Deloitte released the tenth edition of the “Global Powers of Luxury Goods 2023” report, analyzing the sales performance of the world’s top 100 luxury companies in various geographical and product sectors, based on their consolidated sales for the 2022 fiscal year. The report also delves into the trends of the luxury goods market.

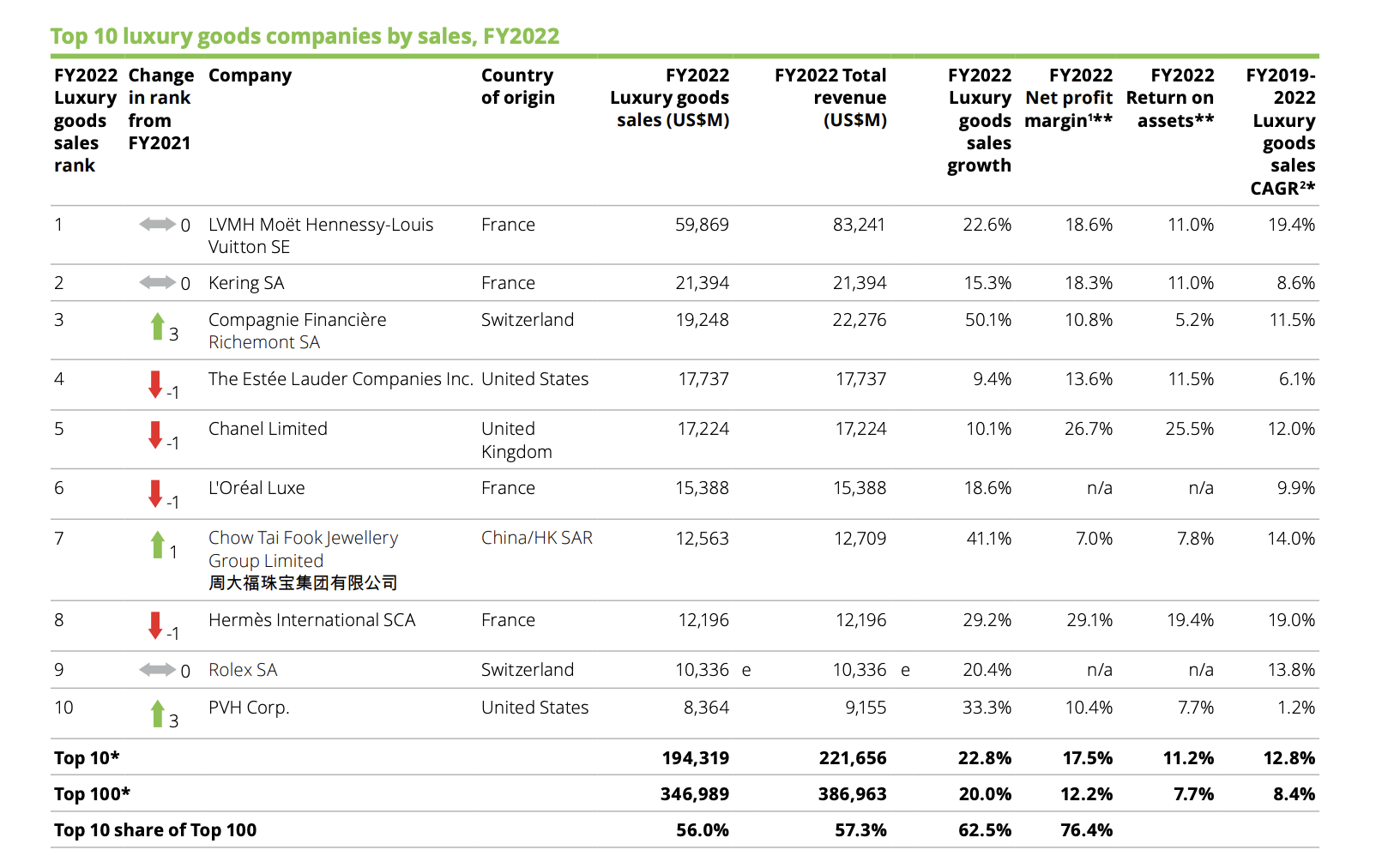

In the 2022 fiscal year, the top 10 luxury companies globally are: LVMH Moët Hennessy Louis Vuitton (same as last year), Kering (same as last year), Richemont (up 3 places from last year), Estée Lauder Companies (down 1 place from last year), Chanel (down 1 place from last year), L’Oréal Luxe (down 1 place from last year), Chow Tai Fook Jewellery Group Limited (up 1 place from last year), Hermès (down 1 place from last year), Rolex (same as last year), and PVH Corp (up 3 places from last year).

The Top 10 companies in the Global Powers of Luxury Goods Ranking and their share of total sales in the list

The main highlights of the report are as follows:

- In 2022, the dominance of the top 10 luxury companies slightly declined, accounting for 38.4% of the total sales of the top 100 luxury companies, down from 56.2% the previous year.

- In 2022, the minimum annual sales revenue to enter the top 100 luxury companies was $284 million, higher than the previous year’s $240 million.

- From the 2019 to 2022 fiscal years, the top 20 fastest-growing luxury companies had a compounded annual growth rate of 18.3%, more than double the overall rate for the top 100 luxury companies.

- The apparel and footwear sectors had the most companies in the top 100, totaling 37.

- In the 2022 fiscal year, 91 out of the top 100 luxury companies reported growth in luxury goods sales (compared to 72 in 2021 and 23 in 2020), with 77 companies reporting double-digit sales growth.

- In the 2022 fiscal year, 80 of the top 100 luxury companies had a higher net profit margin than the previous year by 1.2 percentage points, reaching 13.4%, which is also higher than the pre-pandemic level.

The apparel and footwear industry dominates the top 100 luxury goods companies with 37 enterprises

Emerging Brands

This year, six new companies entered the top 100 luxury goods companies list: Malabar Gold & Diamonds (India), Swarovski Crystal Business (Switzerland), DR Corporation Limited (China), Senco Gold Limited (India), Look Holdings Incorporated (Japan), and Thangamayil Jewellery Limited (India).

Except for Look Holdings Incorporated, the rest of the new entrants are all jewelry and watch companies, with four of these companies originating from India and China. The highest-ranked among the new entrants is Malabar Gold & Diamonds, positioned at 19th.

Five of the six new entrants in this year’s top 100 luxury goods companies list are participants in the jewelry and watch industry.

*Note: In the table, bold company names indicate those that are newly listed due to sales growth (in USD), company restructuring, or previously listed in the top 100. Other companies are new to the top 100 due to improved data.

Regional Highlights

In this year’s top 100 luxury goods companies list, 10 companies are from China (including Mainland, Hong Kong, and Taiwan): Chow Tai Fook Jewellery Group Limited (ranked 7th, up 1 from last year), Lao Feng Xiang Co., Ltd. (ranked 11th, up 1 from last year), China Gold Group Jewelry Co., Ltd. (ranked 13th, down 3 from last year), Chow Sang Sang Holdings International Limited (ranked 29th, down 3 from last year), Luk Fook Holdings (International) Limited (ranked 44th, up 7 from last year), Chao Hong Ji Industrial Co., Ltd. (ranked 70th, down 5 from last year), DR Corporation Limited (ranked 77th, new to the list), Zhejiang Mingpai Jewelry Co., Ltd. (ranked 77th, down 10 from last year), Lanvin Group (ranked 81st, same as last year), and TSL Jewelry (ranked 94th, down 8 from last year).

Similar to the six companies from India, most of the Chinese companies on the list are vertically integrated jewelry retailers. This reflects the significance of China and India as leading markets in global gold and jewelry consumption.

Italy continues to lead in the number of companies in the top 100 luxury goods companies, with 23 companies, accounting for 32.4% of the top 100. However, these 23 Italian companies only account for 7.8% of the sales of the top 100 luxury companies.

According to the report, among the 23 Italian companies in the top 100 global luxury goods, Prada (ranked 18th), Moncler (ranked 27th), and Giorgio Armani (ranked 30th) are the top three Italian luxury goods companies in terms of ranking. Their combined sales account for 35% of the sales of the listed Italian luxury brands in the 2022 fiscal year.

Additionally, the average growth rate of the listed Italian companies is 19.4%, slightly lower than the average for the top 100 luxury goods companies globally. However, most of these companies are profitable, with Prada, Moncler, Max Mara, Euroltalia, Liu.Jo, De Rigo, and Morellato all achieving double-digit profit margins.

Notably, Golden Goose is the fastest-growing Italian company on the list.

In contrast, while Italy leads in the number of listed companies, France dominates in luxury goods sales: the seven French luxury goods companies on the list (four of which are in the top 10) account for nearly one-third (32.3%) of the total sales of the top 100 luxury goods companies, solidifying its leadership in the luxury goods sector.

The seven French companies and their specific rankings are LVMH Group, Kering, L’Oréal Luxe, Hermès, Clarins Group (ranked 38th, down 3 from last year), SMCP Group (ranked 50th, down 6 from last year), Zadig & Voltaire (ranked 87th, down 2 from last year). Additionally, the French luxury brand Chanel (ranked 5th, down 1 from last year), with its headquarters relocated to London, is counted among the UK companies.

Investment Trends

Following a surge in 2021, mergers and acquisitions activity among the top 100 luxury goods companies slowed slightly in 2022 and the first eight months of 2023. The Deloitte Global Fashion and Luxury Private Equity and Investors Survey 2023 report indicates a decrease of 30 transactions in 2022 compared to 2021. The beauty and fragrance sector is considered the most attractive for investors in 2023, followed by apparel and accessories.

Beyond in-depth analysis of the top 100 luxury goods companies and assessing their performance across regions and product sectors, the report also reviews and forecasts the recent and future development directions of the luxury goods industry, exploring trends reshaping the luxury market:

— Recovery and Transformation

The report states that luxury companies have not only returned to pre-pandemic profitability levels but are also transitioning towards environmentally friendly and circular economy business models. This shift is driven by customer demand and increasing regulatory pressure, with technology playing a key role in accelerating this green transformation.

The luxury industry, synonymous with uniqueness, craftsmanship, and innovation, is now actively embracing cutting-edge digital technologies such as Artificial Intelligence (AI), Machine Learning, and the Internet of Things (IoT). These innovations are changing customer experiences and having a revolutionary impact on sustainability, supply chains, and product authenticity.

— Embracing Artificial Intelligence (AI)

This year’s report emphasizes that the luxury industry views AI and the circular economy as game-changing forces. The ongoing transformation in the luxury industry is expected to redefine the sector, enhance customer experience, and promote sustainable development. As technology merges with luxury, the possibilities for the future are limitless.

AI, in particular, is emerging as a pivotal tool in the luxury industry. Luxury brands are using AI to offer personalized product recommendations, styling advice, and real-time customer support through chatbots and virtual shopping assistants powered by Generative AI (GenAI), aiming to create a more unique and enjoyable shopping experience.

— Moving Towards a Circular Economy

The luxury industry is also moving towards a circular economy model, a trend supported by AI and technology. The industry is deploying Digital Product Passports (DPP) and digital IDs to record the sustainability and recyclability of products throughout their lifecycle, from design to end-of-life. The benefits of these initiatives are multifaceted, including increasing consumer trust, improving brand sentiment, reducing greenwashing risks, comprehensive product tracking, reducing the number of goods in circulation, and exploring potential new business models.

One of the report’s authors, Giovanni Faccioli, Deloitte Global Fashion and Luxury Industry Leader, emphasizes the stability of the luxury industry compared to last year. He also highlights the importance of luxury companies reshaping themselves, including process innovation, supply chain circularity, compliance with new ESG regulations, and adaptation to ongoing major technological changes, which will be crucial in the coming years.

| Source: Deloitte’s Report

| Image Credit: Deloitte’s Report

丨Reporter:Ying Yuze

| Editor: Liu Jun