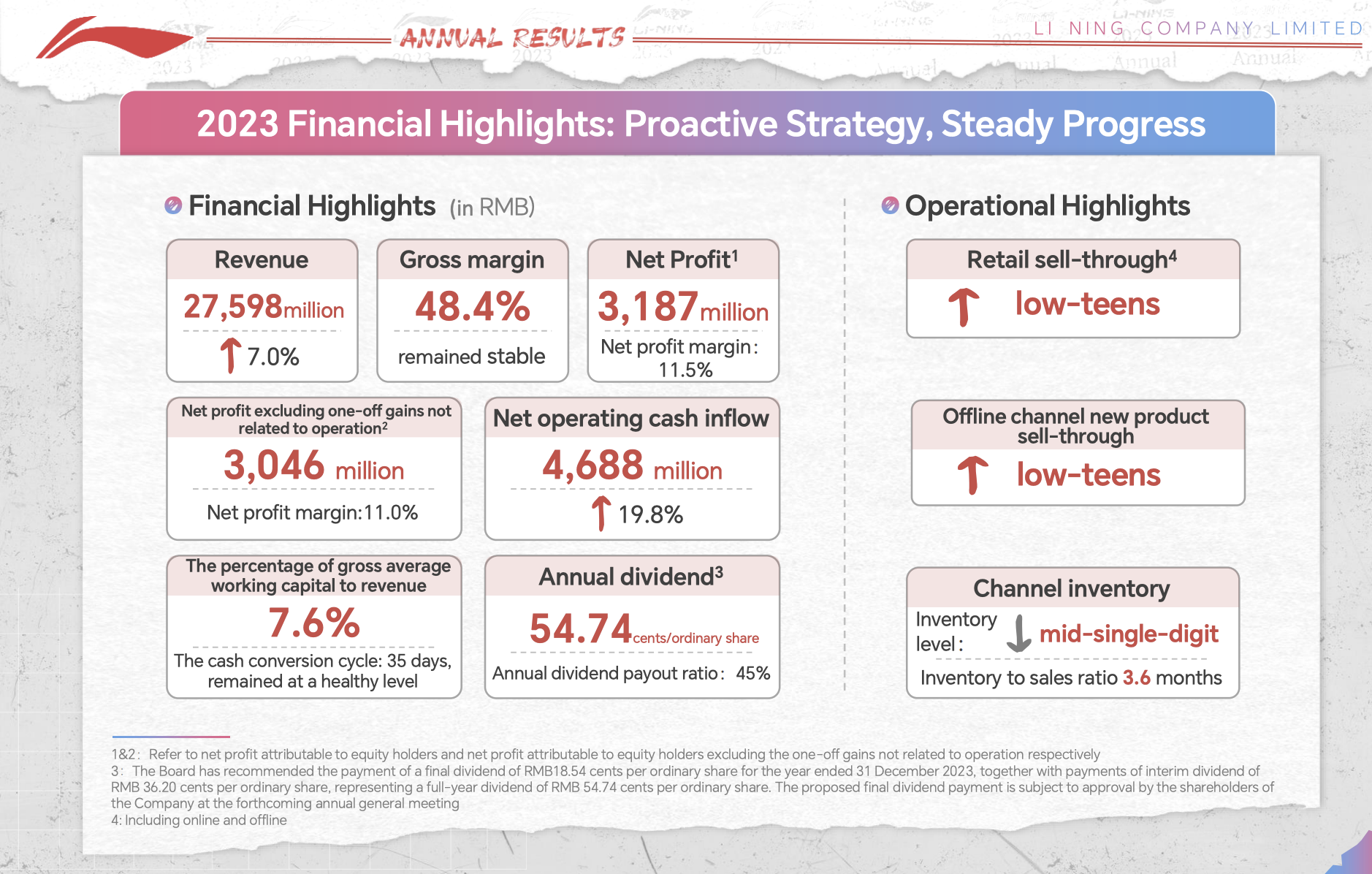

On March 20th, Li-Ning Company, a Chinese sports apparel giant listed in Hong Kong (HK: 02331), disclosed its 2023 full-year performance: revenue rose by 7.0% year-on-year to 27.598 billion yuan, while net profit attributable to the parent company dropped by 21.6% year-on-year to 3.187 billion yuan. Moreover, the group’s gross profit margin remained at 48.4%, similar to the previous year, with net cash inflow from operations increasing by 19.8% to 4.688 billion yuan. Notably, international revenue surged by 16.6% year-on-year to 532 million yuan.

In its financial report, the group stated that its strategy remains unchanged: focusing on the core strategy of “Single Brand, Multi-Categories, Diversified Channels,” concentrating on basketball, running, fitness, badminton, and sports casual as the five core categories of professional sports.

2023 was a challenging year for Li-Ning, with its stock price falling from 67.75 HKD/share at the beginning of the year to 20.90 HKD/share, a decline of nearly 70%. Recently, there have been rumors about the company considering privatization.

At the earnings conference, Li Ning himself responded to recent events: ” The stock price is beyond my control; it’s dictated by the market. As part of the company’s management, our primary focus is on delivering high-quality products, ensuring employee satisfaction, and efficient operations to meet investor expectations. We are open to any strategy that could enhance investor returns, including dividends. Currently, a 45% dividend payout ratio is competitive compared to our industry peers.”

“Faced with varying competitive landscapes, we are open to exploring strategies that boost investor returns, but as of now, no such plans are in place. We will update everyone if that changes.”

As of the close on March 20th, the group’s stock price was 21.45 HKD/share, up 5.67% from the previous day, with a current market value of 55.4 billion HKD.

This financial report allows us to observe some quiet changes happening at the brand, product, and channel levels within Li-Ning Group. Luxeplace.com will present these “changes and transformations” through four charts.

Chart One: Accelerated Growth in the Fourth Quarter

Looking at retail flow, Li-Ning Group experienced declines across all channels in the third quarter but saw a rebound in the fourth quarter, with offline retail (direct sales) channels achieving 50%-60% growth.

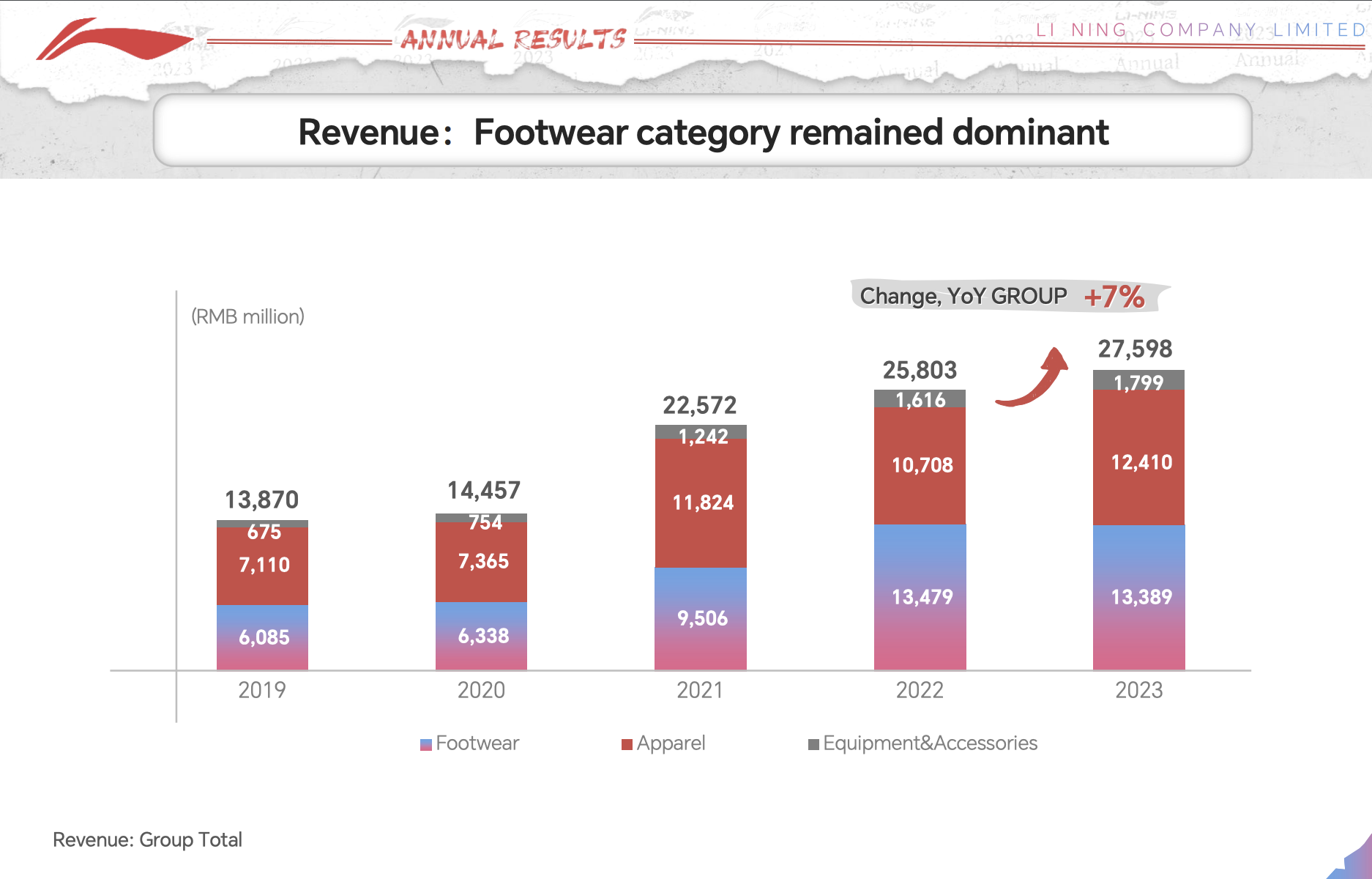

Chart Two: Footwear Makes the Largest Contribution, Apparel Grows the Fastest

In 2023, footwear revenue fell by 0.7% year-on-year to 13.389 billion yuan, contributing 48.5% of the group’s revenue (2022: 52.2%), while apparel revenue grew by 15.9% year-on-year to 12.411 billion yuan, increasing its share from 41.5% to 45.0%.

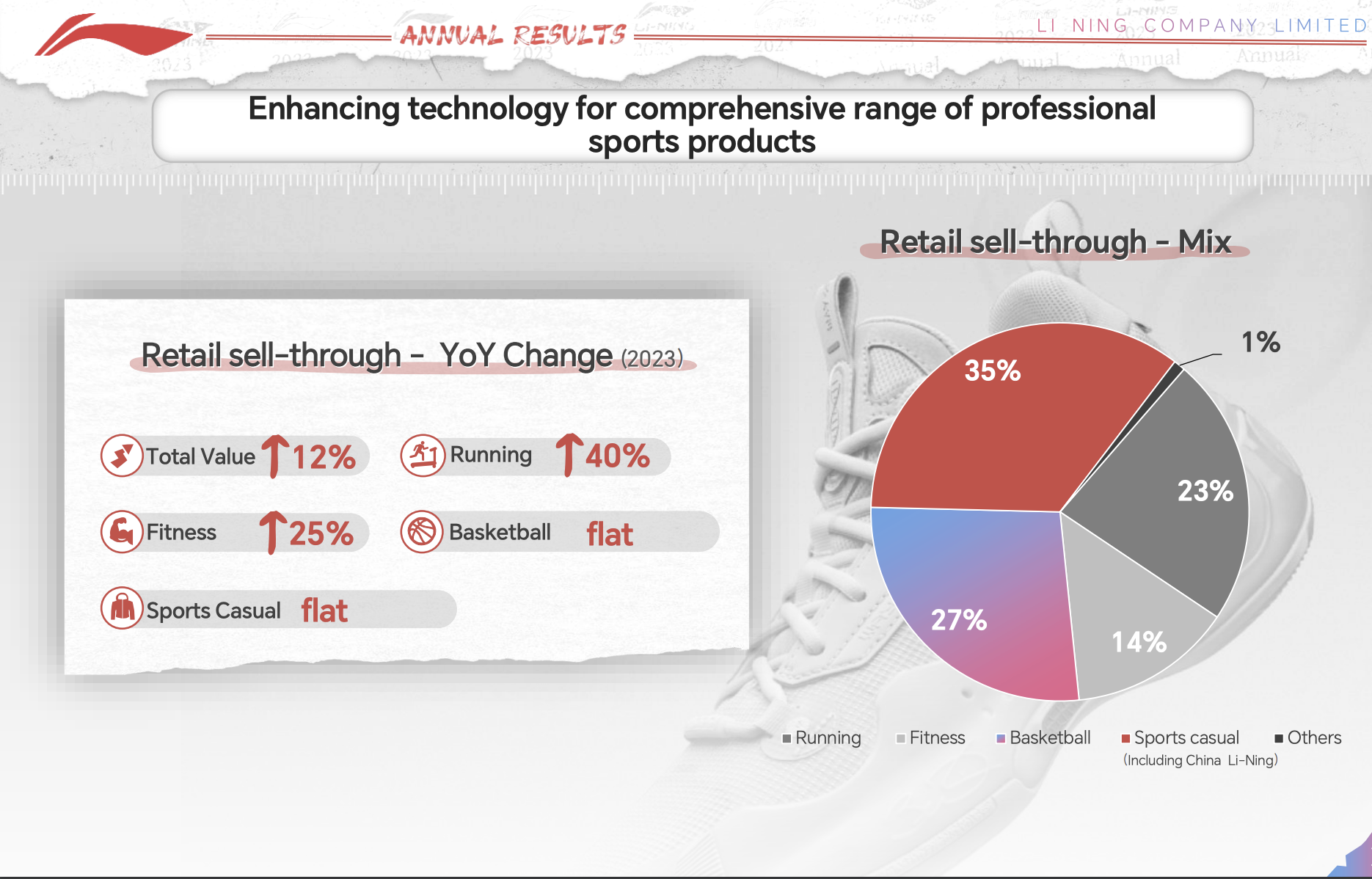

Chart Three: Multiple Hit Products Boost Running Retail Flow by 40%

The financial report shows that basketball, running, fitness, badminton, and sports casual, the five core categories, all achieved positive growth in retail flow across all channels, with a total increase of 12% year-on-year. Running, in particular, saw the best performance with a 40% increase. Sports lifestyle (including Li-Ning China) continues to contribute the largest retail flow to the group, accounting for 35%.

In 2023, the group launched several hit running shoe models: the Super Light, Rouge Rabbit, and Feidian series collectively sold over 9 million pairs throughout the year, a 62% increase year-on-year. The Feidian 3 Challenge alone sold over 1.3 million pairs within the year, becoming a phenomenal IP among carbon plate running shoes.

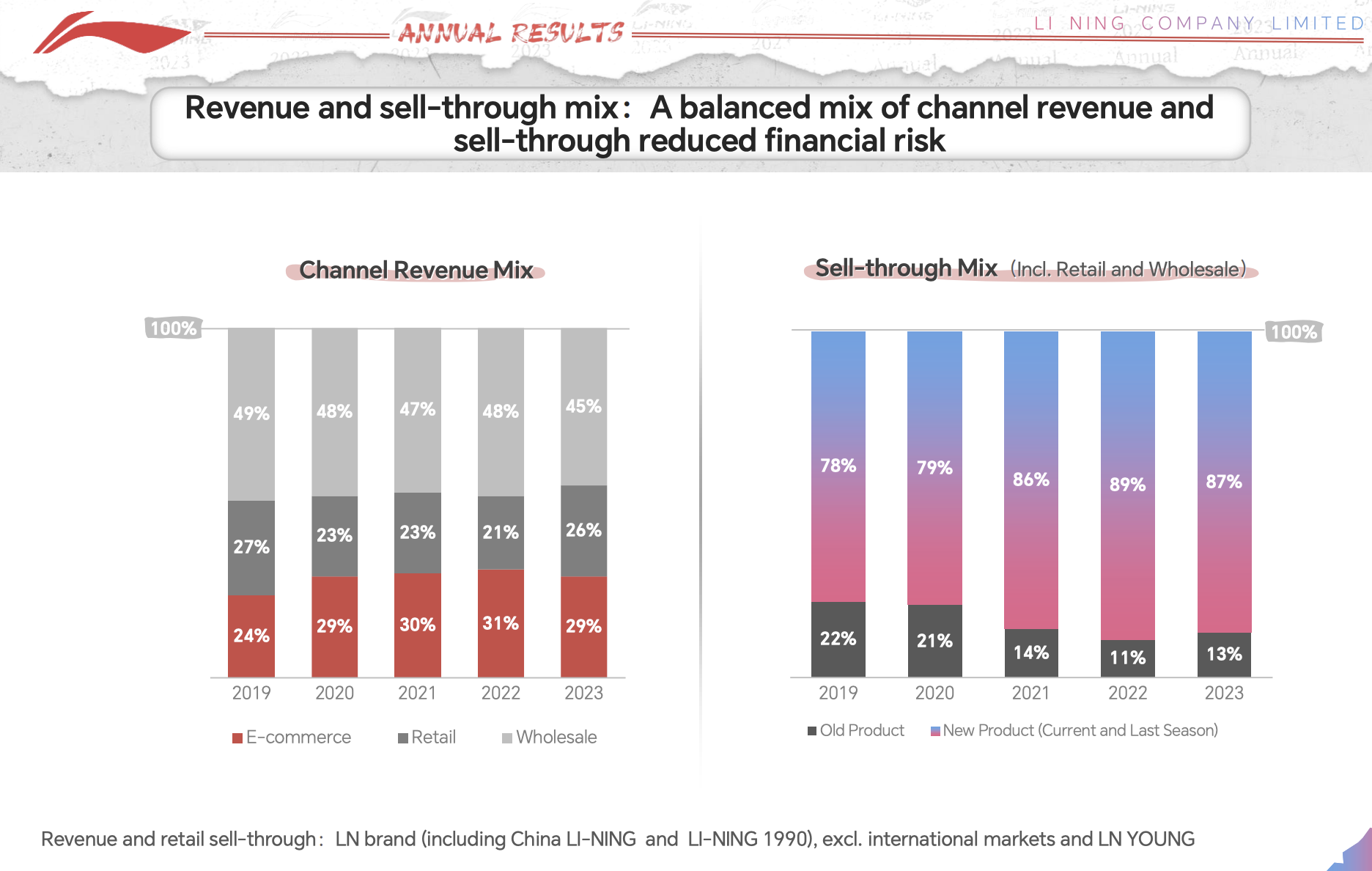

Chart Four: Direct Sales Channel Revenue Share Returns to Over 25%

Looking at channels, in 2023, direct sales revenue grew by 29.6%, performing the best (e-commerce platform revenue slightly increased by 0.9%, and wholesale revenue slightly increased by 0.6%). The revenue share of the direct sales channel also reached 26%, having been below 25% in the previous three years and only 21% in 2022.

| Source: Official financial report

| Image Credit: Li-Ning Company’s official website

丨Reporter:Wang Jiaqi

| Editor: LeZhi