On August 16th, China’s menswear brand listed in Hong Kong, LILANZ (China LiLang Limited, stock code: HK1234), announced its mid-year performance for 2023. Revenue increased by 6.7% to 1.491 billion Chinese Yuan, while net profit rose by 5.2% to 271 million Chinese Yuan, marking a comprehensive recovery in positive growth.

Simultaneously, the group maintained fiscal prudence during the period, with ample cash flow. The mid-term dividend per share was 13 Hong Kong cents, with an additional special mid-term dividend per share of 5 Hong Kong cents, maintaining a stable dividend distribution ratio.

In the past three challenging years, China LiLang has faced various challenges and undergone comprehensive transformations in products, channels, and branding. From this first “report card” in the post-pandemic era, we can see that the company’s transformation efforts have been largely completed, and LiLang is poised to embrace the next stage of development with healthier and more sustainable growth.

In this article, Luxeplace.com will comprehensively interpret the transformative effects of LiLang through four key data points implied in this financial report.

Data Point 1: Gross Margin Increased by 3.1 Percentage Points to Reach 51.8%

According to the financial report, Lilanz’s gross margin for the first half of the year increased by 3.1 percentage points, exceeding 50% for the first time, reaching 51.8%. This indicator was 41.9% and 46.0% in 2021 and 2022 respectively, and 38.4% in 2019 before the pandemic.

The main driving factors behind this increase are: significant growth in the light business sector and the introduction of higher-priced original flagship products.

— Significant growth in the high-gross-margin light business sector

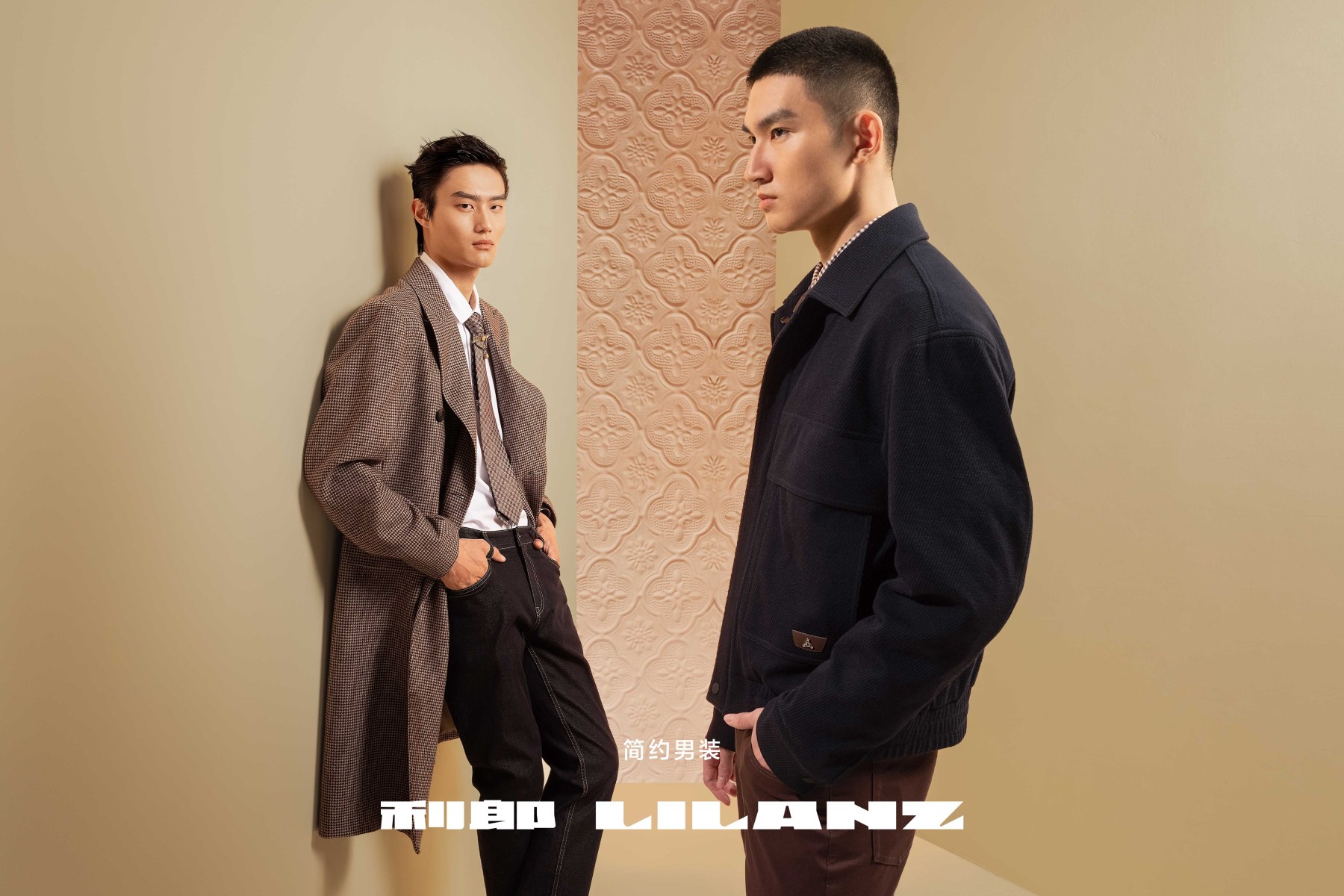

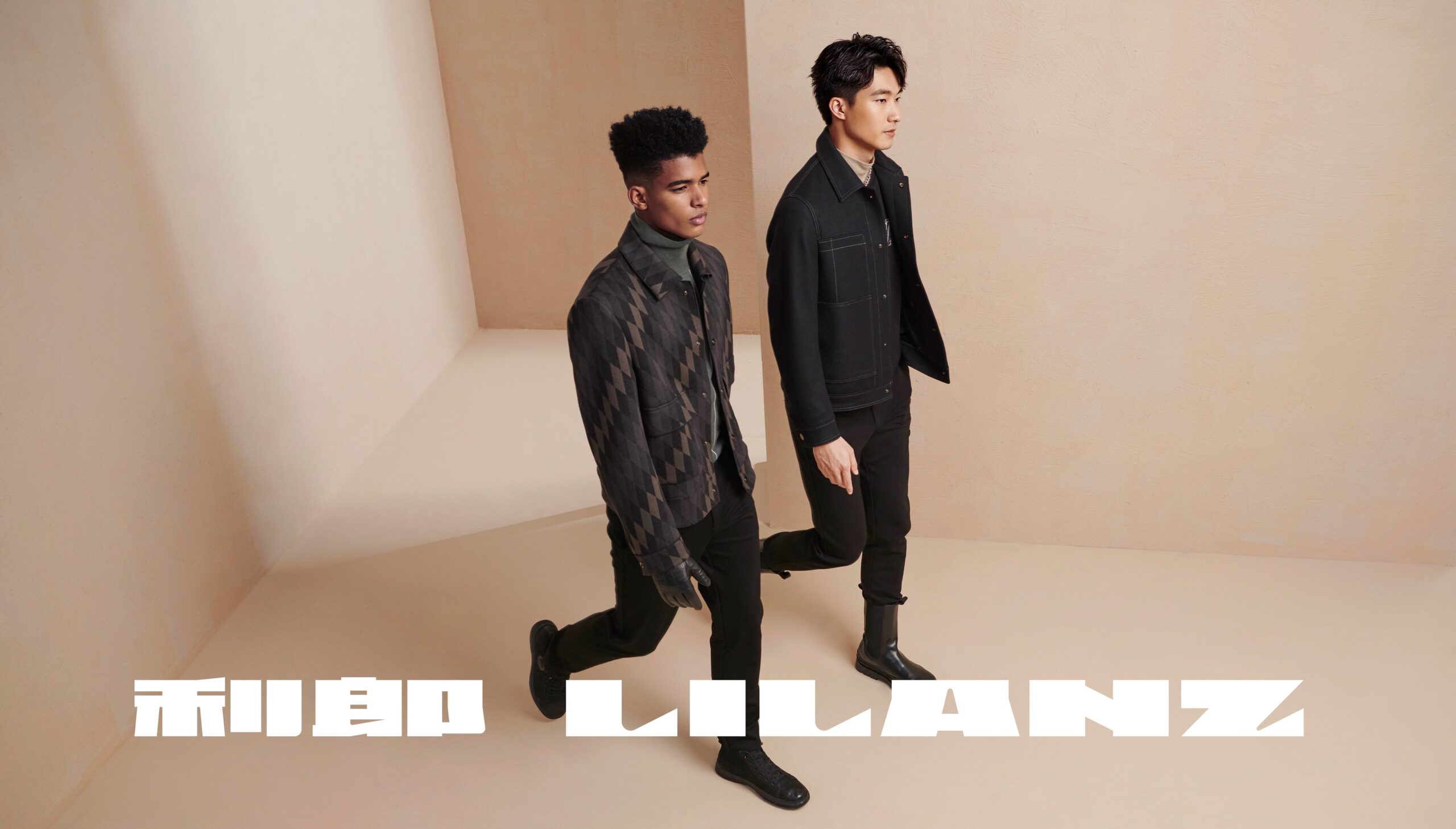

Lilanz has two brand series: the main Lilanz series and the LESS IS MORE light business series. The main series primarily targets consumers aged 25 to 45 and is popular in traditional third- and fourth-tier cities, gradually expanding into first- and second-tier markets. The light business series targets first- and second-tier city markets, focusing on consumers aged 20 to 30.

As society returned to normal, for the main series, all stores resumed normal operations, and with the price increase in the second half of the previous year, sales improved. However, some distributors are still reducing orders while digesting channel inventory. Similarly, light business stores are fully operational, with sales continuing to improve, achieving higher sell-through rates and double-digit sales growth, with a corresponding increase in sales proportion.

— Continued launch of original ultimate products, exceeding expectations

In 2023, the group continues to adhere to the strategy of “providing value-for-money products,” focusing on expanding the core brand “Lilanz minimalist menswear”. By combining fashion with cultural art, the brand creates product personality with original spirit, differentiating itself from competitors. During the reporting period, the proportion of original products in sales remained at around 75%, and the proportion of products using unique fabrics developed by the group was about 50%, both at a high level.

The R&D department currently has about 350 team members, covering all aspects of product design, material development, and sample production.

In the first half of the year, to address the time-consuming issue of cleaning and ironing clothes, LiLang introduced two ultimate products: the durable washable shirt and the durable washable Polo shirt, which were highly sought after by consumers:

- The durable washable shirt uses fabric developed by the Lilanz Fabric Research Institute, machine washable without easy deformation or fading, comfortable with a light bounce and wrinkle resistance. The fabric stays smooth after a single stroke, and after machine washing, it naturally flattens without the need for ironing, making it easy to achieve 30 machine washes without fading or deformation. In addition, seamless high-temperature heat pressing technology is used for parts that are prone to deformation, such as the collar and placket, to ensure that machine washing does not cause deformation. Lilanz’s durable washable shirt has also passed 30 machine wash tests conducted by a third-party national-level testing laboratory.

- The durable washable Polo shirt uses 180°C high-temperature seamless heat pressing technology to replace traditional stitching processes. It is durable, not easily deformed, and has efficient sun protection features. It can effectively resist strong ultraviolet rays and temperature drops, providing a comfortable and refreshing wearing experience.

Data Point 2: Inventory Turnover Days Reduced by Another 6 Days, Inventory Surplus Decreased by 92.3 Million Chinese Yuan

The main driving factors are: multi-channel clearance of off-season inventory and increased efficiency due to the operation of the logistics park.

— Multi-channel clearance of off-season inventory

During the reporting period, the group opened more outlet stores and established online retail as a permanent clearance channel.

As of the end of June 2023, the outlet stores totaled 60, compared to 55 at the end of 2022. Additionally, the group continued to use the WeChat platform to open stores on the micro-store and provide customer relationship management services, boosting store efficiency and clearing off-season inventory.

— Increased efficiency due to the operation of the logistics park

In September 2022, the newly planned logistics park, which had been in the works for two years, officially began operation. With the aid of an intelligent logistics system, it helps implement the group’s nationwide logistics layout, accelerate distribution to single stores, and enhance the efficiency of inventory control and logistics distribution. The LiLang logistics park is located in the Quanzhou Comprehensive Bonded Zone, with a total investment of 335 million Chinese Yuan and a total floor area of approximately 125,000 square meters.

With the increased efficiency of inventory turnover as the logistics park becomes operational, inventory at both main series and light business self-operated stores has continued to improve. According to the group’s inventory reserve policy, as of the end of June 2023, the reserve was 56 million Chinese Yuan.

Data Point 3: Retail Sales of Self-operated Online Stores Soared by About 24% YoY

In early 2021, LiLang’s brand stores transitioned to self-operation, replacing the previous distributor-operated model, further enhancing the group’s control over online operations.

During the reporting period, the group flexibly launched product promotions and other activities through self-operated online stores. During the 6.18 e-commerce shopping festival, the group introduced a popular product, the Ice Polo shirt, and quickly responded through its own factory. Retail sales of self-operated online stores in the first half of the year increased by about 24% year-on-year. Due to the increased proportion of new product sales, profit margins also increased further.

The group stated that in the second half of the year, it will invest in smart workshops to further enhance the group’s ability for rapid replenishment. The online store will serve as an important platform for launching new products. More e-commerce special edition products will be introduced. Before the Double 11 e-commerce festival, unique ultimate products will also be launched online. This will provide another growth point for the overall annual performance.

Data Point 4: Average Store Area Increased to 155 Square Meters

Data Point 4: Average Store Area Increased to 155 Square Meters

As of the end of June 2023, the group had a total of 2,646 retail stores nationwide (end of 2022: 2,646), with a total store area of approximately 410,231 square meters (end of 2022: 403,703 square meters).

By this calculation, the average store area for the first half of 2023 was approximately 155 square meters. This compares to 147.8 square meters in 2021, 152.7 square meters in 2022, and approximately 144.4 square meters in 2019 before the pandemic.

The main driving factors behind the optimization of this indicator are:

— Completion of sales channel reform

After the sales channel reform, the group established four sales channels: distribution and consignment models for the main series, self-operated model for light business, and self-operated e-commerce sales model.

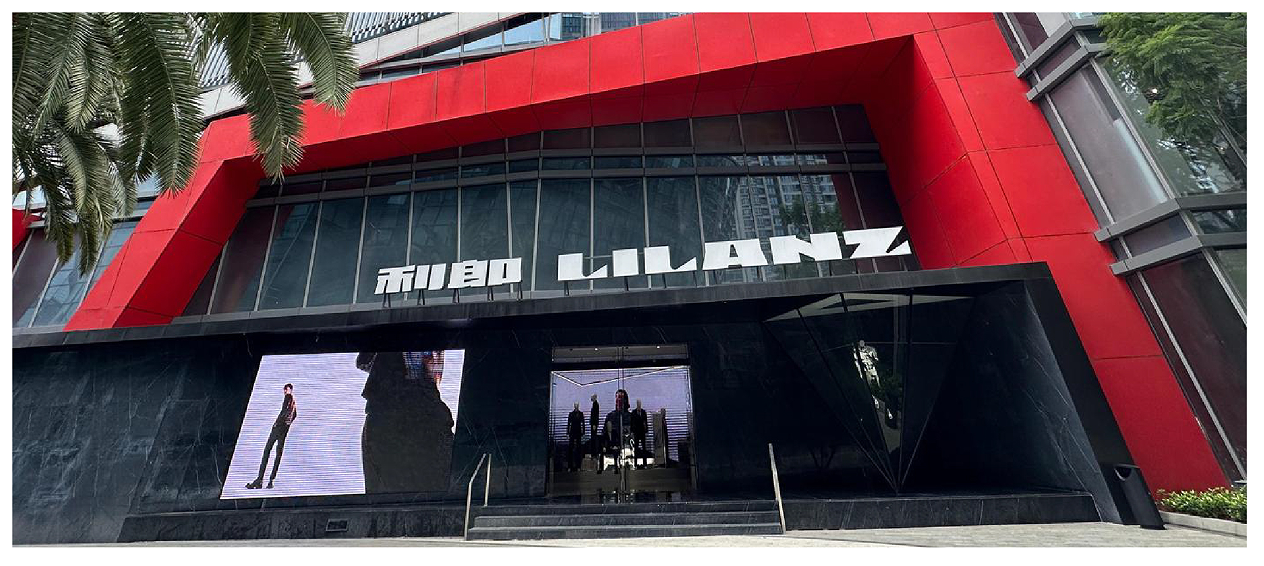

— Store location and image upgrade

During the reporting period, the group optimized the locations of several stores to be closer to first- and second-tier markets and improved the utilization of store space. In addition, the seventh generation store image of the main series was gradually promoted to existing stores, with renovations completed for 156 stores during the reporting period.

The group stated that in the second half of the year, it will continue to adopt a cautious store-opening strategy, aiming to achieve a net increase of 100 stores throughout 2023. Store upgrades will include opening stores in high-quality shopping centers in provincial capitals and prefecture-level cities. Some original shopping mall stores will be relocated to more superior locations within the malls and with larger store areas. In the second half of the year, store modifications will be especially focused on stores in Jiangsu, Qingdao, and Wuhan.

Looking ahead, the group stated that it would further leverage inventory sharing, optimize channels, improve store networks, enhance store efficiency and product sell-through rates, drive steady sales growth, and achieve a 10% increase in total retail sales for 2023.

In conjunction with the mid-year performance announcement, China LiLang upgraded its brand slogan from “Simple but not simple” to “Lilang Minimalist Menswear,” refining the brand’s core essence. A new logo was also unveiled. Visually, the new logo appears as a concise and sophisticated line, exuding a sense of strength. The distinctive “L” in Lilanz’s logo was strengthened and transformed into a highly recognizable flat pattern.

Wang Dong Xing, Chairman and CEO of China LiLang, summed up by saying that in the face of multiple challenges, China LiLang will continue to actively respond, maintain a cautiously optimistic attitude, adopt flexible sales strategies, solidify store networks, accelerate new retail development, enhance brand image and sales efficiency, all to sustain robust performance.

| Source: China LiLang

| Image Credit: China LiLang, Luxe.CO

| Editor: Maier