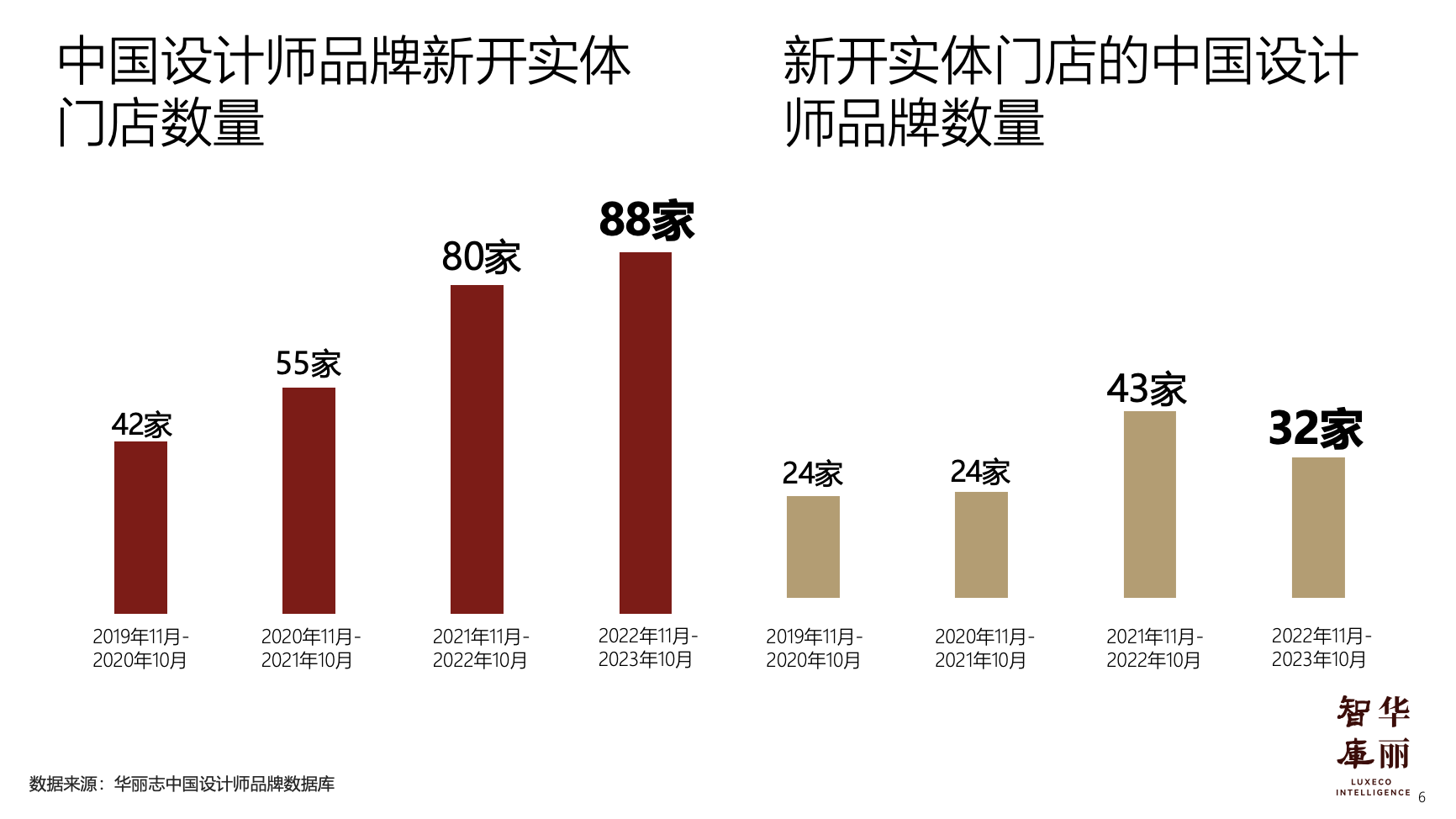

A new report from Luxe.CO Intelligence reveals a surprising trend: over the past four years, the number of physical stores opened by Chinese designer brands has skyrocketed (see left graph below)! Even the pandemic couldn’t halt this trend.

Interestingly, in the past year, while the number of new stores increased by 10% year-over-year, the number of designer brands opening new stores decreased by 26% (see right graph below). This indicates that after more than a decade of market evolution, Chinese designer brands are entering a new phase of development. The emergence of leading brands is becoming evident, with some brands standing out, gaining broader market recognition, and expanding their business footprint.

It’s not just in retail channels. Through international Fashion Week stages and extensive collaborative partnerships, the voice of China’s independent designer community is growing louder. Brand recognition and reputation are steadily improving, with some even embarking on international ventures.

In the past year (November 2022 – October 2023), Luxeplace.com recorded 448 marketing initiatives and channel expansion movements from 151 Chinese designer brands in its “Chinese Designer Brand Monthly Watch,” averaging nearly 40 significant industry updates per month.

Based on this, Luxe.CO Intelligence has compiled and summarized the past year’s key movements, data, and practical cases of Chinese designer brands, exclusively releasing the “Chinese Designer Brands in 2023” .

This 40-page report covers important topics such as offline store expansion, marketing communication, cross-border collaboration, and the latest industry trends. It aims to comprehensively present the opportunities and challenges facing designers, updating and strengthening the industry’s understanding of designer brands.

Highlighted contents of the report:

– The store footprint of Chinese independent designer brands has continually expanded over the past four years.

Over the past four years (2020-2023), the number of new stores opened by Chinese designer brands has increased yearly, with 2023 witnessing more than double the number of new stores compared to 2020, and a 10% increase over 2022.

In the past year, the brands with the most store openings were two accessory-focused Chinese designer brands: BLACKHEAD (16 stores) and HEFANG Jewelry (13 stores). As of now, BLACKHEAD has opened 50 stores in total, and HEFANG Jewelry has opened 54.

– Dynamic cross-industry collaborations of designer brands continue to thrive.

According to the Luxe.CO Chinese Designer Brand Database, there were 150 instances of cross-industry collaborations involving Chinese designer brands in the past year (November 2022 – October 2023).

These collaborations ranged from launching co-branded products to long-term partnerships with commercial brands, including guest designer roles and fashion show collaborations.

Among these, the American footwear brand UGG, known for its snow boots, was the most active in cross-border collaborations with Chinese designer brands, partnering 12 times.

– New trends in designer brand marketing.

In the past year, more designer brands independently set up pop-up stores in malls, strengthening consumer awareness; they promoted brand culture and values through exhibitions and appointed celebrities as brand ambassadors for high-profile promotions.

Such activities were not common among independent designer brands in the past, but have been increasing in recent years, reflecting a new level of market recognition and revenue capability for some brands.

– Accelerating expansion into overseas markets.

Over the past few years, Chinese designer brands have frequently been included in the official schedules of international fashion weeks, won global design awards, and entered overseas showrooms and boutiques, gradually gaining international market recognition.

Now, Chinese designer brands are making more substantial progress in overseas markets, with some opening independent stores in key commercial districts of foreign cities, directly engaging overseas fashion consumers and international tourists.

Note: Luxe.CO Intelligence’s criteria for “designer brands” include brands that promote a “designer” at their core, with a clear “principal” or “creative director,” or co-founders with a design background. The commercial sub-lines of designer brands are not included in this report.

About Luxe.CO Intelligence

Luxe.CO Intelligence has been deeply involved in the fashion and luxury sectors for a long time. Leveraging our continuously expanding industry network, data intelligence, and knowledge system, we are committed to providing professional, innovative, and forward-looking consulting services to brands and companies in China and overseas. Our areas of focus include brand revitalization and upgrade strategies, brand content and communication strategies, niche industry positioning and opportunity analysis, and strategies for entering the Chinese market.

View all reports published by Luxe.CO Intelligence: https://luxe.co/page/hlzk

Other brand research reports published by Luxe.CO Intelligence in the past six months include:

– “Hermès in 2023”

– “ON in China”

– “2023 Outdoor Brands China Power Ranking”

– “2023 H1 China Luxury Brands Power Rankings”

– “Southeast Asia Fashion Report” (2023 Updated Version)

…

For collaboration, contact: lci@luxe.co

丨Reporter:You Jia