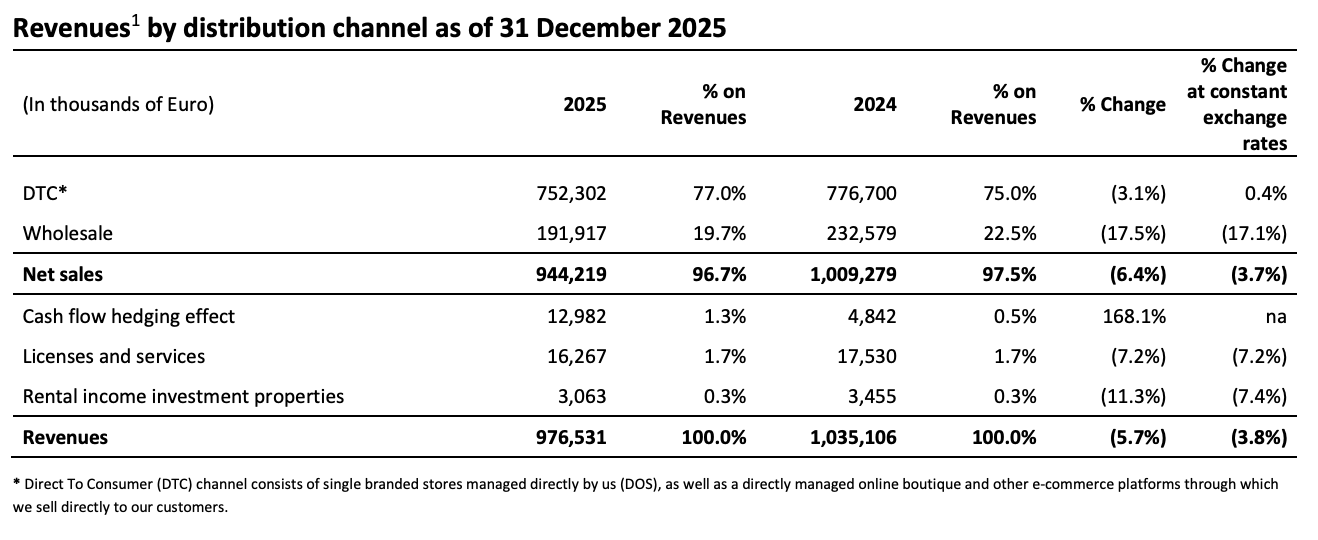

On January 27, the Italian luxury group Salvatore Ferragamo Group released preliminary results for fiscal year 2025 ended December 31: full-year consolidated revenue decreased by 5.7% year-on-year to EUR 977 million (-3.8% at constant exchange rates); net sales fell by 6.4% year-on-year to EUR 944 million (-3.7% at constant exchange rates).

Among this, fourth-quarter consolidated revenue declined by 3.2% year-on-year to EUR 282 million (-2% at constant exchange rates). In the fourth quarter, revenue from the DTC (direct-to-consumer) channel grew by 6.3% at constant exchange rates, accelerating compared with the third quarter of 2025, while revenue from the wholesale channel declined.

*The Group’s consolidated revenue includes net sales, licensing and services, rental income from investment properties, and the impact generated by cash flow hedging.

The Group stated in its official press release:

“Since the second quarter of 2025, the Group has identified new key business priorities and began implementing the necessary actions to ensure full alignment and coherence across design, product, communication and distribution channels, leveraging its strong heritage and creative capabilities.

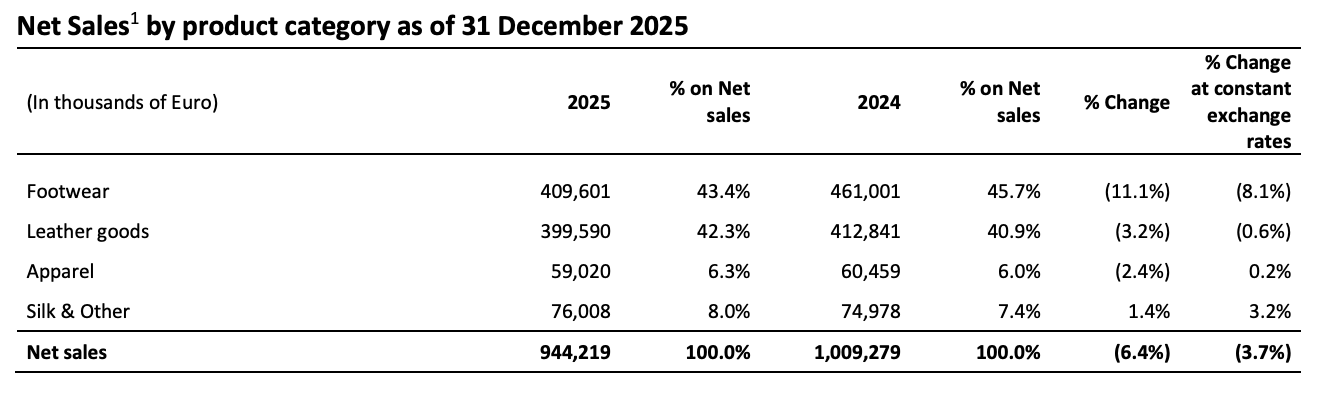

Regarding the product offer, for shoes we have further strengthened our icons, uplifting the Vara proposition for women and reinforcing the Tramezza line for men. As far as leather goods, we enhanced the Hug line and introduced new best-sellers, such as the Soft bag, while also supporting leather accessories and silk to improve cross-selling and customers’ acquisition.

Our narrative and communication strategy was updated to celebrate the Brand’s codes and craftmanship, elevating storytelling and improving targeting and efficiency to maximize ROI. We developed 360 degrees campaigns with curated in-store activations and a strong digital-first approach, enhancing the customer experience also through omnichannel and client acquisition projects and uplifting clienteling through innovative marketing programs.

Another focus area has been our retail network, where we improved visual displays and enriched the in-store experience, while progressing with store renovations and strengthening data-driven clienteling. We also enhanced our online presence through a better user experience. In wholesale, we concentrated on key accounts, aligned with our brand positioning. Given the continued uncertainty in the geopolitical and macroeconomic environment, the wholesale business may remain under pressure. Our focus for 2026 will be to maintain the current growth momentum, fully deploy the revised brand positioning, and reassess our retail distribution network.

We continued to execute our strategy with flexibility and operational discipline, through effective cost control, higher collection efficiency and inventory optimization.

The execution of these strategic initiatives supported the positive DTC performance also in the fourth quarter of 2025, which accelerated sequentially despite a tougher comparison base, with all regions posting positive trends. The results benefitted from higher conversion rate and average ticket, improved cross-selling and a continued solid growth of the online business.

Wholesale channel continued to decline, as in previous quarters, consistent with our reinforced focus on key accounts aligned with our brand image.

Mindful that the geopolitical and macroeconomic environment remains uncertain, and that wholesale is likely to remain challenging, our focus in 2026 will be to sustain current momentum, fully deploy the revised positioning and re-assess our retail distribution network. We look forward to build on these initial positive results, reigniting brand desirability and supporting topline and profitability.”

As of the close of trading on January 27, Salvatore Ferragamo Group’s share price fell 1.47% from the previous trading day to EUR 6.7 per share, with a current market capitalization of approximately EUR 1.109 billion.

As of December 31, channel performance for Salvatore Ferragamo in fiscal year 2025 was as follows:

- DTC channel revenue grew by 0.4% at constant exchange rates (down 3.1% at current exchange rates), with positive performance in the Americas, Europe, and Latin America at constant exchange rates offsetting weakness in the Asian market.

- Wholesale channel revenue declined by 17.1% at constant exchange rates and by 17.5% at current exchange rates.

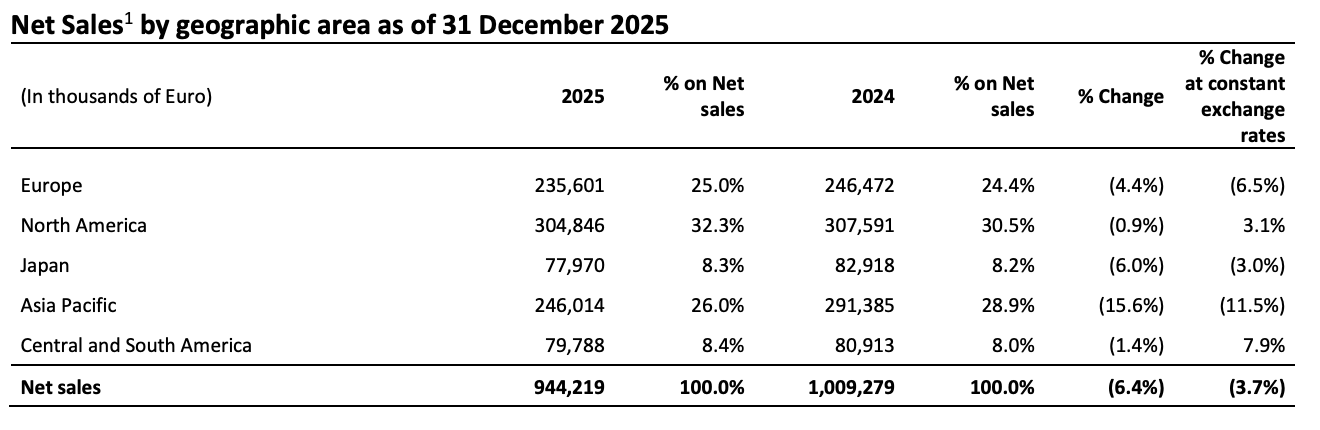

Net sales performance by region and by product category was as follows:

—— By regional market

- Europe, the Middle East, and Africa: DTC net sales achieved mid-single-digit growth in the fourth quarter, mainly driven by improvements in conversion rates and average transaction value. For fiscal year 2025, positive performance in the DTC channel in this region was offset by double-digit declines in the wholesale channel.

- Asia-Pacific: In the fourth quarter, the DTC channel recorded positive growth at constant exchange rates in South Korea, the Chinese Mainland, and Southeast Asia, while the wholesale channel declined by double digits year-on-year. For fiscal year 2025, net sales in the region declined by 11.5% year-on-year at constant exchange rates (down 15.6% at current exchange rates), mainly due to the decline in the wholesale business.

- Central and South America: Total net sales grew by 7.9% at constant exchange rates (down 1.4% at current exchange rates).

—— By product category

| Source: Official financial report

| Image Credit: Official financial report

| Editor: LeZhi