According to data compiled by Luxe.CO Tong, the first global real-time dynamic platform for fashion business under Luxe.CO‘s umbrella, Penhaligon‘s and Editions de Parfums Frederic Malle emerged as the two most active high-end niche fragrance brands in the Chinese market over the past year.

Specifically:

- Penhaligon’s opened the most new stores in the past year.

- Editions de Parfums Frederic Malle opened the most new pop-up stores in the past year.

In this article, Luxe.CO will explore the unique features of these two brands through a comparison of their development histories, market strategies in China, the strength of their parent companies, and their business compositions.

*Note: This article was originally written in Mandarin.

Distinct Differences Spanning 130 Years and Unique Origins

Founding Year

- Penhaligon’s: 1870

- Editions de Parfums Frederic Malle: 2000

Country of Origin

- Penhaligon’s: United Kingdom

- Editions de Parfums Frederic Malle: France

Founders

- Penhaligon’s: William H. Penhaligon founded the brand at the age of 33. He started as a barber in Cornwall, England, and later moved to London, where he established a grooming shop. He also served as the official barber and perfumer to Queen Victoria. In 1872, William created the brand’s first fragrance, Hammam Bouquet.

- Editions de Parfums Frederic Malle: Frédéric Malle, born into a family with a background in art and perfumery. His grandfather, Serge Hefler-Louiche, was a co-founder and the first CEO of Parfums Christian Dior. Frédéric himself entered the fragrance industry at an early age and founded Editions de Parfums Frédéric Malle at the age of 38. Notably, he is not the brand’s perfumer but rather holds the role of “Perfume Editor,” collaborating with renowned perfumers in the industry.

Product Categories and Pricing

- Penhaligon’s: Fragrances, body care (hand wash, hand cream, shower gel, body lotion), home goods (candles).

- Editions de Parfums Frederic Malle: Fragrances, body care (shower gel, hand wash, body lotion, hair oil), home goods (candles, fragrance sprays).

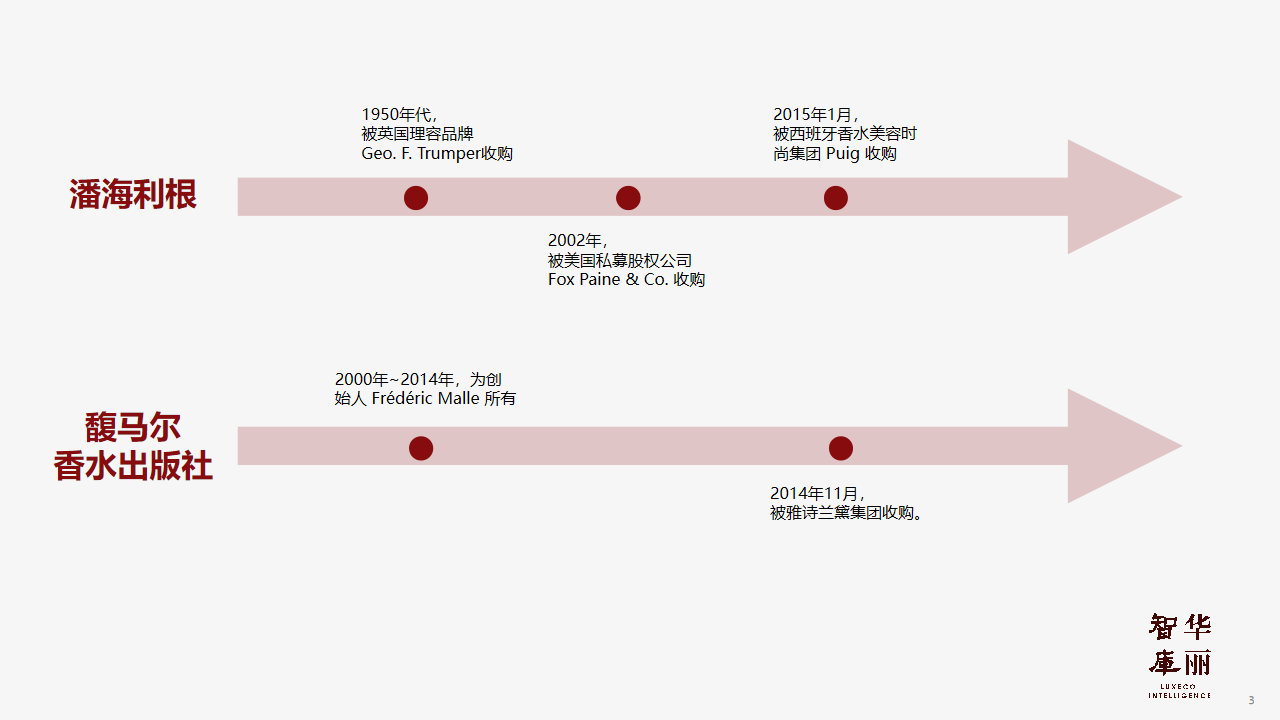

Parent Companies

- Penhaligon’s: Puig Group (Spain)

- Editions de Parfums Frederic Malle: Estée Lauder Companies (USA)

China Market Strategies

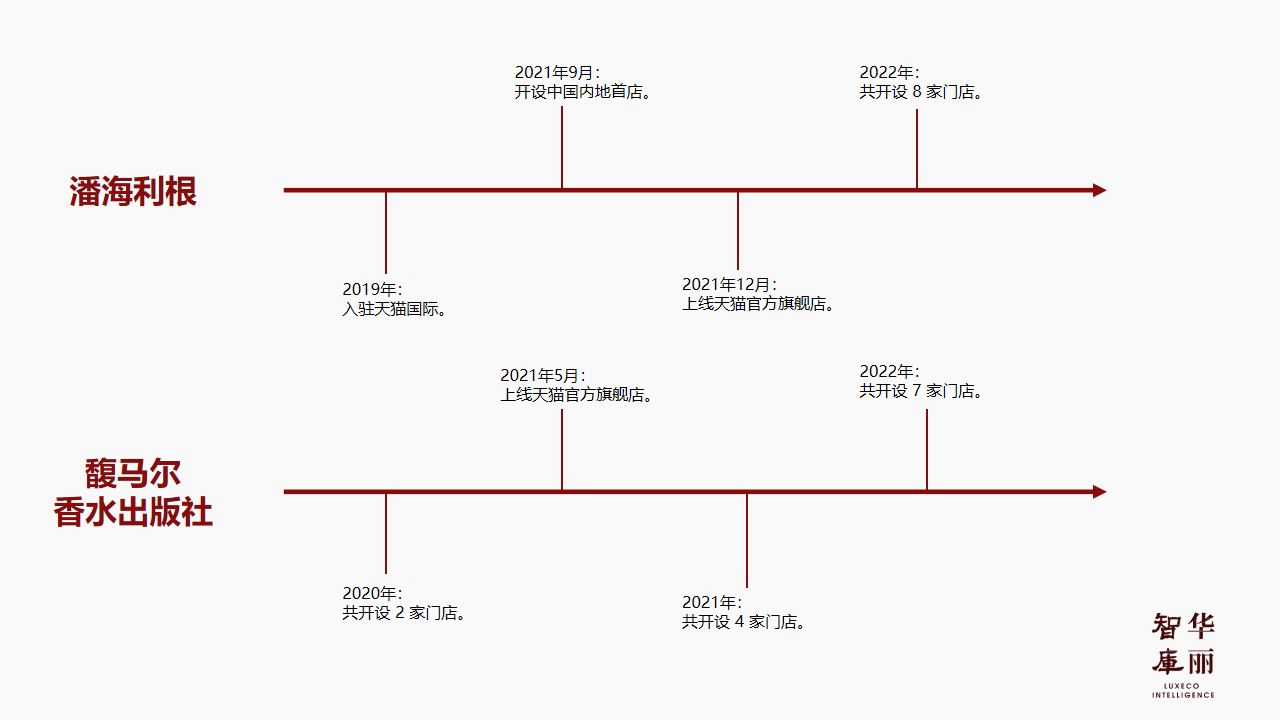

First Store Opening Dates in Mainland China

- Penhaligon’s: September 2021

- Editions de Parfums Frederic Malle: June 2020

First Location in Mainland China

- Penhaligon’s: IFC International Finance Center, Shanghai

- Editions de Parfums Frederic Malle: IFC International Finance Center, Shanghai

Total Number of Stores in Mainland China

- Penhaligon’s: 9 stores

- Editions de Parfums Frederic Malle: 14 stores

Cities with More than 2 Store Openings in Mainland China

- Penhaligon’s: 2 stores each in Shanghai, Shenzhen, and Chengdu

- Editions de Parfums Frederic Malle: 3 stores in Hangzhou, 2 stores each in Beijing, Shanghai, Shenzhen, and Chengdu

Store Opening Pace in Mainland China

- Looking at Store Openings Over Time

- Looking at Store Openings by City/Commercial Centers (excluding pop-up stores)

Strength of Parent Companies

Full-Year 2022 Performance of the Two Major Groups

- Puig Group: Achieved a record-breaking 3.62 billion euros in full-year 2022 performance. Through selective distribution, the company’s market share in the global perfume market reached 10% for the first time in its history, marking a significant milestone for Puig’s development.

- Estée Lauder Companies: Achieved sales of $30.54 billion in full-year 2022.

Based on the full-year 2022 performance, the breakdown of various business sectors under the two major groups is as follows:

Introduction of Other High-End Perfume Brands Under the Two Major Groups to the Chinese Market

| Image Credit: Luxe.CO, Brand Websites, Official Instagram

| Editor: Zhu Ruoyu