On May 13, Laopu Gold Co., Ltd. (hereinafter referred to as “Laopu Gold“) updated its prospectus, continuing to advance its listing process on the main board of the Hong Kong Stock Exchange. Laopu Gold had previously submitted a prospectus to the Hong Kong Stock Exchange in November 2023, aiming for a main board listing. Earlier, Laopu Gold had submitted main board listing applications to the Shenzhen Stock Exchange in June 2020 and June 2023.

The latest announcement shows that Laopu Gold, founded in 2009, is the first brand in China to promote the concept of “heritage gold.” According to Frost & Sullivan, Laopu Gold is the only brand among major brands in China’s gold jewelry market that focuses on the design, production, and sales of traditional gold products.

Laopu Gold stated that ancient method gold has initiated a new product era in China’s gold jewelry industry, becoming the most promising and fastest-growing gold category in the market. According to Frost & Sullivan, the market size of China’s traditional method gold jewelry, measured by sales revenue, grew from approximately RMB 13 billion in 2018 to approximately RMB 157.3 billion in 2023, with a compound annual growth rate (CAGR) of 64.6%. It is expected that by 2028, the market size will reach approximately RMB 421.4 billion, with a CAGR of 21.8%.

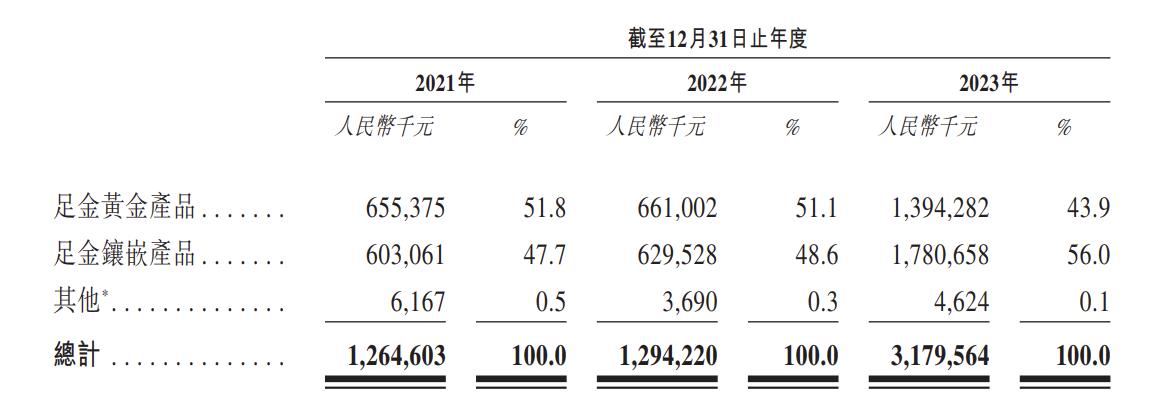

The updated prospectus also disclosed Laopu Gold’s latest financial data for 2023: revenue increased from RMB 1.265 billion in 2021 to RMB 1.295 billion in 2022, and surged by 146% to RMB 3.18 billion in 2023, with a CAGR of 58.6% from 2021 to 2023. Net profit attributable to the parent company was RMB 114 million, RMB 95 million, and RMB 416 million, respectively, in 2021, 2022, and 2023, with a 338% increase in 2023.

In terms of product categories, the sales proportion of pure gold inlaid products increased annually from 47.7% in 2021 to 56.0% in 2023.

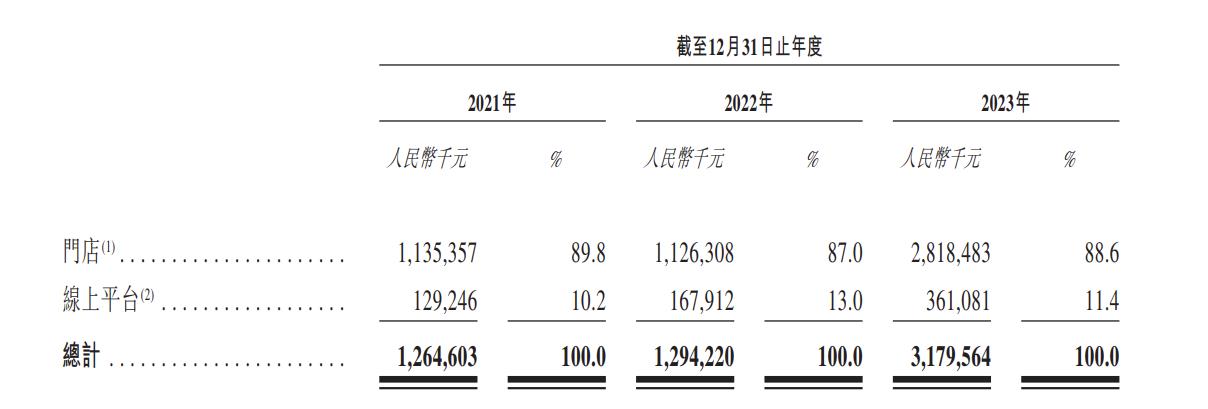

In terms of sales channels, offline stores still contributed nearly 90% of the brand’s revenue, accounting for 89.8%, 87.0%, and 88.6% in 2021, 2022, and 2023, respectively.

Laopu Gold stated that they operate offline stores through a self-operated model and themed store model. As of May 6, they had opened 32 self-operated stores in 13 cities in China, most of which are first-tier and new first-tier cities. All stores are located in high-end fashion department centers with strict admission requirements, including SKP and MixC.

According to Frost & Sullivan, Laopu Gold’s single-store revenue ranked first among all gold jewelry brands in China for two consecutive years in 2022 and 2023. The average revenue per store in 2023 was RMB 93.9 million, double that of 2022. The two stores located in Beijing’s SKP had a total revenue of RMB 336 million, with a monthly sales per square meter of RMB 440,000.

In November 2023, Laopu Gold completed its first and only institutional financing round since its establishment before the IPO. BA Capital invested RMB 175 million, and Fosun Hanxing Fund, controlled by Yuyuan Inc., invested RMB 50 million. The post-investment valuation for this round was RMB 5.225 billion. Before the IPO, BA Capital and Fosun Hanxing held 3.35% and 0.96% of the shares, respectively.

In the prospectus, Laopu Gold stated that the net proceeds from the IPO will mainly be used to expand the sales network by opening new stores in domestic and overseas markets in the coming years to promote brand internationalization; maintain brand positioning and increase brand awareness; optimize internal IT systems and improve automation and informatization to enhance operational efficiency; strengthen R&D capabilities; and for general operating funds and corporate purposes.

丨Source: Company Announcements

丨Image Credit: Company Official Website

丨Editor: LeZhi