In the past few months, due to insufficient consumer confidence and a sluggish real estate market, the growth of China’s consumer goods market has slowed down. However, recent surveys and data from sources like Bloomberg and Bank of America indicate that Chinese consumer confidence improved in August, ending a several-month-long downward trend. Nonetheless, compared to earlier in the year, it still appears somewhat fragile.

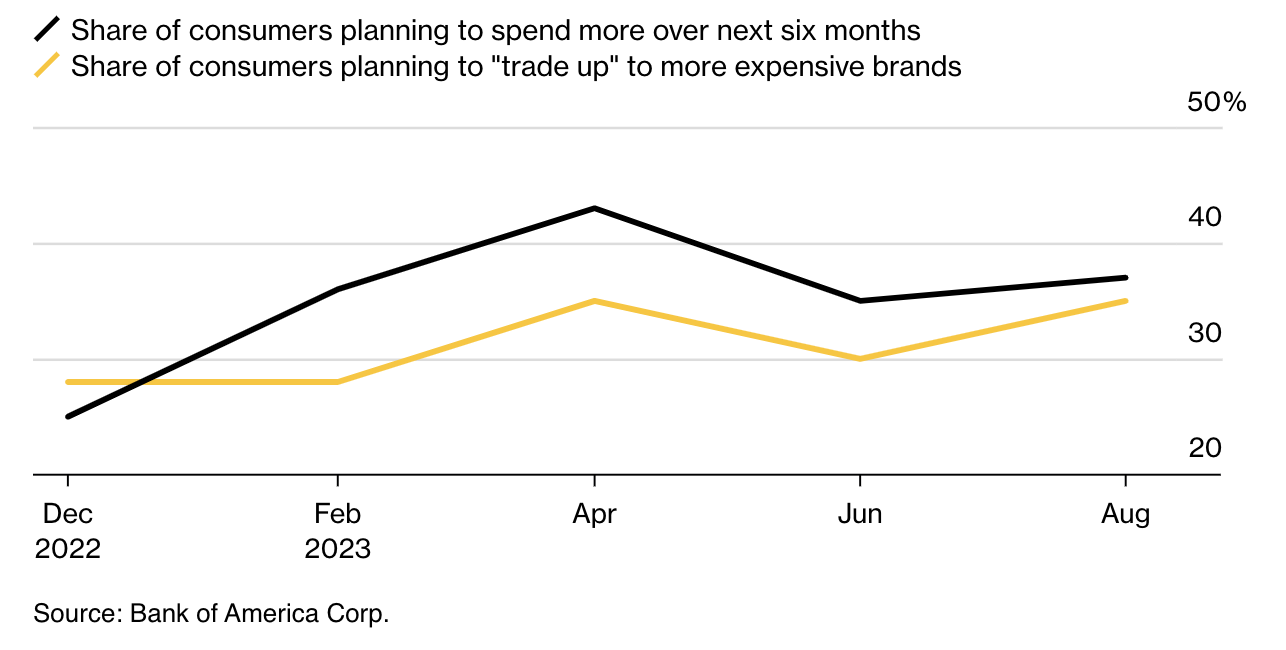

Bank of America’s bi-monthly survey revealed that in August, Chinese consumer confidence strengthened. The proportion of consumers planning to increase expenditures and “upgrade” to more expensive brands in the next six months increased compared to June. However, the proportion of consumers planning expenditures remained lower than that of April.

Trend in the proportion of consumers planning to increase expenditures in the next six months (black line) and trend in the proportion of consumers planning to “upgrade” to more expensive brands (yellow line)

Bank of America stated in a report, “Our latest survey in August shows a slight improvement in consumer willingness to spend, likely benefiting from a thriving demand for summer services.”

Similarly, a survey by the U.S. consulting firm Morning Consult, which measures Chinese consumer confidence, showed an improvement in the index in August, indicating a resurgence in Chinese consumer confidence, though it hasn’t yet reached the peak of 2021.

Consumer confidence index improved in August, but hasn’t reached the peak of 2021

In July, China’s consumer prices experienced their first decline since 2021, reflecting signs of weak consumption and investment demand. As real estate sales remained sluggish, housing prices further decreased. The weak data prompted the People’s Bank of China to reduce the MLF (Medium-term Lending Facility) rate by 15 basis points and the 7-day reverse repurchase rate in open market operations by 10 basis points. However, after excluding volatile energy and food costs, the core consumer price index remained positive.

This week, Wang Dan, Chief China Economist at Hang Seng Bank, stated in an interview with Bloomberg TV that due to ongoing increases in core prices, “This suggests an improvement in domestic demand, leading me to believe that there might be unexpected growth in consumption over the next few months.”

China’s stock market received a boost this week from record-breaking summer box office data and better-than-expected profits from Anta, one of the largest sportswear companies in China.

The current MSCI China Non-Essential Consumer Goods Index is only about one-third of the 2021 peak

The MSCI China Non-Essential Consumer Goods Index, tracking 73 companies including Alibaba, Meituan, JD.com, Pinduoduo, BYD, and Li-Ning, rose by approximately 3.2% this week, poised to achieve its largest increase in nearly a month. However, the index is still only about one-third of the 2021 peak.

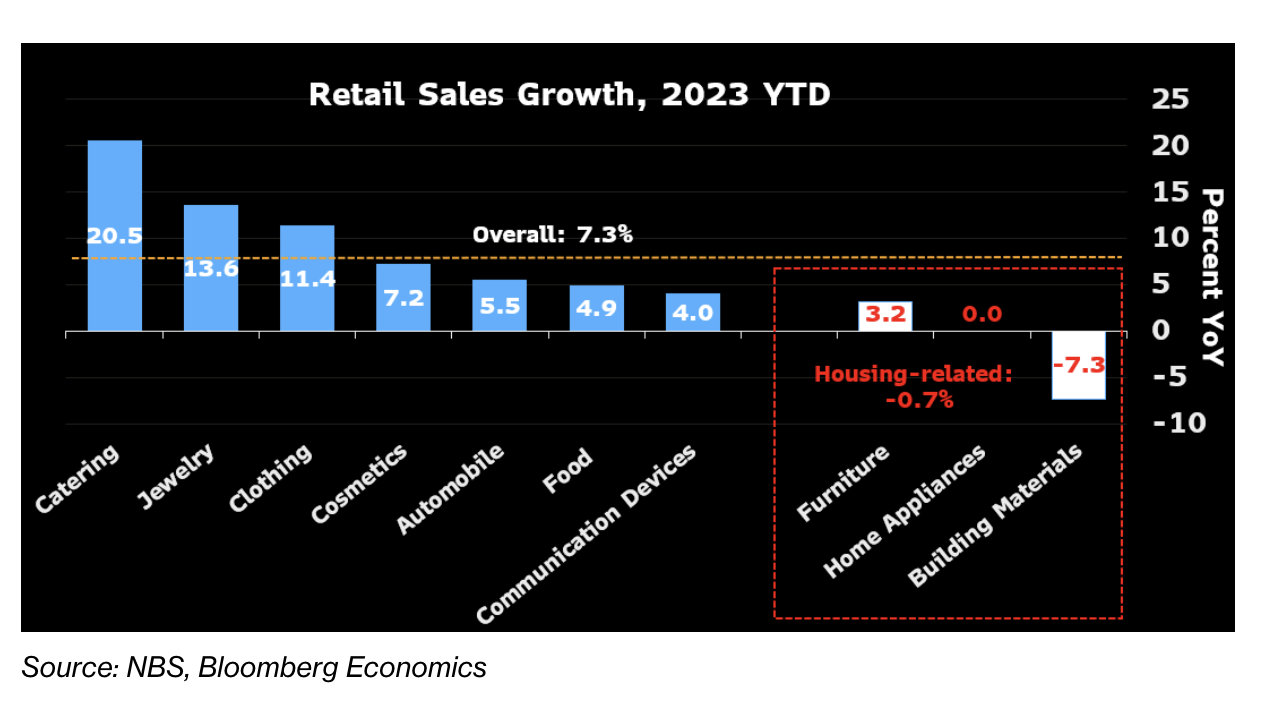

A report from Bloomberg Economics published this week indicated that the growth of consumer services far exceeded that of housing-related commodities. Data suggested “strong growth” in consumer spending (such as summer-related demands) in August.

Consumer services’ growth far outpaces housing-related commodities

The recent improvement in Chinese consumer confidence could have significant implications for businesses, particularly those conducting operations in the Chinese market. While market sentiment remains weaker than earlier this year, the upward trend suggests a potential rebound in consumer spending.

For businesses, this could mean an increased willingness among Chinese consumers to purchase high-end brands, presenting opportunities for companies offering quality products or services. However, compared to previous levels, market sentiment remains subdued, indicating that businesses need to maintain cautious and adaptive market strategies.

| Source: Bloomberg, Businessformation, Bank of America, Morning Consult, MSCI, National Bureau of Statistics (NBS)

| Image Credit: Original reports, Pexels

| Editor: Liu Juan