On the afternoon of August 13, China’s men’s clothing brand LILANZ (China Lilang Limited, Stock Code: HK1234), listed on the Hong Kong Stock Exchange, announced its 2024 interim results: Revenue increased by 7.3% year-on-year to RMB 1.6 billion, and net profit rose by 3.6% year-on-year to RMB 280 million, achieving “double growth” in both revenue and profit once again.

It is worth noting that Lilang Group’s revenue in the first half of this year exceeded that of the first half of 2019 (RMB 1.54 billion), setting a new record.

In the face of an evolving market environment and increasingly diverse consumer demands, Lilang Group’s continued growth is driven by its steady and reliable strategy, gradually increasing the proportion of its DTC (direct-to-consumer) model and strengthening brand control.

Notably, Lilang Group made significant strides in its “multi-brand, internationalization” strategy: In August this year, it signed a joint venture agreement with partners, securing the operating rights for the Chinese market of the globally renowned golf apparel brand MUNSINGWEAR and expects to officially launch MUNSINGWEAR products next year. Additionally, the Group has registered a new company in Malaysia and is preparing to open its first overseas store there.

Lilang Group’s new image, characterized by being younger, more international, and having stronger brand control, is now emerging before the world.

Younger: Youth Business Series Continues High Growth, Reaching Consumers on Multiple Fronts

Currently, Lilang operates two brand lines: the main LILANZ series and the LESS IS MORE Youth Business Series (hereinafter referred to as “Youth Business Series” or “Light Business”). The main series primarily targets consumers aged 25 to 45 and is popular in traditional third- and fourth-tier cities, with plans to gradually expand in first- and second-tier markets. The Youth Business Series targets the market in first- and second-tier cities, focusing on urban youth aged 20 to 30.

According to the financial report, driven by store operations and new retail efforts, the Youth Business Series continued the growth momentum from the fourth quarter of last year, with revenue increasing by 17.3% year-on-year to RMB 387.7 million during the reporting period, contributing 24.2% to the Group’s revenue, up from 22.2% in the same period last year. The main series grew by 4.5% to RMB 1.2124 billion.

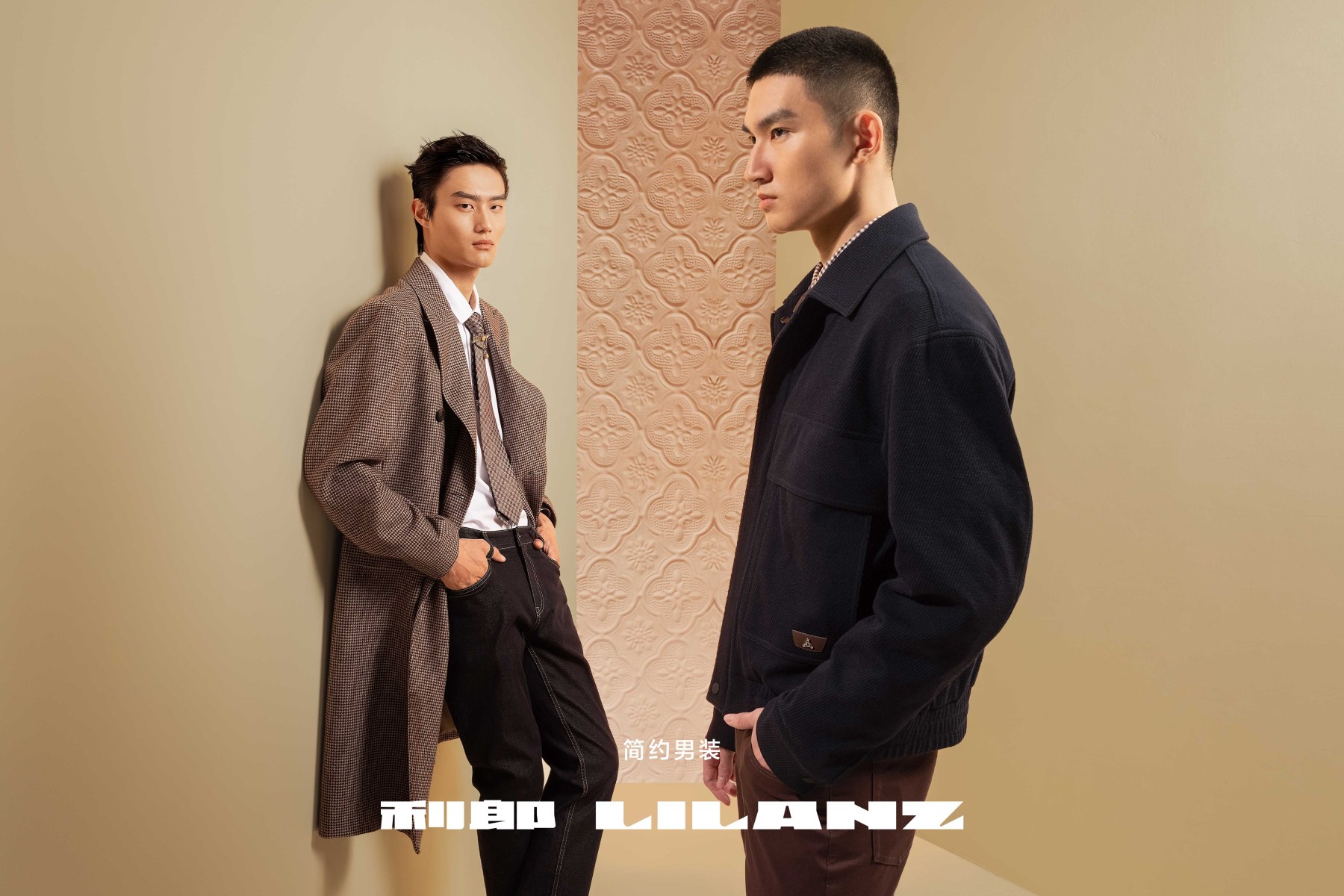

Lilang Group is also innovating in multiple dimensions, including products, channels, and brand image, to respond to the personalized demands of the new era consumer and their preference for cost-effective products. For example, during the reporting period, the “SMART Elite Series Suits” were launched, showcasing the simplicity concept of the Lilang brand, with exquisite details in the design that appeal to Gen Z consumers, complemented by precise promotion on social media platforms, receiving high praise from users.

During the 2024 Paris Olympics, LILANZ partnered with Chinese National Geography magazine to complete the “Journey Along the Silk Road to Paris” discovery tour. Team members from various fields, including sports, science, exploration, and film, wore the “LILANZ SMART Elite Series Suits” while exploring the Silk Road.

According to the financial report, Lilang Group’s R&D team currently consists of approximately 357 members, covering all aspects of product design, material development, sample making, and more. During the reporting period, R&D expenditures amounted to nearly RMB 53 million, representing a 3.2% year-on-year increase, maintaining a high level compared to similar companies.

Among the products sold in the first half of this year, about 75% were original designs, and approximately 50% of these utilized exclusive fabrics developed by the Group, both remaining at high levels.

LILANZ’s first-ever long-lasting wrinkle-free white shirt, certified by the World Record Certification Agency (WRCA).

Taking into account the shopping habits of younger consumers, the Group has intensified its efforts in live-streaming e-commerce. During the 6.18 e-commerce shopping festival, the Group conducted promotional activities on platforms such as Douyin, Tmall, JD.com, and Vipshop, and introduced more e-commerce-exclusive products, successfully ranking fourth in Tmall’s men’s clothing sales. During this period, new retail sales grew by 37% year-on-year.

The Group plans to launch a special edition of environmentally-friendly products for e-commerce in the fall of this year, along with popular, high-demand items, aiming to meet consumers’ dual pursuit of environmental sustainability and fashion. The goal for the new retail business is to achieve over 30% growth for the year.

Additionally, the Group plans to complete the seventh-generation renovation of 400 stores by the end of 2024. By incorporating a fresh, tech-savvy visual effect and a youthful, fashionable interior design, while also optimizing spatial layout, the “simple men’s wear” brand image will be further ingrained in consumers’ minds.

Stronger Control: Strengthening the DTC Model and Initiating a New Round of Channel Adjustments

Since 2020, Lilang Group has been reforming its sales channels: The Youth Business Series and the Group’s e-commerce platform transitioned to self-operation in 2020 and 2021, respectively, while the main LILANZ series introduced a consignment model in 2021.

By 2023, the Group had completed its three-year channel reform, forming four major sales channels: distribution and consignment for the main series, self-operation for the Youth Business Series, and a self-operated e-commerce platform. All four channels achieved profitability in 2023, successfully enhancing store efficiency and profitability, demonstrating Lilang’s control in channel reform.

Starting from the first half of this year, Lilang Group initiated a new round of channel adjustments:

The Group decided to implement the DTC model (a mix of Group-operated stores and secondary distributor stores) for the main series in Heilongjiang Province, replacing the previous model operated by primary distributors. The plan includes repurchasing inventory and compensating to implement the DTC model in Liaoning and Jilin Provinces.

The Group stated that streamlining the channel structure would significantly enhance store operation efficiency and product management in the region. Leveraging the Group’s advanced digital operation system and the value integration of the entire chain from production to retail, it will bring consumers higher-quality and more cost-effective products and a superior shopping experience. These measures will help the Group achieve healthy growth in the Northeast region, contributing more to the Group in the long term.

This round of channel adjustments is driven by the remarkable performance of the Youth Business Series. As the Group’s retail pioneer, the Youth Business Series has accumulated valuable self-operated experience after years of cultivation.

The Group further noted that increasing the proportion of the DTC model is not only an important measure in response to market changes but also a critical step towards achieving sustainable brand development.

As of the end of June 2024, the main series had 2,412 stores, of which 38.5% (959 stores) operated under the consignment model. With the transition to the DTC model in the Northeast region, the number of self-operated stores increased to 15. The Youth Business Series had 292 self-operated stores, with an additional five operating through the distribution model. Overall, the Group’s store count increased by 14 compared to the end of last year.

Regarding store opening plans for the second half of the year, the Group stated it would strictly control cost expenditures and cautiously adjust its store opening plans, aiming for a net increase of 50-100 stores in 2024, with new stores primarily in shopping malls and outlet stores.

Internationalization Progress: Securing the Operating Rights for MUNSINGWEAR in China and Preparing to Open Its First Overseas Store

According to the financial report, in August this year, China Lilang’s subsidiary Lilang Fashion (Fujian) Group Co., Ltd., Descente Ltd., and Shanghai Descente Commercial Co., Ltd. signed an agreement to establish a joint venture company, Munsingwear (China) Co., Ltd. (tentative name).

The company’s registered capital is approximately RMB 278 million, with China Lilang investing RMB 150 million and holding a 54% stake in the joint venture. This joint venture will operate and engage in the design, sales, and distribution of products bearing the “MUNSINGWEAR” trademark in China.

The Group expects to commence related business activities in 2025.

MUNSINGWEAR, founded in 1886, is widely recognized for its iconic penguin logo and introduced the world’s first knitted golf shirt in 1955. MUNSINGWEAR is committed to combining functionality and comfort, continuously introducing high-tech fabrics and innovative craftsmanship, earning widespread acclaim from golf enthusiasts worldwide.

“MUNSINGWEAR enjoys a strong reputation in the golf apparel field and holds growth potential in the future,” said Lilang Group. “We believe that with Lilang Group’s expertise in retail management and supply chain management, MUNSINGWEAR’s competitiveness in the Chinese market will be significantly enhanced. This collaboration will generate positive synergies among the Group’s brands, further strengthening our ability to meet diverse consumer demands, in line with Lilang Group’s multi-brand development strategy.”

Moreover, the Group plans to expand into the Southeast Asian market. It has already established a company in Malaysia and is preparing to open the Group’s first overseas store there, seizing more market opportunities while expanding new revenue sources for the Group.

Outlook for the Future

Looking ahead to the second half of 2024, Wang Dongxing, Chairman and Non-Executive Director of China Lilang, said:

“Despite the challenges posed by the macroeconomic environment, China’s economy remains generally stable, and there is still demand for high-value products. The Group remains cautiously optimistic about the retail market. China Lilang will continue to leverage its competitive advantages, actively adopt flexible sales strategies, consolidate its store network, accelerate new retail development, and enhance brand image and sales efficiency, further solidifying China Lilang’s leadership in the men’s clothing industry, achieving sustainable long-term growth, and rewarding shareholders, employees, and customers for their support of the Group.”

|Image Credit: LILANZ

|Editor: Maier