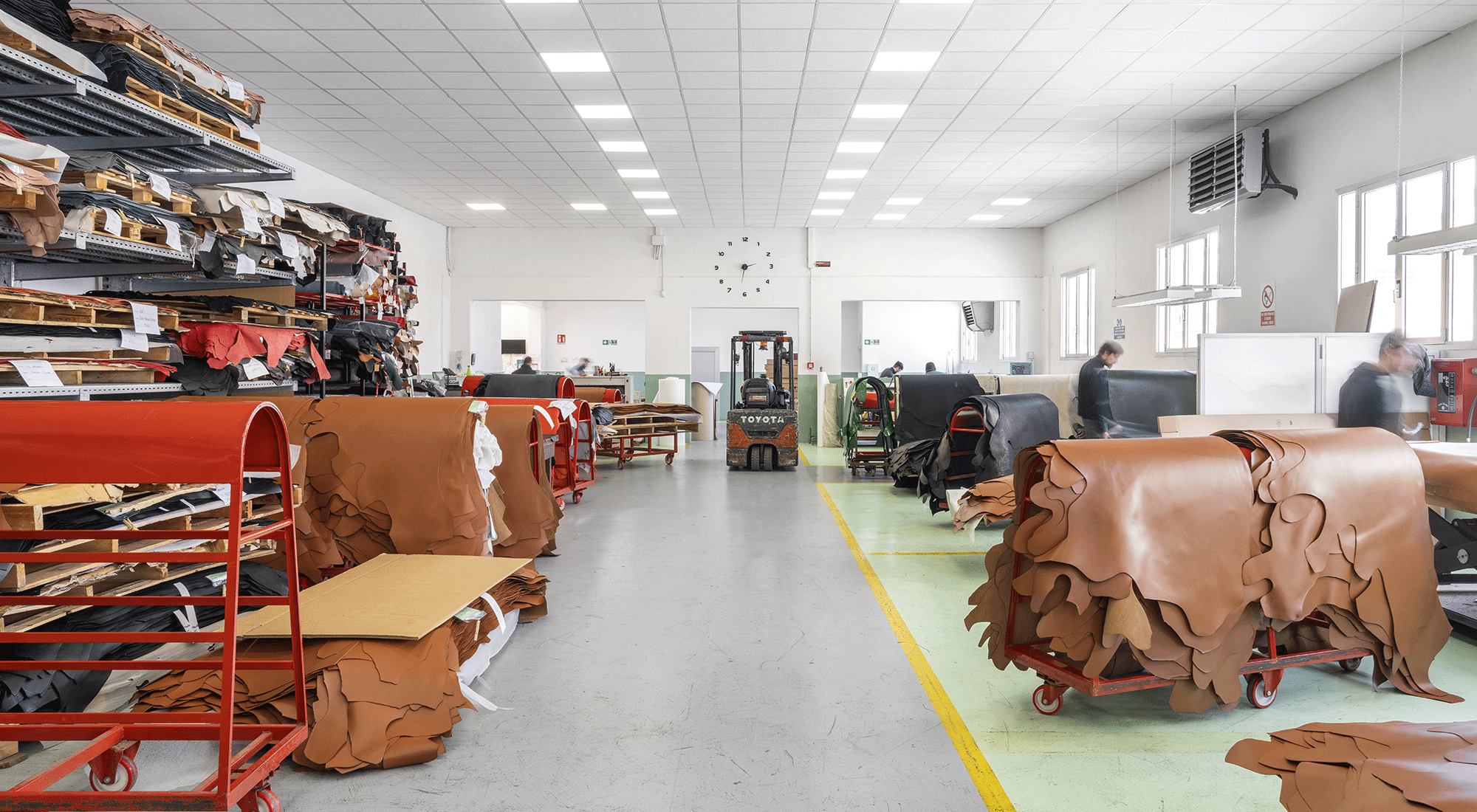

Founded in 1860 by Jean Baptiste Edmond Frette, Alexandre Payre, and Charles Chaboud, Frette has provided top-quality bed linens to European royalty, the Vatican, top hotels, and luxury cruise liners. Notably, in 1912, the luxury cruise liner Titanic used their products to furnish its first-class cabins.

Today, Frette is a supplier to several five-star hotels, including the Ritz in Paris, the Plaza in New York, the Peninsula in Hong Kong, and the Mandarin Oriental in Hong Kong, among others. Frette’s business is divided into two parts: one serves retail customers through boutiques and shops, while the other serves corporate clients like hotels and airlines under the GUEST at FRETTE brand.

Frette remained a family business until it was acquired by the Italian industrial group Fin.part in 1999, which also owned the Italian men’s fashion brand Cerruti 1881 at the time.

In 2004, Fin.part sold Frette to JH Partners, a private equity investment firm based in San Francisco, which specialized in consumer brands and also owned the Italian luxury lingerie brand La Perla at the time.

In 2014, the London-based private equity fund Change Capital Partners acquired Frette from JH Partners, which retained a minority stake in the company after the transaction. At that time, Frette had an annual turnover of approximately 90 million euros.

It’s worth noting that Change Capital Partners was founded by Luc Vandevelde, the former Chairman of Marks & Spencer. He aimed to replicate the success of turning around Jil Sander. In 2006, Change Capital Partners acquired Jil Sander from Prada, and after turning it into a profitable venture in 2008, they sold it to the Japanese clothing manufacturer Onward Holdings.

In 2021, Frette achieved a turnover of 100 million euros, marking a historic high, with a 40% growth compared to 2020 and a 4% increase compared to pre-pandemic 2019. The earnings before interest, taxes, depreciation, and amortization (EBITDA) reached 13%, and more than 80% of the company’s sales came from overseas markets. The company stated its intention to continue expanding its product line beyond just bedding.

Additionally, Frette CEO revealed the latest data in 2022, indicating a revenue of 128 million euros, with 45% coming from direct-to-consumer channels, 15% from wholesale, and 40% from B2B hotel revenue.

In spring this year, Luxe.CO Intelligence, a fashion industry research institute under Luxe.CO published a new research report titled “Italian Fashion Brands in China,” covering 123 of the most representative Italian brands, with Frette being one of the 13 brands in the home and lighting category. According to Luxe.CO Intelligence’s research, Frette is also among the 12 Italian “treasured brands” highly recommended by Chinese consumers.

In January, ANTA Group announced adjustments to its executive management functions to align with its strategic direction. Ding Shizhong would step down as CEO but continue as Chairman of the Board, playing a core leadership role in the group’s strategy, talent development, corporate culture, and business oversight, including internal audit and inspection functions, as well as mergers and acquisitions.

Furthermore, earlier this month, Bloomberg reported, citing insiders, that ANTA’s subsidiary Amer Sports had applied for an IPO in the United States, aiming to go public as early as next year with a valuation potentially reaching $10 billion or more. The IPO aims to raise over $1 billion, and banks like Bank of America, Goldman Sachs, JPMorgan, and Morgan Stanley may be involved as underwriters. ANTA Group’s representatives responded to market rumors by stating that they would not comment on them.

In the first half of this year, ANTA Group’s “Single Focus, Multi-brands, Globalization” strategy yielded results, with revenue increasing by 14.2% year-on-year to 29.65 billion yuan (approximately 4.64 billion euros), doubling compared to the same period in 2019. Net profit also saw a significant increase of 39.8% year-on-year to 5.26 billion yuan (approximately 821 million euros).

| Sources: Italian media MFFashion, Bloomberg

| Image Credit: Frette Official Website

| Editor: LeZhi