On July 28th, French beauty giant L’Oréal Group released its financial data for the first half of 2023, ending on June 30th:

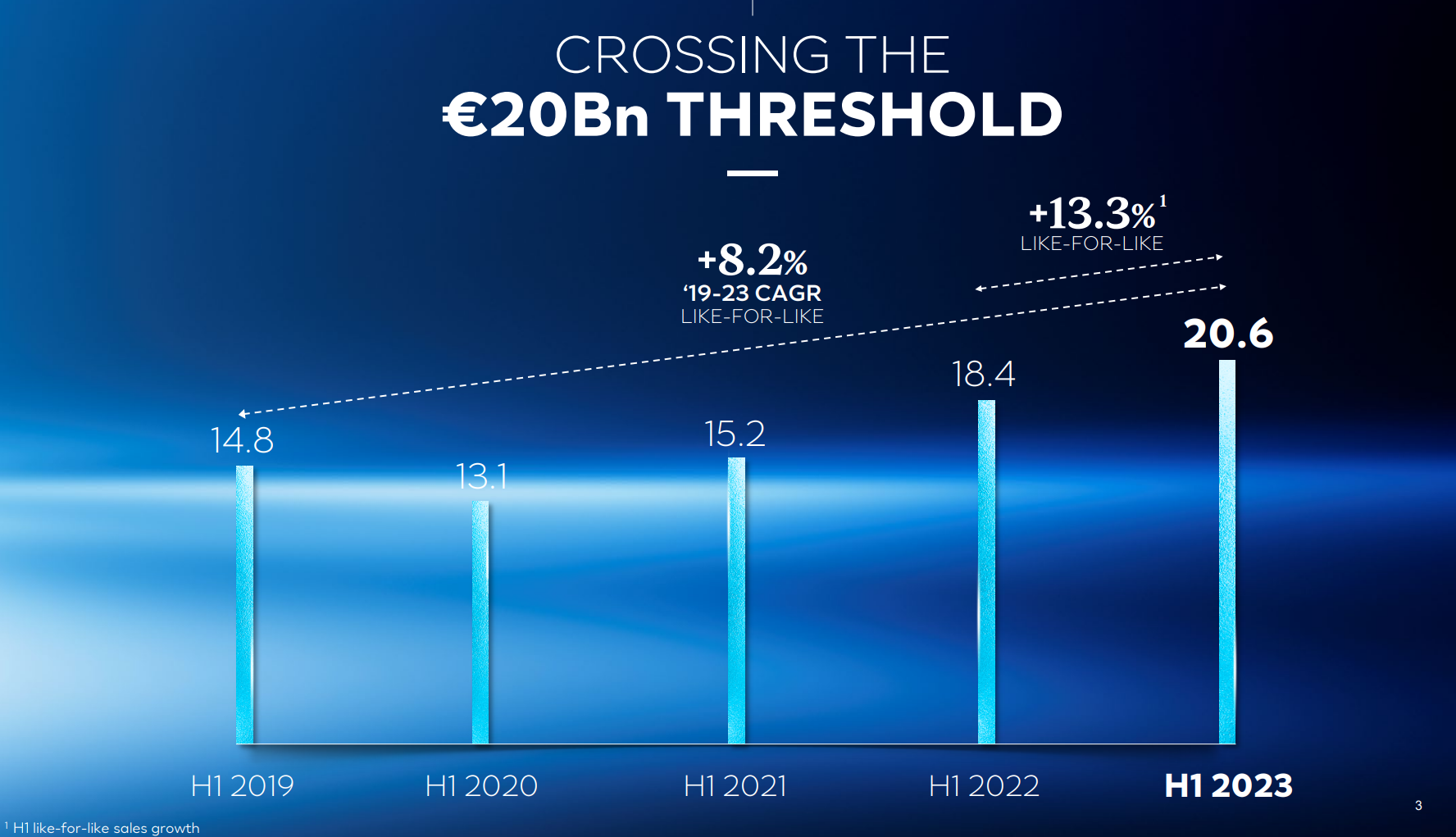

In the first half of the year, the company achieved sales of €20.57 billion, marking a 13.3% year-on-year growth and the first time it surpassed €20 billion in sales for a half-year period (quoted from the group’s analyst conference call). The second-quarter sales reached €10.194 billion, representing a 13.7% increase at constant exchange rates compared to the same period in 2022. The operating profit margin rose by 30 basis points to 20.7%, and earnings per share increased by 11.2% to €6.73.

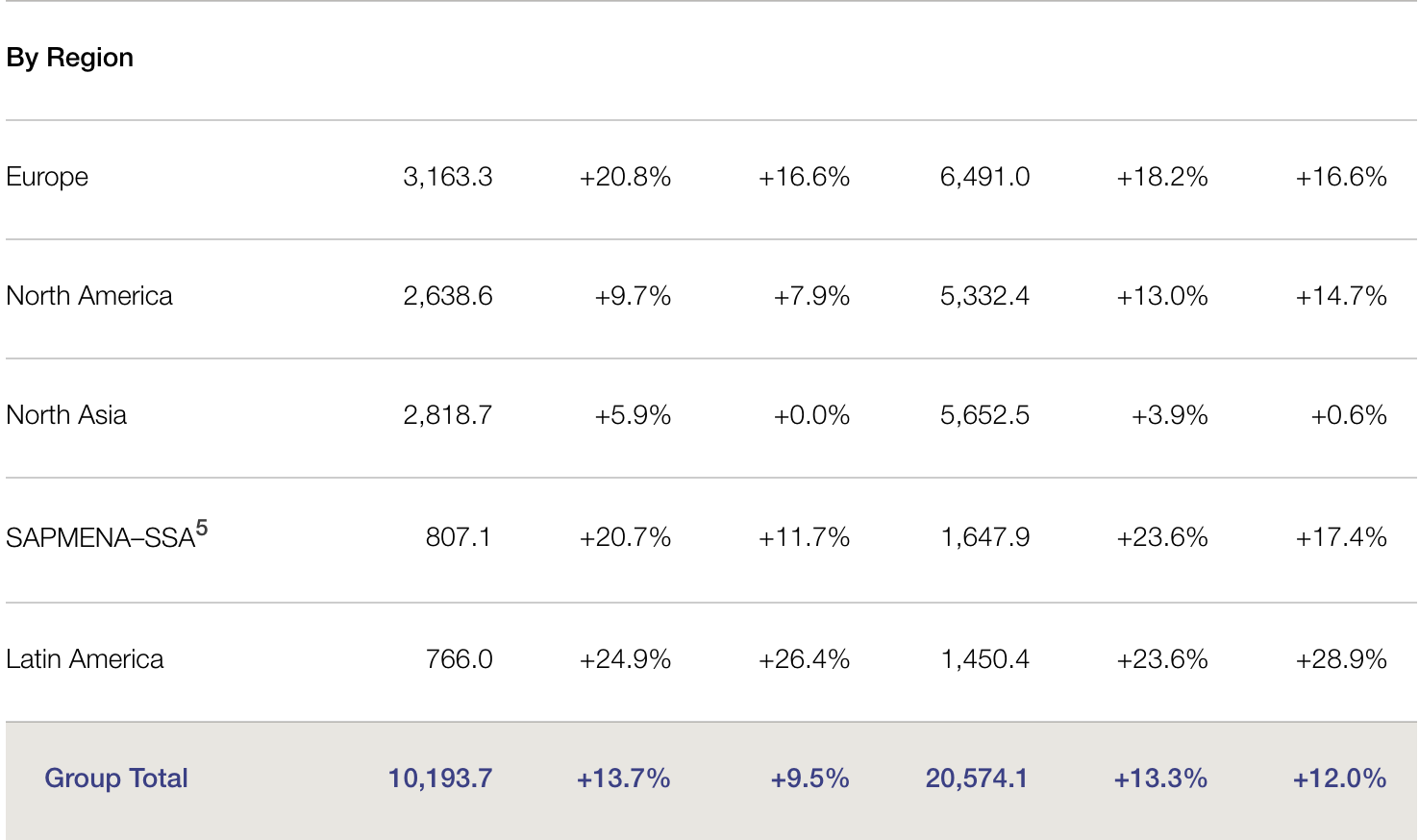

During the reporting period, all business divisions of the group experienced growth, with consumer products division setting a new record with a 15% year-on-year growth, surpassing the market average of 9%.

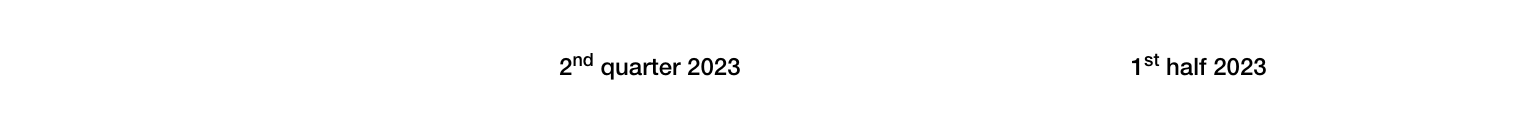

All regions witnessed growth, with Europe surpassing North Asia to become the largest market, while the mainland China market demonstrated strong recovery in the second quarter.

At constant exchange rates, the North Asia zone, where L’Oréal China is located, achieved a 3.9% year-on-year growth for the first half, with a consolidated growth of 0.6%.

The market data for L’Oréal Group is as follows:

L’Oréal China’s performance far exceeded the market average, with robust growth across all channels and business divisions. New brands such as Valentino Beauty, Prada Fragrances & Beauty, and Takami performed exceptionally well. During the 6.18 shopping festival, L’Oréal China’s four major business divisions had a total of eight brands ranking in the top 20, with L’Oréal Paris and Lancôme claiming the first and second spots in cumulative rankings across all platforms and categories.

During the analyst conference call following the financial report, L’Oréal Group’s CEO, Nicolas Hieronimus, listed China as one of the “five major countries contributing to growth,” with the other four being the United States, the DACH (Germany, Austria, Switzerland) cluster, France, and Mexico.

He stated that in mainland China, the group has seen clear signs of consumption recovery. Consumer confidence is increasing, restaurants are full, and local tourism is recovering. The recovery is a bit slower than expected, but honestly, it takes some time to fully digest three years of the pandemic.

He adds that Hainan accounts for less than 3% of the Group’s business, while the overall sales generated by Chinese consumers both domestically and abroad account for approximately 23% of their total sales. Therefore, mainland China has always been their focus, and they believe that the new model in Hainan should have a positive impact on the domestic market. Given their significant market share in mainland China, this is advantageous for the Group. Overall, the sales generated by Chinese consumers both domestically and abroad achieved a growth rate of 10% in the first half, far ahead of the market average growth rate of 2.6%.

Regarding the business divisions, Hieronimus highlighted that the dermatological beauty business achieved a year-on-year growth of 29%, with mainland China’s growth rate being three times the market average.

Regarding the luxe division, he mentioned that it is worth noting that since the beginning of the year, the division’s market share in China is equivalent to the combined market share of the second and third-ranked companies.

Sales data for each business division are as follows:

In terms of categories, after facing various challenges earlier in the year, the makeup category significantly rebounded in the second quarter, driven by both mass-market and luxury brands.

In the mainland China market, L’Oréal’s luxe division demonstrated strong recovery in the second quarter, achieving double-digit growth and reaching a new high in market share. Meanwhile, China’s Hong Kong market benefited from the recovery of mainland tourism and also showed robust growth.

The growth drivers in the North Asia region for the first half mainly came from: 1) the haircare category, especially Kérastase and L’Oréal Pro; 2) the skincare category represented by Helena Rubinstein, Shu Uemura, and Takami; 3) the fragrance category, with Maison Margiela fragrances, as well as perfumes launched by Prada Fragrances & Beauty and Valentino Beauty.

Additionally, according to the authorization obtained from the Annual Shareholders’ Meeting on April 21, 2023, the L’Oréal Group’s Board of Directors decided to establish a share buyback program in the second half of 2023, with a maximum repurchase amount of €500 million and a cap of 2 million shares for repurchase. The repurchased shares are intended to be canceled.

| Source: Official financial report, analyst conference call recordings, and presentation slides

| Editor: LeZhi