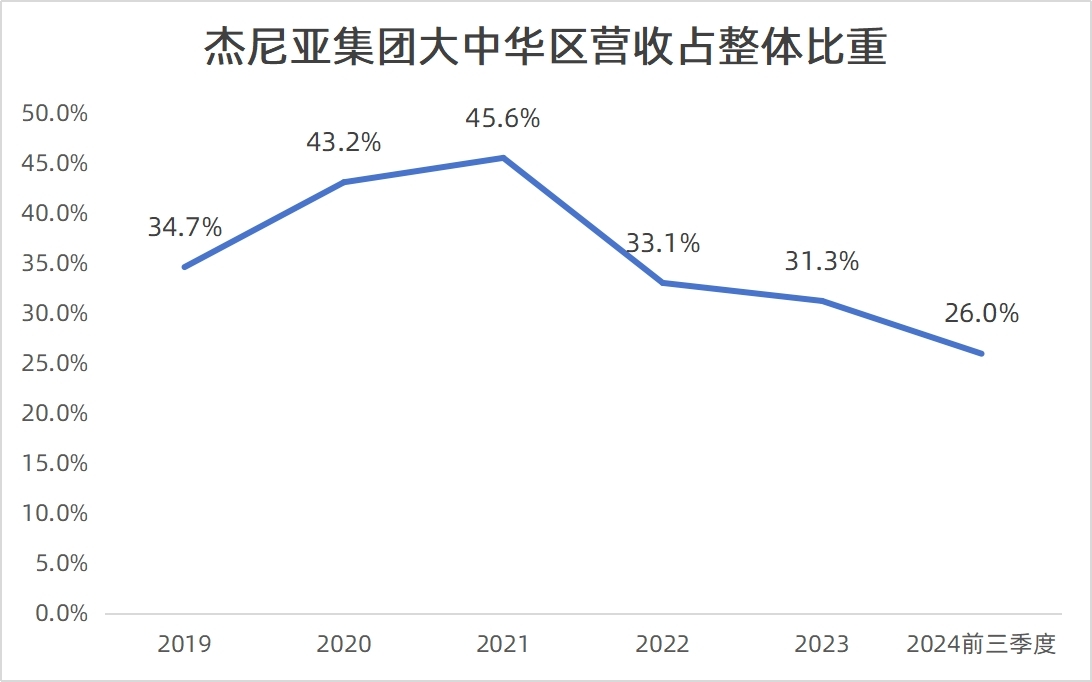

Upon reviewing Zegna Group‘s historical financial data released after its public listing (from 2019 to present), Luxeplace.com has noted that the Greater China region has consistently been Zegna Group’s largest single market over recent years, reaching a peak of 45.6% of global revenue in 2021. However, this proportion has declined steadily since then.

According to the latest financial report for the first three quarters of 2024, the Group’s revenue increased by 1.7% year-over-year to €1.357 billion but fell 4.0% on an organic basis. Revenue in Greater China dropped by 15.8% year-over-year to €353 million, a 14.6% decrease on an organic basis, accounting for 26% of the Group’s revenue. Although Greater China remains the largest single market, its significance has declined substantially compared to its peak in 2021.

The decline in Greater China’s revenue share can be partly attributed to Zegna Group’s acquisition of Tom Ford’s fashion business in April 2023, which has a lower share of the Chinese market. However, a more significant factor is that ZEGNA and Thom Browne brands have not grown as quickly in the Chinese market compared to other key regions such as North America, Europe, the Middle East, and Japan.

Revitalizing this major market has thus become a focal point in Zegna Group’s global strategy.

During a recent earnings call, Gildo Zegna, Chairman and CEO of Zegna Group, along with COO and CFO Gianluca Ambrogio Tagliabue, offered further insights into the Greater China market’s performance and shared some positive trends they’ve observed recently.

Tagliabue acknowledged that the decline in Greater China’s performance is primarily due to extremely low consumer confidence in the region, which further deteriorated in the summer, especially in August. However, among the Group’s three brands, ZEGNA’s performance in this market has remained above the Group average.

“Still, in terms of the ZEGNA brand’s direct-to-consumer (DTC) channels, conditions in Greater China continue to worsen, with foot traffic seeing a double-digit decrease. This impact has not been offset by a modest yet healthy increase in average transaction value.”

Regarding Chinese consumers, Tagliabue further confirmed that global spending by Chinese consumers declined by over 10% in the third quarter, primarily driven by the Chinese Mainland, where 90% of transactions occur locally.

“Of course, we have also seen some Chinese consumer spending abroad, mainly in Japan, with stable growth observed in this segment both year-round and in the third quarter.”

Gildo Zegna shared recent performance insights from the “Golden Week” holiday. For the Group, “Golden Week” results slightly exceeded expectations, showing improvement over the downward trend of the third quarter. Nevertheless, revenue remained below last year’s levels:

- ZEGNA attracted higher-quality traffic, meaning that despite a decrease in foot traffic, conversion rates and average transaction values improved, aligning with the strategy set for the brand.

- Thom Browne also showed initial positive signs, although they remain cautious about the overall outlook due to persisting uncertainties.

- The Tom Ford fashion business, with low exposure in China, saw limited impact from Golden Week.

During the meeting, analysts inquired about the weak consumer confidence in the Chinese market and its future trends.

In response, Gildo Zegna revealed his imminent trip to China, in which he is sure to gain more specific insights. This underscores the country’s importance and the Group’s strong belief in this crucial luxury market. He acknowledged the challenging period China has faced in 2024 and anticipated that these conditions would likely persist through the first half of 2025. Thus, he noted that expectations for both the ZEGNA and Thom Browne brands should remain cautious.

Gildo Zegna also shared some positive observations, stating, “This should give us more confidence in the long-term outlook.”

He noted that for the ZEGNA brand, they continue to see steady growth in ASP (Average Selling Price) and ATV (Average Transaction Value). The brand is attracting a younger customer base, driven not only by iconic products like the Triple Stitch but also by the brand’s broader appeal to new young clients.

“I believe this is a very, very strong signal, indicating that our new brand revitalization strategy is working,” he emphasized.

Zegna further explained that, compared to markets like the U.S., progress in China has been somewhat slower, yet traction is steadily increasing. The Group has refreshed its store network in China, securing prime locations in major shopping centers and building strong, trusted relationships with top landlords.

Regarding the ZEGNA brand, he identified the current challenge as enhancing store productivity. This may involve additional relocations in the coming years, but the foundational work is largely complete. For instance, they held the VILLA ZEGNA event in Shanghai, a personalized approach previously launched in New York to elevate the brand. Encouragingly, customers who attended VILLA ZEGNA have returned to physical stores for purchases, marking another important signal.

“In China, the key is establishing strong relationships with landlords. We are fortunate to be in touch with the right stakeholders, who trust our Group. This presents an opportunity to solidify our position as the Chinese market evolves,” he added.

Furthermore, their “uber-luxury” and bespoke services are growing, which is unique to Zegna. Unlike other luxury players, Zegna offers a distinctive culture of customization, with “uber-luxury” taking bespoke services to a higher level. Zegna believes this emphasis on ultra-luxury customization will also benefit their efforts in China.

Looking ahead at the Chinese market, Gildo Zegna emphasized the importance of targeting higher-spending clients. “You may recall that a significant portion of ZEGNA’s business was impacted during the pandemic, but thanks to the brand’s strength, we navigated through that period. Now, we are seeking clients with higher spending levels, and we have started to find them, although this will take some time. I believe we are on the right path.”

In addition to the ZEGNA brand, Gildo Zegna also discussed the progress of the Group’s Thom Browne and Tom Ford fashion businesses in China.

Gildo Zegna highlighted that significant efforts have been made in recent months to strengthen Thom Browne’s organizational structure, led by a skilled retail manager who has implemented numerous personnel changes to support new store openings. Recently, events were held in South Korea and Hong Kong, with another event three months ago in the Chinese Mainland, aimed at promoting Thom Browne’s refreshed image, which includes a focus on women’s wear, accessories, and enhanced personalization. “Remember, personalization is something all three of our brands believe in,” he noted.

He emphasized that these efforts go beyond event hosting; they are about creating exclusive spaces where customers receive one-on-one service, enjoying privacy and a sense of exclusivity. This approach has been well-received in both men’s and women’s lines, and Zegna believes Thom Browne is now positioned to achieve positive growth in 2025 to make up for the lack of growth in 2024.

As for Tom Ford Fashion, the situation is different. While the brand is strong in the United States, it still has a long way to go in Asia. Zegna noted that CEO Lelio Gavazza has prioritized the Asian market for 2025 growth. A recent example is the opening of Tom Ford’s first flagship store in China at the Beijing China World Mall in July.

Zegna added that it might take another quarter to fully realize the brand’s potential, particularly in women’s wear and accessories, with new designer Haider Ackermann on board. They anticipate that Tom Ford Fashion’s performance in the second half of 2025 will be stronger than in the first half.

In conclusion, Gildo Zegna summarized the strategies pursued across the Group’s three brands. He expressed confidence that, regardless of what happens in the Chinese market, the Group’s position in 2024 is stronger than ever before.

“As I mentioned, the ‘One Brand’ strategy is not just a label; it represents a profound cultural shift for our brand and store employees, moving from a transaction-driven focus to one centered on customer engagement. While we haven’t yet reached our goals in China, the path forward is clear, and we are now completing the final steps in that journey.”

| Source: Official Financial Report, Earnings Call

| Image Credit: Group’s Official Website

| Editor: LeZhi